The situation in Europe is slowly getting worse:

The cost of insuring against default on European sovereign debt climbed to records and European stocks fell amid concern Portugal is next in line for a bailout. Portuguese securities reversed declines after three traders with knowledge of the deals said the ECB purchased the government’s bonds.

With European governments including Portugal and Spain due to borrow at least $43 billion this week, attention is shifting to whether Europe is doing enough to stem the crisis. Chancellor Angela Merkel was today forced to deny that Germany was pushing Portugal to seek a bailout to alleviate the market pressure.

…

The cost of insuring Portuguese bonds against default rose to a record today, while Belgian and Spanish bonds declined on funding concerns. The benchmark Stoxx Europe 600 Index lost 0.9 percent to 278.48 at the 4:30 p.m. close in London, the biggest drop since Dec. 30.For the first time, investors view western European government bonds as riskier than emerging-market debt, the Markit iTraxx SovX Western Europe Index of credit-default swaps showed last week.

Mr Patrick Honohan, Governor of the Central Bank of Ireland, gave a speech:

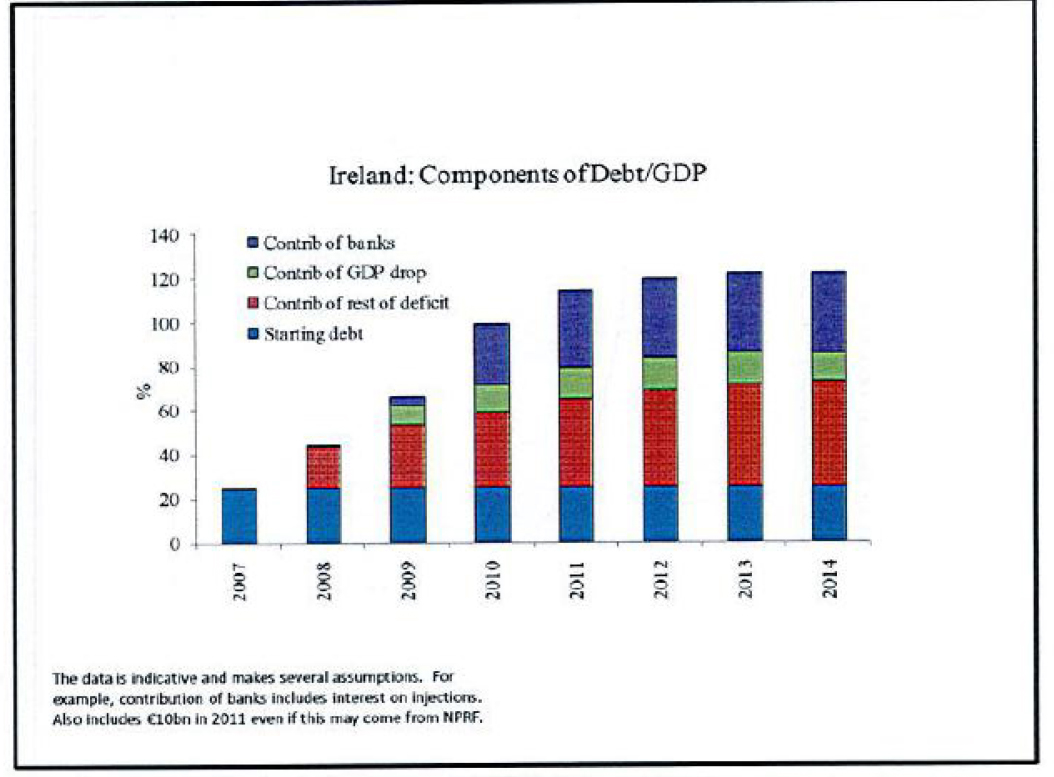

The current impact of the banking losses on the economy is not so much via the net long-term taxpayer cost, but comes mainly as a result of the accumulation of debt. The jump in debt associated with these losses is of the same order of magnitude as the rest of the borrowing 2009–10 (Fig. 4). Either of these components would have been unproblematic, together they make the markets and the rating agencies nervous. The fiscal adjustment could possibly have been delayed by a year or two had it not been for the banking losses; now it cannot wait.

