The Bank of Canada has released its December 2008 Financial System Review.

An interesting comment was:

Further improvements by some Canadian banks would be desirable to align disclosure standards, particularly regarding valuation techniques, more closely with the best practices of leading foreign banks. On the issue of transparency of structured products, progress in implementing the [Financial Stability Forum] recommendations has been slow to materialize, and there is a role for provincial securities commissions to advance this initiative.

… which seems to be a nice way of saying the banks here are falling behind. The Financial Stability Forum has been discussed on PrefBlog.

Also of interest was a short section on revision of bank capital rules to reduce the procyclicity inherent in the current rules:

These concerns have motivated proposals that argue that systemic risks can be mitigated if macroeconomic conditions are taken into account in the design of capital regulations. Under these proposals, banks would be required to build up a capital buffer during the boom part of the cycle—thereby strengthening their balance sheets and reducing the risk that financial imbalances will develop from excessive easing of financial conditions. During a downturn, banks would be allowed to draw down these buffers, which would alleviate the need to liquidate assets or restrict loan growth at a time when credit conditions and asset prices are already under stress. Thus, minimum capital requirements would move procyclically—the reverse of what happens under the current Basel II framework— and would help moderate cyclical fluctuations in the economy. This strategy could be implemented by linking capital requirements to movements in macroeconomic indicators of the state of the credit cycle, such as loan growth and asset prices.

…

Another question is whether there should be a rules-based approach linking capital requirements in a predetermined way to observable variables such as loan or asset growth, or whether discretion should be used to adjust the minimum capital ratios. In a system with discretion, it would be necessary to define the appropriate roles for the prudential regulator and for other agencies (such as the central bank) that have a broader macroeconomic perspective.

I like the last bit – ‘Give us the work, not OSFI!’

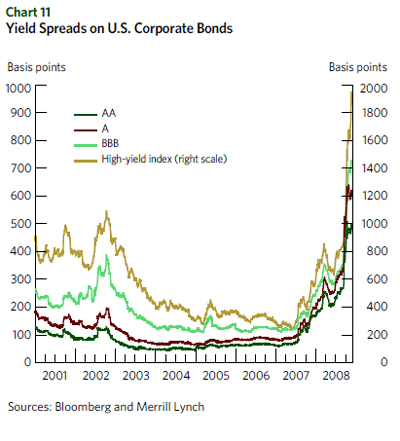

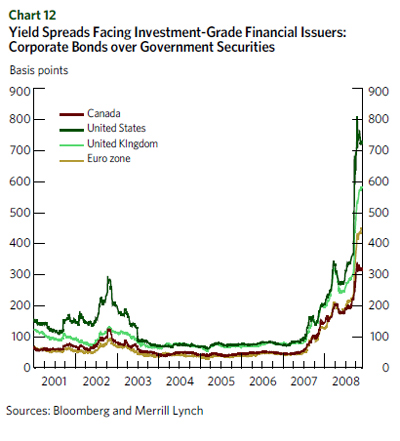

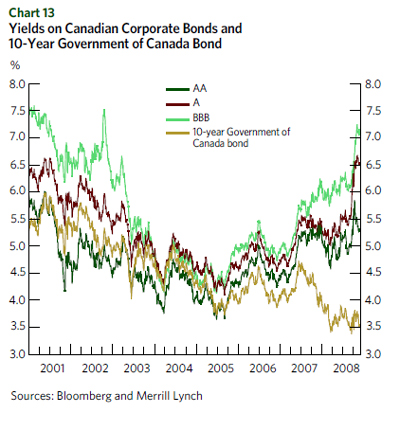

Longer-term credit markets have also deteriorated since the publication of the June FSR, as perceived default risk rose and the dysfunction in short term funding markets spread to longer-term debt markets. With the cost of financing trading positions higher and more uncertain, the liquidity premium demanded by agents also increased. This, in turn, contributed to the widening of credit spreads relative to government securities beyond what would be expected solely from the increase in default risk and expected losses. Yield spreads on corporate bonds around the globe rose to all-time highs in both the secondary bond and credit default swap markets, with the increase being particularly significant for high-yield and lower-rated issuers, reflecting an increasing degree of credit tiering (Chart 11).

