So it was another crummy day for equities:

Canadian bank stocks were down more than 3.5 per cent during the day, marking the biggest decline for the group since August, 2009, when stock markets were emerging fitfully from the global financial crisis.

Stocks recovered some lost ground later in the day, but over all, Canadian bank stocks have tumbled more than 7 per cent this year.

While that is relatively mild next to the double-digit declines among U.S. and European bank stocks, Tuesday’s downturn suggests investors are starting to lump the big banks together with their global peers.

…

The backdrop to the day’s market turbulence certainly pointed to indiscriminate alarm among investors. European stocks fell 1.8 per cent and Japanese stocks fell 5.4 per cent. The Toronto Stock Exchange tumbled 2 per cent.

And the Canadian short-term yield curve inverted:

The Canadian yield curve was briefly inverted out to five years on Tuesday before recovering to roughly flat levels. This is bad news for domestic investors. Just how bad things will get depends on how much faith remains in central bank monetary policy and the extent to which “it’s different this time.”

Supported by Federal Reserve research studies, inverted yield curves are a widely accepted, long-standing indicator of economic recessions. In Canada, the last time the yield curve was inverted out to five years (the five-year Government of Canada bond yielded less than the three-month T-bill yield) was in January, 2015, just as the domestic technical recession began.

… and oil’s in the tank:

Crude tumbled the most in five months in London as price volatility climbed to a seven-year high and Goldman Sachs Group Inc. warned of wider swings to come.

Brent futures fell 7.8 percent as global equities neared a bear market. Volatility is set to “spike” as prices seek an equilibrium, which could drag oil below $20 a barrel, Goldman Sachs said. The CBOE Crude Oil Volatility Index, which measures expectations of price swings, rose as high as 73.52, almost the highest since 2009. The world oil surplus will be bigger in the first half of this year than previously estimated, according to the International Energy Agency.

… and overnight markets are grim:

Japanese stocks extended losses and Singaporean shares tumbled following a two-day break, as persistent concern over market volatility helped the yen solidify its ascent. Oil climbed back above $28 a barrel before an update on U.S. stockpiles.

The Topix index headed for the biggest two-day drop since the aftermath of the March 2011 earthquake in Tokyo as a gauge of Japanese equity volatility soared. The Straits Times Index in Singapore sank the most in three weeks while the yen strengthened a third day and gold resumed its advance. U.S. index futures reversed some early gains as Vermont Senator Bernie Sanders defeated Hillary Clinton in the New Hampshire Democratic Primary, while Donald Trump prevailed over a crowded Republican field.

But cheer up! The regulators are making investing safer!

New proposals from the U.S. securities watchdog aimed at reducing risks in exchange-traded funds (ETFs) may end up being the best thing that ever happened to rival exchange-traded notes (ETNs).

ETFs holding some $225 billion worth of assets are likely to violate the new rules suggested by the Securities and Exchange Commission (SEC), and could ironically spark a mass migration of investors into riskier products.

…

The first rule proposal attempts to address liquidity concerns by requiring that no more than 15 percent of a fund’s holdings take longer than seven days to liquidate without moving the market. This effectively means that “every broad corporate and high-yield bond fund and every broad emerging markets fund would be in trouble,” according to Nadig, who ran the numbers using his own trading estimates of how many ETFs would be in violation.

…

The other proposal attempts to address derivatives usage by limiting the leverage in 40 Act funds to 150 percent. That puts a majority of the two-times and three-times levered ETFs in violation. While the issuers may be able to find clever workarounds to get to the two- and three-times exposure while still remaining in compliance, it does put another $25 billion at risk of being in violation, leaving many investors searching to find other ways to get this exposure, such as ETNs.Unlike ETFs, exchange-traded notes involve investors taking on significant credit risk to the ETN’s issuers.

ETNs are unsecured debt obligations regulated under the less-stringent Securities Act of 1933, and are not required to physically hold anything. As such, there is a risk that the issuer could default and investors would lose some or all of their investment. This is very different to the structure of a high-yield bond ETF or even a leveraged ETF, both of which physically hold the securities or derivatives involved. Shareholders have ownership of those assets even if the issuer goes out of business.

I continue to feel that the best option is to allow for staggered redemptions, so that ETF (and mutual fund) investors get a break on fees if they agree to a delayed redemption schedule; e.g., you have to give 20 trading day’s notice of redemption and your cash redemption value is based on the equally weighted mean average of the redemption prices on each of those days. Perhaps a third class of share would not be redeemable or exchangeable at all; at the core of an ETF would be a CEF.

