The International Monetary Fund has released the January 2010 Market Update to the Global Financial Stability Report, which contained some items of interest:

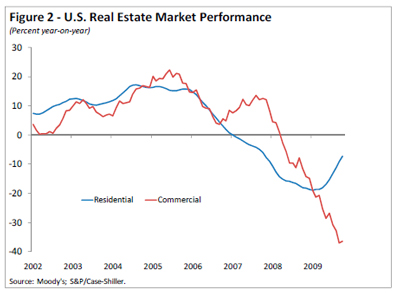

Credit losses arising from commercial real estate exposures are expected to increase substantially (Figure 2). The expected writedowns are concentrated in countries that experienced the largest run-ups in prices and subsequent corrections and are in line with our previous estimates.

And without wishing to become too think-tanky, I interpret the following as a warning shot against Comrade Peace-Prize’s unilateralism:

Policymakers should be mindful of the costs associated with uncertainty about future regulation, as this may hinder financial institutions’ plans regarding their business lines and credit provision. But they should also avoid the risks associated with too rapid deployment of new regulations without proper overall impact studies. It also continues to be vitally important that differences in international implementation of the new regulatory framework are minimized to avoid an uneven playing field and regulatory arbitrage that could compromise financial stability.

… but at least one guy thinks that nobody cares anyway, not even Comrade PP himself:

Philip Swagel, a former U.S. Treasury Department official who teaches at Georgetown University in Washington, said G7 officials would be wise not to worry too much about whether Mr. Obama’s boldest proposals will see the light of day, let alone fret about the U.S. gaining – or even seeking – enough global support that other countries end up having to replicate the measures.

“It’s not that they’re dead on arrival, they were never intended to be initiatives to push forward in the international agenda,” Mr. Swagel said in an interview. “They were aimed at domestic consumption, signalling to the American people that the President is as mad as they are.”

YES WE CAN indulge ourselves with cynical grandstanding!

A mixed day for Canadian preferreds with PerpetualDiscounts up 5bp and FixedResets losing 14bp. The market was well-behaved, with only four issues on the performance highlights list; one of the losers was our old friend POW.PR.C, gradually winding down toward normalcy. Volume continued at elevated levels.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3490 % | 1,718.7 |

| FixedFloater | 5.62 % | 3.71 % | 36,038 | 19.38 | 1 | 0.1554 % | 2,811.7 |

| Floater | 2.28 % | 2.65 % | 106,680 | 20.64 | 3 | 0.3490 % | 2,147.1 |

| OpRet | 4.85 % | -3.82 % | 116,109 | 0.09 | 13 | -0.0532 % | 2,315.6 |

| SplitShare | 6.35 % | -1.52 % | 162,772 | 0.08 | 2 | 0.4176 % | 2,116.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0532 % | 2,117.4 |

| Perpetual-Premium | 5.81 % | 5.65 % | 151,503 | 13.76 | 12 | -0.0597 % | 1,888.6 |

| Perpetual-Discount | 5.75 % | 5.79 % | 180,492 | 14.20 | 63 | 0.0514 % | 1,828.3 |

| FixedReset | 5.42 % | 3.60 % | 343,870 | 3.82 | 42 | -0.1369 % | 2,179.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| POW.PR.D | Perpetual-Discount | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-26 Maturity Price : 21.31 Evaluated at bid price : 21.31 Bid-YTW : 5.92 % |

| TD.PR.O | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-26 Maturity Price : 22.09 Evaluated at bid price : 22.23 Bid-YTW : 5.48 % |

| POW.PR.C | Perpetual-Discount | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-26 Maturity Price : 24.22 Evaluated at bid price : 24.61 Bid-YTW : 5.93 % |

| PWF.PR.K | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-26 Maturity Price : 21.51 Evaluated at bid price : 21.51 Bid-YTW : 5.79 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.L | FixedReset | 107,119 | Nesbitt crossed two blocks of 40,000 each, both at 27.75. CIBC sold 20,000 to RBC at 27.75. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.75 Bid-YTW : 3.76 % |

