The Bank for International Settlements has released its December 2009 Quarterly Review with:

- A review of current conditions

- Macro stress tests and crises: what can we learn?

- Monetary policy and the risk-taking channel

- Government size and macroeconomic stability

- Issues and developments in loan loss provisioning: the case of Asia

- Dollar appreciation in 2008: safe haven, carry trades, dollar shortage and overhedging

The review contained the following snippet of interest:

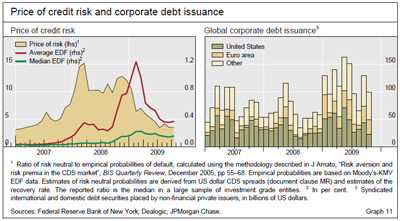

the market-implied price of credit risk also continued its downward trend, but to its pre-crisis level (Graph 11, left-hand panel).

The return to more normal credit market conditions was also reflected in corporate bond issuance (Graph 11, right-hand panel, and Highlights section).

The methodology used to prepare the chart of market implied cost of risk has been summarized on PrefBlog.

The paper by Leonardo Gambacorta, Monetary policy and the risk-taking channel, has been highlighted by Bloomberg and makes the claim that ‘reaching for yield’ is not merely a retail problem:

This paper investigates the link between low interest rates and bank risk-taking. Monetary policy may influence banks’ perceptions of, and attitude towards, risk in at least two ways: (i) through a search for yield process, especially in the case of nominal return targets; and (ii) by means of the impact of interest rates on valuations, incomes and cash flows, which in turn can modify how banks measure risk. Using a comprehensive dataset of listed banks, this paper finds that low interest rates over an extended period cause an increase in banks’ risk-taking.

For instance:

The inertia in nominal targets at a time of lower interest rates may reflect a number of factors. Some are psychological, such as money illusion: investors may ignore the fact that nominal interest rates may decline to compensate for lower inflation. Others may reflect institutional or regulatory constraints.

…

More generally, financial institutions regularly enter into long-term contracts committing them to produce relatively high nominal rates of return. The same mechanism could be in place whenever private investors use short-term returns as a way of judging manager competence and withdraw funds after poor performance

In the short term, low interest rates reduce the probability of default of outstanding variable rate loans, by reducing interest burdens of existing borrowers. In the medium term, however, due to the higher collateral values and the search for yield, banks tend to grant more risky loans and, in general, to soften their lending standards: they lend more to borrowers with bad credit histories and with more uncertain prospects. Overall, these results suggest that low interest rates reduce credit risk in banks’ portfolios in the short term – since the volume of outstanding loans is larger than the volume of new loans – but raise it in the medium term.

The empirical exercise points to a number of other interesting findings. First, developments in housing prices prior to the crisis appear to have contributed to bank risk-taking. An inflation-adjusted house price growth rate that is 1 percentage point above its long-run average for six consecutive years leading up to the crisis increases the probability of default of the average bank by 1.5%. This result is in line with the view that the housing market had a substantial role in the crisis and that banking distress was typically more severe in countries that experienced a more pronounced boom-bust cycle in house prices.

Second, banks that experienced a higher growth rate of lending with respect to the industry average prior to the crisis proved to be riskier ex post. For example, lending of about 10% above average over the six years preceding the crisis caused an increase in bank probability of default by 3.9%.