There is speculation regarding negative US rates:

If the world’s biggest economy weakens enough that traditional policy measures don’t help, the Fed may consider pushing rates below zero, according to Bank of America Corp. and JPMorgan Chase & Co.

That step would broaden the Fed’s toolkit beyond what was available during the financial crisis, when it slashed its overnight benchmark near zero and bought bonds to stimulate the economy. In 2012, New York Fed researchers said negative rates could prompt individuals to avoid depositing money in banks, potentially weakening the financial system.

“They’re still concerned, but not as much as they once were,” said Mark Cabana, a New York-based interest-rate strategist at Bank of America. “They’ve seen how successful they were in other countries, where there haven’t been adverse impacts on market functioning.”

Traders may be getting on board with the possibility too. The implied probability of U.S. rates sinking below zero by the end of 2017 has jumped to roughly 13 percent, the highest since at least July, data compiled by Bloomberg show. The wagers are tied to the London interbank offered rate, which partly reflects expectations for Fed rates.

Click for Big

Click for BigAnd 10-Year JGBs are at zero:

The yield on Japan’s benchmark 10-year government bonds fell to zero for the first time, an unprecedented low for a Group-of-Seven economy, as global financial turmoil and the Bank of Japan’s adoption of negative interest rates drive demand for the notes.

The 10-year yield has tumbled from 0.22 percent before the BOJ surprised markets with the decision on Jan. 29 to introduce a minus 0.1 percent rate on some of the reserves financial institutions park at the central bank. It fell four basis points to zero percent as of 10:17 a.m. in Tokyo.

Japanese bonds are also climbing as sovereign securities rally worldwide. Global stocks have dropped almost 10 percent this year on concern growth is slowing in China, and as slumping oil prices undermine policy makers efforts to revive inflation. About 29 percent of the outstanding debt in the Bloomberg Global Sovereign Bond index was yielding less than zero as of 5 p.m. in New York on Monday. Swiss 3 percent notes due in 2018 were offering the lowest yield in the index, according to data compiled by Bloomberg.

Deutsche Bank might have trouble paying coupons on its CoCos:

Deutsche Bank AG may struggle to pay coupons on its riskiest bonds next year if operating results disappoint or litigation costs are higher than expected, according to analysts at CreditSights Inc.

Bonds and stock of Germany’s largest bank have plunged this year, with the shares shedding 39 percent of their value and its contingent convertible bonds — known as CoCos, or additional Tier 1 securities — turning in a similar performance. The cost of protecting the company’s subordinated debt from default for five years using credit-default swaps has more than doubled since the end of 2015, rising to 438 basis points, a four-year high, from 187.

…

The question for CoCo investors and holders of trust preferred securities is whether Deutsche Bank has sufficient “available distributable items,” a measure based on audited unconsolidated accounts calculated under German accounting principles, to make the payments, according to [CreditSights analyst Simon] Adamson. Given that there are reserves available to make up any shortfall that might prevent payouts, “we would be surprised” if Deutsche Bank didn’t pay coupons on its CoCos this year, which are determined by its 2015 performance, he said.

At the end of 2014, the latest figure available, Deutsche Bank had 2.87 billion euros ($3.2 billion) of ADIs, according to a presentation. The company also has 2.93 billion euros in a general reserve that could be used to top up ADI, as well as a 5.5 billion-euro “blocked amount” that was excluded from the ADI calculation and could probably be unblocked if necessary, according to CreditSights.

Click for Big

Click for BigUK authorities have done much to cement perception of regulators as Keystone Kops:

The first signs of trouble for prosecutors came about three weeks into the trial. Their witness was a government investigator called to lay out details of the probe into the alleged rigging of a key interest rate by a group of brokers who faced up to 20 years in prison.

But as the investigator went through a calendar his agency had compiled listing days the rates had allegedly been manipulated, his team admitted they had some of the dates wrong. Waving the schedule as he spoke, defense lawyer Philip Hackett asked if the prosecution was “making this up as they go along.”

….