Sell-side analysis has been worse than usual lately:

Companies in the Standard & Poor’s 500 Index that analysts loved the most rose 73 percent on average since the benchmark for U.S. equity started to recover in March 2009, while those with the fewest “buy” recommendations gained 165 percent, according to data compiled by Bloomberg. Now, banks’ favorites include retailers and restaurant chains, the industry that did best in last year’s rally and that are more expensive than the S&P 500 compared with their estimated 2011 profits.

The brokerage houses are great for data and a good source of ideas. Actionable investment recommendations… not so much.

In another example of “gotcha regulation”, the SEC has commenced proceedings to enforce Rule 105 of Regulation M:

Rule 105 of Regulation M of the Exchange Act provides, in pertinent part:

In connection with an offering of equity securities for cash pursuant to a registration statement. . . filed under the Securities Act of 1933 (“offered securities”), it shall be unlawful for any person to sell short . . . the security that is the subject of the offering and purchase the offered securities from an underwriter or broker or dealer participating in the offering if such short sale was effected during the period (“Rule 105 restricted period”) that is the shorter of the period: (1) Beginning five business days before the pricing of the offered securities; or (2) Beginning with the initial filing of such registration statement . . . and ending with the pricing. … Rule 105 of Regulation M is designed to protect the independent pricing mechanism of the securities market shortly before follow-on or secondary offerings.

For the life of me, I can’t make out why this rule exists, or what useful purpose it might serve.

However, an important part of the federal budget deficit appears to be structural rather than cyclical; that is, the deficit is expected to remain unsustainably elevated even after economic conditions have returned to normal. For example, under the Congressional Budget Office’s (CBO) so-called alternative fiscal scenario, which assumes that most of the tax cuts enacted in 2001 and 2003 are made permanent and that discretionary spending rises at the same rate as the gross domestic product (GDP), the deficit is projected to fall from its current level of about 9 percent of GDP to 5 percent of GDP by 2015, but then to rise to about 6–1/2 percent of GDP by the end of the decade. In subsequent years, the budget outlook is projected to deteriorate even more rapidly, as the aging of the population and continued growth in health spending boost federal outlays on entitlement programs. Under this scenario, federal debt held by the public is projected to reach 185 percent of the GDP by 2035, up from about 60 percent at the end of fiscal year 2010.

The CBO projections, by design, ignore the adverse effects that such high debt and deficits would likely have on our economy. But if government debt and deficits were actually to grow at the pace envisioned in this scenario, the economic and financial effects would be severe. Diminishing confidence on the part of investors that deficits will be brought under control would likely lead to sharply rising interest rates on government debt and, potentially, to broader financial turmoil. Moreover, high rates of government borrowing would both drain funds away from private capital formation and increase our foreign indebtedness, with adverse long-run effects on U.S. output, incomes, and standards of living.

It is widely understood that the federal government is on an unsustainable fiscal path. Yet, as a nation, we have done little to address this critical threat to our economy. Doing nothing will not be an option indefinitely; the longer we wait to act, the greater the risks and the more wrenching the inevitable changes to the budget will be. By contrast, the prompt adoption of a credible program to reduce future deficits would not only enhance economic growth and stability in the long run, but could also yield substantial near-term benefits in terms of lower long-term interest rates and increased consumer and business confidence. Plans recently put forward by the President’s National Commission on Fiscal Responsibility and Reform and other prominent groups provide useful starting points for a much-needed national conversation about our medium- and long-term fiscal situation. Although these various proposals differ on many details, each gives a sobering perspective on the size of the problem and offers some potential solutions.

The Fed’s reintermediation made a good profit:

The U.S. Federal Reserve System, which includes the Board of Governors in Washington and 12 regional banks based in cities such as New York and San Francisco, returned a record $78.4-billion (U.S.) to the Treasury in 2010 – a remarkable 65-per-cent increase from 2009.

Toronto Mayor Rob Ford is making the right noises:

Toronto Mayor Rob Ford has issued a clear warning to any managers or staff who defy his cost-cutting edicts: Rein in spending or find a new job.

