I am pleased to announce that the Seminar on FixedReset Preferred Shares is now on-line and available for purchase of access via PrefLetter.com.

Month: June 2009

YPG.PR.A & YPG.PR.B: Guidance from Bonds

YPG Holdings has launched a 5-Year MTN issue with a 7.30% coupon:

Yellow Pages Group announced today an offering by YPG Holdings Inc. (the “Company”) of Medium Term Notes for gross proceeds of $260 million. The net proceeds from the issuance of the Notes will be used for general corporate purposes, to repay indebtedness outstanding under the Company’s commercial paper program and to repay an amount of $200 million under its term credit facility. This offering is scheduled to close on or about June 25, 2009.

Pursuant to this offering, the Company will issue $260 million of 7.30% Series 7 Notes (compounded semi-annually), which will be dated June 25, 2009, will mature on February 2, 2015 and will be issued at a price of $100.00.

The Series 7 Notes will be guaranteed by Yellow Pages Income Fund (TSX: YLO.UN), YPG Trust, YPG LP, Yellow Pages Group Co., Trader Corporation, YPG (USA) Holdings, Inc., Yellow Pages Group, LLC and YPG Directories, LLC. The Notes have been assigned a rating of BBB (high) with a stable trend by DBRS Limited and a rating of BBB- with a stable outlook from Standard & Poor’s Rating Service.

Their ability to issue on these terms provides credibility to their previously announced issuer bid for YPG.PR.A and YPG.PR.B. The former closed yesterday at 22.50-58 to yield 7.52%-7.40% to retraction 2012-12-31, while the latter closed at 17.35-49 to yield 10.84%-10.71% to retraction 2017-6-30. There is, of course, a difference in the credit quality between the MTNs and the preferreds, but that’s a very high tax-adjusted spread!

YPG.PR.A and YPG.PR.B are both tracked by HIMIPref™ but are relegated to the “Scraps” index on credit concerns.

June 18, 2009

The New York Times points out – albeit disapprovingly – one of the good elements of the Obama regulation plan: it leaves Credit Rating Agencies alone:

The proposals call for the agencies to improve disclosure and release more detailed information, as well as establish policies for “managing and disclosing conflicts of interest.”

But the plan does not alter the issuer-pay model, whereby the companies selling securities pay to have them rated. Nor does it encourage competitors to enter the industry, which many regard as an oligopoly.

The proposal does call for regulators to reduce their reliance on agency ratings when deciding whether structured investments are safe enough for banks, insurance companies, pension funds and money market mutual fund investors. Regulators should encourage more independent analysis, a Treasury official said, but the administration did not propose an alternative standard.

Bank of Canada Governor Mark Carney gave a speech today:

The performance of core funding markets during the crisis intensified the financial panic and helped trigger the recession. This is totally unacceptable. As a consequence, one of the Bank of Canada’s top priorities is to promote institutional changes to create more robust core funding markets. Promising avenues to break such (il)liquidity spirals include introducing clearing houses, standardizing products, implementing through-the-cycle margining, and ensuring more effective netting.

Does anybody else think this is non-sequiter? When I think of “core funding”, I think of deposits, deposit notes and GICs. One might well make the argument that the “promising avenues” might contain a mathod whereby the market for these instruments remains stable … but Mr. Carney doesn’t.

There is a possibility that the panel surveyed to calculate US LIBOR will increase:

The dollar rose versus the euro yesterday for the first time in three days after British Bankers’ Association said it may allow more institutions to take part in the daily survey that sets Libor, the benchmark for more than $360 trillion of financial products around the world.

…

“It would be a wider group of banks, so some ‘weaker’ ones who would submit higher rates, thus Libor would aggregate higher,” said Scott Ainsbury, a portfolio manager at New York- based FX Concepts Inc., the world’s largest currency hedge fund with about $12 billion in assets.

Not much price action today in Canadian Preferreds, but volume continued high.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -5.2289 % | 1,221.5 |

| FixedFloater | 7.02 % | 5.48 % | 35,706 | 16.32 | 1 | 0.0000 % | 2,150.2 |

| Floater | 3.12 % | 3.36 % | 81,292 | 18.86 | 3 | -5.2289 % | 1,526.1 |

| OpRet | 4.96 % | 3.78 % | 135,875 | 0.92 | 14 | 0.0931 % | 2,196.4 |

| SplitShare | 5.82 % | 6.24 % | 59,589 | 4.23 | 3 | -0.3499 % | 1,873.7 |

| Interest-Bearing | 5.99 % | 7.69 % | 23,215 | 0.52 | 1 | -0.1992 % | 1,991.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1097 % | 1,737.7 |

| Perpetual-Discount | 6.32 % | 6.30 % | 167,613 | 13.38 | 71 | 0.1097 % | 1,600.4 |

| FixedReset | 5.68 % | 4.83 % | 536,966 | 4.35 | 39 | -0.0800 % | 2,011.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| TRI.PR.B | Floater | -12.06 % | Traded 8,100 shares in a range of 14.80-16.15 before closing at 14.51-15.89 (!). Somebody took out the bid with a sale of 2500 shares at $14.80 at 3:59, with the last ten trades of the day totalling 6200 shares in the last eight minutes of trading … whatever the merits of floaters may be, liquidity is not one of them! YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 14.51 Evaluated at bid price : 14.51 Bid-YTW : 2.71 % |