The case against the brokers looked like a slam-dunk for [Serious Fraud Office chief prosecutor Mukul] Chawla. To begin with, [Tom] Hayes [now serving an 11-year sentence] had admitted conspiring with the six men to rig the rate to boost his trading profits. Reams of e-mail and instant-message evidence showed the defendants discussing the alleged crimes with Hayes. Two of the firms they worked for — ICAP and RP Martin — had already been fined $90 million by U.K. and U.S. regulators for failing to curb the brokers’ behavior.

…

But as Chawla laid out his case, even some of his own witnesses seemed to undermine it. In the second week, the prosecutor called John Ewan, a former director of the British Bankers’ Association, the trade body that officially oversaw Libor until 2013, in an effort to explain how the system was supposed to work when it wasn’t being rigged.

Instead of upstanding, Ewan came off as evasive. At one point, he claimed he had no idea the rate was being manipulated, despite written evidence that traders had told him.

…

The following week, Chawla called Paul Chadwick, the SFO investigator. It should have been a routine discussion on how the evidence was compiled, but descended into an argument when it emerged that the SFO had changed the dates it claimed rigging took place. The initial version had some defendants accused of manipulation on days when they’d been on vacation. Hackett, a defense counsel, would later denounce the SFO’s handling of the probe as an “utter shambles.”

However, the best line I’ve seem coming out of a courtroom in recent memory comes from one of the defendants:

Former Tullett Prebon broker Noel Cryan, for example, had exchanged dozens of instant messages with Hayes over a 10-month period in 2009 in which he pledged to help manipulate the rate.

Prosecutors argued the communications proved Cryan’s guilt. But he testified that it had all been a ruse. He’d never actually followed through on Hayes’s requests, he said, but only deceived him to allow his firm to pocket the more than 200,000 pounds commissions Hayes’s bank paid as rewards.

When Chawla asked Cryan how he justified lying to one of his best and longest-standing customers, Cryan cracked a wide smile. “It’s called broking Mr. Chawla,” he said.

Members of the jury rolled their eyes when defense counsel revealed that the SFO didn’t have any proof that Cryan had actually passed on Hayes’s requests to Tullett Prebon’s cash brokers to carry them out.

Meanwhile, Timothy Lane, Deputy Governor of the BoC, has implied he not only has a crystal ball but is much wiser than investor-scum:

Macroprudential tools can be used in two ways. One is to foster a more resilient financial system on an ongoing basis. To give just one example, regulators can establish ceilings on mortgage loan-to-value ratios on an ongoing basis, so that any correction in housing prices is less likely to create stress for the financial system. With a more resilient system, all of the financial stability concerns I have been discussing become more manageable.

Authorities could also, in principle, adjust macroprudential tools to dampen financial cycles—tightening them when leverage is building up and risk taking is increasing, and easing those requirements when that cycle turns. For example, regulators can lower loan-to-value ratios in response to indications of rising household sector vulnerabilities. Another example is the countercyclical capital buffer introduced as part of the Basel III reform of bank capital requirements.

Such countercyclical measures are designed, in part, to weaken the feedback loop between asset prices and credit growth that can lead to the kind of financial excesses that set the stage for a crisis. The track record of countercyclical measures in leaning against a financial cycle is not yet nearly sufficient to form a definite view of their practical effectiveness, however.

“Not yet nearly sufficient”? There’s complete negative evidence, more like. The Fed never saw the US housing bubble and has produced convincing evidence that there was no reason for them to see it.

Central bankers are about bright and wise enough to change policy rates when inflation changes and sometimes miss that boat completely as well. Once they are permitted to apply “macro-prudential tools” (the new euphemism for Soviet-style central planning) we’ll all be worse off.

There are some things I support that might be considered “macro-prudential”, but which fall far short of Mr. Lane’s winner-picking and crony-capitalism. I think, for instance, that given that 40% of Canadian bank assets are mortgages, compared to a 30% historical rate, it would be entirely proper to apply a surcharge to the risk weights of this asset class – as well as, potentially, other balloons. But I do not suggest this because I’m the smartest guy in the room and my uncle once dated the sister of a cabinet minister; I suggest this simply because it is a large change and it behooves us to behave with caution when things are changing. When things get significantly out of whack with historical averages, lean against them; but do not attempt to pick winners and over-ride the judgement of the guy on the ground who figures he can handle a 95% LTV mortgage; or the guy in the bank who figures he’s right. To do so is intellectual narcissism.