But really, requiring that 85% of ETF holdings have a reasonable probability of being liquidated in seven days with ABSOLUTELY ZERO MARKET IMPACT is going way too far. But how else can the public be forced to buy government bonds at yields below the inflation rate?

It’s also going to force people into direct corporate bond holdings, as well. Just wait until Joe Lunchbucket finds that one of his five holdings has gone bust!

I really suggest that preferred share investors relax a little. Maybe watch a nice movie:

It was a horrible day for the Canadian preferred share market, with PerpetualDiscounts off 89bp, FixedResets down 150bp and DeemedRetractibles losing 151bp. The Performance highlights table is, of course, ridiculous; all four of the FTS FixedResets are down over 150bp on the day in the wake of the company’s ambitious takeover announcement. Volume was average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

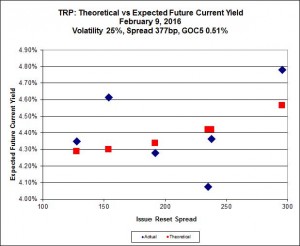

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 17.55 to be $1.36 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $0.85 cheap at its bid price of 18.15.

Most expensive is MFC.PR.L, resetting at +216bp on 2019-6-19, bid at 16.60 to be 0.68 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 18.00 to be 0.79 cheap.

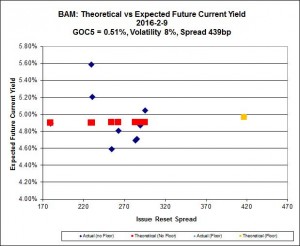

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 12.57 to be $1.77 cheap. BAM.PF.E, resetting at +255bp on 2020-3-31 is bid at 16.66 and appears to be $1.05 rich.

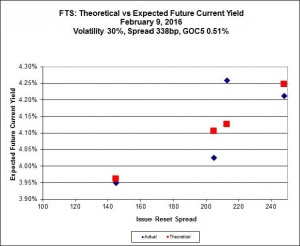

FTS.PR.K, with a spread of +205bp, and bid at 15.90, looks $0.31 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 15.50 and is $0.50 cheap.

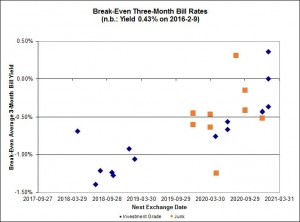

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.95%, with two outliers below -1.50%. There is one junk outlier below -1.50% and one above +0.50%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.29 % | 6.43 % | 17,696 | 16.14 | 1 | -0.6982 % | 1,474.7 |

| FixedFloater | 7.69 % | 6.72 % | 25,764 | 15.52 | 1 | -1.2000 % | 2,584.5 |

| Floater | 4.71 % | 4.81 % | 74,939 | 15.81 | 4 | -0.0249 % | 1,627.6 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2220 % | 2,711.1 |

| SplitShare | 4.87 % | 6.27 % | 77,398 | 2.69 | 6 | 0.2220 % | 3,172.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2220 % | 2,475.3 |

| Perpetual-Premium | 5.88 % | 5.88 % | 83,066 | 13.94 | 6 | -0.1603 % | 2,511.4 |

| Perpetual-Discount | 5.81 % | 5.85 % | 99,218 | 14.07 | 33 | -0.8904 % | 2,485.8 |

| FixedReset | 5.59 % | 4.78 % | 215,725 | 14.59 | 83 | -1.3007 % | 1,814.7 |

| Deemed-Retractible | 5.35 % | 5.55 % | 127,752 | 5.20 | 34 | -1.5051 % | 2,524.7 |

| FloatingReset | 3.05 % | 4.69 % | 49,492 | 5.55 | 16 | -0.9230 % | 1,994.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.Q | FloatingReset | -6.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 10.75 Evaluated at bid price : 10.75 Bid-YTW : 4.76 % |

| BAM.PR.R | FixedReset | -4.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 12.57 Evaluated at bid price : 12.57 Bid-YTW : 5.77 % |

| BMO.PR.S | FixedReset | -4.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.01 Evaluated at bid price : 17.01 Bid-YTW : 4.48 % |

| TRP.PR.F | FloatingReset | -4.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 11.27 Evaluated at bid price : 11.27 Bid-YTW : 5.28 % |

| BAM.PR.X | FixedReset | -4.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 11.80 Evaluated at bid price : 11.80 Bid-YTW : 5.37 % |

