Rather an odd thing happened with the HIMIPref™ PerpetualDiscount Indices today … compare the published index data:

| HIMIPref™ PerpetualDiscount Index These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Date | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| March 4 | 7.34 % | 7.46 % | 172,278 | 12.03 | 71 | -0.1996 % | 1,354.8 |

| March 5 | 7.44 % | 7.43 % | 172,255 | 12.00 | 71 | -1.3749 % | 1,336.1 |

See that? It’s most peculiar … The PerpetualDiscount index got hammered today, down 1.37% which would normally be expected to be about equivalent to a 10bp uptick in yields … but the reported YTW was actually down 3bp! Today, anyway, the mean current yield did a far better job of explaining the total return of the index.

So I had a little look …

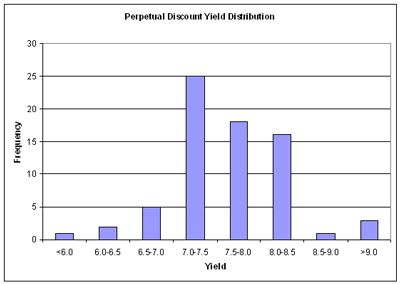

There’s nothing particularly surprising about the distribution – one would normally expect to see the top credits clustered in a top credits’ zone, with the distribution showing a positive skew as they tail off into the … er … not-quite-top credits’ zone (although, I hasten to add, all members of the index are rated Pfd-2(low) or higher by DBRS).

But it must be remembered that I report the Median-by-Weight YTW. This was done on purpose; the problem I found while experimenting with various formats was that reporting mean-by-weight caused immense volatility in the data, as outliers had a large effect on the calculated number. This is not so much a problem with the PerpetualDiscounts index now that it has 71 members, but can be a problem with smaller data sets.

Anyway, for better or worse, I report Median-by-Weight; and today the Median-by-Weight is W.PR.H with a yield of 7.43%.

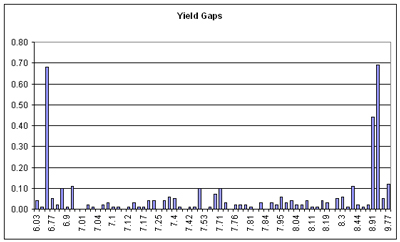

Now let’s look at the gaps between each of these issues:

And – you guessed it! The gap between W.PR.H and the next higher yielding issue (GWO.PR.I, 7.53%) is 10bp, as large a gap as you get in the important range of yields. A few pennies worth of price changes, and GWO.PR.I would have been the median issue and the return of -1.37% would have been matched with a reported increase in median YTW of 7bp … not a perfect modified-duration-approved relationship; but then, it isn’t supposed to be.

I can’t, at this point, think of any way to use this insight; but the more little odd factoids one understands, the better chance there is of achieving a useful understanding.