But on a bright note, there’s another currency-driven takeover:

Reno, Nevada-based Tahoe agreed to acquire Lake Shore on Monday in an all-stock deal valued at C$945 million ($678 million). From the perspective of Tahoe, which has mines in Latin America, the advantages are twofold, according to Barry Allan, a Toronto-based senior vice president at Mackie Research Capital Corp.

“It’s political diversification for these Tahoe shareholders,” Allan said by phone. “You’ve got stable Canada, thank you very much, an attractive currency. It’s just an insurance policy.”

…

In the deal, Lake Shore investors will get 0.1467 of a Tahoe share for every share they own, the companies said Monday in a statement. The ratio implies C$1.71 per Lake Shore common share, based on Tahoe’s closing on Friday, representing a premium of about 15 percent to Lake Shore’s closing price that day, the companies said.

It was a horrible day for the Canadian preferred share market, with PerpetualDiscounts off 35bp, FixedResets losing 98bp and DeemedRetractibles down 56bp. The Performance Highlights table is lengthy. Volume was well below average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

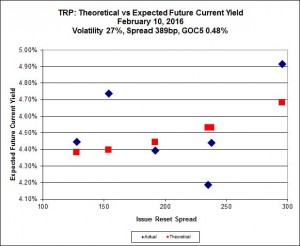

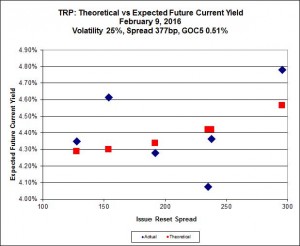

Here’s TRP:

Click for Big

Click for BigTRP.PR.E, which resets 2019-10-30 at +235, is bid at 17.60 to be $1.43 rich, while TRP.PR.C, resetting 2021-1-30 at +154, is $0.78 cheap at its bid price of 11.11.

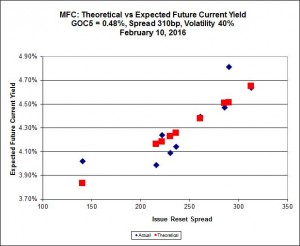

Click for Big

Click for BigMost expensive is MFC.PR.N, resetting at +230bp on 2020-3-19, bid at 17.65 to be 0.83 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 18.20 to be 0.95 cheap.

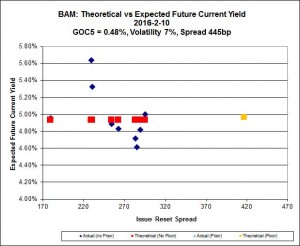

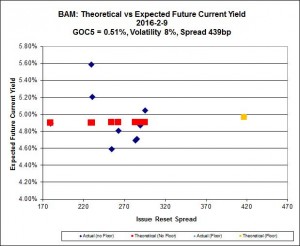

Click for Big

Click for BigThe cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 13.15 to be $1.52 cheap. BAM.PF.E, resetting at +255bp on 2020-3-31 is bid at 17.11 and appears to be $1.13 rich.

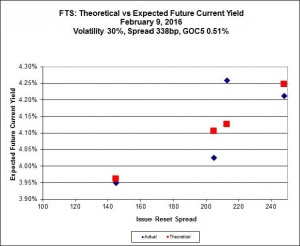

Click for Big

Click for BigFTS.PR.K, with a spread of +205bp, and bid at 16.03, looks $0.24 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 15.69 and is $0.51 cheap.

Click for Big

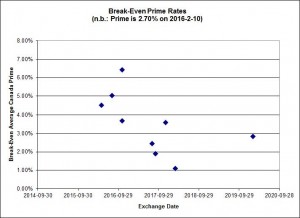

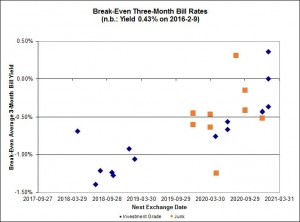

Click for BigInvestment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.84%, with three outliers below -1.50%. Note the x-axis has been shifted today. There are two junk outliers below -1.50% and one above +0.50%.

