Malachite Aggressive Preferred Fund’s Net Asset Value per Unit as of the close May 31, 2019, was $8.1061.

| Returns to May 31, 2019 |

| Period |

MAPF |

BMO-CM “50” Preferred Share Index |

TXPR*

Total Return |

CPD – according to Blackrock |

| One Month |

-5.01% |

-3.47% |

-3.00% |

N/A |

| Three Months |

-5.92% |

-4.00% |

-3.24% |

N/A |

| One Year |

-17.69% |

-12.44% |

-9.88% |

-10.47% |

| Two Years (annualized) |

-2.27% |

-1.56% |

–1.39% |

N/A |

| Three Years (annualized) |

+5.31% |

+4.45% |

+4.03% |

+3.58% |

| Four Years (annualized) |

-0.36% |

+0.30% |

-0.21% |

N/A |

| Five Years (annualized) |

-0.63% |

-0.44% |

-0.79% |

-1.21% |

| Six Years (annualized) |

-0.10% |

-0.30% |

-0.70% |

N/A |

| Seven Years (annualized) |

+1.26% |

+0.46% |

+0.18% |

N/A |

| Eight Years (annualized) |

+1.04% |

+0.88% |

+0.56% |

N/A |

| Nine Years (annualized) |

+3.65% |

+2.61% |

+2.00% |

N/A |

| Ten Years (annualized) |

+5.18% |

+3.45% |

+2.62% |

+2.10% |

| Eleven Years (annualized) |

+6.99% |

+2.64% |

+1.86% |

|

| Twelve Years (annualized) |

+6.63% |

+2.25% |

|

|

| Thirteen Years (annualized) |

+6.52% |

+2.15% |

|

|

| Fourteen Years (annualized) |

+6.42% |

+2.21% |

|

|

| Fifteen Years (annualized) |

+6.67% |

+2.51% |

|

|

| Sixteen Years (annualized) |

+7.53% |

+2.62% |

|

|

| Seventeen Years (annualized) |

+7.47% |

+2.92% |

|

|

| Eighteen Years (annualized) |

+7.95% |

+2.86% |

|

|

| MAPF returns assume reinvestment of distributions, and are shown after expenses but before fees. |

| The full name of the BMO-CM “50” index is the BMO Capital Markets “50” Preferred Share Index. It is calculated without accounting for fees. |

| “TXPR” is the S&P/TSX Preferred Share Index. It is calculated without accounting for fees, but does assume reinvestment of dividends. |

| CPD Returns are for the NAV and are after all fees and expenses. Reinvestment of dividends is assumed. |

| Figures for National Bank Preferred Equity Income Fund (formerly Omega Preferred Equity) (which are after all fees and expenses) for 1-, 3- and 12-months are -2.84%, -2.92% and -8.05%, respectively, according to Morningstar after all fees & expenses. Three year performance is +3.95%; five year is +0.18%; ten year is +3.47% |

| Manulife Preferred Income Class Adv has been terminated by Manulife. The performance of this fund was last reported here in March, 2018. |

| Figures for Horizons Active Preferred Share ETF (HPR) (which are after all fees and expenses) for 1-, 3- and 12-months are -3.79%, -4.78% & -13.57%, respectively. Three year performance is +3.40%, five-year is -0.35% |

| Figures for National Bank Preferred Equity Fund (formerly Altamira Preferred Equity Fund) are -3.55%, -4.67% and -13.66% for one-, three- and twelve months, respectively. Three year performance is +2.95%; five-year is -1.12%.

Acccording to the fund’s fact sheet as of June 30, 2016, the fund’s inception date was October 30, 2015. I do not know how they justify this nonsensical statement, but will assume that prior performance is being suppressed in some perfectly legal manner that somebody at National considers ethical.

The last time Altamira Preferred Equity Fund’s performance was reported here was April, 2014; performance under the National Bank banner was first reported here May, 2014. |

| The figures for the NAV of BMO S&P/TSX Laddered Preferred Share Index ETF (ZPR) is -12.56% for the past twelve months. Two year performance is -2.23%, three year is +4.25%, five year is -2.78%. |

| Figures for Natixis Canadian Preferred Share Class Series F (formerly NexGen Canadian Preferred Share Tax Managed Fund) are -3.22%, =3.55% and -12.23% for one-, three- and twelve-months, respectively. Three year performance is +1.71%; five-year is +0.13% |

| Figures for BMO Preferred Share Fund (advisor series) according to Morningstar are -3.81%, -4.89% and -14.49% for the past one-, three- and twelve-months, respectively. Three year performance is +0.37%; five-year is -2.75%. |

| Figures for PowerShares Canadian Preferred Share Index Class, Series F are -11.64% for the past twelve months. The three-year figure is +4.72%; five years is -0.37% |

| Figures for the First Asset Preferred Share Investment Trust (PSF.UN) are no longer available since the fund has merged with First Asset Preferred Share ETF (FPR).