| BNS.PR.R | FixedReset | -1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 24.61 Evaluated at bid price : 24.66 Bid-YTW : 4.83 % |

| GWO.PR.H | Perpetual-Discount | -1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 18.10 Evaluated at bid price : 18.10 Bid-YTW : 6.74 % |

| CU.PR.B | Perpetual-Discount | -1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 24.32 Evaluated at bid price : 24.62 Bid-YTW : 6.14 % |

| BAM.PR.O | OpRet | 1.10 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 23.81 Bid-YTW : 6.35 % |

| CIU.PR.A | Perpetual-Discount | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 18.60 Evaluated at bid price : 18.60 Bid-YTW : 6.25 % |

| CIU.PR.B | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-01 Maturity Price : 25.00 Evaluated at bid price : 27.60 Bid-YTW : 4.51 % |

| PWF.PR.M | FixedReset | 1.96 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 26.51 Bid-YTW : 4.78 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| GWO.PR.X | OpRet | 129,915 | RBC crossed 120,000 at 25.85. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-09-29 Maturity Price : 25.00 Evaluated at bid price : 25.75 Bid-YTW : 4.01 % |

| BAM.PR.P | FixedReset | 74,039 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.37 Bid-YTW : 6.79 % |

| RY.PR.I | FixedReset | 72,325 | National crossed 50,000 at 25.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 24.66 Evaluated at bid price : 24.71 Bid-YTW : 4.84 % |

| RY.PR.N | FixedReset | 66,625 | TD bought 12,900 from National at 26.65. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.71 Bid-YTW : 4.77 % |

| PWF.PR.I | Perpetual-Discount | 66,000 | Nesbitt bought two blocks from RBC, 14,500 at 22.78 and 15,000 at 22.80, then crossed 32,000 at 22.88. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 22.55 Evaluated at bid price : 22.76 Bid-YTW : 6.70 % |

| RY.PR.D | Perpetual-Discount | 63,145 | RBC crossed blocks of 23,900 and 25,000 shares, both at 18.49. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-18 Maturity Price : 18.39 Evaluated at bid price : 18.39 Bid-YTW : 6.20 % |

| There were 46 other index-included issues trading in excess of 10,000 shares. | |||

New Issue: BNA SplitShares, 5-Year, 7.35%

BAM Split Corp has entered into a bought-deal refunding the BNA.PR.A, which pays 6.25% and matures 2010-9-30, but is redeemable at par commencing 2010-10-1.

Issue: BAM Split Corp. Cumulative Class AA preferred shares, Series 4

Size: 5-million shares (= $125-million)

Dividend: 7.25% paid quarterly (=$0.453125 quarterly, =$1.8125 p.a.). First coupon payable Sept. 7 for $0.26318, based on closing July 9.

Redemption: Will be redeemed 2014-7-9 at lesser of $25.00 or NAV. Optional redemption at $26.00 at any time – company may redeem early only if Capital Units retracted or there is a takeover bid for BAM.A

Retraction: Into Debentures. No Cash Retractions (except that the 2014-7-9 counts as a retraction for analytical purposes)! Debs pay interest of 7.35%, same maturity and – I PRESUME – are senior to prefs. Check the prospectus when available.

Update: BNA Press Release

June 17, 2009

That guy who had a baby in 1967 is about to become a grandfather:

The International Olympic Committee has yet to secure two more international sponsors, leading to a $30-million shortfall so far in the money Vancouver organizers had expected to receive from them.

And the recession has scared off potential suppliers, said John McLaughlin, the Vancouver committee’s chief financial officer.

TCA issued about $1.6-billion in equity to fund a major purchase and had its credit rating affirmed by DBRS.

S&P had a mass downgrade of US Banks today:

Standard & Poor’s reduced its credit ratings or revised its outlook on 22 U.S. banks, including Wells Fargo & Co., PNC Financial Services Group and KeyCorp, citing tighter regulation and increased market volatility.

“Financial institutions are now shedding balance-sheet risk and altering funding profiles and strategies for the marketplace’s new reality,” S&P credit analyst Rodrigo Quintanilla said in a statement today. “Such a transition period justifies lower ratings as industry players implement changes.”

…

S&P lowered Carolina First Bank, Citizens Republic Bancorp Inc., Huntington Bancshares Inc., Synovus Financial Corp. and Whitney Holding Corp. to “junk” ratings. High-yield, high- risk, or junk, debt is rated below BBB- by S&P.

…

Capital One Financial Corp., BB&T Corp., Regions Financial Corp., U.S. Bancorp and were also among the lenders downgraded today.

Meanwhile, the stronger brethren repaid some funds:

JPMorgan Chase & Co. and three of the nation’s largest banks repaid $44.7 billion to the U.S. Treasury’s bailout fund in a step toward ridding themselves of government restrictions on lending and pay.

JPMorgan repaid $25 billion, Morgan Stanley gave back $10 billion, Minneapolis-based U.S. Bancorp refunded $6.6 billion and Winston-Salem, North Carolina-based BB&T Corp. paid $3.1 billion, the companies said today in separate statements.

Interesting that BB&T is on both lists!

