It’s nice to see my number one market worry get some play in the press:

1. Fund managers decide how much their assets are worth

Legalese: “Asset valuations will be determined by managers. The fund does not intend to commission periodic appraisals of the investments and will not be obligated to provide fair market value estimates.”

What that means: Private equity managers often have large holdings in illiquid assets such as troubled companies and real estate, which are, in fact, difficult to value. That said, it’s in the managers’ best interests to assign generous values because the managers typically get to keep 20 percent of profits and rely on historical returns to pitch new funds to investors.

Fed watching has become more intensive:

The euro made its third attempt this month to climb and stay above $1.10 as Federal Reserve Vice Chairman Stanley Fischer added to speculation U.S. interest rates will increase at a limited pace as stimulus expands in Europe.

The single currency extended its biggest weekly gain in three years on Monday after Fischer said there won’t be a “smooth upward path” for interest rates even as the first increase may be warranted before the end of 2015.

…

San Francisco Fed President John Williams, who votes on central bank policy this year, said in remarks prepared for delivery in Sydney Tuesday that a discussion should happen mid-year about tightening policy. He also said that he sees a stronger dollar pushing down growth.

“Williams gave dollar a bit of a lift because he didn’t rule out a tightening in June,” said Yuji Saito, director of foreign exchange at Credit Agricole SA in Tokyo. “Markets remain mixed over the outlook of the Fed tightening with Fischer’s comments blending with that of Williams’.”

Fischer said Monday in New York that “a smooth path upward in the federal funds rate will almost certainly not be realized” as the economy will encounter headwinds such as the surprise plunge in oil prices. He said while forward guidance on rates remains important, its role may diminish.

Traders predict 56 basis points of increases to the federal funds target rate over the next 12 months, down from 62 on March 6, according to a Credit Suisse Group AG swaps index.

Stanford’s just hired a new honcho for their $21-billion endowment fund. I know nothing more about the guy than what’s in the Bloomberg notice – but what I do know, I like!

Wallace graduated from Yale in New Haven, Connecticut, in 2002 and went to work for the university’s renowned investment arm, which is run by David Swensen, according to the office. In 2005, he joined Alta Advisers, an investment company serving the family of Swedish industrialist Hans Rausing.

Before his career in investment management, Wallace danced professionally for 16 years with the American Ballet Theater, the Boston Ballet and the Washington Ballet, according to a profile. He has also served on an investment committee for Cambridge University and as a governor of the Royal Ballet School in London.

See – he’s buy-side! Always has been buy-side! Uncontaminated by any sell-side idiocy and – presumably! – with a good record of buy-side performance. And the fact that he had an actual career before going into the biz is also a plus – it increases the chance that he’s not a dork, although you never can be sure …

Did you load up on debt in the past couple of years? You’re in good company:

Vancouver, B.C. – TELUS announced today it is offering $1.75 billion of senior unsecured notes in three series, the first with a 3-year maturity, the second with a 7-year maturity and the third with a long 30-year maturity. The notes are offered through a syndicate of agents led by CIBC World Markets, Scotia Capital, and TD Securities. Closing of the offering is expected to occur on or about March 27, 2015.

The 1.50 per cent 3-year Notes, Series CS, were priced at $99.962 per $100 principal amount for an effective yield of 1.513 per cent per annum and will mature on March 27, 2018. The 2.35 per cent 7-year Notes, Series CT, were priced at $99.731 per $100 principal amount for an effective yield of 2.392 per cent per annum and will mature on March 28, 2022. The 4.40 per cent long 30-year Notes, Series CU, were priced at $99.972 per $100 principal amount for an effective yield of 4.402 per cent per annum and will mature on January 29, 2046.

The net proceeds will be used to fund all or a portion of the remaining $1.2 billion required to acquire the AWS-3 spectrum licences and repay short term indebtedness, with any remaining balance used for general corporate purposes.

Of course, all that debt comes with a price:

DBRS Limited (DBRS) has today placed the Issuer Rating, Notes rating and Commercial Paper rating of TELUS Corporation (TELUS or the Company; rated A (low), A (low) and R-1 (low), respectively) and the Senior Debentures rating of TELUS Communications Inc. (rated A (low)) Under Review with Negative Implications. The rating action follows the Company’s announcement that it has secured 15 megahertz (MHz) of AWS-3 (advanced wireless services) spectrum for $1.5 billion. While DBRS recognizes the importance of investing sufficiently in spectrum over the long term, the Negative Implications of the review status reflect DBRS’s concern that this particularly large spectrum purchase will likely be financed with debt and weaken the financial risk profile of TELUS well beyond its previously stated policy range (net debt-to-EBITDA of 1.5 times (x) to 2.0x) and levels appropriate for the current rating categories. Operationally and financially, DBRS expects TELUS will continue to perform well and deliver mid-single digit growth in EBITDA to approximately $4.4 billion in 2015, based on the Company’s growing subscriber bases across both wireless and wireline, increasing revenues per user and ongoing network expansion.