Click for Big

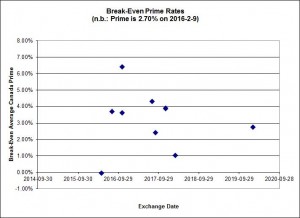

Click for BigShall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

5.26 % |

6.39 % |

17,413 |

16.20 |

1 |

0.7031 % |

1,485.0 |

| FixedFloater |

7.60 % |

6.64 % |

25,967 |

15.62 |

1 |

-0.7937 % |

2,615.9 |

| Floater |

4.71 % |

4.87 % |

75,285 |

15.70 |

4 |

-2.9035 % |

1,628.0 |

| OpRet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0970 % |

2,705.1 |

| SplitShare |

4.88 % |

6.26 % |

78,533 |

2.69 |

6 |

-0.0970 % |

3,165.5 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0970 % |

2,469.9 |

| Perpetual-Premium |

5.87 % |

5.85 % |

82,389 |

13.95 |

6 |

-0.7292 % |

2,515.4 |

| Perpetual-Discount |

5.76 % |

5.81 % |

97,861 |

14.17 |

33 |

-0.3513 % |

2,508.2 |

| FixedReset |

5.52 % |

4.84 % |

217,721 |

14.78 |

83 |

-0.9831 % |

1,838.7 |

| Deemed-Retractible |

5.27 % |

5.81 % |

128,170 |

6.92 |

34 |

-0.5625 % |

2,563.3 |

| FloatingReset |

3.02 % |

4.55 % |

49,522 |

5.55 |

16 |

-0.4445 % |

2,013.3 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BMO.PR.Q |

FixedReset |

-6.42 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.50

Bid-YTW : 8.30 % |

| TRP.PR.C |

FixedReset |

-5.53 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 11.11

Evaluated at bid price : 11.11

Bid-YTW : 4.78 % |

| MFC.PR.M |

FixedReset |

-4.44 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.45

Bid-YTW : 8.35 % |

| BAM.PR.T |

FixedReset |

-4.21 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 13.65

Evaluated at bid price : 13.65

Bid-YTW : 5.45 % |

| TRP.PR.B |

FixedReset |

-3.86 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 10.20

Evaluated at bid price : 10.20

Bid-YTW : 4.66 % |

| MFC.PR.N |

FixedReset |

-3.55 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.65

Bid-YTW : 8.12 % |

| TRP.PR.D |

FixedReset |

-3.54 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 16.06

Evaluated at bid price : 16.06

Bid-YTW : 4.84 % |

| IAG.PR.G |

FixedReset |

-3.50 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.91

Bid-YTW : 8.15 % |

| BAM.PR.B |

Floater |

-3.37 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 9.76

Evaluated at bid price : 9.76

Bid-YTW : 4.90 % |

| PWF.PR.A |

Floater |

-3.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 10.81

Evaluated at bid price : 10.81

Bid-YTW : 4.37 % |

| TRP.PR.I |

FloatingReset |

-2.86 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 10.85

Evaluated at bid price : 10.85

Bid-YTW : 4.57 % |

| BNS.PR.D |

FloatingReset |

-2.83 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.50

Bid-YTW : 7.77 % |

| BAM.PR.K |

Floater |

-2.68 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 9.81

Evaluated at bid price : 9.81

Bid-YTW : 4.87 % |

| FTS.PR.G |

FixedReset |

-2.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 15.69

Evaluated at bid price : 15.69

Bid-YTW : 4.57 % |

| BAM.PR.C |

Floater |

-2.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 9.75

Evaluated at bid price : 9.75

Bid-YTW : 4.90 % |

| GWO.PR.S |

Deemed-Retractible |

-2.40 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.55

Bid-YTW : 6.22 % |

| CIU.PR.C |

FixedReset |

-2.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 10.21

Evaluated at bid price : 10.21

Bid-YTW : 4.60 % |

| CCS.PR.C |

Deemed-Retractible |

-2.24 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.85

Bid-YTW : 7.04 % |

| PWF.PR.Q |

FloatingReset |

-2.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 11.50

Evaluated at bid price : 11.50

Bid-YTW : 4.44 % |

| HSE.PR.C |

FixedReset |

-2.06 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 14.76