Comrade Obama laid out his financial regulation plans today:

The central bank would get responsibility to oversee all systemically risky financial firms, a move that aims to eliminate gaps in oversight that contributed to the collapse of Bear Stearns Cos. and Lehman Brothers Holdings Inc. last year. The Fed would monitor not only banks but large financial companies, such as insurers or hedge funds, whose interconnections in the financial industry mean their failure would endanger the system.

“These firms should not be able to escape oversight of their risky activities by manipulating their legal structure,” the White Paper said. Through higher capital requirements and stronger regulatory scrutiny “our proposals would compel these firms to internalize the costs they could impose on society in the event of failure.”

So, since the Fed designed and supervised a system of bank regulation without a sufficient moat to protect it from EVIL HEDGE FUNDS, the solution is to regulate hedge funds. Goodbye Connecticut, hello Dubai!

And the chief purpose of any Central Bank, lender of last resort, is going to be politicized:

The Fed, while gaining a bigger role as the systemic regulator, would have some of its emergency lending power curbed. The plan calls for the Treasury secretary to approve in writing any emergency funding.

Oh, well, at leastRep. Scott Garrett is keeping his head:

President Barack Obama’s proposal to expand financial capital requirements to non-banking firms that trade in the $592 trillion over-the-counter derivatives market is misguided, said U.S. Representative Scott Garrett.

…

“It is unclear how applying the regulatory system that so woefully failed the banking sector to the rest of the U.S. economy could possibly be helpful,” Garrett, the ranking Republican on a subcommittee on Capital Markets, Insurance and Government Sponsored Enterprises, said in an e-mail. The subcommittee is part of the House Financial Services Committee, which will have to turn the Obama proposal into legislation.

I’ve said all along: it’s clear that derivatives were a source of fear – and, in the case of AIG’s counterparties, a definite destabilizing force. This may be addressed simply by altering the existing capitalization rules … those exposed to loss (or those buying insurance and exposed to loss if the insurer fails) should obtain collateral. If the counterparty won’t put up the collateral (AIG, MBIA, et al.), then the required collateral is a straight deduction from the regulated entities’ capital. So what’s the problem? Increasing the scope of regulation is simply a make-work project.

The market was off a bit today, although damage to FixedResets was minimal. Volume continues high.

PerpetualDiscounts closed with a yield of 6.32%, equivalent to 8.85% interest at the standard equivalency factor of 1.4x. Long Corporates continued their yield decline to about 6.3%, sending the Perpetual-Discount Interest-Equivalent Spread to 255bp, as PDs continue to lag the extraordinary strength in bonds.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.1867 % | 1,288.9 |

| FixedFloater | 7.02 % | 5.49 % | 35,884 | 16.31 | 1 | 0.3236 % | 2,150.2 |

| Floater | 2.96 % | 3.34 % | 81,718 | 18.90 | 3 | -1.1867 % | 1,610.3 |

| OpRet | 4.97 % | 3.77 % | 137,273 | 0.92 | 14 | 0.0452 % | 2,194.3 |

| SplitShare | 5.80 % | 6.08 % | 56,200 | 4.23 | 3 | 0.1829 % | 1,880.3 |

| Interest-Bearing | 5.98 % | 7.26 % | 23,032 | 0.52 | 1 | 0.1996 % | 1,995.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2766 % | 1,735.8 |

| Perpetual-Discount | 6.33 % | 6.32 % | 167,404 | 13.37 | 71 | -0.2766 % | 1,598.7 |

| FixedReset | 5.67 % | 4.81 % | 538,878 | 4.35 | 39 | -0.0741 % | 2,012.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.C | Perpetual-Discount | -2.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.62 Evaluated at bid price : 19.62 Bid-YTW : 6.53 % |

| BAM.PR.B | Floater | -2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 11.76 Evaluated at bid price : 11.76 Bid-YTW : 3.34 % |

| CIU.PR.A | Perpetual-Discount | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 18.39 Evaluated at bid price : 18.39 Bid-YTW : 6.32 % |

| PWF.PR.M | FixedReset | -1.55 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 26.00 Bid-YTW : 5.26 % |

| BAM.PR.M | Perpetual-Discount | -1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 15.66 Evaluated at bid price : 15.66 Bid-YTW : 7.63 % |

| HSB.PR.D | Perpetual-Discount | -1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.52 Evaluated at bid price : 19.52 Bid-YTW : 6.44 % |

| PWF.PR.L | Perpetual-Discount | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.38 Evaluated at bid price : 19.38 Bid-YTW : 6.70 % |

| BAM.PR.K | Floater | -1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 11.71 Evaluated at bid price : 11.71 Bid-YTW : 3.36 % |

| RY.PR.A | Perpetual-Discount | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 18.35 Evaluated at bid price : 18.35 Bid-YTW : 6.14 % |

| BNS.PR.K | Perpetual-Discount | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.65 Evaluated at bid price : 19.65 Bid-YTW : 6.21 % |

| CGI.PR.B | SplitShare | 1.00 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2014-03-14 Maturity Price : 25.00 Evaluated at bid price : 25.16 Bid-YTW : 4.53 % |

| TD.PR.Y | FixedReset | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 25.02 Evaluated at bid price : 25.07 Bid-YTW : 4.62 % |

