Encouraging news regarding Wall Street’s structure is being reported:

Smaller firms are emerging from the wreckage of the world’s largest financial companies, which are conserving capital following more than $1.2 trillion of writedowns and credit losses since the start of 2007. They’re luring traders with a shot at $500,000 commissions for two days’ work as banks that accepted federal bailouts retrench and slash bonuses.

…

“I don’t mean to dance on anybody’s graves here, but it’s just this incredible opportunity to reassemble a securities firm that does business the right way,” said Lee Fensterstock, chief executive officer of one of the firms, Broadpoint Securities Group Inc. in New York. “That business is going to lead with brain as opposed to capital. We’re not planning to run big balance sheets or big leveraged positions.”

Let’s just hope this trickles down to Bay Street! Since the banks took over the industry in 1990, there has been a marked evolution towards bond traders and salesmen being jumped-up tellers more than anything else.

In shocking news, a UK bond auction has failed:

The U.K. failed to find enough buyers for 1.75 billion pounds ($2.55 billion) of bonds for the first time in almost seven years as debt investors repudiated Prime Minister Gordon Brown’s plan to stem the worst economic crisis in three decades.

Gilts slumped after the London-based Debt Management Office, which manages bond auctions on behalf of the Treasury, said investors bid for 1.63 billion pounds of the 40-year securities. The last time the U.K. government was unable to attract enough investors was in 2002 when it tried to sell 30- year inflation-protected bonds. The yield on the 4.5 percent gilt due 2049 rose 10 basis points to 4.55 percent.

…

“This sinks Brown below the waterline,” said Bill Jones, professor of politics at Liverpool Hope University. Brown’s “whole strategy is based on borrowing and now he can’t get anyone to buy his gilts. This means the prospect of going cap in hand to the IMF hovers increasingly into view.”

…

The auction failure comes as the Bank of England uses newly printed money to purchase government and corporate debt in an attempt to drive down borrowing costs. The Treasury gave the central bank authority March 5 to purchase as much as 150 billion pounds of securities.

“It doesn’t help to have your central bank say it’s buying government debt and then when you’re selling it you can’t find enough buyers,” Kit Juckes, head of fixed-income research at Royal Bank of Scotland Group Plc in London, said in an interview today on Bloomberg Radio. “It doesn’t impress.”

Watch out, Kit Juckes, head of fixed-income cheerleading at Royal Bank of Scotland Group PLC in London! You work for a nationalized firm! No bonus for YOU!

Equities were having a nice day, until the Treasury 5-Year auction drew weak interest. Across the Curve is not impressed by the Fed’s implementation of its somewhat offsetting buy-back programme.

The political incitement to riot continues; politicians can be proud that their efforts have not just resulted in the bleating of sheep, but much more direct action.

Kudos to the Hospitals of Ontario Pension Plan, which delivered superb performance in 2008:

The Hospitals of Ontario Pension Plan (HOOPP) announced an investment rate of return for 2008 of -11.96 per cent, closing the year 97% funded.

“HOOPP weathered the financial market storm better than most in 2008, but it’s our long-term ability to pay pensions that counts…and we want to assure our members that their pensions are secure. Whether markets are up or down, by focusing first and foremost on our obligations HOOPP continues to provide a pension our members can count on,” said John Crocker, President and CEO. “HOOPP’s joint governance structure ensures that our Board of Trustees is continuously engaged and able to take action as required to keep our pension promise.”

An example of this active Board involvement is HOOPP’s change in investment strategy in late 2007 to reduce risk by adjusting the asset mix to better match the maturing plan’s pension liabilities. This change minimized losses by significantly reducing public equity exposure and increasing investments in Canadian bonds.

Can you imagine? Paying attention to liabilities when investing the assets? Incredible! Revolutionary! John Crocker is a GENIUS!!!

The Chief Investment Officer, John Keohane, was promoted from his position as Vice-President of Portfolio Strategy & Derivatives. John Crocker was promoted from CIO.

Assiduous Readers may remember my thesis that outperformance is very easy for large institutional funds. All you need is a captive investment team that can concentrate on performance and is rewarded for performance, without having to worry about sales and story-telling. OMERS & Teachers are such plans. Even the Caisse qualifies, although just barely. Unfortunately, this thesis will never be stringently tested by academics; there’s too much risk that it might be found that markets are not efficient, which would mean forty years’ work down the drain.