Performance for the fund was last reported here in September, 2016; the first report of unavailability was in October, 2016. |

| Figures for Lysander-Slater Preferred Share Dividend Fund according to Morningstar are -3.78%, -3.91% and -13.14% for the past one, three and twelve months, respectively. Three year performance is +2.80%. |

| Figures for the Desjardins Canadian Preferred Share Fund A Class, as reported by Morningstar are -3.49%, -4.08% and -12.72% for the past one, three and twelve months, respectively. Three year performance is +2.34%. |

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page. The fund is available either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited.

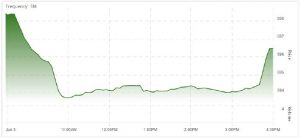

The preferred share market has suffered a sharp reverse in the past five months, leaving a lot of room for outsized gains. The Seniority Spread (the interest-equivalent yield on reasonably liquid, investment-grade PerpetualDiscounts less the yield on long term corporate bonds) is extremely elevated (chart end-date 2019-5-10)

Click for Big

Click for BigNote that the Seniority Spread was 345bp on May 29. As a good practical example of the spreads between markets, consider that on March 20 the redemption of IGM.PR.B was announced; the redemption of this 5.90% Straight Perpetual was explicitly financed by the issue of 4.206% debentures, implying a Seniority Spread for this issuer of about 350bp at that time.

… and the relationship between five-year Canada yields and yields on investment-grade FixedResets is also well within what I consider ‘decoupled panic’ territory (chart end-date 2019-5-10):

Click for Big

Click for BigIn addition, I feel that the yield on five-year Canadas is unsustainably low (it should be the inflation rate plus an increment of … 1%? 1.5%? 2.0%?),and a return to sustainable levels is likely over the medium term.

It seems clear that many market players are, wittingly or not, using FixedResets to speculate on future moves in the Canada 5-Year yield. This is excellent news for those who take market action based on fundamentals and the long term characteristics of the market because nobody can consistently time the markets. The speculators will, over the long run, lose money, handing it over to more sober investors.

FixedReset (Discount) performance on the month was -5.64% vs. PerpetualDiscounts of -1.15% in May; the two classes finally decoupled in mid-November after months of moving in lockstep, but it still appears to me that yields available on FixedResets are keeping the yields of PerpetualDiscounts up, even though a consistent valuation based on an expectation of declining interest rates would greatly increase the attractiveness of PerpetualDiscounts:

Click for Big

Click for BigAs is often the case, there is a lot of noise in the graph of One Month Performance vs. Issue Reset Spread, but the correlation for the Pfd-3 Group was reportable at 16%. It is interesting to note that the Pfd-3 Group clearly outperformed investment grade issues:

Click for Big

Click for BigFloaters got hammered again, returning +-5.29% for May and -33.71% for the past twelve months. Look at the long-term performance:

Click for Big

Click for BigSome Assiduous Readers will be interested to observe that the ‘Quantitative Easing’ decline was not as bad as the ‘Credit Crunch’ decline, which took the sector down to the point where the 15-year cumulative total return was negative. I wrote about that at the time and still can’t get over it. Fifteen years!

It seems clear that Floaters are used, wittingly or otherwise, as a vehicle for speculation on the policy rate and Canada Prime, while FixedResets are being used as a vehicle for speculation on the five-year Canada rate. In support of this idea, I present an Implied Volatility analysis of the TRP series of FixedResets (as of May 31), which is comprised of six issues without a Minimum Rate Guarantee and two issues which do have this feature:

Click for Big

Click for BigThe two issues with floors, TRP.PR.J (+469, minimum 5.50%) and TRP.PR.K (+385, minimum 4.90%) are $1.60 and an incredible $3.09 rich, respectively, despite the fact that their floor will not become effective unless five-year Canadas dip below 0.81% and 1.05%, respectively. For all the recent gloom, we’re still a long way from those levels!

As for the future, of course, it’s one thing to say that ‘spreads are unsustainable and so are government yields’ and it’s quite another to forecast just how and when a more economically sustainable environment will take effect. It could be years. There could be a reversal, particularly if Trump’s international trade policies cause a severe recession or even a depression. And, of course, I could be just plain wrong about the sustainability of the current environment.

Yields on preferred shares of all stripes are extremely high compared to those available from other investments of similar quality. A I told John Heinzl in an eMail interview in late November, the best advice I can offer investors remains Shut up and clip your coupons!