| POW.PR.D | Perpetual-Discount | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.60 Evaluated at bid price : 19.60 Bid-YTW : 6.51 % |

| BAM.PR.I | OpRet | 1.44 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 24.65 Bid-YTW : 5.84 % |

| MFC.PR.B | Perpetual-Discount | 1.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 18.75 Evaluated at bid price : 18.75 Bid-YTW : 6.25 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.E | FixedReset | 79,046 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.33 Bid-YTW : 5.41 % |

| HSB.PR.D | Perpetual-Discount | 56,370 | Desjardins crossed 50,000 at 19.70. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.52 Evaluated at bid price : 19.52 Bid-YTW : 6.44 % |

| SLF.PR.B | Perpetual-Discount | 54,350 | Desjardins crossed 50,000 at 18.27. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 18.30 Evaluated at bid price : 18.30 Bid-YTW : 6.59 % |

| RY.PR.E | Perpetual-Discount | 50,272 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 18.30 Evaluated at bid price : 18.30 Bid-YTW : 6.23 % |

| TD.PR.S | FixedReset | 49,965 | Nesbitt bought two blocks from RBC: 15,500 at 25.05 and 19,900 at 25.03. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 24.88 Evaluated at bid price : 24.93 Bid-YTW : 4.54 % |

| TD.PR.O | Perpetual-Discount | 47,960 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-17 Maturity Price : 19.90 Evaluated at bid price : 19.90 Bid-YTW : 6.20 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. | |||

June 16, 2009

There is a kerfuffle in the UK regarding the FSA’s attempt to increase the bank’s liquidity requirements, in accordance with the Turner Review (previously discussed on PrefBlog):

Similarly, if banks have to hold more assets in liquid form, and more of those in super-liquid form, like cash or government bonds, their income will decline. The FSA’s proposals on the subject accept these increased costs, though they are only sketchily estimated. Against these vague costs it sets a massive “reduction in the costs of systemic instability” of “3 billion to 5 billion bounds on an annualised basis.”

The problem for the banks is that, in contrast to the past, they will bear the costs of increased stability, while the taxpayer will enjoy the benefits.

The BBA’s tactic of playing the UK competitiveness card to stall the unilateral introduction of liquidity requirements is a clever one: international agreements can take years to complete.

It is also politically astute to play up the tension for banks between increasing their liquidity reserves at a time when the government is pressing them to increase lending to homeowners and businesses.

While Knight did not exactly put it like this, the FSA is asking banks to lend to government at the expense of the private sector. But the government is very strapped for cash right now. With regulatory and political interests fully aligned in favour of reform, this looks like a battle the banks will lose.

Those interested in hedging hyperinflation may wish to follow the strategy of Excelsior Fund:

The Excelsior Fund targets returns that will be five times the average annual rate of inflation of the Group of Five economies — France, Germany, Japan, the U.K. and the U.S. — should the rate exceed 5 percent, Jerry Haworth, co-founder of the firm, said yesterday. Raising $100 million for the fund would be a “good” amount, he said.

…

36 South’s Excelsior Fund will buy long-dated options it considers cheap and that “stand a good chance of outperforming in an inflationary environment,” Haworth said. Options are contracts to buy or sell a security by a certain date at a specific price.The fund will wager on an increase in commodity and equity prices, bond yields and increased currency volatility.

“It’s a very high-risk, high-return fund,” said Haworth, who has been trading derivatives for more than 20 years as the former head of equity derivatives at Johannesburg-based Investec Ltd., and co-founder of Peregrine Holdings Ltd., a South African money manager and stockbroker.

The General Secretary of United Soviet Socialist America gave an indication of his plans today:

“Wall Street seems to maybe have a shorter memory about how close we were to the abyss than I would have expected,” Obama said in an interview with Bloomberg Television today at the White House. “All we’re doing is cleaning up after the mess that was made.”

…

Crafted by Treasury Secretary Timothy Geithner and National Economic Council Director Lawrence Summers, Obama’s plan would put the Federal Reserve in charge of regulating companies whose collapse could damage the entire financial system. It would also create a new agency for overseeing consumer financial products, such as mortgages and credit cards.The proposal encompasses areas ranging from derivatives to executive pay to the mortgage-backed securities that helped fuel the housing boom and then touch off the credit crisis.

…

Obama called the derivatives market “an entire shadow system of enormous risk” and pledged to make it more transparent.“Derivatives are a huge potential risk to the system,” he said. “We are going to make sure that they have to register, that they are regulated, that you have clearinghouses.”

However, I like this bit, somewhat:

Financial firms deemed too-big-to-fail will be required to maintain extra capital cushions, which are designed to curb the excessive risk taking that led to the collapse of last year of Bear Stearns Cos. and Lehman Brothers Holdings Inc. and the government seizure of insurer American International Group Inc.

I would like it a lot more if it was rules based … with a progressive risk-weight surcharge applied to risk-weighted assets in excess of a manageable level.

I find it most interesting that political culpability in the crisis has been ignored. If prime mortgages had yielded a little more, maybe the banks wouldn’t have plunged so heavily into sub-prime. But prime mortgages were wink-wink NOT guaranteed by Treasury nudge-nudge and hence traded at razor-thin spreads to Treasuries.

