I went to a seminar on Risk Management today, presented as part of the Finance Experts Discussion Series @ Rotman.

Rather disappointing, really. Panelists were:

- Derrell Hendrix, CEO, RISConsulting and Founding Partner and CEO, Karson Management (Bermuda) Limited

- John Hull, Maple Financial Group Chair in Derivatives and Risk Management, Professor of Finance and Co-Director, Master of Finance Program, Rotman School of Management, U of Toronto

- Robert (Bob) Tapscott, interim CEO, RISConsulting

One of the RISConsulting guys – I forget which one – was of the view that transparency will save the world and drew comparisons to nuclear reactor design and operation. He did not address the problems inherent in forecasting financial markets – rather than designing and operating physical technology – nor did he explain whereby investors are presumed to be able to find the time to utilize such transparency. Hands up everybody who’s read through the entire annual report of every company in which they’ve invested!

Dr. Hull claimed that the world would be saved through reduction of perverse incentives, by which he means he wants deferred bonuses rather than immediate ones. He did not address the question of who in their right mind would willingly work for a deferred bonus, or what discounting rate a rational participant should apply to the deferred portion since eventual payment of the amount due is basically discretionary. I’d suggest 50%+. Counterparty risk is pretty extreme in such circumstances.

Limited / Deferred / Regulated compensation is getting a lot of ink nowadays. Econbrowser‘s James Hamilton is also beating that drum. Sigh. Time to move to Dubai, ’cause that’s where all the action’s going to be in ten years, at this rate.

Credit crunch commentary has now reached its most tiresome phase: it’s just being used as a vehicle to push along various long-standing agendas. The crisis itself is merely a tired rehash of the panic of 1825 and it’s BORING.

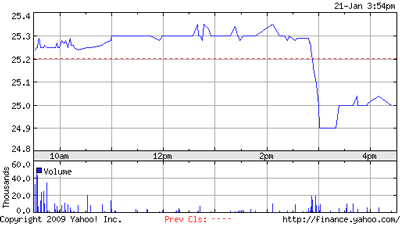

Good volume today, but the market was off a good bit, probably due – as much as anything in the markets is ever due – to a combination of rotten equities and heavy issuance.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.83 % | 7.42 % | 37,658 | 13.67 | 2 | -0.0347 % | 868.3 |

| FixedFloater | 7.32 % | 6.90 % | 153,304 | 13.82 | 8 | -0.1379 % | 1,400.9 |

| Floater | 5.36 % | 4.79 % | 35,027 | 15.87 | 4 | -1.9529 % | 980.2 |

| OpRet | 5.32 % | 4.78 % | 141,464 | 4.05 | 15 | -0.1617 % | 2,018.0 |

| SplitShare | 6.26 % | 9.78 % | 82,309 | 4.14 | 15 | -0.9220 % | 1,777.3 |

| Interest-Bearing | 7.18 % | 8.24 % | 36,981 | 0.90 | 2 | -0.1170 % | 1,971.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.5751 % | 1,554.3 |

| Perpetual-Discount | 6.90 % | 6.94 % | 233,509 | 12.63 | 71 | -0.5751 % | 1,431.5 |

| FixedReset | 6.00 % | 4.89 % | 828,051 | 15.05 | 22 | -0.7398 % | 1,808.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| DFN.PR.A | SplitShare | -7.44 % | Asset coverage of 1.7-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.33 Bid-YTW : 9.13 % |

| BAM.PR.B | Floater | -7.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 7.61 Evaluated at bid price : 7.61 Bid-YTW : 6.99 % |

| PWF.PR.I | Perpetual-Discount | -5.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 7.03 % |

| NA.PR.M | Perpetual-Discount | -4.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 21.20 Evaluated at bid price : 21.20 Bid-YTW : 7.10 % |

| WFS.PR.A | SplitShare | -3.75 % | Asset coverage of 1.2-:1 as of January 15, according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-06-30 Maturity Price : 10.00 Evaluated at bid price : 8.48 Bid-YTW : 12.98 % |

| BNS.PR.R | FixedReset | -3.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 21.33 Evaluated at bid price : 21.61 Bid-YTW : 4.46 % |

| FBS.PR.B | SplitShare | -3.58 % | Asset coverage of 1.1-:1 as of January 15 according to TD Securities. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-12-15 Maturity Price : 10.00 Evaluated at bid price : 7.81 Bid-YTW : 14.60 % |

| GWO.PR.H | Perpetual-Discount | -3.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 16.81 Evaluated at bid price : 16.81 Bid-YTW : 7.32 % |

| SLF.PR.A | Perpetual-Discount | -2.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 16.28 Evaluated at bid price : 16.28 Bid-YTW : 7.40 % |

| SLF.PR.D | Perpetual-Discount | -2.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 15.38 Evaluated at bid price : 15.38 Bid-YTW : 7.34 % |

| PWF.PR.H | Perpetual-Discount | -2.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 20.49 Evaluated at bid price : 20.49 Bid-YTW : 7.07 % |

| RY.PR.L | FixedReset | -2.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 24.08 Evaluated at bid price : 24.12 Bid-YTW : 4.89 % |

| BNA.PR.C | SplitShare | -2.27 % | Asset coverage of 1.8+:1 as of December 31 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 10.75 Bid-YTW : 16.32 % |

| GWO.PR.G | Perpetual-Discount | -2.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 18.11 Evaluated at bid price : 18.11 Bid-YTW : 7.28 % |

| POW.PR.D | Perpetual-Discount | -2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 17.91 Evaluated at bid price : 17.91 Bid-YTW : 7.05 % |

