The Bank of Canada left the policy rate unchanged today:

The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

Major economies around the world continue to show resilience to US trade protectionism, but uncertainty is still high. In the United States, economic growth is being supported by strong consumption and a surge in AI investment. The US government shutdown caused volatility in quarterly growth and delayed the release of some key economic data. Tariffs are causing some upward pressure on US inflation. In the euro area, economic growth has been stronger than expected, with the services sector showing particular resilience. In China, soft domestic demand, including more weakness in the housing market, is weighing on growth. Global financial conditions, oil prices, and the Canadian dollar are all roughly unchanged since the Bank’s October Monetary Policy Report (MPR).

Canada’s economy grew by a surprisingly strong 2.6% in the third quarter, even as final domestic demand was flat. The increase in GDP largely reflected volatility in trade. The Bank expects final domestic demand will grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.

Canada’s labour market is showing some signs of improvement. Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November. Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued.

CPI inflation slowed to 2.2% in October, as gasoline prices fell and food prices rose more slowly. CPI inflation has been close to the 2% target for more than a year, while measures of core inflation remain in the range of 2½% to 3%. The Bank assesses that underlying inflation is still around 2½%. In the near term, CPI inflation is likely to be higher due to the effects of last year’s GST/HST holiday on the prices of some goods and services. Looking through this choppiness, the Bank expects ongoing economic slack to roughly offset cost pressures associated with the reconfiguration of trade, keeping CPI inflation close to the 2% target.

If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. Uncertainty remains elevated. If the outlook changes, we are prepared to respond. The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

… while the FOMC decreased its policy rate by 25bp, also as expected … and with dissents, also as expected:

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up through September. More recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months.

In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-1/2 to 3‑3/4 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The Committee judges that reserve balances have declined to ample levels and will initiate purchases of shorter-term Treasury securities as needed to maintain an ample supply of reserves on an ongoing basis.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Philip N. Jefferson; Alberto G. Musalem; and Christopher J. Waller. Voting against this action were Stephen I. Miran, who preferred to lower the target range for the federal funds rate by 1/2 percentage point at this meeting; and Austan D. Goolsbee and Jeffrey R. Schmid, who preferred no change to the target range for the federal funds rate at this meeting.

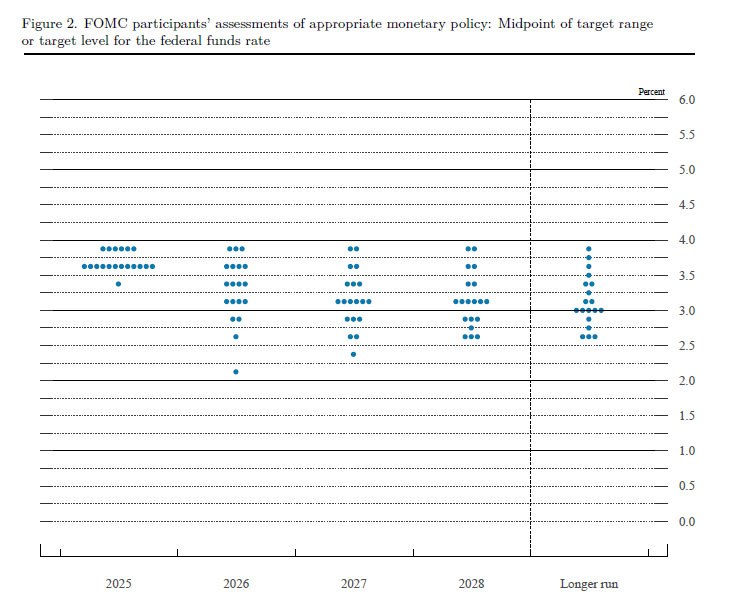

The dotplot was interesting, as always:

PerpetualDiscounts now yield 5.65%, equivalent to 7.34% interest at the standard conversion factor of 1.3x. Long corporates yielded 4.96% on 2025-12-10, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) has narrowed slightly (and perhaps spuriously) to 240bp from the to 245bp reported December 3.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2541 % |

2,432.6 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2541 % |

4,612.6 |

| Floater |

5.92 % |

6.22 % |

63,149 |

13.50 |

3 |

0.2541 % |

2,658.2 |

| OpRet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0709 % |

3,658.4 |

| SplitShare |

4.77 % |

4.30 % |

72,402 |

2.10 |

5 |

-0.0709 % |

4,368.9 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0709 % |

3,408.8 |

| Perpetual-Premium |

5.67 % |

5.54 % |

82,777 |

6.82 |

7 |

0.4936 % |

3,097.5 |

| Perpetual-Discount |

5.55 % |

5.65 % |

49,703 |

14.39 |

26 |

0.2522 % |

3,409.5 |

| FixedReset Disc |

5.84 % |

6.12 % |

108,809 |

13.49 |

31 |

-0.0341 % |

3,123.5 |

| Insurance Straight |

5.52 % |

5.54 % |

56,033 |

14.58 |

21 |

0.2623 % |

3,293.9 |

| FloatingReset |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0341 % |

3,715.7 |

| FixedReset Prem |

5.91 % |

4.80 % |

105,261 |

2.25 |

20 |

0.3702 % |

2,656.7 |

| FixedReset Bank Non |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0341 % |