| FTS.PR.J | Perpetual-Discount | -3.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 20.76 Evaluated at bid price : 20.76 Bid-YTW : 5.84 % |

| CM.PR.O | FixedReset | -3.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.01 Evaluated at bid price : 17.01 Bid-YTW : 4.50 % |

| HSE.PR.C | FixedReset | -3.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 14.23 Evaluated at bid price : 14.23 Bid-YTW : 6.90 % |

| BMO.PR.T | FixedReset | -3.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.61 Evaluated at bid price : 16.61 Bid-YTW : 4.47 % |

| MFC.PR.N | FixedReset | -3.51 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.03 Bid-YTW : 8.64 % |

| MFC.PR.K | FixedReset | -3.41 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.57 Bid-YTW : 9.60 % |

| CM.PR.P | FixedReset | -3.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 4.54 % |

| PWF.PR.T | FixedReset | -3.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 20.01 Evaluated at bid price : 20.01 Bid-YTW : 3.86 % |

| FTS.PR.F | Perpetual-Discount | -3.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 5.82 % |

| CU.PR.C | FixedReset | -3.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.30 Evaluated at bid price : 16.30 Bid-YTW : 4.58 % |

| GWO.PR.R | Deemed-Retractible | -3.24 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.90 Bid-YTW : 7.46 % |

| BNS.PR.F | FloatingReset | -3.20 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.83 Bid-YTW : 7.92 % |

| RY.PR.M | FixedReset | -3.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 18.00 Evaluated at bid price : 18.00 Bid-YTW : 4.53 % |

| TD.PF.A | FixedReset | -3.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.75 Evaluated at bid price : 16.75 Bid-YTW : 4.47 % |

| GWO.PR.H | Deemed-Retractible | -2.98 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.14 Bid-YTW : 7.35 % |

| SLF.PR.B | Deemed-Retractible | -2.95 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.36 Bid-YTW : 7.15 % |

| HSE.PR.E | FixedReset | -2.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 15.30 Evaluated at bid price : 15.30 Bid-YTW : 6.98 % |

| GWO.PR.Q | Deemed-Retractible | -2.88 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.26 Bid-YTW : 6.94 % |

| PWF.PR.A | Floater | -2.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 10.50 Evaluated at bid price : 10.50 Bid-YTW : 4.50 % |

| GWO.PR.L | Deemed-Retractible | -2.82 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.10 Bid-YTW : 6.31 % |

| SLF.PR.C | Deemed-Retractible | -2.77 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.02 Bid-YTW : 7.68 % |

| FTS.PR.I | FloatingReset | -2.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 10.02 Evaluated at bid price : 10.02 Bid-YTW : 4.76 % |

| SLF.PR.D | Deemed-Retractible | -2.69 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.88 Bid-YTW : 7.78 % |

| SLF.PR.A | Deemed-Retractible | -2.66 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.24 Bid-YTW : 7.17 % |

| RY.PR.J | FixedReset | -2.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 18.40 Evaluated at bid price : 18.40 Bid-YTW : 4.54 % |

| BAM.PF.E | FixedReset | -2.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.66 Evaluated at bid price : 16.66 Bid-YTW : 5.14 % |

| MFC.PR.H | FixedReset | -2.61 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.43 Bid-YTW : 7.34 % |

| MFC.PR.B | Deemed-Retractible | -2.57 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.51 Bid-YTW : 7.59 % |

| BIP.PR.A | FixedReset | -2.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.66 Evaluated at bid price : 17.66 Bid-YTW : 6.02 % |

| NA.PR.W | FixedReset | -2.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 15.95 Evaluated at bid price : 15.95 Bid-YTW : 4.74 % |

| BAM.PR.Z | FixedReset | -2.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 5.33 % |

| HSE.PR.G | FixedReset | -2.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 15.62 Evaluated at bid price : 15.62 Bid-YTW : 6.83 % |

| TD.PF.B | FixedReset | -2.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.86 Evaluated at bid price : 16.86 Bid-YTW : 4.43 % |

| MFC.PR.C | Deemed-Retractible | -2.37 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.15 Bid-YTW : 7.67 % |

| NA.PR.S | FixedReset | -2.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.29 Evaluated at bid price : 17.29 Bid-YTW : 4.53 % |

| RY.PR.H | FixedReset | -2.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.13 Evaluated at bid price : 17.13 Bid-YTW : 4.36 % |