There is a very topical note on DB Pension Funding:

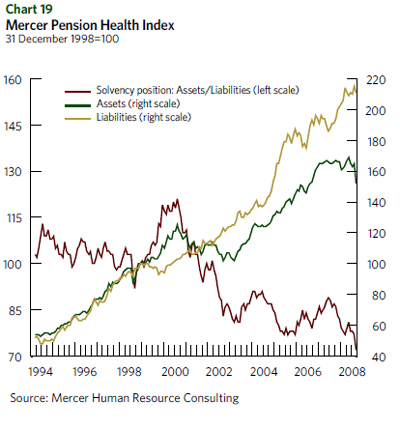

Firms that sponsor defined-benefit (DB) pension plans are facing additional pressures. The funding condition of DB plans in Canada has deteriorated sharply in recent months as a consequence of the severe sell-off in equity markets. Chart 19 presents the trend in Mercer’s Pension Health Index, which incorporates indexes of the assets, liabilities, and funding positions (assets less liabilities) of a representative DB plan in Canada. Note that assets have recently been falling, whereas liabilities have continued to rise. Firms are required to make special contributions to eliminate deficits over a time period specified by the pension regulators. These contributions adversely affect the

earnings and cash flow of the sponsoring corporation.

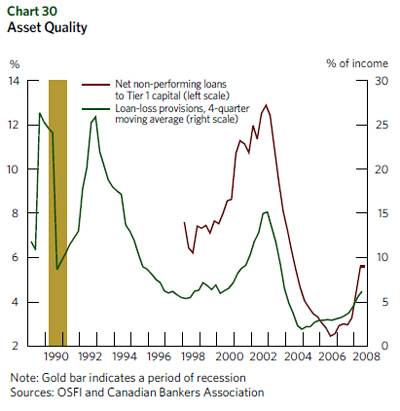

Bank asset quality is always of interest:

Profits and return on equity for the major Canadian banks have been on an improving track since the apparent trough in the first quarter of 2008, when writedowns seem to have peaked (Chart 29). Since the start of the turmoil, the major banks have reported cumulative capital market writedowns of almost $12 billion on a pre-tax basis. For the fourth quarter, five banks have pre-announced additional writedowns totalling around $2 billion.

As discussed, the volatility in the value of the securities portfolios of financial

institutions has continued (through the requirements of fair value accounting) to adversely affect their earnings.20 Recently, changes were announced by the Canadian Accounting Standards Board (AcSB), which mirror recent changes in International Accounting Standards (IAS). These modifications permit financial institutions, in some cases, to reclassify assets from the “held for trading” account to the banking book. This change is expected to reduce future volatility in the earnings of some banks. Several banks have since reclassified assets under these guidelines.

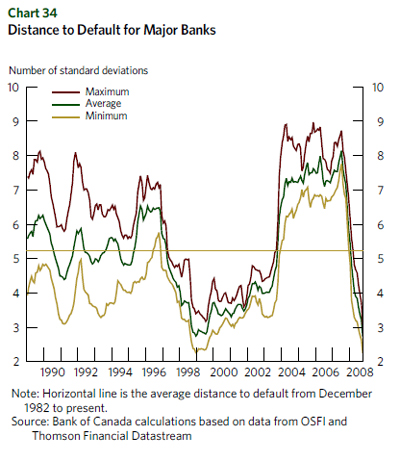

Of particular interest to preferred share investors is the banks’ “Distance to Default”, which is based solely on market prices – not on any fundamental analysis:

An assessment of overall default risk derived from market data, the distance to default for major Canadian banks, suggests a deterioration in their perceived credit quality since the June 2008 FSR (Chart 34). Driven by continued volatility in bank share prices, this measure has, in fact, reached its

lowest point on record.

And finally, given the recent MFC fiasco:

While the level of disclosure at life and health insurance companies has improved in recent years, it is generally not as detailed as that of banks, and recent events have underlined the need for further enhancements. For example, it would be desirable for life and health insurance companies to provide more information about the consolidated capital position of the enterprise as a whole, not just at the unconsolidated operating company level.

Thats the review section. There are also articles titled:

- Credit, Asset Prices, and Financial Stress in Canada

- Fair Value Accounting and Financial Stability

- The Impact of Sovereign Wealth Funds on the International Financial System

- Liquidity Risk at Banks: Trends and Lessons Learned from the Recent Turmoil

- A Model of Housing Boom and Bust in a Small Open Economy

- The Role of Bank Capital in the Propogation of Shocks

- Good Policies or Good Fortune: What Drove the Compression in Emerging-Market Spreads?