Accrued Interest worries that Fed purchases are distorting the Agency MBS market:

Obviously the Fed wants to buy the current coupon because that’s the one that influences current borrowing rates. But as a consequence, the Fed has become the overwhelming owner of the 4% and 4.5% coupons: 90% of the former and 80% of the later.

…

And you have to expect the majority of the widening to hit low coupons, because that’s what Vanguard/the Fed will either be selling or what they will stop buying. At that point mortgage rates will rise, not in a disastrous fashion, but probably at least 50bps. Then what? The borrower within a 4.5% pool will be way out of the money, which will not only prevent any kind of refinancing from ever happening, but also impair his/her mobility. In other words, those MBS will repay extremely slowly for investors.

Andreas Hackethal, Michalis Haliassos and Tullio Jappelli write a piece for VoxEU that is sure to make it into the bibliography of countless DIY-Investing websites: Do financial advisors improve portfolio performance?:

Do financial advisors aid their clients in making wise investments? This column shows that investors who delegate their portfolio management achieve better results. But that’s due to the fact that advisors tend to be matched with richer, older investors. In fact, financial advisors tend to lower returns and raise risk relative to clients who manage their own investment.

…

The budding literature on financial advice and its regulation is usually based on the premise that advisors know what is good for individual customers but have an incentive to misrepresent this and take advantage of their typically uninformed customers. In recent research (Hacketal, Haliasso, and Jappelli, 2009), we ask:

- •How do brokerage accounts run by individuals without financial advisors actually perform compared to accounts run by (or in consultation with) financial advisors?

- •Are financial advisors are indeed matched with poorer, uninformed investors or with richer, experienced but presumably busy investors?

- •Is the contribution of financial advisors to the accounts that they do run actually positive relative to what investors with the characteristics of their clients tend to obtain on their own?

…

Our econometric analysis suggests that advisors tend to be matched with richer, older investors rather than with poorer, younger ones. Taking account of this sample selection bias yields the opposite result. Once we control for different characteristics of investors using financial advisors, we discover that advisors actually tend to lower returns, raise portfolio risk, increase the probabilities of losses, and increase trading frequency and portfolio turnover relative to what account owners of given characteristics tend to achieve on their own.

…

One interpretation could be that advisors overcharge for their services. If they do, should they be regulated? Or should we be content with the idea that they do not tend to serve those lacking sophistication but those lacking time to make money on the market? But then, why do rich, older people pay so much for advice? Could part of it arise because these individuals would not have undertaken the investment themselves if it were not for the help of advisors?

The problem – and the worthy target of research – is that most financial advisors (whether registered with the regulatory authorities as such or not) are not, in fact, financial advisors. They are salesmen. Regulators should insist that, at a minimum, those with discretionary authority over investor accounts must prepare meaningful composites – two versions, one defined by sector of investment and, importantly, the other defined by the results of a KYC form – and that these composites be supplied to the regulators, subject to possible audit by the regulators and published by the regulators as part of the normal registration reporting.

Given that most advisory relationships are effectively discretionary, consideration should be given to forcing the same disclosure for these as well … but this is somewhat murky! What if the client doesn’t take the advice? What it the advice is taylored to what a client might actually do? If a client is convinced oil will triple to year end and insist on overweighting in oil producers, all an advisor can do is recommend the relatively safe ones … whatever “safe” means!

The full paper is available from the Centre for Economic Policy Research.

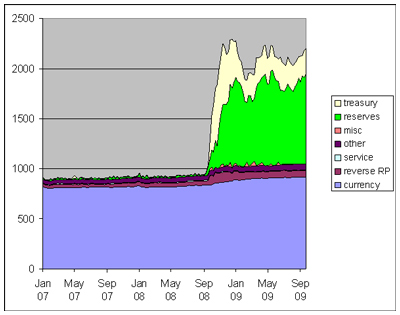

Jim Hamilton of Econbrowser discusses reports of planning for unwinding the Fed’s balance sheet and includes a chart of the Fed’s liabilities:

I mused on September 24 about the discount window and the importance of deposits in funding bank assets. In a normal bank-run scenario, short-term bank liabilities such as deposits are used to fund long-term bank assets such as mortgages and term loans. Liquidity crises come when the bank experiences difficulties rolling over its liabilities and in such a case, the theory goes, they refinance their assets at the Central Bank’s discount window instead.