| TRP.PR.A | FixedReset | 87,073 | Nesbitt crossed 11,200 at 26.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.02 Bid-YTW : 3.78 % |

| W.PR.J | Perpetual-Discount | 51,000 | Nesbitt crossed 50,000 at 23.04. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-26 Maturity Price : 22.71 Evaluated at bid price : 23.00 Bid-YTW : 6.13 % |

| CM.PR.M | FixedReset | 47,275 | Nesbitt crossed 40,000 at 27.87. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.72 Bid-YTW : 3.91 % |

| NA.PR.N | FixedReset | 43,100 | TD crossed 25,000 at 26.45; RBC crossed 16,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-14 Maturity Price : 25.00 Evaluated at bid price : 26.46 Bid-YTW : 3.53 % |

| HSB.PR.E | FixedReset | 36,520 | RBC crossed 10,000 at 28.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 28.00 Bid-YTW : 3.85 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

Hi James,

Why is the maturity date for CM.PR.L listed above 2014-05-30. Shouldn’t it be 2014-04-30? The issue is only redeemable on 2014-04-30 (and every five years after that). Or is there something I don’t understand about redemption (eg: payment comes a month later)?

This is a peculiarity of the HIMIPref™ programming that I really should address some day.

I do not calculate returns to the actual call date; I have a programming constant maturityNoticePeriod that delays the timing of the call.

This is discussed further at What is the yield of RY.PR.Y?.

Thanks very much for the answer.

I guess technically the maturity date should be the later of actual maturity date and today+maturityNoticePeriod (eg: it can’t be called immediately, need to provide investor a minimum notice).

I have a follow up question (if you will kindly allow): How do you determine the maturity price for LimitMaturity scenarios? This price seems to always be near the current bid price but with some variation. I thought it might have to do with the difference between “dirty” and “clean” price (eg: remove implied accrued dividend) but it doesn’t seem to add up to that.

(eg: it can’t be called immediately, need to provide investor a minimum notice).

meant to say: (eg if it can be called immediately, need to provide investor a minimum notice).

I guess it has something to do with selfConsistentMaturityPrice and its difference from the current bid is assumed to be inconsequential (in the case of a LimitMaturity)?

Presumably the “correct” YTW for a perpetual-discount is its current yield? Or perhaps its current yield as calculated on its clean price.

Presumably the “correct” YTW for a perpetual-discount is its current yield? Or perhaps its current yield as calculated on its clean price.

Definitely not the Current Yield, as that makes no allowance for the proximity of the next dividend date. It should be clear that something that pays the next dividend next week is more valuable than an otherwise identical investment that makes its first payment three months hence.

Using the “clean price” (the actual price less an allowance for the notional “accrued dividend”) is a better approximation, but is not precise. It is used chiefly by little outfits that can’t afford to do their calculations properly, like Bloomberg.

A precise answer can be reached using a page or two of high school algebra.

You will be familiar with the closed-form solution of the sum of a series,

(sum) = r + r^2 + r^3 + … + r^n

which converges when n is infinite as long as r < 0.5. You substitute the price for (sum) and r is then the period yield. That's the formula you can use when the next pay date is exactly one period hence. When the next payment is not exactly one period hence, but is actually receivable a time a, with all subsequent payments received in an integral number of periods from time a, then (offset sum) = r^a + r^(a+1) + r^(a+2) + ... + r^(a+n) and you can get a closed form solution since (offset sum) = r^(a-1) * (sum) but the closed form solution for "r" given "(sum)" and "a" is a lot scarier than you might think! ******************************************* The question about the limitMaturity price is much more complex, but you get full marks for digging into the glossary. This question is becoming more frequent and pressing nowadays due to the prices of the instruments and I'll dedicate a post to the matter ... um ... soon.