Brookfield Properties has announced:

that the Toronto Stock Exchange accepted a notice filed by Brookfield Properties of its intention to make a normal course issuer bid for its class AAA preference shares, series F (“Series F Shares”), series G (“Series G Shares”), series H (“Series H Shares”), series I (“Series I Shares”), series J (“Series J Shares”) and series K (“Series K Shares”). Brookfield Properties stated that at times its class AAA preference shares trade in price ranges that do not fully reflect their value. As a result, from time to time, acquiring class AAA preference shares will represent an attractive and a desirable use of available funds.

The notice provides that Brookfield Properties may, during the twelve month period commencing December 11, 2009 and ending December 10, 2010, purchase on the Toronto Stock Exchange up to 400,000 Series F Shares, 220,000 Series G Shares, 400,000 Series H Shares, 400,000 Series I Shares, 400,000 Series J Shares and 300,000 Series K Shares, each representing approximately 5% of the issued and outstanding of the relevant series of class AAA preference shares. At December 3, 2009, there were 8,000,000 Series F Shares, 4,400,000 Series G Shares, 8,000,000 Series H Shares, 8,000,000 Series I Shares, 8,000,000 Series J Shares and 6,000,000 Series K Shares issued and outstanding. Under the normal course issuer bid, Brookfield Properties may purchase up to 2,652 Series F Shares, 1,000 Series G Shares, 2,614 Series H Shares, 4,439 Series I Shares, 2,026 Series J Shares, and 1,550 Series K Shares on the Toronto Stock Exchange during any trading day, each of which represents 25% of the average daily trading volume on the Toronto Stock Exchange for the most recently completed six calendar months prior to the Toronto Stock Exchange’s acceptance of the notice of the normal course issuer bid. This limitation does not apply to purchases made pursuant to block purchase exemptions.The price to be paid for the class AAA preference shares under the normal course issuer bid will be the market price at the time of purchase. The actual number of class AAA preference shares to be purchased and the timing of such purchases will be determined by Brookfield Properties, and all class AAA preference shares will be purchased on the open market or such other means as approved by the Toronto Stock Exchange. All class AAA preference shares purchased by Brookfield Properties under this bid will be promptly cancelled.

The average daily trading volumes of the class AAA preference shares on the Toronto Stock Exchange during the six months ended November, 2009 was 10,606 with respect to the Series F Shares, 3,636 with respect to the Series G Shares, 10,454 with respect to the Series H Shares, 17,755 with respect to the Series I Shares, 8,103 with respect to the Series J Shares, and 6,199 with respect to the Series K Shares.

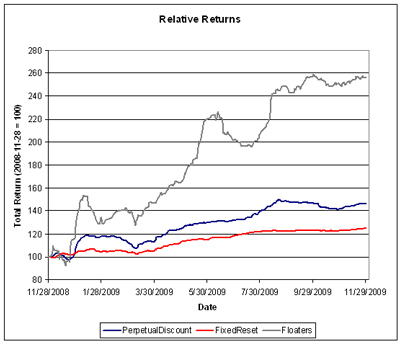

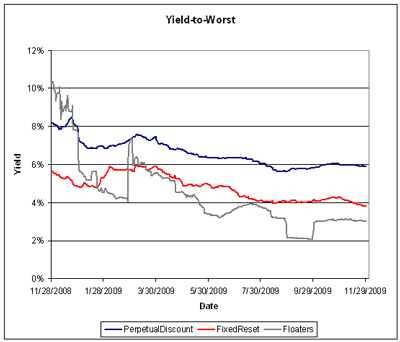

There is no mention of a preferred share NCIB in the 2008 Annual Report (although there is a significant common share NCIB), so this announcement is not something I would normally report. In this case, however, I was specifically asked about it by Assiduous Reader MP and there are some other things that give credence to the idea … like, f’rinstance, relative yields:

| BPO Issues | ||

| Ticker | Retraction | YTW |

| BPO.PR.F | 2013-3-31 | 6.35% |

| BPO.PR.H | 2015-12-31 | 7.52% |

| BPO.PR.I | 2011-1-1 | 4.65% |

| BPO.PR.J | 2014-12-31 | 7.11% |

| BPO.PR.K | 2016-12-31 | 7.58% |

| BPO.PR.L | Never. Resets 2014-9-30 | 6.29% (to presumed call on reset date) |

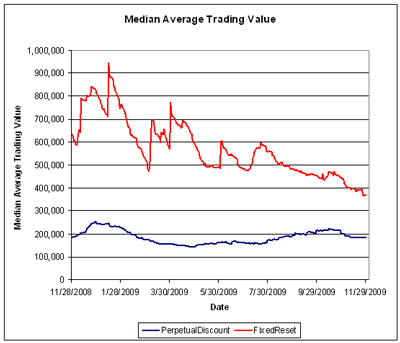

BPO.PR.L, the FixedReset, has been insanely expensive since its opening date, yielding less, with a lower chance of 5-year maturity, than the retractible.

Even that might not have been enough for me to take this bid seriously … but there is also the recent YPG FixedReset 6.90%+426 issue to consider. This, the second YPG FixedReset, has just been announced and YPG.PR.B, retractible 2017-6-30 and the target of a real issuer bid continues to trade with a double digit yield. Such is the allure of FixedResets!

A FixedReset issue, being perpetual, will appear in the equity section of the balance sheet (retractibles are considered liabilities for balance sheet purposes) improving credit ratios; additionally, credit rating agencies will assign a greater equity equivalency factor to perpetuals. In terms of lowering the cost of bond issues, refinancing retractibles with FixedResets makes all kinds of sense.

No predictions! But it will be interesting to see how this turns out.