In this crisis, they are selling their assets to the Fed and leaving the proceeds on deposit; in other words, instead of acting on the liability side of their balance sheet, the banks are taking action on the asset side, converting their long term assets into risk free deposits. I confess that I have not been able to draw any conclusions as yet regarding the costs, benefits and causes of this phenomenon and tied it in with the empirical evidence regarding the importance of a stable deposit base; I can only draw solace from the idea that I haven’t seen this discussed in detail anywhere else, either!

Willem Buiter of Maverecon criticizes the Obama administration:

But it is on the economic front that the damage is really piling up. President Obama’s speech yesterday (the first anniversary of the collapse of Lehman Brothers) on the lessons from Lehman’s demise demonstrated once again that we are stuck with a president who knows little about economics and cares less. There was some perfunctory populist bank and banker bashing, but nothing concrete. Like most other political leaders in the financially benighted north-Atlantic region, president Obama will use the absence of international cooperation and the undesirability of unilateral action by any one country as an excuse to avoid radical reform of the cross-border banking and financial system. No doubt the French president, Mr. Sarkozy, will again threaten his by now traditional walk-out over some trivial issue, but the chances of international agreement on measures that could reduce the frequency and severity of future systemic crises are slim.

The US officials supposed to lead the systemic reforms of the domestic and international financial system are the same people who failed to recognise the emerging disfunctionalities that produced the crisis, who indeed were responsible for creating some of these disfunctionalities, who failed to prevent the crisis, who re-fought the battle of the 1930s (and insist on taking great credit for doing so) and left us with the moral hazard nightmare legacy of the end of the first decade of the twenty first century.

There’s been another entry in the bash-the-banker sweepstakes:

Chancellor of the Exchequer Alistair Darling, targeting what he calls “greed and recklessness” in Britain’s financial system, asked banks to curtail bonuses and said the rich will pay more in tax.

“It is right that those who earn the most should shoulder the biggest burden,” the finance minister told the ruling Labour Party’s annual conference today in Brighton, England. “We will introduce legislation to end the reckless culture that puts short-term profits over long term success. It will mean an end to automatic bank bonuses year after year.”

…

Prime Minister Gordon Brown’s government is attempting to shore up support among voters by attacking bankers and suggesting the rich will have to foot the bill for the sharpest recession since World War II.“This is a government on the cusp of losing the next election, and if banker-bashing is going to be popular they’ll do it,” said Simon Maughan, a banking analyst at MF Global Securities in London. “This is a classic case of knee-jerk political reaction to a crisis.”

Politics of division, politics of resentment, politics of envy … you never have to scratch the surface too deeply to find the Lord of the Flies. Mr. Darling did not, as far as I can tell, address the shortcomings of his regulatory authorities.

The Boston Fed has released a paper on social learning by Julian Jamison, David Owens, and Glenn Woroch, Social and Private Learning with Endogenous Decision Timing:

Firms often face choices about when to upgrade and what to upgrade to. We discuss this in the context of upgrading to a new technology (for example, a new computer system), but it applies equally to the upgrading of processes (for example, a new organizational structure) or to individual choices (for example, buying a new car). This paper uses an experimental approach to determine how people address such problems, with a particular focus on the impact of information flows. Specifically, subjects face a multi‐round decision, choosing when (if ever) to upgrade from the status quo to either a safe or a risky new technology. The safe technology

yields more than the status quo, and the risky technology may yield either less than the status quo or more than the safe technology. Every round, subjects who have not yet upgraded receive noisy information about the true quality of the risky technology. Our focus on the timing of endogenous choice is novel and differentiates the results from previous experimental papers on herding and cascades. We find that, in the single‐person decision problem, subjects tend to wait too long before choosing (relative to optimal behavior). In the second treatment, they observe payoff‐irrelevant choices of other subjects. This turns out to induce slightly faster decisions, so the “irrationality” of fads actually improves profits in our framework. In the third and final treatment, subjects observe payoff‐relevant choices of other subjects (that is, others who have the same value for the risky technology but independent private signals). Behavior here is very similar to the second treatment, so having “real” information does not seem to have a strong marginal effect. Overall we find that social learning, whether or not the behavior of others is truly informative, plays a large role in upgrade decisions and hence in technology diffusion.