…

Notwithstanding the Company’s prospects for growth in earnings over the near to medium term, DBRS questions TELUS’ willingness and ability to deleverage toward its previously stated leverage target within a reasonable time frame (i.e., two years), given its capital investment plan and anticipated returns to shareholders. In its ongoing review with management, DBRS will focus on an update of the Company’s business strategy going forward (including capital investment and spectrum purchases) and its financial management intentions (including dividend distributions, share repurchases and financing sources) in order to determine whether a downgrade is warranted. DBRS aims to receive clarity from TELUS management on the aforementioned issues in the coming weeks in order to resolve the Under Review status of the ratings.

But don’t worry! All that debt will be inflated away:

Data today showed the cost of living in the U.S. excluding food and fuel rose more than forecast in February, reflecting broad-based gains that helped keep a floor under inflation.

The so-called core consumer-price index climbed 0.2 percent for a second month, a Labor Department report showed Tuesday in Washington. A broader measure of prices overall also climbed 0.2 percent, the first advance in four months, as fuel costs stabilized.

Purchases of new homes in the U.S. unexpectedly rose in February to a seven-year high as stronger job gains helped bolster industry activity amid severe weather. Sales climbed 7.8 percent to a 539,000 annualized pace, the most since February 2008.

But the US has a problem: too many jobs:

Now, Goldman Sachs Group Inc. is weighing in. Job growth will have to slow going forward to catch down to the rest of the data, according to David Mericle, a Goldman Sachs economist, who says the pace of employment gains has “been running ‘too hot’ recently” relative to overall economic growth.

“Our model suggests that the recent 275-300k rate of monthly payroll gains is likely to be as good as it gets,” Mericle wrote in a note to clients. “Under our baseline forecast for 3% real GDP growth this year and next, we expect a gradual deceleration to a roughly 200k rate. The risks to both the GDP and employment numbers in 2016 are a bit to the downside.”

Outsize payroll growth in recent months has helped generate a swift decline in the unemployment rate. In February, it was 5.5 percent, down from 6.7 percent a year earlier.

The speed of the drop has taken Federal Reserve policy makers by surprise, and it prompted them to lower their year-end forecasts for the unemployment rate at the Federal Open Market Committee’s March meeting. The central tendency of those projections, which excludes the top and bottom three of the 17 committee members’ forecasts, fell to 5 percent to 5.2 percent from 5.2-5.3 percent in December, when the previous set of projections were published.

That 5-5.2 percent range matches the central tendency of what Fed officials deem to be “full employment.” Fed officials would say lower rates of unemployment would start to spur an acceleration in consumer price increases

It isn’t just Big Data that’s watching you … it’s your colleagues!

Stroz Friedberg, a New York-based consulting firm that specializes in digital forensics, is rolling out software called Scout, which evaluates users through the content of their e-mails and other communications using linguistic and behavioral analysis techniques developed by the FBI. The software establishes a base line and then scans for variations that may signal that an employee presents a growing risk to the company. Red flags could include a spike in references to financial stresses such as “late rent” and “medical bills.”

Edward Stroz, the firm’s founder and a former FBI agent, says that while companies may have found this idea too intrusive in the past, he’s seen a change in perception in the past year. He’s still careful when discussing the software, describing it as a way to help employers build a “caring workplace.”

…

Some of the methods at companies that hire Securonix make even Baikalov wonder how much is too much. He cites the practice of matching information on user behavior online with feeds from video cameras and other systems that monitor physical locations. Some companies, he says, have created ticket systems so employees can report suspicious behavior by colleagues. “Is it too much, or is it actually the right amount of diligence?” he says. “I’m really curious how much we will get out of it. It’s really the extreme in kind of Orwell-like monitoring.”

And it’s been too long since my last rant on university tuition:

Some top-ranked business schools are raising tuition by between 2 percent and 10 percent this fall, bumping up the cost of classes for the 2015-16 academic year to nearly $66,000 at the high end. Throw in room and board, fees, and textbooks, and it will cost as much as $99,000 to attend B-school next year, according to data compiled by Bloomberg Business.