| RY.PR.Z | FixedReset | -2.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.07 Evaluated at bid price : 17.07 Bid-YTW : 4.32 % |

| BAM.PF.B | FixedReset | -2.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.33 Evaluated at bid price : 16.33 Bid-YTW : 5.17 % |

| GWO.PR.I | Deemed-Retractible | -2.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.25 Bid-YTW : 7.57 % |

| GWO.PR.G | Deemed-Retractible | -2.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.58 Bid-YTW : 6.78 % |

| ELF.PR.G | Perpetual-Discount | -2.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 20.35 Evaluated at bid price : 20.35 Bid-YTW : 5.90 % |

| GWO.PR.P | Deemed-Retractible | -2.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.47 Bid-YTW : 6.44 % |

| HSE.PR.A | FixedReset | -2.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 8.32 Evaluated at bid price : 8.32 Bid-YTW : 6.85 % |

| SLF.PR.E | Deemed-Retractible | -2.09 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.10 Bid-YTW : 7.68 % |

| TD.PF.D | FixedReset | -2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 18.85 Evaluated at bid price : 18.85 Bid-YTW : 4.50 % |

| CM.PR.Q | FixedReset | -2.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 18.71 Evaluated at bid price : 18.71 Bid-YTW : 4.54 % |

| BMO.PR.Y | FixedReset | -2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 18.91 Evaluated at bid price : 18.91 Bid-YTW : 4.45 % |

| MFC.PR.M | FixedReset | -1.95 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.11 Bid-YTW : 8.64 % |

| BMO.PR.Z | Perpetual-Discount | -1.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 22.09 Evaluated at bid price : 22.41 Bid-YTW : 5.58 % |

| SLF.PR.H | FixedReset | -1.86 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.28 Bid-YTW : 10.32 % |

| BAM.PF.A | FixedReset | -1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.52 Evaluated at bid price : 17.52 Bid-YTW : 5.18 % |

| CU.PR.F | Perpetual-Discount | -1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 19.48 Evaluated at bid price : 19.48 Bid-YTW : 5.79 % |

| BMO.PR.W | FixedReset | -1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 4.39 % |

| TD.PR.S | FixedReset | -1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.60 Bid-YTW : 3.74 % |

| IFC.PR.A | FixedReset | -1.55 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 13.94 Bid-YTW : 10.64 % |

| SLF.PR.I | FixedReset | -1.54 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.23 Bid-YTW : 8.47 % |

| TRP.PR.H | FloatingReset | -1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 9.01 Evaluated at bid price : 9.01 Bid-YTW : 4.80 % |

| POW.PR.B | Perpetual-Discount | -1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 22.54 Evaluated at bid price : 22.79 Bid-YTW : 5.93 % |

| FTS.PR.H | FixedReset | -1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 12.41 Evaluated at bid price : 12.41 Bid-YTW : 4.27 % |

| CU.PR.E | Perpetual-Discount | -1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 21.08 Evaluated at bid price : 21.08 Bid-YTW : 5.83 % |

| TD.PF.C | FixedReset | -1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.91 Evaluated at bid price : 16.91 Bid-YTW : 4.41 % |

| BNS.PR.M | Deemed-Retractible | -1.44 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.91 Bid-YTW : 5.41 % |

| CIU.PR.A | Perpetual-Discount | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 19.18 Evaluated at bid price : 19.18 Bid-YTW : 6.02 % |

| BAM.PF.G | FixedReset | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.84 Evaluated at bid price : 17.84 Bid-YTW : 5.17 % |

| MFC.PR.F | FixedReset | -1.40 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.01 Bid-YTW : 11.58 % |

| FTS.PR.M | FixedReset | -1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.75 Evaluated at bid price : 17.75 Bid-YTW : 4.63 % |

| TRP.PR.A | FixedReset | -1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 14.20 Evaluated at bid price : 14.20 Bid-YTW : 4.65 % |

| RY.PR.E | Deemed-Retractible | -1.36 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.92 Bid-YTW : 5.35 % |

| RY.PR.W | Perpetual-Discount | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 22.43 Evaluated at bid price : 22.69 Bid-YTW : 5.41 % |

| CCS.PR.C | Deemed-Retractible | -1.28 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.57 Bid-YTW : 7.23 % |

| TD.PF.E | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 19.45 Evaluated at bid price : 19.45 Bid-YTW : 4.48 % |

| TD.PF.F | Perpetual-Discount | -1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 22.00 Evaluated at bid price : 22.30 Bid-YTW : 5.52 % |