There is a lot of blather about replacing the USD as the international reserve currency of choice; this is mere political mischief making. Replacing the USD is easy, you can do it tomorrow, if you like. Simply ask for international payments to be made in some other currency and accept no substitutes. Accrued Interest has ridiculed the Chinese position on US investments, which is a rather dangerous view to take: trends don’t have to execute completely overnight to cause a lot of problems … Americans will become very upset over time if they discover in ten years that their mortgage rates are set in Peking.

A dull day, price-wise, but volume was good. PerpetualDiscounts now yield 7.30%, equivalent to 10.22% interest at the standard equivalency factor of 1.4x. Long Corporates continue to be DULL and BORING, trading in a tight range around 7.5%, so the pre-tax interest-equivalent spread is now 272bp; high by any standards but those of the past six months.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

1.8015 % |

868.8 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

1.8015 % |

1,405.0 |

| Floater |

4.55 % |

5.51 % |

64,173 |

14.66 |

3 |

1.8015 % |

1,085.3 |

| OpRet |

5.25 % |

4.81 % |

130,377 |

3.88 |

15 |

0.1433 % |

2,067.3 |

| SplitShare |

6.73 % |

9.29 % |

49,658 |

4.79 |

6 |

0.8849 % |

1,651.2 |

| Interest-Bearing |

6.09 % |

9.73 % |

34,556 |

0.73 |

1 |

-0.3036 % |

1,927.7 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0613 % |

1,507.6 |

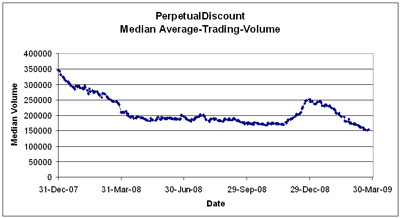

| Perpetual-Discount |

7.19 % |

7.30 % |

153,880 |

12.19 |

71 |

-0.0613 % |

1,388.5 |

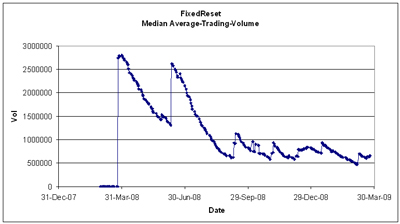

| FixedReset |

6.14 % |

5.80 % |

645,016 |

13.75 |

31 |

-0.0131 % |

1,808.1 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| GWO.PR.F |

Perpetual-Discount |

-1.79 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 19.25

Evaluated at bid price : 19.25

Bid-YTW : 7.72 % |

| NA.PR.L |

Perpetual-Discount |

-1.76 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 17.26

Evaluated at bid price : 17.26

Bid-YTW : 7.15 % |

| BNS.PR.O |

Perpetual-Discount |

-1.59 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 21.01

Evaluated at bid price : 21.01

Bid-YTW : 6.80 % |

| PWF.PR.G |

Perpetual-Discount |

-1.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 19.01

Evaluated at bid price : 19.01

Bid-YTW : 7.94 % |

| BMO.PR.K |

Perpetual-Discount |

-1.53 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 18.02

Evaluated at bid price : 18.02

Bid-YTW : 7.40 % |

| RY.PR.B |

Perpetual-Discount |

-1.42 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 17.40

Evaluated at bid price : 17.40

Bid-YTW : 6.86 % |

| TD.PR.Y |

FixedReset |

-1.34 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 21.36

Evaluated at bid price : 21.36

Bid-YTW : 4.41 % |

| SLF.PR.D |

Perpetual-Discount |

-1.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 14.56

Evaluated at bid price : 14.56

Bid-YTW : 7.70 % |

| BNS.PR.R |

FixedReset |

-1.25 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 21.30

Evaluated at bid price : 21.30

Bid-YTW : 4.61 % |

| BNS.PR.K |

Perpetual-Discount |

-1.18 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 17.57

Evaluated at bid price : 17.57

Bid-YTW : 6.97 % |

| RY.PR.E |

Perpetual-Discount |

-1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 16.69

Evaluated at bid price : 16.69

Bid-YTW : 6.85 % |

| RY.PR.D |

Perpetual-Discount |

-1.07 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 16.67

Evaluated at bid price : 16.67

Bid-YTW : 6.85 % |

| IAG.PR.A |

Perpetual-Discount |

-1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 14.60

Evaluated at bid price : 14.60

Bid-YTW : 7.94 % |

| BNS.PR.J |