Half of the MBA programs ranked in Bloomberg Businessweek’s top 20 have announced updated tuition numbers so far this year. Of that group, the University of Maryland’s Smith School of Business has biggest tuition hike, with tuition up by 9.9 percent next year for out-of-state residents, bringing the cost of classes to $52,380 from $47,655.

It’s ridiculous. How can a university education possibly cost that much? How can it possibly be worth that much?

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts and FixedResets both gaining 13bp, while DeemedRetractibles were off 8bp. The Performance Highlights table is back to it’s usual (for the past four months) length. Volume was on the high side of average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

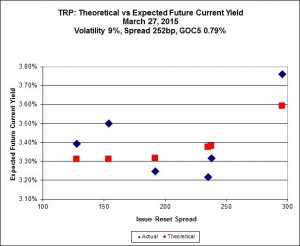

Here’s TRP:

Click for Big

Click for BigTRP.PR.E, which resets 2019-10-30 at +235, is bid at 24.75 to be $1.23 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $1.24 cheap at its bid price of 24.95.

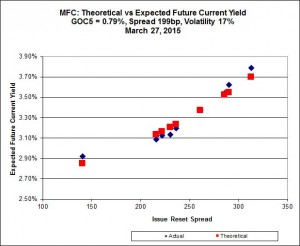

Click for Big

Click for BigAnother excellent fit, but the numbers are perplexing. Implied Volatility for MFC continues to be a conundrum, although it declined substantially today. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

Most expensive is MFC.PR.L, resetting at +216 on 2019-6-19, bid at 24.41 to be $0.74 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 25.54 to be $0.64 cheap.

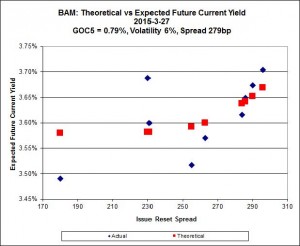

Click for Big

Click for BigThe fit on this series is actually quite reasonable – it’s the scale that makes it look so weird.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 21.36 to be $0.61 cheap. BAM.PF.E, resetting at +255bp 2020-3-31 is bid at 24.30 and appears to be $0.70 rich.

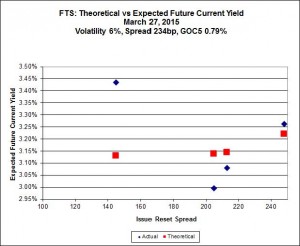

Click for Big

Click for BigThis is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 16.32, looks $1.47 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp and resetting 2019-3-1, is bid at 23.71 and is $1.06 rich.

Click for Big

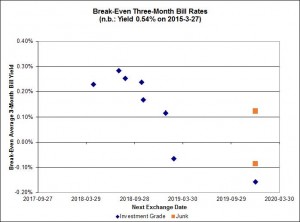

Click for BigInvestment-grade pairs predict an average over the next five years of about 0.10% – except for one outlier, TRP.PR.A / TRP.PR.F, which has a break-even of -0.48%. The DC.PR.B / DC.PR.D pair has gone completely insane and now predicts an average bill rate over the next 4 3/4 years of -5.15% … but the indicated bid of 19.08 on DC.PR.D is just a little bit more Toronto Stock Exchange idiocy, since the low for the day was 21.65 on frenetic volume of 1,500 shares.

Click for Big

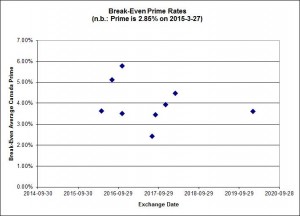

Click for BigShall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-1.2562 % |