I cheerfully admit to lack of familiarity with what the authors refer to as the “vast literature” on the “causes and patterns of the adoption and diffusion of innovations”, but it seems to me that you don’t have to squint too much to read “safe or risky new investment class” for “safe or risky new technology”.

Not much of a day for price movement in the preferred share market, with only four issues making it to the price change highlights table (three of them negative; all of them PerpetualDiscounts), while more broadly, PerpetualDiscounts were down 6bp while FixedResets lost 2bp. Volume was good though, dominated by FixedResets.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3860 % | 1,513.1 |

| FixedFloater | 5.72 % | 3.97 % | 52,167 | 18.63 | 1 | 0.5291 % | 2,683.1 |

| Floater | 2.42 % | 2.07 % | 37,261 | 22.26 | 4 | 0.3860 % | 1,890.4 |

| OpRet | 4.86 % | -8.78 % | 126,936 | 0.09 | 15 | 0.2458 % | 2,289.8 |

| SplitShare | 6.38 % | 6.58 % | 832,979 | 4.01 | 2 | 0.0000 % | 2,073.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2458 % | 2,093.8 |

| Perpetual-Premium | 5.79 % | 5.70 % | 149,748 | 6.11 | 12 | -0.0794 % | 1,872.4 |

| Perpetual-Discount | 5.75 % | 5.82 % | 202,037 | 14.17 | 59 | -0.0635 % | 1,793.9 |

| FixedReset | 5.49 % | 4.05 % | 454,436 | 4.04 | 40 | -0.0230 % | 2,111.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| POW.PR.D | Perpetual-Discount | -1.75 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-09-28 Maturity Price : 21.35 Evaluated at bid price : 21.35 Bid-YTW : 5.88 % |

| POW.PR.A | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-09-28 Maturity Price : 23.15 Evaluated at bid price : 23.41 Bid-YTW : 5.99 % |

| HSB.PR.C | Perpetual-Discount | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-09-28 Maturity Price : 21.55 Evaluated at bid price : 21.87 Bid-YTW : 5.85 % |

| SLF.PR.B | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-09-28 Maturity Price : 20.61 Evaluated at bid price : 20.61 Bid-YTW : 5.86 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.L | FixedReset | 96,403 | Nesbitt crossed blocks of 35,000 and 50,000 shares, both at 27.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.50 Bid-YTW : 4.05 % |

| TD.PR.N | OpRet | 51,580 | Desjardins crossed 50,000 at 26.22. YTW SCENARIO Maturity Type : Call Maturity Date : 2010-05-30 Maturity Price : 25.75 Evaluated at bid price : 26.22 Bid-YTW : 2.80 % |

| RY.PR.X | FixedReset | 45,400 | RBC crossed 10,000 at 27.81. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 27.80 Bid-YTW : 3.95 % |

| HSB.PR.E | FixedReset | 44,950 | RBC crossed 30,200 at 27.65. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.52 Bid-YTW : 4.33 % |

| BAM.PR.P | FixedReset | 42,160 | Nesbitt crossed 25,000 at 26.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 26.61 Bid-YTW : 5.57 % |

| BNS.PR.R | FixedReset | 37,906 | Nesbitt crossed 25,000 at 25.95. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-25 Maturity Price : 25.00 Evaluated at bid price : 25.95 Bid-YTW : 4.25 % |

| There were 44 other index-included issues trading in excess of 10,000 shares. | |||