Today’s Globe & Mail contained an article by Rob Carrick that mentioned preferred shares.

Riccardo Palombi, a salesperson at the Manitoba-based McLean & Partners had a few words to say:

Mr. Palombi of Mclean & Partners suggests sticking to preferred shares issued by the big banks and other top-quality issuers. As an example, he mentioned the TD preferred series O shares, which pay $1.21 in dividends a year and currently yield about 4.6%.

So, I thought I’d write a bit about TD.PR.O today.

The option schedule for TD.PR.O is:

| Redemption |

2010-11-01 |

2011-10-30 |

26.000000 |

| Redemption |

2011-10-31 |

2012-10-30 |

25.750000 |

| Redemption |

2012-10-31 |

2013-10-30 |

25.500000 |

| Redemption |

2013-10-31 |

2014-10-30 |

25.250000 |

| Redemption |

2014-10-31 |

INFINITE DATE |

25.000000 |

A perpetual, paying $1.2125.

Firstly, the 4.6% Carrick mentions is currentYield and I’m saddened, but not surprised that Carrick mentioned it in his article. As readers of my article A Call too, Harms know, I’m not a big fan of Current Yield and greatly prefer yield-to-worst as a measure of preferred share value – assuming, of course, that I’m writing for general publication and am only allowed a single measure of value!

The pre-tax YTW of TD.PR.O is 4.14%, based on the January 12 closing bid of $26.15. So the first thing we want to know is: why accept 4.14% when there are new issues (new bank issues, what’s more, from Royal, Scotia and BMO that yield 4.50%?

One possibility is the implicit degree of interest rate protection afforded to investors by the higher coupon. The TD issue pays $1.2125, as mentioned above, which works out to 4.85% on the original issue price. If rates rise, then all fixed income issue will be hurt, but (for the first little while, at least) TD.PR.O will have some protection, because it will still make sense for the issuer to call the issue at the same price as it would have called them in the absence of a rise.

If, for instance, all perpetual preferreds are trading at 4.80% (pre-tax) in 2014, then we will expect TD.PR.O to be redeemed at $25.00 (or trading slightly above that price), whereas one of the current new issues, paying $1.125 p.a., will be trading at around $23.40, at which price they will be yielding the 4.8% imposed by these hypothetical market conditions. In other words, they will have lost about $1.60 in value, compared to only $1.15 in value for the TD.PR.O. Additionally, the TD.PR.O will have paid about $0.09 more p.a. as dividends.

When HIMIPref™ is used to analyze the cash flows of TD.PR.O for the YTW scenario, we get the the attached report from the cashFlowDiscountingAnalysisBox. This report can also be saved as a text file and uploaded to an Excel spreadsheet.

I hate using Excel spreadsheets to explain things. At some point I’ll write a little feature into HIMIPref that will do this automatically, but that’s way down the list. The purpose of HIMIPref™ is to analyze preferreds write blog posts! While this sort of analysis is implicit in HIMIPref™ it’s buried pretty deeply, in things like curvePrice!

On the tab “Initial Analysis” of the attached spreadsheet, the data provided above has been put into Excel format. Additionally, equivalent data for the RY.PR.? new issue has been approximated by multiplying the cash flows for TD.PR.O by a factor of (4.50 / 4.85) to account for the reduced coupon. The cells highlighted in yellow have been further changed, to reflect an estimated value of $25.00 for the RY.PR.? on 2014-11-30: that is, this analysis projects no change in market interest rates between now and the analysis end-date.

When we sum the values of the individual flows, we find that the net present value for TD.PR.O is, indeed, about $26.10 (there’s some rounding error. So sue me.) which of course it should be since the discounting factors are derived from the Yield that results if it is redeemed on the End Date.

We are amazed and astounded, however, to note that the cash flows of the RY.PR.? new issue sum to about $25.40, which is forty cents more than the price we have to pay for it now. Bonus! Using this analysis, we can say that the TD.PR.O is fairly priced (by definition) but the RY.PR.? is forty cents cheap! So why buy the TD.PR.O.

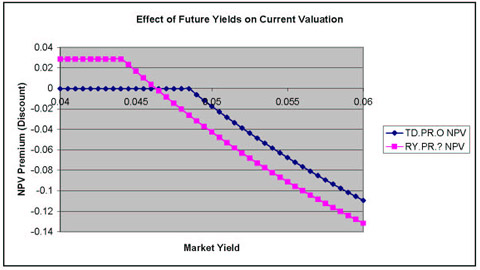

Some scenario analysis is done on the “Scenarios” tab of the spreadsheet. For each presumed market yield, we calculate the price of each issue, being careful to cap this value at the appropriate redemption price. Then we account for tax effects to derive an exit value. We use the discounting factor from the “Initial Analysis” tab to compute the present value of the exit value, add this to the present value of the dividends, and then come up with the present value of the whole package. In columns “Q” & “R”, we compare this discounted present value to the actual market price to see whether it’s cheap or expensive, given the scenario for market yields. Obviously, if our scenario is for rising yields, they’re both expensive. Any fixed income will be! But the degree of protection has been calculated.

I’ve prepared a chart:

So, if you want some protection from rising interest rates, you may well prefer TD.PR.O to the new bank issues, accepting the fact that this will probably be an underperforming choice if rates are unchanged from this time until the call-date.

I consider this analysis to be very approximate and do not explicitly use it in HIMIPref™. I’m more interested in curvePrice, the price at which an instrument should theoretically trade if all its features are valued the same way as similar features on similar issues, and at Yield-to-Worst, these being two major components of valuation:

| Curve Price Component |

TD.PR.O |

RY.PR.? |

| Price due to base-rate |

24.30 |

23.31 |

| Price due to short-term |

0.04 |

0.04 |

| Price due to long-term |

0.50 |

0.46 |

| Price due to Liquidity |

1.52 |

1.48 |

| Price due to error |

-0.03 |

-0.03 |

| Total Curve Price |

26.33 |

25.27 |

| Current Quote |

26.15-19 |

25.00 Issue |

| After-tax Yield-To-Worst |

3.30% |

3.58% |

A full HIMIPref™ analysis shows this issue roughly comparable to one of the new bank issues. But I like RY.PR.B & RY.PR.C better in that “bank perpetual” space.