“If they are unable to manage effectively in the best interest of the taxpayers, then we will have to find new managers that can,” Mr. Ford said Monday.

Mr. Ford singled out Toronto police for its proposed 3-per-cent budget increase and summoned Chief Bill Blair to his office at 2 p.m. Monday.

The mayor toned down his rhetoric by the time he and Chief Blair emerged from their hour-and-a-half-long meeting. “I have the utmost confidence in the chief continuing to do the job. We had a very, very constructive meeting and I support the chief 100 per cent,” Mr. Ford said.

I have sent him an eMail, titled “Police Force Gravy Train”:

As you are probably aware, there are many instances of poor personnel management in the Toronto Police Service that are very costly to Toronto taxpayers.

i) Overtime for court appearances. A considerable amount of money is spent on this, with the TPS being unable or unwilling to schedule shifts to match required court appearances. Will you be seeking change in this area, if necessary by increasing the TPS complement so that officers in court can have their duties covered by another officer on straight time?

ii) Paid-Duty. Organizers of special events hire Constables and more senior officers at a high premium to officers’ regular wages, as is entirely normal in any private sector operation. However, the bulk of this premium is paid to the officers directly, instead of being retained by TPS, the contractor. Will you be seeking to arrange matters such that policing for special events is explicitly performed by the TPS, assigning officers on regular shifts as much as possible? Again, I recognize that the TPS complement may need to be increased to facilitate the mandate.

It was a mixed day on the Canadian preferred share market, with PerpetualDiscounts gaining 20bp and FixedResets down 2bp. Volume was average; there is but a single entry on the Performance Highlights table.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0737 % | 2,320.1 |

| FixedFloater | 4.78 % | 3.51 % | 28,448 | 18.94 | 1 | 0.6192 % | 3,518.8 |

| Floater | 2.58 % | 2.37 % | 44,676 | 21.26 | 4 | 0.0737 % | 2,505.1 |

| OpRet | 4.81 % | 3.36 % | 67,566 | 2.32 | 8 | -0.1154 % | 2,391.0 |

| SplitShare | 5.33 % | 1.64 % | 634,101 | 0.91 | 4 | 0.0201 % | 2,449.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1154 % | 2,186.3 |

| Perpetual-Premium | 5.66 % | 5.23 % | 131,706 | 5.20 | 20 | -0.0414 % | 2,024.3 |

| Perpetual-Discount | 5.41 % | 5.43 % | 239,475 | 14.79 | 57 | 0.1957 % | 2,044.7 |

| FixedReset | 5.24 % | 3.45 % | 288,160 | 3.08 | 52 | -0.0173 % | 2,270.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -1.59 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2011-07-30 Maturity Price : 25.25 Evaluated at bid price : 25.45 Bid-YTW : 4.30 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| IAG.PR.F | Perpetual-Premium | 45,200 | Desjardins crossed 42,900 at 25.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2019-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.39 Bid-YTW : 5.73 % |

| SLF.PR.E | Perpetual-Discount | 44,209 | Desjardins bought 20,000 from RBC at 20.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-10 Maturity Price : 20.90 Evaluated at bid price : 20.90 Bid-YTW : 5.43 % |

| BNS.PR.Q | FixedReset | 39,025 | RBC crossed 33,100 at 26.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-11-24 Maturity Price : 25.00 Evaluated at bid price : 26.10 Bid-YTW : 3.25 % |

| PWF.PR.H | Perpetual-Premium | 27,600 | Scotia crossed 25,000 at 25.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-01-09 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 5.45 % |

| RY.PR.D | Perpetual-Discount | 24,800 | Desjardins crossed 12,000 at 22.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-10 Maturity Price : 22.06 Evaluated at bid price : 22.19 Bid-YTW : 5.14 % |

| TRI.PR.B | Floater | 20,700 | Nesbitt crossed 20,000 at 22.50. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-10 Maturity Price : 22.12 Evaluated at bid price : 22.40 Bid-YTW : 2.32 % |

| There were 27 other index-included issues trading in excess of 10,000 shares. | |||