Deutsche Bank is cackling with glee over the recent improvements to its competitive position:

Deutsche Bank AG Chief Executive Officer Josef Ackermann said Germany has a “comparative advantage” over other financial hubs because it doesn’t plan to tax bonuses like Britain and France.

“To strengthen the financial hub of Germany I think is a very wise move,” Ackermann said in an interview in Berlin late yesterday.

RBC is redeeming some sub-debt.

Econbrowser‘s James Hamilton makes a good point in his post Should the Fed be the nation’s bubble fighter?:

Before we can discuss this issue, we’d need to agree on what we mean by a “bubble”. Here’s one definition that a lot of people may have in mind: a bubble describes a condition where the price of a particular asset is higher than it should be based on fundamentals and will eventually come crashing back down.

If that’s what you believe, then there’s a potential profit opportunity from selling the asset short whenever you’re sure there’s a bubble. And if that’s the case, my question for you would be, why don’t you do put your money where your mouth is instead of telling the Fed to do it for you?

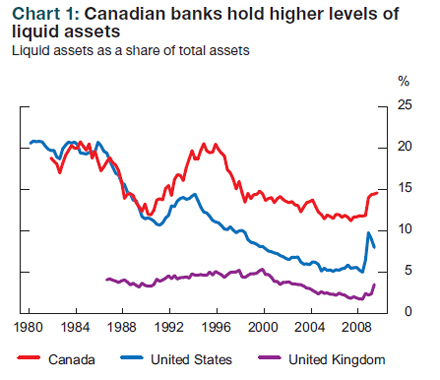

Dr. Hamilton references an excellent Cleveland Fed commentary, Why Didn’t Canada’s Housing Market Go Bust?, most of which I agree with but I would add one very important difference to the list: Canadian mortgages are issued with recourse to the borrower, while many of the defaulted mortgages in the US were without recourse. The ability of American speculators to put little or no money down gave them a one-way bet on the market.

The Bank of Engand has released its 4Q09 Quarterly Bulletin with an excellent as usual review of the Bank’s operations and the UK economy.

Citigroup is about to exit TARP:

The bank, the only major U.S. lender still dependent on what the government calls “exceptional financial assistance,” said it will sell at least $20.5 billion of equity and debt to exit the Troubled Asset Relief Program. The U.S. Treasury Department also plans to sell as much as $5 billion of common stock it holds in the company, and will unload the rest of its stake during the next six to 12 months

…

The U.S. earned a net profit of at least $13 billion from its investment in Citigroup, a Treasury official said today. The estimate includes about $3 billion in dividends and gains on the common-equity stake, roughly $5.8 billion based on the Dec. 11 share price.

… and so is Wells Fargo:

Wells Fargo & Co., seeking to shake the stigma of government bailout funds and keep up with its rivals, plans to raise $10.4 billion in a share sale so it can get out of the Troubled Asset Relief Program.

The bank plans to return all of the $25 billion that taxpayers invested last year, according to a company statement issued today. The exit from TARP would put Wells Fargo on the same footing as Bank of America Corp., JPMorgan Chase & Co. and Citigroup Inc., its three largest competitors, which have already paid back the U.S. or announced plans to do so.

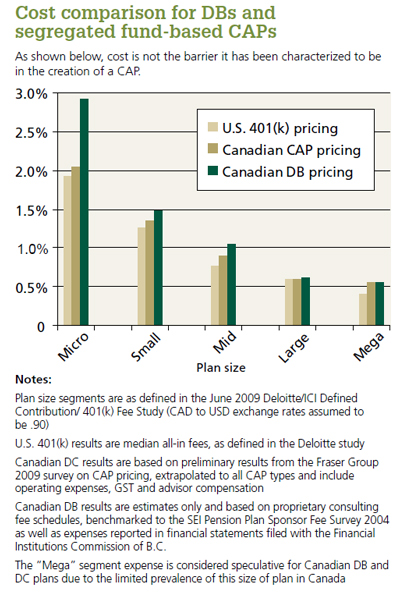

Great-West Lifeco has released a position paper on pension reform titled The strength of CAPs in Canada’s retirement market

It was a strong day on good volume for preferreds, with PerpetualDiscounts gaining 23bp and FixedResets up 6bp. The median-weighted-average YTW for FixedResets is now 3.70% and the chant of “How low can they go?” is getting deafening … at least it is around here!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0217 % | 1,524.8 |

| FixedFloater | 5.89 % | 4.02 % | 38,093 | 18.76 | 1 | -0.2162 % | 2,644.7 |

| Floater | 2.57 % | 3.02 % | 96,913 | 19.69 | 3 | 0.0217 % | 1,904.9 |

| OpRet | 4.87 % | -2.75 % | 143,242 | 0.09 | 15 | -0.0690 % | 2,313.1 |

| SplitShare | 6.44 % | -3.06 % | 252,732 | 0.08 | 2 | -0.5738 % | 2,087.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0690 % | 2,115.1 |

| Perpetual-Premium | 5.88 % | 5.82 % | 74,729 | 5.99 | 7 | 0.0854 % | 1,875.0 |

| Perpetual-Discount | 5.79 % | 5.85 % | 197,684 | 13.99 | 68 | 0.2341 % | 1,795.8 |

| FixedReset | 5.42 % | 3.70 % | 357,380 | 3.88 | 41 | 0.0616 % | 2,159.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.K | Floater | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 12.91 Evaluated at bid price : 12.91 Bid-YTW : 3.04 % |

| BNA.PR.C | SplitShare | -1.31 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 18.80 Bid-YTW : 8.36 % |

| BAM.PR.J | OpRet | -1.30 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 25.91 Bid-YTW : 4.86 % |

| IAG.PR.C | FixedReset | 1.11 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 27.40 Bid-YTW : 3.60 % |

| SLF.PR.A | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 20.32 Evaluated at bid price : 20.32 Bid-YTW : 5.87 % |

| TRI.PR.B | Floater | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 20.10 Evaluated at bid price : 20.10 Bid-YTW : 1.97 % |

| TD.PR.O | Perpetual-Discount | 2.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 22.60 Evaluated at bid price : 22.77 Bid-YTW : 5.39 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| GWO.PR.J | FixedReset | 236,089 | Nesbitt crossed blocks of 181,300 and 25,000 shares, both at 27.10. TD bought 25,000 from anonymous at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 27.12 Bid-YTW : 3.69 % |

| RY.PR.E | Perpetual-Discount | 81,306 | RBC crossed 50,000 at 20.30. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 20.40 Evaluated at bid price : 20.40 Bid-YTW : 5.57 % |

| BNS.PR.L | Perpetual-Discount | 53,949 | TD crossed 10,000 at 20.75; Desjardins crossed 24,000 at 20.83. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 20.68 Evaluated at bid price : 20.68 Bid-YTW : 5.52 % |

| TD.PR.K | FixedReset | 46,900 | Desjardins crossed 20,000 at 27.97. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.97 Bid-YTW : 3.71 % |

| RY.PR.B | Perpetual-Discount | 45,285 | Desjardins crossed 20,000 at 21.33. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 21.24 Evaluated at bid price : 21.24 Bid-YTW : 5.59 % |

| BMO.PR.J | Perpetual-Discount | 43,870 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-12-14 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 5.54 % |

| There were 40 other index-included issues trading in excess of 10,000 shares. | |||