The Office of the Superintendent of Financial Institutions has announced:

Canada’s six largest banks have been identified as being of domestic systemic importance, and will be subject to continued supervisory intensity, enhanced disclosure, and a one per cent risk weighted capital surcharge by January 1, 2016.

Grant Robertson of the Globe claims:

The move is designed to avert a liquidity crisis in the sector, and comes on top of the 7 per cent of capital that the Office of the Superintendent of Financial Institutions (OSFI) requires them to hold, which can be easily liquidated by the banks during a time of financial pressure to stabilize operations.

This shows a common confusion between “liquidity” and “solvency”. If you own a house worth a million with no mortgage, but can’t pay for groceries, you are solvent, but illiquid. If you pay for the groceries with all that’s left of the 1.5-million mortage you took on the place five years ago, you are liquid, but insolvent. There was a time when reporters were familiar with their subjects and had the names and ‘phone numbers of experts available to explain arcane elements of business news. Imagine that!

The adjustment to the capital rules under discussion here addresses expectations of solvency but do nothing directly to address liquidity.

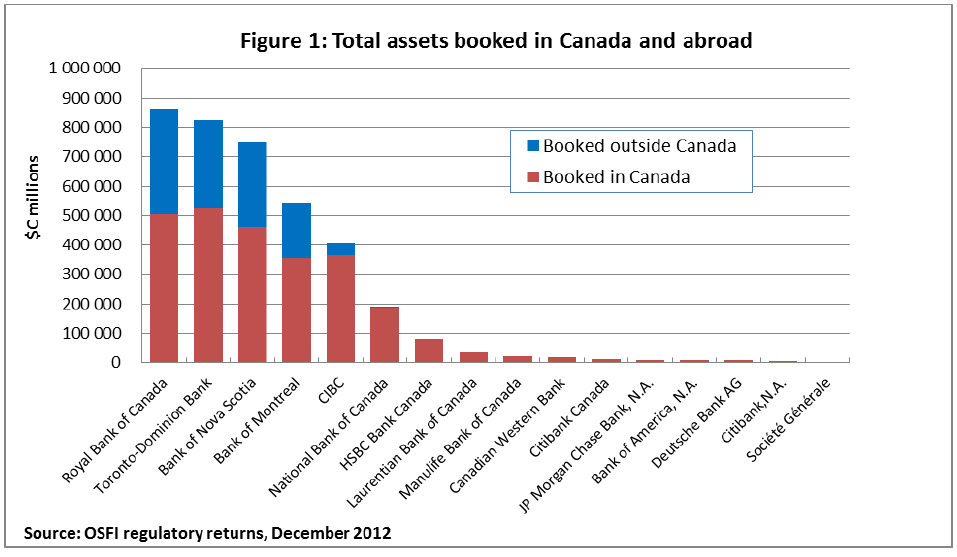

Be that as it may, OSFI provided some charts with its cover letter to the banks:

As is OSFI’s habit, the Advisory giving effect to the decision, Domestic Systemic Importance and Capital Targets – DTIs, makes only the slightest possible effort to explain the decision:

The common equity surcharge associated with D-SIB status in Canada will be 1% Risk Weighted Assets (RWA).This surcharge takes into account the structure of the Canadian financial system, the importance of large banks to this financial architecture, and the expanded regulatory toolkit to resolve a troubled financial institution. This means that banks designated as a D-SIB will be required to meet an all-in Pillar 1 target common equity Tier 1 (CET1) of 8% RWA commencing January 1, 2016. The 1% capital surcharge will be periodically reviewed in light of national and international developments. This is consistent with the levels and timing set out in the BCBS D-SIB framework.

The BCBS D-SIB framework provides for national discretion to accommodate characteristics of the domestic financial system, and other local features, including the domestic policy framework. The additional capital surcharge for banks designated as systemically important provides credible additional loss absorbency given:

- Extreme loss events as a percentage of RWA among this peer group over the past 25 years would be less than the combination of the CET1 (2.5%) capital conservation buffer and an additional 1%; and

- Current business models of the six largest banks are generally less exposed to the fat tailed risks associated with investment banking than some international peers, and the six largest banks have a greater reliance on retail funding models compared to wholesale funding than some international peers – features that proved beneficial in light of the experience of the last financial crisis.