I think that a broad, sustainable rally in FixedResets will require higher five-year Canada yields (or a widespread expectation of them) … and although I’m sure this will happen eventually, it would be foolish to speculate on just when it will happen!

| Calculation of MAPF Sustainable Income Per Unit |

| Month |

NAVPU |

Portfolio

Average

YTW |

Leverage

Divisor |

Securities

Average

YTW |

Capital

Gains

Multiplier |

Sustainable

Income

per

current

Unit |

| June, 2007 |

9.3114 |

5.16% |

1.03 |

5.01% |

1.3240 |

0.3524 |

| September |

9.1489 |

5.35% |

0.98 |

5.46% |

1.3240 |

0.3773 |

| December, 2007 |

9.0070 |

5.53% |

0.942 |

5.87% |

1.3240 |

0.3993 |

| March, 2008 |

8.8512 |

6.17% |

1.047 |

5.89% |

1.3240 |

0.3938 |

| June |

8.3419 |

6.034% |

0.952 |

6.338% |

1.3240 |

$0.3993 |

| September |

8.1886 |

7.108% |

0.969 |

7.335% |

1.3240 |

$0.4537 |

| December, 2008 |

8.0464 |

9.24% |

1.008 |

9.166% |

1.3240 |

$0.5571 |

| March 2009 |

$8.8317 |

8.60% |

0.995 |

8.802% |

1.3240 |

$0.5872 |

| June |

10.9846 |

7.05% |

0.999 |

7.057% |

1.3240 |

$0.5855 |

| September |

12.3462 |

6.03% |

0.998 |

6.042% |

1.3240 |

$0.5634 |

| December 2009 |

10.5662 |

5.74% |

0.981 |

5.851% |

1.1141 |

$0.5549 |

| March 2010 |

10.2497 |

6.03% |

0.992 |

6.079% |

1.1141 |

$0.5593 |

| June |

10.5770 |

5.96% |

0.996 |

5.984% |

1.1141 |

$0.5681 |

| September |

11.3901 |

5.43% |

0.980 |

5.540% |

1.1141 |

$0.5664 |

| December 2010 |

10.7659 |

5.37% |

0.993 |

5.408% |

1.0298 |

$0.5654 |

| March, 2011 |

11.0560 |

6.00% |

0.994 |

5.964% |

1.0298 |

$0.6403 |

| June |

11.1194 |

5.87% |

1.018 |

5.976% |

1.0298 |

$0.6453 |

| September |

10.2709 |

6.10%

Note |

1.001 |

6.106% |

1.0298 |

$0.6090 |

| December, 2011 |

10.0793 |

5.63%

Note |

1.031 |

5.805% |

1.0000 |

$0.5851 |

| March, 2012 |

10.3944 |

5.13%

Note |

0.996 |

5.109% |

1.0000 |

$0.5310 |

| June |

10.2151 |

5.32%

Note |

1.012 |

5.384% |

1.0000 |

$0.5500 |

| September |

10.6703 |

4.61%

Note |

0.997 |

4.624% |

1.0000 |

$0.4934 |

| December, 2012 |

10.8307 |

4.24% |

0.989 |

4.287% |

1.0000 |

$0.4643 |

| March, 2013 |

10.9033 |

3.87% |

0.996 |

3.886% |

1.0000 |

$0.4237 |

| June |

10.3261 |

4.81% |

0.998 |

4.80% |

1.0000 |

$0.4957 |

| September |

10.0296 |

5.62% |

0.996 |

5.643% |

1.0000 |

$0.5660 |

| December, 2013 |

9.8717 |

6.02% |

1.008 |

5.972% |

1.0000 |

$0.5895 |

| March, 2014 |

10.2233 |

5.55% |

0.998 |

5.561% |

1.0000 |

$0.5685 |

| June |

10.5877 |

5.09% |

0.998 |

5.100% |

1.0000 |

$0.5395 |

| September |

10.4601 |

5.28% |

0.997 |

5.296% |

1.0000 |

$0.5540 |

| December, 2014 |

10.5701 |

4.83% |

1.009 |

4.787% |

1.0000 |

$0.5060 |

| March, 2015 |

9.9573 |

4.99% |

1.001 |

4.985% |

1.0000 |

$0.4964 |

| June, 2015 |

9.4181 |

5.55% |

1.002 |

5.539% |

1.0000 |

$0.5217 |

| September |

7.8140 |

6.98% |

0.999 |

6.987% |

1.0000 |

$0.5460 |

| December, 2015 |

8.1379 |

6.85% |

0.997 |

6.871% |

1.0000 |

$0.5592 |

| March, 2016 |

7.4416 |

7.79% |

0.998 |

7.805% |

1.0000 |

$0.5808 |

| June |

7.6704 |

7.67% |

1.011 |

7.587% |

1.0000 |

$0.5819 |

| September |

8.0590 |

7.35% |

0.993 |

7.402% |

1.0000 |

$0.5965 |

| December, 2016 |

8.5844 |

7.24% |

0.990 |

7.313% |

1.0000 |

$0.6278 |

| March, 2017 |

9.3984 |

6.26% |

0.994 |

6.298% |

1.0000 |

$0.5919 |

| June |

9.5313 |

6.41% |

0.998 |

6.423% |

1.0000 |

$0.6122 |

| September |

9.7129 |

6.56% |

0.998 |

6.573% |

1.0000 |

$0.6384 |

| December, 2017 |

10.0566 |

6.06% |

1.004 |

6.036% |

1.0000 |

$0.6070 |

| March, 2018 |

10.2701 |

6.22% |

1.007 |

6.177% |

1.0000 |

$0.6344 |

| June |

10.2518 |

6.22% |

0.995 |

6.251% |

1.0000 |

$0.6408 |

| September |

10.2965 |

6.62% |

1.018 |

6.503% |

1.0000 |

$0.6696 |

| December, 2018 |

8.6875 |

7.16% |

0.997 |

7.182% |

1.0000 |

$0.6240 |

| March, 2019 |

8.4778 |

7.09% |

1.007 |

7.041% |

1.0000 |

$0.5969 |

| May, 2019 |

8.1061 |

7.56% |

0.995 |

7.598% |

1.0000 |