PrefBlog’s One-Born-Every-Minute Department passes on this SEC news release:

The Securities and Exchange Commission today obtained a court order halting an $11 million Ponzi scheme in which a Chicago-based promoter who is a convicted felon promised investors unusually high returns from purported investments in payday advance stores.

The SEC alleges that David J. Hernandez, who was convicted in 1998 for wire fraud arising from his previous employment at a bank, sold “guaranteed investment contracts” through his company that, unbeknownst to investors, was actually out of business. Hernandez promised returns of 10 percent to 16 percent per month and made false and misleading statements about his background, the use of investor proceeds, and the safety of the investment.

Actually, I only looked at the SEC site hoping for a definitive statement regarding a rumoured Madoff settlement, but nothing shows up yet.

Good performance from preferreds of all classes (well … except the single member of the FixedFloater subindex) with continued elevated volume.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5719 % | 1,304.4 |

| FixedFloater | 7.04 % | 5.52 % | 33,095 | 16.27 | 1 | -0.3226 % | 2,143.2 |

| Floater | 2.92 % | 3.27 % | 82,420 | 19.07 | 3 | 0.5719 % | 1,629.6 |

| OpRet | 4.97 % | 3.79 % | 138,548 | 0.92 | 14 | 0.1951 % | 2,193.3 |

| SplitShare | 5.81 % | 6.14 % | 56,283 | 4.23 | 3 | 0.0915 % | 1,876.9 |

| Interest-Bearing | 5.99 % | 7.61 % | 22,781 | 0.52 | 1 | 0.0999 % | 1,991.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2050 % | 1,740.6 |

| Perpetual-Discount | 6.31 % | 6.34 % | 158,122 | 13.44 | 71 | 0.2050 % | 1,603.1 |

| FixedReset | 5.67 % | 4.83 % | 541,660 | 4.36 | 39 | 0.1425 % | 2,014.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.B | Perpetual-Discount | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 18.42 Evaluated at bid price : 18.42 Bid-YTW : 6.36 % |

| ELF.PR.F | Perpetual-Discount | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 18.52 Evaluated at bid price : 18.52 Bid-YTW : 7.32 % |

| PWF.PR.L | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 19.64 Evaluated at bid price : 19.64 Bid-YTW : 6.61 % |

| CM.PR.J | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 18.41 Evaluated at bid price : 18.41 Bid-YTW : 6.22 % |

| RY.PR.H | Perpetual-Discount | 1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 23.41 Evaluated at bid price : 23.58 Bid-YTW : 6.06 % |

| PWF.PR.K | Perpetual-Discount | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 19.01 Evaluated at bid price : 19.01 Bid-YTW : 6.63 % |

| BAM.PR.N | Perpetual-Discount | 1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 15.67 Evaluated at bid price : 15.67 Bid-YTW : 7.62 % |

| BAM.PR.B | Floater | 1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 12.01 Evaluated at bid price : 12.01 Bid-YTW : 3.27 % |

| BAM.PR.O | OpRet | 1.89 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 23.70 Bid-YTW : 6.47 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.B | Perpetual-Discount | 63,109 | Desjardins crossed 50,000 at 18.60. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 18.42 Evaluated at bid price : 18.42 Bid-YTW : 6.36 % |

| BAM.PR.P | FixedReset | 55,685 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.62 Bid-YTW : 6.56 % |

| MFC.PR.E | FixedReset | 45,714 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.28 Bid-YTW : 5.45 % |

| TD.PR.I | FixedReset | 43,775 | National Bank crossed 33,000 at 27.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.04 Bid-YTW : 4.68 % |

| CM.PR.H | Perpetual-Discount | 38,700 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 18.87 Evaluated at bid price : 18.87 Bid-YTW : 6.47 % |

| SLF.PR.E | Perpetual-Discount | 36,785 | RBC crossed 25,000 at 17.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-16 Maturity Price : 17.03 Evaluated at bid price : 17.03 Bid-YTW : 6.64 % |

| There were 39 other index-included issues trading in excess of 10,000 shares. | |||

Bank of Canada Releases Financial System Review

The Bank of Canada has released the June 2009 Financial System Review with the usual high level views of government and corporate finance.

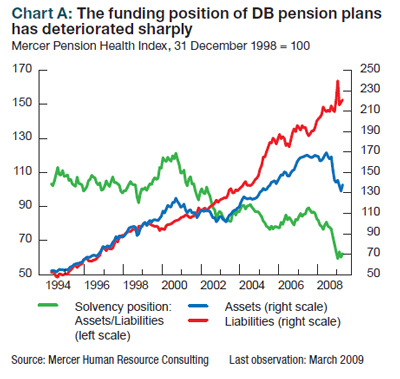

I was most interested to see a policy recommendation in the review of the funding status of pension plans. First they state the problem:

Assets fell in 2008, largely because of the steep decline in Canadian and international equity markets. At the same time, declines in long-term bond yields caused the present value of liabilities to increase.

… and provide an illustration:

… and provide a prescription:

In this environment, plan members are concerned about pension obligations being met.

To address these issues, reforms should focus on: (i) flexibility to manage risks and (ii) proper incentives. Reforms (regulatory, accounting, and legal) should also focus on providing sponsors with the flexibility needed to actively maintain a balance between the future income from the pension fund and the payouts associated with promised benefits. Small pension funds should be encouraged to pool with larger funds to better diversify market risk as another way to help make pension funds more resilient to market volatility.

