Assiduous Readers will be well aware that I often include articles in the blog for no other reason than to bookmark them. Having just spent twenty minutes trying to find this article after reading it some time ago, it is clear that I shall have to redouble my efforts!

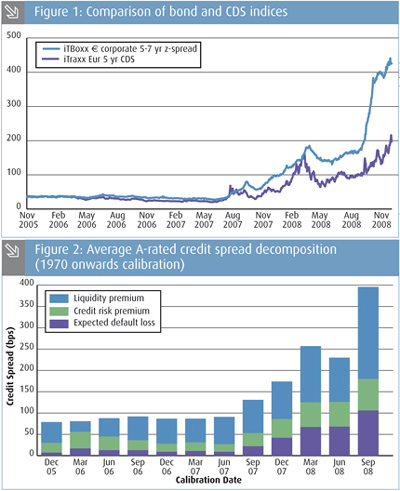

Paul Fulcher of UBS and Colin Wilson of Barrie & Hibbert wrote a nice summary regarding credit spread decomposition for The Actuary, titled Financial Crisis: The Value of Liquidity. I thought they made the central point very well:

The spread on corporate bonds over the liquid risk-free rate (for example, government bonds) represents compensation for several different factors:

A Expected default losses

B Unexpected default risk, such as default and recovery rate risk

C Mark-to-market risk, such as the risk of a fall in the market price of the bond

D Liquidity risk, such as the risk of not finding a ready buyer at the theoretical market price.Investors concerned with the realisable value of their investment in the short-term require compensation for all these risks.

However, investors who can hold bonds to maturity need compensation only for A and B. Such investors can enjoy the premiums for C and D, and we refer to these collectively as a ‘liquidity premium’.

There are some good references, too:

- Presentations at the Open Forum on Liquidity Premia, November 2008

- Credit Derivatives by the Derivatives Working Party, presented to Faculty in January 2007

- Decomposing corporate bond spreads by Webber and Churn, Bank of England Quarterly Bulletin 2007 Q4 (this has been discussed on PrefBlog)

- Decomposing credit spreads by Churm and Panigirtzoglou, Bank of England Working Paper no. 253

[…] quite hard enough to decompose spreads into credit risk & liquidity (see, for example, The Value of Liquidity), without adding other […]

[…] can’t, at this point, see why not. In the meantime, we will remember one of the ways in which the liquidity premium can be captured: The spread on corporate bonds over the liquid risk-free rate (for example, government bonds) […]