2,310.7 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-1.2562 % |

4,040.3 |

| Floater |

3.28 % |

3.24 % |

61,794 |

19.12 |

3 |

-1.2562 % |

2,456.5 |

| OpRet |

4.07 % |

0.97 % |

102,798 |

0.24 |

1 |

0.0000 % |

2,765.8 |

| SplitShare |

4.36 % |

4.42 % |

32,890 |

3.48 |

4 |

0.2807 % |

3,209.8 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0000 % |

2,529.1 |

| Perpetual-Premium |

5.30 % |

1.00 % |

58,783 |

0.09 |

25 |

-0.0658 % |

2,523.4 |

| Perpetual-Discount |

4.97 % |

5.00 % |

168,673 |

15.26 |

9 |

0.1305 % |

2,816.3 |

| FixedReset |

4.38 % |

3.38 % |

231,905 |

16.83 |

85 |

0.1295 % |

2,434.5 |

| Deemed-Retractible |

4.90 % |

0.53 % |

112,569 |

0.17 |

37 |

-0.0842 % |

2,658.2 |

| FloatingReset |

2.43 % |

2.82 % |

82,031 |

6.31 |

8 |

0.1173 % |

2,343.6 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BAM.PR.K |

Floater |

-2.89 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 14.78

Evaluated at bid price : 14.78

Bid-YTW : 3.37 % |

| CU.PR.D |

Perpetual-Premium |

-1.65 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 24.59

Evaluated at bid price : 25.03

Bid-YTW : 4.92 % |

| GWO.PR.H |

Deemed-Retractible |

-1.27 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.78

Bid-YTW : 4.98 % |

| MFC.PR.K |

FixedReset |

-1.19 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.16

Bid-YTW : 3.70 % |

| FTS.PR.H |

FixedReset |

-1.15 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 16.32

Evaluated at bid price : 16.32

Bid-YTW : 3.35 % |

| SLF.PR.G |

FixedReset |

-1.01 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.65

Bid-YTW : 6.18 % |

| IFC.PR.A |

FixedReset |

1.18 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.45

Bid-YTW : 4.81 % |

| BNS.PR.Z |

FixedReset |

1.20 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.59

Bid-YTW : 3.29 % |

| MFC.PR.C |

Deemed-Retractible |

1.26 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.20

Bid-YTW : 4.95 % |

| ENB.PR.F |

FixedReset |

1.46 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 20.10

Evaluated at bid price : 20.10

Bid-YTW : 4.21 % |

| CIU.PR.C |

FixedReset |

1.48 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 17.10

Evaluated at bid price : 17.10

Bid-YTW : 3.19 % |

| PWF.PR.P |

FixedReset |

1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 19.00

Evaluated at bid price : 19.00

Bid-YTW : 3.20 % |

| HSE.PR.A |

FixedReset |

1.88 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 17.32

Evaluated at bid price : 17.32

Bid-YTW : 3.68 % |

| ENB.PR.J |

FixedReset |

1.92 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 21.43

Evaluated at bid price : 21.76

Bid-YTW : 4.04 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| FTS.PR.G |

FixedReset |

155,021 |

Nesbitt crossed 148,900 at 23.80.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 22.78

Evaluated at bid price : 23.71

Bid-YTW : 3.12 % |

| TD.PF.A |

FixedReset |

153,647 |

RBC crossed 42,800 at 24.96. TD crossed two blocks of 50,000 each at the same price.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 23.16

Evaluated at bid price : 24.92

Bid-YTW : 3.06 % |

| TRP.PR.C |

FixedReset |

143,666 |

Nesbitt crossed 131,300 at 17.21.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 17.28

Evaluated at bid price : 17.28

Bid-YTW : 3.44 % |

| TD.PF.C |

FixedReset |

126,115 |

TD crossed two blocks of 50,000 each, both at 24.71.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 23.06

Evaluated at bid price : 24.69

Bid-YTW : 3.12 % |

| RY.PR.M |

FixedReset |

115,625 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 23.00

Evaluated at bid price : 24.65

Bid-YTW : 3.35 % |

| CM.PR.P |

FixedReset |

110,344 |

Desjardins crossed 100,000 at 24.65.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 23.12

Evaluated at bid price : 24.85

Bid-YTW : 3.01 % |

| There were 36 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| GWO.PR.H |

Deemed-Retractible |

Quote: 24.78 – 25.18

Spot Rate : 0.4000

Average : 0.2519

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.78

Bid-YTW : 4.98 % |

| CU.PR.D |

Perpetual-Premium |

Quote: 25.03 – 25.45

Spot Rate : 0.4200

Average : 0.3114

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2045-03-24

Maturity Price : 24.59

Evaluated at bid price : 25.03

Bid-YTW : 4.92 % |

| MFC.PR.K |

FixedReset |

Quote: 24.16 – 24.60

Spot Rate : 0.4400

Average : 0.3451

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.16

Bid-YTW : 3.70 % |

| MFC.PR.I |

FixedReset |

Quote: 25.80 – 26.08

Spot Rate : 0.2800

Average : 0.1894

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2017-09-19

Maturity Price : 25.00

Evaluated at bid price : 25.80

Bid-YTW : 3.09 % |

| GWO.PR.I |

Deemed-Retractible |

Quote: 24.35 – 24.57

Spot Rate : 0.2200

Average : 0.1562

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.35

Bid-YTW : 4.85 % |

| SLF.PR.E |

Deemed-Retractible |

Quote: 23.76 – 24.08

Spot Rate : 0.3200

Average : 0.2603

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.76

Bid-YTW : 5.16 % |