3,192.8 |

| FixedReset Ins Non |

5.32 % |

5.55 % |

83,420 |

14.32 |

13 |

-1.2232 % |

3,084.4 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| GWO.PR.N |

FixedReset Ins Non |

-15.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 15.46

Evaluated at bid price : 15.46

Bid-YTW : 7.03 % |

| BN.PF.E |

FixedReset Disc |

-2.92 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.88

Evaluated at bid price : 22.30

Bid-YTW : 6.24 % |

| MFC.PR.L |

FixedReset Ins Non |

-2.64 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 22.88

Evaluated at bid price : 23.95

Bid-YTW : 5.52 % |

| GWO.PR.H |

Insurance Straight |

-1.35 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.70

Evaluated at bid price : 21.95

Bid-YTW : 5.53 % |

| MFC.PR.Q |

FixedReset Ins Non |

-1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 23.53

Evaluated at bid price : 25.19

Bid-YTW : 5.54 % |

| MFC.PR.F |

FixedReset Ins Non |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 18.70

Evaluated at bid price : 18.70

Bid-YTW : 5.87 % |

| SLF.PR.E |

Insurance Straight |

1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.62

Evaluated at bid price : 21.87

Bid-YTW : 5.14 % |

| RY.PR.S |

FixedReset Prem |

1.13 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2029-02-24

Maturity Price : 25.00

Evaluated at bid price : 26.80

Bid-YTW : 3.60 % |

| ENB.PR.Y |

FixedReset Disc |

1.19 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.22

Evaluated at bid price : 21.22

Bid-YTW : 6.40 % |

| POW.PR.G |

Perpetual-Discount |

1.21 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 24.83

Evaluated at bid price : 25.05

Bid-YTW : 5.68 % |

| PWF.PR.E |

Perpetual-Discount |

1.53 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 24.27

Evaluated at bid price : 24.57

Bid-YTW : 5.66 % |

| ENB.PR.N |

FixedReset Disc |

1.57 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 22.95

Evaluated at bid price : 23.95

Bid-YTW : 6.15 % |

| SLF.PR.C |

Insurance Straight |

1.73 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.51

Evaluated at bid price : 21.77

Bid-YTW : 5.11 % |

| FTS.PR.J |

Perpetual-Discount |

1.96 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 22.60

Evaluated at bid price : 22.85

Bid-YTW : 5.22 % |

| NA.PR.C |

FixedReset Prem |

1.97 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2027-11-15

Maturity Price : 25.00

Evaluated at bid price : 26.41

Bid-YTW : 4.26 % |

| MFC.PR.C |

Insurance Straight |

2.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.98

Evaluated at bid price : 22.21

Bid-YTW : 5.07 % |

| POW.PR.C |

Perpetual-Premium |

2.59 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2026-01-09

Maturity Price : 25.00

Evaluated at bid price : 25.70

Bid-YTW : -16.40 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| PWF.PR.P |

FixedReset Disc |

71,885 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 19.11

Evaluated at bid price : 19.11

Bid-YTW : 6.09 % |

| POW.PR.C |

Perpetual-Premium |

69,425 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2026-01-09

Maturity Price : 25.00

Evaluated at bid price : 25.70

Bid-YTW : -16.40 % |

| ENB.PF.E |

FixedReset Disc |

68,047 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.84

Evaluated at bid price : 22.25

Bid-YTW : 6.34 % |

| CU.PR.C |

FixedReset Disc |

65,322 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 24.15

Evaluated at bid price : 24.50

Bid-YTW : 5.55 % |

| ENB.PR.B |

FixedReset Disc |

49,990 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.00

Evaluated at bid price : 21.00

Bid-YTW : 6.50 % |

| BN.PF.B |

FixedReset Disc |

39,551 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 23.05

Evaluated at bid price : 24.26

Bid-YTW : 6.01 % |

| There were 21 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. |

| Issue |

Index |

Quote Data and Yield Notes |

| GWO.PR.N |

FixedReset Ins Non |

Quote: 15.46 – 18.35

Spot Rate : 2.8900

Average : 1.6815

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 15.46

Evaluated at bid price : 15.46

Bid-YTW : 7.03 % |

| PVS.PR.H |

SplitShare |

Quote: 25.08 – 26.08

Spot Rate : 1.0000

Average : 0.5408

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2026-02-28

Maturity Price : 25.00

Evaluated at bid price : 25.08

Bid-YTW : 3.42 % |

| CU.PR.F |

Perpetual-Discount |

Quote: 20.52 – 21.80

Spot Rate : 1.2800

Average : 0.8244

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 20.52

Evaluated at bid price : 20.52

Bid-YTW : 5.53 % |

| ENB.PF.G |

FixedReset Disc |

Quote: 22.25 – 24.00

Spot Rate : 1.7500

Average : 1.3051

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.82

Evaluated at bid price : 22.25

Bid-YTW : 6.43 % |

| ENB.PF.C |

FixedReset Disc |

Quote: 22.21 – 24.50

Spot Rate : 2.2900

Average : 1.9016

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.82

Evaluated at bid price : 22.21

Bid-YTW : 6.37 % |

| BN.PF.E |

FixedReset Disc |

Quote: 22.30 – 23.65

Spot Rate : 1.3500

Average : 1.0407

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2055-12-10

Maturity Price : 21.88

Evaluated at bid price : 22.30

Bid-YTW : 6.24 % |