It’s been a bad few weeks for pension plans:

Pension consulting firm Aon Hewitt estimates the average funded position of corporate pension plans in Canada fell from 97 per cent on July 25 to 85 per cent by Aug. 8 after stock markets went into a tailspin. That means plans have slid into a significant deficit after being close to fully funded, based on financial statement disclosure measures.

…

The results show pension plans have been “on a roller coaster,” [Aon Hewitt vice-president] Mr. [Tom] Ault said, with high volatility and daily swings of more than two percentage points in their funded position on many of the days in August so far.

There’s at least one European bank with a major funding problem:

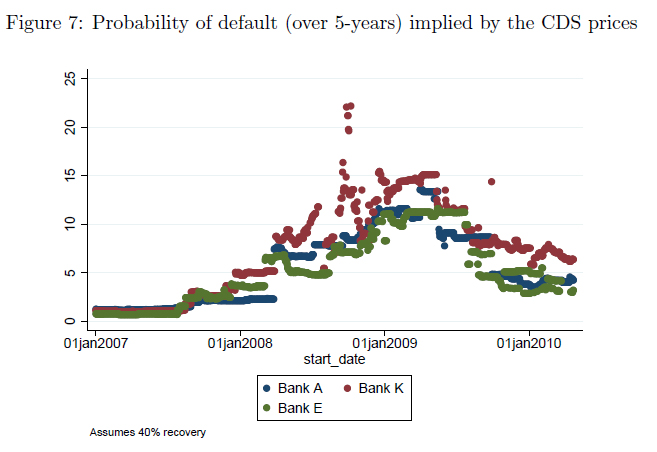

The euro zone’s sovereign debt crisis knows no bounds. The European Central Bank’s disclosure that it had provided $500-million to a bank — the biggest sum in two years — shows that one euro zone institution is struggling to raise dollars.

…

U.S. money market funds, although a small proportion of overall European bank funding, give an idea of the risk: they have reduced both maturities and funding lines. BBVA and Santander, Spanish banks with U.S. retail units, had a foretaste last year when they struggled to raise dollar funds. This year, as investors fret about Italy’s sovereign risk, it is Italian lenders that are looking for alternative short-term funding as U.S. sources hug the sidelines.In July alone, their usage of ECB repo lines increased by €40-billion to compensate, Morgan Stanley notes. French banks are also big users of U.S. money funds (perhaps €50-billion for BNP Paribas and €38-billion for Société Générale, the broker estimates) but their ECB usage rose by much less, suggesting they could roll over dollar funding, but perhaps only at shorter maturities.

It was quite a day:

Stocks plunged while Treasuries rallied, pushing yields to record lows, amid growing signs the economy is slowing and speculation that European banks lack sufficient capital. Gold climbed to a record, while oil led commodities lower.

The Standard & Poor’s 500 Index tumbled 4.5 percent to 1,140.74 at 4 p.m. in New York. The Stoxx Europe 600 Index lost 4.8 percent in its worst plunge since March 2009 and Germany’s DAX Index slid 5.8 percent, the most since 2008. Ten-year Treasury yields fell as much as 19 basis points to 1.97 percent as rates on similar-maturity Canadian and British debt also reached all-time lows. The dollar gained versus 15 of 16 major peers, strengthening 0.6 percent to $1.4336 per euro. Gold futures rallied as much as 2.1 percent to $1,832 an ounce, while oil slid 5.9 percent.

Banks led losses a day after the European Central Bank said a lender will borrow dollars for the first time in six months. Lars Frisell, chief economist at Sweden’s financial regulator, said it won’t take much for interbank lending to freeze and the Wall Street Journal reported regulators were scrutinizing the U.S. operations of Europe’s largest lenders to assess their vulnerability. U.S. jobless claims rose and Philadelphia-area manufacturing shrank by the most since 2009, while hopes for more stimulus from the Federal Reserve receded.

Politicians like to pretend they care about productivity, while at the same time forking over millions in milkfare, protecting Air Canada from foreign competition and subsidizing not-ready-for-prime-time solar technology. The latest example is a little more homespun:

A local fruit vendor has been forced to close a popular produce stand after the City of Vancouver decided the operation had grown too large for its streetside space.

…

To continue operating the stand at its present size, [Vancouver deputy chief licence inspector] Mr. [Tom] Hamilton said, Mr. Smith would require a farmer’s-market permit.But such a permit would require Mr. Smith’s suppliers to sell their produce directly to the public at the stand, Mr. Hamilton said.

Quick! Find out who developed the rules and put them in charge of Toronto’s food cart programme! With some help, we can make it even more counterproductive and precious this time ’round!