$0.6159 |

NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains.

Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00%

The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99

Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings.

The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested.

Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company or the regulator (definition refined in May, 2011). These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31 (banks) or the Deemed Maturity date for insurers and insurance holding companies (see below)), in addition to the call schedule explicitly defined. See the Deemed Retractible Review: September 2016 for the rationale behind this analysis.

The same reasoning is also applied to FixedResets from these issuers, other than explicitly defined NVCC from banks. |

| The Deemed Maturity date for insurers was set at 2022-1-31 at the commencement of the process in February, 2011. It was extended to 2025-1-31 in April, 2013 and to 2030-1-31 in December, 2018 |

| Yields for September, 2011, to January, 2012, were calculated by imposing a cap of 10% on the yields of YLO issues held, in order to avoid their extremely high calculated yields distorting the calculation and to reflect the uncertainty in the marketplace that these yields will be realized. From February to September 2012, yields on these issues have been set to zero. All YLO issues held were sold in October 2012. |

These calculations were performed assuming constant contemporary GOC-5 and 3-Month Bill rates, as follows:

| Canada Yields Assumed in Calculations |

| Month-end |

GOC-5 |

3-Month Bill |

| September, 2015 |

0.78% |

0.40% |

| December, 2015 |

0.71% |

0.46% |

| March, 2016 |

0.70% |

0.44% |

| June |

0.57% |

0.47% |

| September |

0.58% |

0.53% |

| December, 2016 |

1.16% |

0.47% |

| March, 2017 |

1.08% |

0.55% |

| June |

1.35% |

0.69% |

| September |

1.79% |

0.97% |

| December, 2017 |

1.83% |

1.00% |

| March, 2018 |

2.06% |

1.08% |

| June |

1.95% |

1.22% |

| September |

2.33% |

1.55% |

| December, 2018 |

1.88% |

1.65% |

| March, 2019 |

1.46% |

1.66% |

| May, 2019 |

1.50% |

1.68% |

Significant positions were held in NVCC non-compliant regulated FixedReset issues on May 31, 2019; all of these currently have their yields calculated with the presumption that they will be called by the issuers at par prior to 2022-1-31 (banks) or 2030-1-31 (insurers and insurance holding companies) or on a different date (SplitShares, when present in the portfolio) This presents another complication in the calculation of sustainable yield, which also assumes that redemption proceeds will be reinvested at the same rate. It will also be noted that my analysis of likely insurance industry regulation as updated is not given much weight by the market.

I will also note that the sustainable yield calculated above is not directly comparable with any yield calculation currently reported by any other preferred share fund as far as I am aware. The Sustainable Yield depends on:

i) Calculating Yield-to-Worst for each instrument and using this yield for reporting purposes;

ii) Using the contemporary value of Five-Year Canadas to estimate dividends after reset for FixedResets. The assumption regarding the five-year Canada rate has become more important as the proportion of low-spread FixedResets in the portfolio has increased.

iii) Making the assumption that deeply discounted NVCC non-compliant issues from both banks and insurers, both Straight and FixedResets will be redeemed at par on their DeemedMaturity date as discussed above.

LB.PR.H : No Conversion to FloatingReset

Friday, June 7th, 2019Laurentian Bank of Canada has announced:

LB.PR.H is a NVCC-compliant FixedReset, 4.30%+255, that commenced trading 2014-4-3 after being announced 2014-3-25. The extension was announced 2019-5-7. LB.PR.H will reset At 4.123% effective June 15, 2019. I made no recommendation regarding conversion.

This issue is tracked by HIMIPref™ but relegated to the Scraps FixedReset-Discount subindex on credit concerns.

Posted in Issue Comments | 1 Comment »