Perpetual-Discount |

-1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 19.50

Evaluated at bid price : 19.50

Bid-YTW : 6.87 % |

| ELF.PR.G |

Perpetual-Discount |

1.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 13.59

Evaluated at bid price : 13.59

Bid-YTW : 8.99 % |

| HSB.PR.C |

Perpetual-Discount |

1.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 17.76

Evaluated at bid price : 17.76

Bid-YTW : 7.23 % |

| PWF.PR.H |

Perpetual-Discount |

1.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 17.46

Evaluated at bid price : 17.46

Bid-YTW : 8.43 % |

| MFC.PR.B |

Perpetual-Discount |

1.21 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 15.95

Evaluated at bid price : 15.95

Bid-YTW : 7.36 % |

| BAM.PR.O |

OpRet |

1.24 % |

YTW SCENARIO

Maturity Type : Option Certainty

Maturity Date : 2013-06-30

Maturity Price : 25.00

Evaluated at bid price : 22.07

Bid-YTW : 8.35 % |

| MFC.PR.C |

Perpetual-Discount |

1.33 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 15.20

Evaluated at bid price : 15.20

Bid-YTW : 7.48 % |

| RY.PR.A |

Perpetual-Discount |

1.41 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 17.24

Evaluated at bid price : 17.24

Bid-YTW : 6.55 % |

| DFN.PR.A |

SplitShare |

1.45 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2014-12-01

Maturity Price : 10.00

Evaluated at bid price : 8.40

Bid-YTW : 9.06 % |

| BAM.PR.M |

Perpetual-Discount |

1.52 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 13.36

Evaluated at bid price : 13.36

Bid-YTW : 8.97 % |

| NA.PR.N |

FixedReset |

1.75 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 22.62

Evaluated at bid price : 22.69

Bid-YTW : 4.50 % |

| BMO.PR.M |

FixedReset |

1.81 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 21.85

Evaluated at bid price : 21.90

Bid-YTW : 4.18 % |

| GWO.PR.H |

Perpetual-Discount |

1.86 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 15.86

Evaluated at bid price : 15.86

Bid-YTW : 7.71 % |

| BAM.PR.B |

Floater |

1.92 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 7.96

Evaluated at bid price : 7.96

Bid-YTW : 5.51 % |

| ACO.PR.A |

OpRet |

1.92 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2009-12-31

Maturity Price : 25.50

Evaluated at bid price : 26.00

Bid-YTW : 3.53 % |

| BAM.PR.N |

Perpetual-Discount |

2.31 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 13.31

Evaluated at bid price : 13.31

Bid-YTW : 9.01 % |

| PWF.PR.A |

Floater |

2.38 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 13.31

Evaluated at bid price : 13.31

Bid-YTW : 3.31 % |

| SBN.PR.A |

SplitShare |

2.48 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2014-12-01

Maturity Price : 10.00

Evaluated at bid price : 8.28

Bid-YTW : 9.29 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.X |

FixedReset |

91,100 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 25.15

Evaluated at bid price : 25.20

Bid-YTW : 6.17 % |

| MFC.PR.D |

FixedReset |

57,705 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 24.58

Evaluated at bid price : 24.63

Bid-YTW : 6.46 % |

| TD.PR.I |

FixedReset |

52,885 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 25.00

Evaluated at bid price : 25.05

Bid-YTW : 5.95 % |

| CM.PR.L |

FixedReset |

48,927 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 24.95

Evaluated at bid price : 25.00

Bid-YTW : 6.19 % |

| BMO.PR.O |

FixedReset |

45,240 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 24.95

Evaluated at bid price : 25.00

Bid-YTW : 6.32 % |

| TD.PR.E |

FixedReset |

42,685 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-25

Maturity Price : 25.13

Evaluated at bid price : 25.18

Bid-YTW : 6.13 % |

| There were 34 other index-included issues trading in excess of 10,000 shares. |