Evaluated at bid price : 14.76

Bid-YTW : 6.64 % |

| BAM.PF.B |

FixedReset |

-2.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 16.70

Evaluated at bid price : 16.70

Bid-YTW : 5.05 % |

| PWF.PR.T |

FixedReset |

-2.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 20.70

Evaluated at bid price : 20.70

Bid-YTW : 3.73 % |

| IFC.PR.C |

FixedReset |

-1.94 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 16.21

Bid-YTW : 9.18 % |

| TD.PR.Y |

FixedReset |

-1.78 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.79

Bid-YTW : 3.79 % |

| MFC.PR.L |

FixedReset |

-1.76 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 16.79

Bid-YTW : 8.68 % |

| BAM.PF.F |

FixedReset |

-1.74 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 18.08

Evaluated at bid price : 18.08

Bid-YTW : 5.05 % |

| CIU.PR.A |

Perpetual-Discount |

-1.72 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 19.46

Evaluated at bid price : 19.46

Bid-YTW : 5.93 % |

| MFC.PR.K |

FixedReset |

-1.71 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 16.12

Bid-YTW : 9.11 % |

| TD.PF.C |

FixedReset |

-1.66 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 17.16

Evaluated at bid price : 17.16

Bid-YTW : 4.35 % |

| BAM.PF.A |

FixedReset |

-1.65 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 17.85

Evaluated at bid price : 17.85

Bid-YTW : 5.08 % |

| BAM.PR.X |

FixedReset |

-1.60 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 12.30

Evaluated at bid price : 12.30

Bid-YTW : 5.13 % |

| PWF.PR.O |

Perpetual-Premium |

-1.56 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 24.14

Evaluated at bid price : 24.66

Bid-YTW : 5.91 % |

| NA.PR.W |

FixedReset |

-1.51 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 16.35

Evaluated at bid price : 16.35

Bid-YTW : 4.62 % |

| IGM.PR.B |

Perpetual-Premium |

-1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 24.62

Evaluated at bid price : 24.92

Bid-YTW : 5.96 % |

| HSE.PR.E |

FixedReset |

-1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 15.76

Evaluated at bid price : 15.76

Bid-YTW : 6.76 % |

| SLF.PR.H |

FixedReset |

-1.49 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 14.55

Bid-YTW : 10.05 % |

| SLF.PR.J |

FloatingReset |

-1.36 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 11.58

Bid-YTW : 11.71 % |

| BAM.PR.Z |

FixedReset |

-1.34 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 17.63

Evaluated at bid price : 17.63

Bid-YTW : 5.20 % |

| RY.PR.J |

FixedReset |

-1.31 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 18.90

Evaluated at bid price : 18.90

Bid-YTW : 4.42 % |

| MFC.PR.C |

Deemed-Retractible |

-1.29 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 20.64

Bid-YTW : 7.32 % |

| POW.PR.D |

Perpetual-Discount |

-1.28 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 21.25

Evaluated at bid price : 21.52

Bid-YTW : 5.86 % |

| HSE.PR.A |

FixedReset |

-1.28 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 8.50

Evaluated at bid price : 8.50

Bid-YTW : 6.70 % |

| HSE.PR.G |

FixedReset |

-1.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 16.00

Evaluated at bid price : 16.00

Bid-YTW : 6.66 % |

| BNS.PR.L |

Deemed-Retractible |

-1.23 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.15

Bid-YTW : 5.22 % |

| TRP.PR.F |

FloatingReset |

-1.18 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 11.76

Evaluated at bid price : 11.76

Bid-YTW : 5.05 % |

| RY.PR.M |

FixedReset |

-1.17 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 18.58

Evaluated at bid price : 18.58

Bid-YTW : 4.38 % |

| PWF.PR.E |

Perpetual-Discount |

-1.14 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 23.14