- From a forward looking perspective:

- o Canadian banks that hold capital at current targets plus a 1% surcharge (i.e. 8%) should be able to weather a wide range of severe but plausible shocks without becoming non-viable; and

- o The higher loss absorbency in a crisis scenario (conversion to common equity or permanent write downs) of the 2% to 3% non-common equity capital in Tier 1 and subordinated debt in total capital required by Basel III also adds to the resiliency of banks.

It gives me a warm feeling inside knowing that OSFI has looked at the past twenty-five years of history to gauge extreme loss events; the Basel II guidelines supposedly calibrated more stringently:

The confidence level is fixed at 99.9%, i.e. an institution is expected to suffer losses that exceed its level of tier 1 and tier 2 capital on average once in a thousand years.

OSFI’s document has a few references, but only to other OSFI documents and a few Basel Committee on Banking Supervision hymn books; nothing of any meat, nothing that would provide any comfort that these guys have thought things through and know what they’re doing – but OSFI’s institutional intellectual dishonesty is well known.

Their efforts may be compared – just for starters – with a paper titled Australia: Addressing Systemic Risk Through Higher Loss Absorbency—Technical Note, published by the IMF and reposted by the Australian Prudential Regulation Authority. One of the useful features of this report is “Table 4. Cross-Country Comparison of Approaches to D-SIBs”, which – although one can hardly credit it – looks at what other countries are doing! Here’s an extract:

| Country | HLA |

| Singapore | 2 percent additional by 2015 |

| Sweden | Accelerated adoption of Basel III; plus 3 percent by 2013; 5 percent by 2015 |

| Switzerland | 19 percent of RWA total capital, of which up to 9 percent cocos, by 2016 |

| United Kingdom | Proposal: 3 percent additional to Basel III and up to 17 percent of RWA loss absorbency for the largest institutions and ring-fenced entities |

| United States | Supplementary Tier 1 of 3 percent of RWA for complex institutions |

Now it may very well be that OSFI is taking a prudent route in being so much more lenient with the banks than their international counterparts – but you’d never know it from reading OSFI material. Canadians are forced to take it on trust that the banking regulator knows what it’s doing; and OSFI’s arrogance makes such trust an awfully scarce commodity.

One highly recommended example of how a prudential regulator should operate is the UK’s Independent Commission on Banking – Final Report Recommendations – September 2011:

The Independent Commission on Banking (the Commission) was established by the Government in June 2010 to consider structural and related non-structural reforms to the UK banking sector to promote financial stability and competition. The Commission was asked to report to the Cabinet Committee on Banking Reform by the end of September 2011. Its members are Sir John Vickers (Chair), Clare Spottiswoode, Martin Taylor, Bill Winters and Martin Wolf.

This report has one of its recommendations highlighted in the table extracted above:

As to that, the Commission recommends that the retail and other activities of large UK banking groups should both have primary loss-absorbing capacity of at least 17%-20%. Equity and other capital would be part of that (or all if a bank so wished). Primary loss absorbing capacity also includes long-term unsecured debt that regulators could require to bear losses in resolution (bail-in bonds). If market participants chose, and regulators were satisfied that the instruments were appropriate, primary loss-absorbing capacity could also include contingent capital (‘cocos’) that (like equity) takes losses before resolution. Including properly loss-absorbing debt alongside equity in this way offers the benefit that debt holders have a particular interest, in a way that equity holders do not, in guarding against downside risk. If primary loss-absorbing capacity is wiped out, regulators should also have the power to impose losses on other creditors in resolution, if necessary.

Assiduous Readers will recognize that I have a fundamental distaste for the trashing of five hundred years of bankruptcy law implied by the last sentence, but at least the rationale is spelt out in credible format – far different from the Canadian model.