| FTS.PR.G | FixedReset | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 4.63 % |

| RY.PR.A | Deemed-Retractible | -1.20 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.80 Bid-YTW : 5.40 % |

| BAM.PR.G | FixedFloater | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 25.00 Evaluated at bid price : 12.35 Bid-YTW : 6.72 % |

| RY.PR.L | FixedReset | -1.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.50 Bid-YTW : 4.11 % |

| CU.PR.D | Perpetual-Discount | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 21.15 Evaluated at bid price : 21.15 Bid-YTW : 5.81 % |

| RY.PR.B | Deemed-Retractible | -1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.29 Bid-YTW : 5.25 % |

| MFC.PR.L | FixedReset | -1.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.60 Bid-YTW : 8.84 % |

| BNS.PR.L | Deemed-Retractible | -1.12 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.88 Bid-YTW : 5.44 % |

| RY.PR.O | Perpetual-Discount | -1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 21.82 Evaluated at bid price : 22.15 Bid-YTW : 5.53 % |

| MFC.PR.I | FixedReset | -1.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.74 Bid-YTW : 7.61 % |

| MFC.PR.G | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.00 Bid-YTW : 8.09 % |

| RY.PR.G | Deemed-Retractible | -1.08 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.85 Bid-YTW : 5.41 % |

| BNS.PR.B | FloatingReset | -1.06 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.42 Bid-YTW : 4.86 % |

| BAM.PF.F | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.89 Evaluated at bid price : 17.89 Bid-YTW : 5.11 % |

| RY.PR.F | Deemed-Retractible | -1.04 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.84 Bid-YTW : 5.36 % |

| PVS.PR.D | SplitShare | 1.12 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2021-10-08 Maturity Price : 25.00 Evaluated at bid price : 22.50 Bid-YTW : 6.87 % |

| BAM.PR.K | Floater | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 9.93 Evaluated at bid price : 9.93 Bid-YTW : 4.81 % |

| BNS.PR.D | FloatingReset | 1.71 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.80 Bid-YTW : 7.46 % |

| BAM.PR.B | Floater | 1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 9.94 Evaluated at bid price : 9.94 Bid-YTW : 4.81 % |

| TRP.PR.D | FixedReset | 3.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 16.56 Evaluated at bid price : 16.56 Bid-YTW : 4.69 % |

| BMO.PR.Q | FixedReset | 4.69 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.32 Bid-YTW : 7.45 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.H | FixedReset | 132,012 | Desjardins crossed 126,200 at 17.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 17.13 Evaluated at bid price : 17.13 Bid-YTW : 4.36 % |

| NA.PR.X | FixedReset | 111,975 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 23.13 Evaluated at bid price : 24.96 Bid-YTW : 5.43 % |

| PWF.PR.A | Floater | 100,508 | Desjardins bought 96,500 from anonymous at 10.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 10.50 Evaluated at bid price : 10.50 Bid-YTW : 4.50 % |

| BMO.PR.Q | FixedReset | 78,800 | TD crossed 50,000 at 18.35; Scotia crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.32 Bid-YTW : 7.45 % |

| TD.PF.G | FixedReset | 76,371 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 23.27 Evaluated at bid price : 25.40 Bid-YTW : 5.12 % |

| BNS.PR.E | FixedReset | 65,032 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-09 Maturity Price : 23.28 Evaluated at bid price : 25.42 Bid-YTW : 5.03 % |

| There were 30 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| GWO.PR.L | Deemed-Retractible | Quote: 24.10 – 24.82 Spot Rate : 0.7200 Average : 0.4782 YTW SCENARIO |

| TD.PF.F | Perpetual-Discount | Quote: 22.30 – 22.85 Spot Rate : 0.5500 Average : 0.3472 YTW SCENARIO |

| RY.PR.J | FixedReset | Quote: 18.40 – 18.93 Spot Rate : 0.5300 Average : 0.3313 YTW SCENARIO |

| BMO.PR.T | FixedReset | Quote: 16.61 – 17.15 Spot Rate : 0.5400 Average : 0.3477 YTW SCENARIO |

| TD.PR.Z | FloatingReset | Quote: 21.95 – 22.60 Spot Rate : 0.6500 Average : 0.4773 YTW SCENARIO |

| GWO.PR.O | FloatingReset | Quote: 11.24 – 13.25 Spot Rate : 2.0100 Average : 1.8387 YTW SCENARIO |