Evaluated at bid price : 23.44

Bid-YTW : 5.90 % |

| BAM.PR.R |

FixedReset |

-1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 13.15

Evaluated at bid price : 13.15

Bid-YTW : 5.51 % |

| RY.PR.G |

Deemed-Retractible |

-1.11 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.11

Bid-YTW : 5.19 % |

| MFC.PR.J |

FixedReset |

-1.10 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 18.00

Bid-YTW : 7.90 % |

| TRP.PR.A |

FixedReset |

-1.10 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 14.40

Evaluated at bid price : 14.40

Bid-YTW : 4.58 % |

| BAM.PF.E |

FixedReset |

-1.10 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 17.11

Evaluated at bid price : 17.11

Bid-YTW : 4.99 % |

| BNS.PR.R |

FixedReset |

-1.04 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.76

Bid-YTW : 4.12 % |

| TD.PF.B |

FixedReset |

-1.03 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 17.27

Evaluated at bid price : 17.27

Bid-YTW : 4.32 % |

| BNS.PR.Q |

FixedReset |

-1.01 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.51

Bid-YTW : 4.04 % |

| BIP.PR.B |

FixedReset |

-1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 22.60

Evaluated at bid price : 23.61

Bid-YTW : 5.88 % |

| SLF.PR.G |

FixedReset |

1.01 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 13.00

Bid-YTW : 10.62 % |

| TD.PR.S |

FixedReset |

1.05 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.98

Bid-YTW : 3.44 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| RY.PR.Q |

FixedReset |

147,180 |

Nesbitt sold 19,600 to CIBC at 25.50, then crossed 100,000 at the same price.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 23.29

Evaluated at bid price : 25.46

Bid-YTW : 5.04 % |

| BMO.PR.Q |

FixedReset |

80,983 |

GMP sold 71,900 to National at 18.55.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.50

Bid-YTW : 8.30 % |

| NA.PR.X |

FixedReset |

54,570 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 23.13

Evaluated at bid price : 24.96

Bid-YTW : 5.43 % |

| TRP.PR.E |

FixedReset |

42,600 |

Nesbitt crossed 31,100 at 17.65.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 17.60

Evaluated at bid price : 17.60

Bid-YTW : 4.48 % |

| BNS.PR.E |

FixedReset |

40,805 |

RBC crossed 25,000 at 25.55.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 23.30

Evaluated at bid price : 25.49

Bid-YTW : 5.01 % |

| MFC.PR.G |

FixedReset |

37,700 |

TD crossed 19,500 at 18.25.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 18.20

Bid-YTW : 7.93 % |

| There were 23 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| BMO.PR.Q |

FixedReset |

Quote: 17.50 – 18.55

Spot Rate : 1.0500

Average : 0.6840

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.50

Bid-YTW : 8.30 % |

| GWO.PR.S |

Deemed-Retractible |

Quote: 23.55 – 24.36

Spot Rate : 0.8100

Average : 0.4600

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.55

Bid-YTW : 6.22 % |

| TRP.PR.B |

FixedReset |

Quote: 10.20 – 10.94

Spot Rate : 0.7400

Average : 0.4421

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 10.20

Evaluated at bid price : 10.20

Bid-YTW : 4.66 % |

| TRP.PR.D |

FixedReset |

Quote: 16.06 – 16.89

Spot Rate : 0.8300

Average : 0.5336

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 16.06

Evaluated at bid price : 16.06

Bid-YTW : 4.84 % |

| BAM.PR.T |

FixedReset |

Quote: 13.65 – 14.30

Spot Rate : 0.6500

Average : 0.4236

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2046-02-08

Maturity Price : 13.65

Evaluated at bid price : 13.65

Bid-YTW : 5.45 % |

| MFC.PR.M |

FixedReset |

Quote: 17.45 – 18.15

Spot Rate : 0.7000

Average : 0.4835

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 17.45

Bid-YTW : 8.35 % |