Jeffery D Amato wrote a paper with the captioned title in the BIS Quarterly Review, 4Q05:

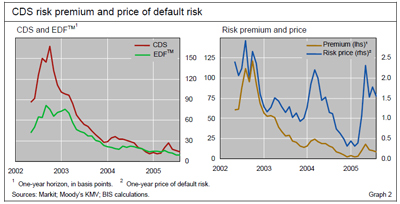

Credit default swap (CDS) spreads compensate investors for expected loss, but they also contain risk premia because of investors’ aversion to default risk. We estimate CDS risk premia and default risk aversion to have been highly volatile during 2002–2005. Both measures appear to be related to fundamental macroeconomic factors, such as the stance of monetary policy, and technical market factors, such as issuance of collateralised debt obligations.

…

To proxy for default probabilities, we use one-year EDFs™ as in the study by Berndt et al (2005). EDFs™ are constructed using balance sheet and equity price data under the principles of a Merton-type model for gauging the likelihood of default. Our data on EDFs™ are available at a monthly frequency for all but two firms in the CDX.NA.IG.4 index. Aggregate and sector EDFs™ are constructed as simple arithmetic averages of existing data on the constituents.

…

In order to see how we obtain measures of risk premia and risk aversion, note that CDS spreads can be roughly decomposed as follows:CDS spread = expected loss + risk premium

= expected loss x risk adjustmentwhere

risk adjustment = 1 + price of default risk

The first equation above says that the CDS spread is approximately equal to expected loss plus a risk premium, where the latter is compensation paid to investors for enduring exposure to default risk. In the second equation, the spread is re-expressed in terms of risk-adjusted expected loss, where the risk adjustment varies proportionally with the price of default risk. The price of default risk has the interpretation as the compensation per unit of expected loss. It is an indicator of investors’ aversion to default risk: a positive price of risk means that investors demand that they be paid more than actuarial losses. Hereafter, we will use the terms “price of default risk” and “indicator of default risk aversion” interchangeably.

While the formulations of spreads above isolate a “risk premium” and a “price of risk”, in principle there are two distinct types of default risk that may command a premium. One is cyclical variation in expected loss, which usually rises during economic downturns, when overall income growth is low. The other is the actual default of an entity and its impact on investors’ wealth due to an inability to perfectly diversify credit portfolios. In the literature, these are generally referred to as systematic and jump-at-default risk, respectively.

The use of Moody’s KMV methodology to determine intrinsic default probability is similar to the Bank of England approach, but different from the recently published Bank of Canada liquidity research which, essentially, assigns a value of zero to the variable “price of default risk”.

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « Risk aversion and risk premia in the CDS market […]