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts winning 22bp, FixedResets up 5bp and DeemedRetractibles down 14bp. Volatility was quite good. Volume was average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.1416 % | 2,175.1 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.1416 % | 3,271.4 |

| Floater | 2.79 % | 2.57 % | 30,895 | 20.89 | 4 | -1.1416 % | 2,348.6 |

| OpRet | 4.87 % | 3.70 % | 57,414 | 0.12 | 9 | 0.0387 % | 2,446.9 |

| SplitShare | 5.45 % | 0.92 % | 62,202 | 0.53 | 4 | -1.3070 % | 2,461.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0387 % | 2,237.4 |

| Perpetual-Premium | 5.69 % | 5.12 % | 136,048 | 2.02 | 14 | -0.1976 % | 2,098.0 |

| Perpetual-Discount | 5.38 % | 5.47 % | 108,723 | 14.63 | 16 | 0.2187 % | 2,220.6 |

| FixedReset | 5.14 % | 3.15 % | 213,539 | 2.73 | 60 | 0.0495 % | 2,319.4 |

| Deemed-Retractible | 5.05 % | 4.66 % | 269,225 | 7.77 | 46 | -0.1422 % | 2,183.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNA.PR.E | SplitShare | -3.81 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 22.31 Bid-YTW : 6.98 % |

| BAM.PR.B | Floater | -2.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 16.13 Evaluated at bid price : 16.13 Bid-YTW : 3.28 % |

| BNA.PR.C | SplitShare | -1.95 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 21.25 Bid-YTW : 6.98 % |

| BAM.PR.K | Floater | -1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 16.20 Evaluated at bid price : 16.20 Bid-YTW : 3.27 % |

| TRI.PR.B | Floater | -1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 22.22 Evaluated at bid price : 22.50 Bid-YTW : 2.32 % |

| GWO.PR.H | Deemed-Retractible | -1.51 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.54 Bid-YTW : 5.72 % |

| IGM.PR.B | Perpetual-Premium | -1.40 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.27 Bid-YTW : 5.81 % |

| TD.PR.Q | Deemed-Retractible | -1.28 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-31 Maturity Price : 25.50 Evaluated at bid price : 26.26 Bid-YTW : 4.66 % |

| MFC.PR.C | Deemed-Retractible | -1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.07 Bid-YTW : 6.17 % |

| PWF.PR.L | Perpetual-Discount | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 23.87 Evaluated at bid price : 24.15 Bid-YTW : 5.31 % |

| PWF.PR.E | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 23.76 Evaluated at bid price : 25.05 Bid-YTW : 5.47 % |

| PWF.PR.F | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 24.25 Evaluated at bid price : 24.55 Bid-YTW : 5.38 % |

| PWF.PR.A | Floater | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 20.51 Evaluated at bid price : 20.51 Bid-YTW : 2.57 % |

| TRP.PR.A | FixedReset | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 23.65 Evaluated at bid price : 26.10 Bid-YTW : 3.24 % |

| CIU.PR.C | FixedReset | 4.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-08-18 Maturity Price : 23.00 Evaluated at bid price : 24.50 Bid-YTW : 2.91 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| IFC.PR.C | FixedReset | 425,905 | New issue settled today. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.90 Bid-YTW : 4.20 % |

| RY.PR.C | Deemed-Retractible | 49,800 | Nesbitt crossed 35,000 at 25.00. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.89 Bid-YTW : 4.67 % |

| RY.PR.R | FixedReset | 30,825 | Nesbitt crossed 26,900 at 27.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.95 Bid-YTW : 2.99 % |

| GWO.PR.G | Deemed-Retractible | 27,564 | RBC crossed 20,000 at 25.05. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.07 Bid-YTW : 5.29 % |

| TD.PR.A | FixedReset | 24,900 | TD crossed 18,100 at 26.05. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-31 Maturity Price : 25.00 Evaluated at bid price : 26.06 Bid-YTW : 3.30 % |

| SLF.PR.H | FixedReset | 22,300 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.73 Bid-YTW : 3.89 % |

| There were 30 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BNA.PR.E | SplitShare | Quote: 22.31 – 23.69 Spot Rate : 1.3800 Average : 0.8233 YTW SCENARIO |

| TRP.PR.C | FixedReset | Quote: 25.59 – 25.99 Spot Rate : 0.4000 Average : 0.2608 YTW SCENARIO |

| TD.PR.Q | Deemed-Retractible | Quote: 26.26 – 26.57 Spot Rate : 0.3100 Average : 0.2018 YTW SCENARIO |

| FTS.PR.E | OpRet | Quote: 27.20 – 27.85 Spot Rate : 0.6500 Average : 0.5457 YTW SCENARIO |

| IGM.PR.B | Perpetual-Premium | Quote: 25.27 – 25.60 Spot Rate : 0.3300 Average : 0.2404 YTW SCENARIO |

| BNS.PR.Y | FixedReset | Quote: 25.01 – 25.36 Spot Rate : 0.3500 Average : 0.2636 YTW SCENARIO |