I may be a little slow, but I fail to follow the chain of logic between the premises and the conclusion that “small pension funds should be encouraged to pool with larger funds to better diversify market risk”.

This will not affect the liability side, which is based on the long Canada rate. But the Bank fails to show – or even to suggest – that the decline in assets was exacerbated by lack of diversification, that large pools are better diversified than small funds, or that pooled funds outperform small funds.

It may well be that these logical steps can be justified – but they ain’t, which makes me suspicious. The recommendation is supportive of the Ontario government’s lunatic plan to encourage the bureaucratization of the Ontario Teachers’ Pension Plan (OTPP) and OMERS, as discussed on March 31, without either mentioning the proposal or providing any of the supporting arguments that were also missing from the original.

This has the look of a quid pro quo – either institution to institution, or the old regulatory game of setting up some lucrative post-retirement consulting gigs. Even if completely straightforward and honest, the argumentation in this section is so sloppy as to be unworthy of the Bank.

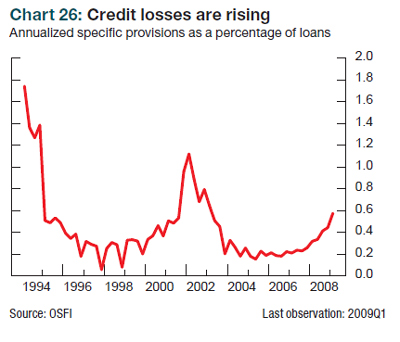

Of more interest to Assiduous Readers will be the section on banks, commencing on page 29 of the PDF.

There are two things of interest here: first, for all the gloom and doom, credit losses are not as high as the post-tech-boom slowdown, let alone the recession of 1990; second, that the graph is cut off after the peak of the 1990 recession.

Why was the graph prepared in this manner? Given the Bank’s increased politicization (also evidenced by the pension plan thing) and increased regulatory bickering with OSFI, I regret that I am not only disappointed that they are not encouraging comparison with the last real recession, but suspicious that there is some kind of weird ulterior purpose. Whatever the rationale, this omission reflects poorly on the Bank’s ability to present convincing objective research.

There are a number of longer articles on the general topic of procyclicity:

- Procyclicality and Bank Capital

- Procyclicality and Provisioning: Conceptual Issues, Approaches, and Empirical Evidence

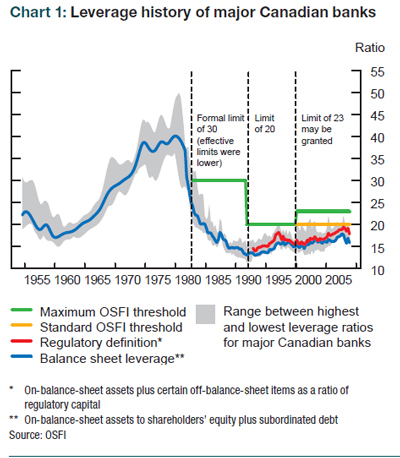

- Regulatory Constraints on Leverage: The Canadian Experience

- Procyclicality and Value at Risk

- Procyclicality and Margin Requirements

- Procyclicality and Compensation

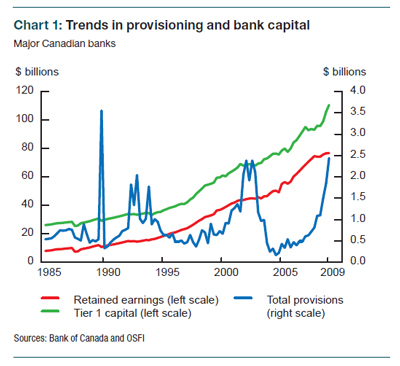

The second article includes a chart on provisioning; not the same thing as credit losses, but a much better effort than that given in the main section of the report:

I was disappointed to see that bank capital and dynamic provisioning were discussed in the contexts of the general macro-economy and with great gobbets of regulatory discretion. I would much prefer to see surcharges on Risk Weighted Assets related to both the gross amount and the trend over time of RWA calculated by individual bank.

The emphasis on regulatory infallibility is particularly distressing because it is regulators who bear responsibility for the current crisis. The banks screwed up, sure. But we expect the banks to screw up, that’s why they’re regulated. And the regulators dropped the ball.

The paper on leverage has an interesting chart:

Update, 2009-7-21:

June 15, 2009

Was it Joseph Mason who said it? Added 2009-7-15: Yes. It was. The fundamental problem with credit ratings and regulations thereof is that while the assumption is that you have a conservative investor looking for a conservative opinion, the regulatory use of credit ratings means that you have regulated investors looking for a license to invest. So, into the breach steps Realpoint:

U.S. credit rating company Realpoint on Thursday said insurers may soon be allowed to use its commercial mortgage bond ratings and preserve capital if rival Standard & Poor’s moves to slash its designations

…

The NAIC move would give insurers more flexibility in choosing ratings that determine their capital levels and avoid forced selling of the assets if S&P adopts more conservative models. Insurers can use the middle rating, if there are three, according to [Realpoint CEO] Dobilas.S&P shocked the the CMBS market last week by advising that its new models, if adopted, would likely prompt ratings cuts on 95 percent of top bonds issued during the peak of the real estate cycle in 2007 and 85 percent of CMBS from 2006. S&P is mulling responses from a formal request for comment.