| CM.PR.K | FixedReset | -1.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 22.11 Evaluated at bid price : 22.75 Bid-YTW : 4.63 % |

| ELF.PR.G | Perpetual-Discount | -1.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 15.20 Evaluated at bid price : 15.20 Bid-YTW : 7.90 % |

| BCE.PR.I | FixedFloater | -1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 25.00 Evaluated at bid price : 16.01 Bid-YTW : 6.97 % |

| HSB.PR.C | Perpetual-Discount | -1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 17.23 Evaluated at bid price : 17.23 Bid-YTW : 7.51 % |

| CM.PR.I | Perpetual-Discount | -1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 16.28 Evaluated at bid price : 16.28 Bid-YTW : 7.27 % |

| ELF.PR.F | Perpetual-Discount | -1.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 15.91 Evaluated at bid price : 15.91 Bid-YTW : 8.43 % |

| FTN.PR.A | SplitShare | -1.74 % | Asset coverage of 1.4-:1 as of January 15, according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2015-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.89 Bid-YTW : 9.67 % |

| TD.PR.A | FixedReset | -1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 22.66 Evaluated at bid price : 22.70 Bid-YTW : 4.32 % |

| RY.PR.I | FixedReset | -1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 22.96 Evaluated at bid price : 23.00 Bid-YTW : 4.37 % |

| TD.PR.C | FixedReset | -1.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 24.11 Evaluated at bid price : 24.15 Bid-YTW : 4.84 % |

| SLF.PR.C | Perpetual-Discount | -1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 15.55 Evaluated at bid price : 15.55 Bid-YTW : 7.26 % |

| BNS.PR.P | FixedReset | -1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 22.77 Evaluated at bid price : 22.85 Bid-YTW : 4.31 % |

| ALB.PR.A | SplitShare | -1.40 % | Asset coverage of 1.2-:1 as of January 15 according to Scotia Managed Companies. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-02-28 Maturity Price : 25.00 Evaluated at bid price : 19.75 Bid-YTW : 16.99 % |

| GWO.PR.F | Perpetual-Discount | -1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 21.70 Evaluated at bid price : 21.70 Bid-YTW : 6.89 % |

| TD.PR.R | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 20.80 Evaluated at bid price : 20.80 Bid-YTW : 6.78 % |

| CM.PR.J | Perpetual-Discount | -1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 15.79 Evaluated at bid price : 15.79 Bid-YTW : 7.18 % |

| MFC.PR.B | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 17.83 Evaluated at bid price : 17.83 Bid-YTW : 6.62 % |

| SLF.PR.E | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 15.61 Evaluated at bid price : 15.61 Bid-YTW : 7.31 % |

| BMO.PR.H | Perpetual-Discount | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 6.76 % |

| BAM.PR.J | OpRet | -1.22 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 17.05 Bid-YTW : 11.15 % |

| BNS.PR.M | Perpetual-Discount | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 6.59 % |

| TRI.PR.B | Floater | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 11.05 Evaluated at bid price : 11.05 Bid-YTW : 4.79 % |

| SBC.PR.A | SplitShare | -1.10 % | Asset coverage of 1.4+:1 as of January 15 according to Brompton Group. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-11-30 Maturity Price : 10.00 Evaluated at bid price : 8.11 Bid-YTW : 11.58 % |

| PWF.PR.L | Perpetual-Discount | -1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 18.25 Evaluated at bid price : 18.25 Bid-YTW : 7.04 % |

| PWF.PR.M | FixedReset | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 24.62 Evaluated at bid price : 24.67 Bid-YTW : 5.29 % |

| TCA.PR.Y | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 43.37 Evaluated at bid price : 44.15 Bid-YTW : 6.36 % |

| NA.PR.N | FixedReset | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 21.96 Evaluated at bid price : 22.01 Bid-YTW : 4.59 % |

| LFE.PR.A | SplitShare | 1.50 % | Asset coverage of 1.5-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.47 Bid-YTW : 6.97 % |

| CU.PR.B | Perpetual-Discount | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 22.66 Evaluated at bid price : 22.87 Bid-YTW : 6.68 % |

| FFN.PR.A | SplitShare | 3.06 % | Asset coverage of 1.1+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.75 Bid-YTW : 10.67 % |

| PPL.PR.A | SplitShare | 4.00 % | Asset coverage of 1.4+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.85 Bid-YTW : 8.64 % |

| BAM.PR.N | Perpetual-Discount | 4.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 11.83 Evaluated at bid price : 11.83 Bid-YTW : 10.23 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| PWF.PR.J | OpRet | 201,898 | Nesbitt crossed 200,000 at 25.05. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 4.70 % |

| BNS.PR.T | FixedReset | 193,491 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 5.92 % |

| RY.PR.P | FixedReset | 108,295 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 24.96 Evaluated at bid price : 25.01 Bid-YTW : 5.96 % |

| TD.PR.M | OpRet | 71,341 | Anonymous bought two blocks of 25,000 shares each from Desjardins at 26.00. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 3.86 % |

| RY.PR.I | FixedReset | 61,273 | Nesbitt crossed 25,000 shares at 23.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-22 Maturity Price : 22.96 Evaluated at bid price : 23.00 Bid-YTW : 4.37 % |

| IGM.PR.A | OpRet | 59,249 | Nesbitt crossed 50,000 at 25.50. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-06-29 Maturity Price : 25.00 Evaluated at bid price : 25.40 Bid-YTW : 5.47 % |

| There were 35 other index-included issues trading in excess of 10,000 shares. | |||