Some 50 insurers have contacted Horsham, Pennsylvania-based Realpoint over the last few days, saying, “you guys need to get approved” by the NAIC, Dobilas said.

This is of particular interest in light of today’s release of the BIS paper Stocktaking on the use of credit ratings:

In the United States, insurance regulators require bonds and preferred stocks to be reported in statutory financial statements in one of six National Association of Insurance Commissioners (NAIC) designations categories that denote credit quality. If an accepted rating organisation (ARO) has rated the security, the security is not required to be filed with the NAIC’s Securities Valuation Office (SVO). Rather, the ARO rating is used to map the security to one of the six NAIC designation categories.18 The NAIC designations are primarily designed to assist regulators (as opposed to investors) to monitor the financial condition of their insurers.

Finally, in light of the impact that the credit market crisis had on the credit ratings of the financial guarantors and the bonds they insure, the NAIC announced that the SVO will be issuing “substitute” ratings for some municipal bonds. In doing so, the NAIC will be assessing the creditworthiness of the municipality that issued the debt. These credit ratings will be used to determine the risk based capital charge for the security. The insurance regulators indicated that the proposal will “decouple” the NAIC rating from the rating agency process.

So NAIC is not just a regulator, it’s also a credit rating agency! Ain’t no conflict of interest there, eh? It sure is a good thing that regulators are infallible!

In Canada, by the way:

In Canada, a significant portion of an insurer’s capital requirement (especially for a life insurer) arises from its exposure to credit risk. This component of the overall insurer capital requirement is determined using asset default factors. For rated short term securities, bonds, loans and private placements, these factors are based on the rating agency grade. In its life insurer capital guideline, the Office of the Superintendent of Financial Institutions (OSFI) states that:

“A company must consistently follow the latest ratings from a recognized, widely followed credit rating agency. Only where that rating agency does not rate a particular instrument, the rating of another recognized, widely followed credit rating agency may be used. However, if the Office believes that the results are inappropriate, a higher capital charge would be required.” [page 3-1-3]

Further, in Canada, asset default factors for preferred shares, where rated, are based on the rating agency grade. For financial leases where rated, and the lease is also secured by the general credit of the lessee, the asset default factor is based on the rating agency grade.

IIROC has (Notice 09-0172) done its bit to ensure that investors are restricted to investments offered by large banks that employ many former regulators:

Leveraged exchange traded funds (ETFs) are probably not suitable for retail investors, the Investment Industry Regulatory Organization of Canada is warning its dealer members.

…

Leveraged ETFs are reset daily by the provider. This means if an investor does not rebalance their leveraged ETFs on a daily basis, there will be tracking error, which will be exacerbated the longer the investment is held.Investors need to have both the right call on a market direction, and more importantly a stable path of direction for these products to work in buy and hold strategies. Volatility can seriously impair the performance of these ETFs if held for the long term.

In its notice IIROC said a Canadian ETFs that seeks to deliver twice the daily return of the COMEX Gold Bullion Index fell 5% between January 22, 2008 and May 29, 2009. However, its inverse fund (twice the inverse daily return of the index) fell 38% in the same time period even though the underlying COMEX Gold Bullion Index increased by 6% during this period IIROC.

“Due to the effects of compounding, their performance over longer periods of time can differ significantly from their stated daily objective. Therefore, leveraged and inverse ETFs that are reset daily typically are unsuitable for retail investors who plan to hold them for longer than one trading session, particularly in volatile markets,” the notice says.

I mentioned some trader-games in the CDS market on June 12 – James Hamilton of Econbrowser comments:

For my money, the first rule we need would be a law, not a rule, that notional not exceed actual.

Barring that, here’s another rule I trust: a fool and his money are soon parted.

I’m OK with the second rule, but strongly disagree with the first. Some idiot made a dumb trade and lost money. Why does this demand a regulatory response?

C-EBS has announced consultation on Large Exposure guidelines for banks. Sadly, these proposed measures appear to be all about reporting, giving more discretion to supervisory authorities. There are no current plans to make regulatory response fair and reasonable by simply applying a surcharge to the Risk-Weighted-Assets calculation.

There are mutterings that CAD strength may hasten (more) quantitative easing:

Bank of Canada Governor Mark Carney, who says a strengthening currency could choke the economic recovery, may be pressed into creating dollars and buying assets such as government bonds to offset the dollar’s rise.

A 16 percent gain for the Canadian dollar since March 9 is threatening to undermine the country’s already battered exporters. This raises the likelihood that Carney will follow the Federal Reserve, Bank of England and Swiss National Bank in pursuing so-called quantitative easing, said Nicholas Rowe, an economist at Carleton University in Ottawa.

Volume came down a little from the recent frenzy, but remains strong. A nothing day for PerpetualDiscounts, Floating Rate issues were down a bit and FixedResets continued to shine.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -2.6857 % | 1,297.0 |

| FixedFloater | 7.02 % | 5.51 % | 32,138 | 16.28 | 1 | -2.1465 % | 2,150.2 |

| Floater | 2.94 % | 3.30 % | 82,825 | 19.00 | 3 | -2.6857 % | 1,620.3 |

| OpRet | 4.98 % | 3.74 % | 140,169 | 0.93 | 14 | 0.0339 % | 2,189.1 |

| SplitShare | 5.82 % | 6.41 % | 56,739 | 4.23 | 3 | 0.0000 % | 1,875.2 |

| Interest-Bearing | 5.99 % | 7.77 % | 22,982 | 0.52 | 1 | -0.0998 % | 1,989.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0440 % | 1,737.1 |

| Perpetual-Discount | 6.33 % | 6.33 % | 157,137 | 13.46 | 71 | -0.0440 % | 1,599.8 |

| FixedReset | 5.68 % | 4.84 % | 548,135 | 4.36 | 39 | 0.1495 % | 2,011.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.B | Floater | -3.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 11.82 Evaluated at bid price : 11.82 Bid-YTW : 3.32 % |

| TRI.PR.B | Floater | -2.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 2.38 % |

| BAM.PR.G | FixedFloater | -2.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 25.00 Evaluated at bid price : 15.50 Bid-YTW : 5.51 % |

| BAM.PR.K | Floater | -1.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 11.90 Evaluated at bid price : 11.90 Bid-YTW : 3.30 % |

| GWO.PR.I | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 17.21 Evaluated at bid price : 17.21 Bid-YTW : 6.57 % |

| RY.PR.F | Perpetual-Discount | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 18.18 Evaluated at bid price : 18.18 Bid-YTW : 6.20 % |

| BAM.PR.O | OpRet | -1.02 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 23.26 Bid-YTW : 6.99 % |

| NA.PR.K | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 23.57 Evaluated at bid price : 23.86 Bid-YTW : 6.20 % |

| GWO.PR.G | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 20.20 Evaluated at bid price : 20.20 Bid-YTW : 6.47 % |

| IAG.PR.C | FixedReset | 1.56 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 5.18 % |

| BAM.PR.M | Perpetual-Discount | 1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 7.46 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.E | FixedReset | 71,672 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.23 Bid-YTW : 5.49 % |

| BNS.PR.T | FixedReset | 55,480 | National crossed 40,000 at 27.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.08 Bid-YTW : 4.60 % |

| SLF.PR.D | Perpetual-Discount | 54,180 | Desjardins crossed 50,000 at 17.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 17.00 Evaluated at bid price : 17.00 Bid-YTW : 6.58 % |

| BAM.PR.P | FixedReset | 51,100 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 6.57 % |

| RY.PR.D | Perpetual-Discount | 38,155 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-15 Maturity Price : 18.36 Evaluated at bid price : 18.36 Bid-YTW : 6.20 % |

| RY.PR.P | FixedReset | 30,695 | Desjardins crossed 19,400 at 27.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.91 Bid-YTW : 4.61 % |

| There were 36 other index-included issues trading in excess of 10,000 shares. | |||

June Edition of PrefLetter Released!

The June, 2009, edition of PrefLetter has been released and is now available for purchase as the “Previous edition”. Those who subscribe for a full year receive the “Previous edition” as a bonus.

The June edition contains a relatively long appendix, introducing the concept of “Break-Even Rate Shock” as a method of valuing new issue FixedResets.

As previously announced, PrefLetter is now available to residents of Alberta, British Columbia and Manitoba, as well as Ontario and to entities registered with the Quebec Securities Commission.

Until further notice, the “Previous Edition” will refer to the June, 2009, issue, while the “Next Edition” will be the July, 2009, issue, scheduled to be prepared as of the close July 10 and eMailed to subscribers prior to market-opening on July 13.

PrefLetter is intended for long term investors seeking issues to buy-and-hold. At least one recommendation from each of the major preferred share sectors is included and discussed.

Note: A recent enhancement to the PrefLetter website is the Subscriber Download Feature. If you have not received your copy, try it!

Note: PrefLetter, being delivered to clients as a large attachment by eMail, sometimes runs afoul of spam filters. If you have not received your copy within fifteen minutes of a release notice such as this one, please double check your (company’s) spam filtering policy and your spam repository. If it’s not there, contact me and I’ll get you your copy … somehow!

Note: There have been scattered complaints regarding inability to open PrefLetter in Acrobat Reader, despite my practice of including myself on the subscription list and immediately checking the copy received. I have had the occasional difficulty reading US Government documents, which I was able to resolve by downloading and installing the latest version of Adobe Reader. Also, note that so far, all complaints have been from users of Yahoo Mail. Try saving it to disk first, before attempting to open it.

FTN.PR.A Reinstates Capital Unit Dividend

Financial 15 Split Corp. has announced:

its regular monthly distribution of $0.1257 for each Class A share ($1.5084 annually) and $0.04375 for each Preferred share ($0.525 annually). Distributions are payable June 10, 2009 to shareholders on record as of May 29, 2009.

This is of interest since the Capital Unit Dividend was suspended in December; therefore capital unitholders received no distributions for the five months from December to April inclusive, which has avoided the reduction of NAV by about $0.62.

The NAV on May 29 was $15.91 on May 29, according to the company.

FTN.PR.A is tracked by HIMIPref™ but has been relegated to the “Scraps” index due to credit concerns. It was last mentioned on PrefBlog when DBRS downgraded it to Pfd-4 in February as part of a mass downgrade of SplitShares.