S&P has Russia on Watch-Negative:

S&P said in its statement that there’s at least a 50 percent chance that Russia’s rating will be lowered to junk within 90 days as it put the country on negative credit watch. Moody’s Investors Service and Fitch Ratings rank Russia one step higher than S&P, which lowered its rating one level in April to BBB-.

The move “stems from what we view as a rapid deterioration of Russia’s monetary flexibility and the impact of the weakening economy on its financial system,” S&P said. The ratings company expects to conclude its review in mid-January. The ruble held its gains after the S&P announcement yesterday, suggesting investors have already priced in the possibility of credit downgrades.

…

Gross domestic product may shrink as much as 4.7 percent next year, the most since 2009, should a “stress scenario” eventuate where oil averages $60 a barrel, the central bank said Dec. 15. Net capital outflows may have more than doubled this year to $134 billion.In October, Moody’s cut Russia’s credit rating by one level to its second-lowest investment grade, citing concerns over the impact of sanctions on the economy. The continued erosion of Russia’s foreign-exchange reserves because of capital flight, low oil prices and borrowers’ lack of access to credit were also cited by Moody’s.

Christmas came early for Canadian preferred share investors, the market rocketed upwards with PerpetualDiscounts winning 70bp, FixedResets gained 37bp and DeemedRetractibles were up 50bp in a session that was foreshortened so that members of the highest paid profession on earth could stand around complaining about the inferior work ethic of minimum wage waiters and shop clerks. The Performance Highlights table is suitably gigantic; volume, however, was quite low.

PerpetualDiscounts now yield 5.05%, equivalent to 6.56% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.1% so the pre-tax interest-equivalent spread (in this context, the Seniority Spread) is now about 245bp, a very sharp narrowing from the 270bp reported December 17.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

- based on Implied Volatility Theory only

- are relative only to other FixedResets from the same issuer

- assume constant GOC-5 yield

- assume constant Implied Volatility

- assume constant spread

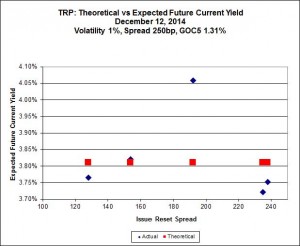

Here’s TRP:

So according to this, TRP.PR.A, bid at 20.12, is $1.59 cheap, but it has already reset (at +192). TRP.PR.D, bid at 25.11 and resetting at +238bp on 2019-4-30 is $0.43 rich and TRP.PR.E, bid at 25.30 and resetting at +235bp on 2019-10-30 (two months prior to the next TRP.PR.A reset), is $0.82 rich.

There is an excellent fit to theory for the MFC issues, but Implied Volatility continues to be a conundrum. It is far too high if we consider that NVCC rules will never apply to these issues; it is far too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

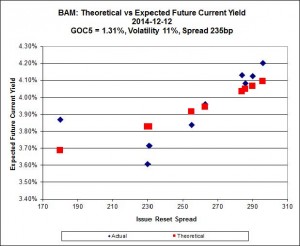

There continues to be cheapness in the lowest-spread issue, BAM.PR.X, resetting at +180bp on 2017-6-30, which is bid at 20.83 after another day of excellent performance and appears to be $0.82 cheap, while BAM.PR.R, resetting at +230bp 2016-6-30 is bid at 25.19 and appears to be $1.24 rich.

It will be noticed that due to price changes in issues other than BAM.PR.X, this issue gained over a point and yet became cheaper to the rest; additionally, it seems clear that the higher-spread issues define a curve with significantly more Implied Volatility than is calculated when the low-spread outlier is included.

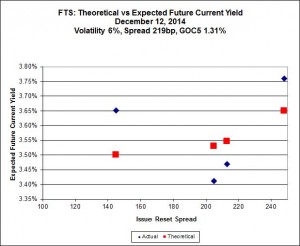

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 18.77, looks $1.24 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp, and bid at 25.15, looks $1.04 expensive and resets 2019-3-1

The average break-even rate has declined from 1.80%-2.00% at the time recent conversion decisions were made to a current cluster of (mostly) 1.50%-1.65%. This decline means that the estimated profit on TRP.PR.A conversion has declined from $0.48 to a mere $0.16 (at the lower end of the range, 1.50%).

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1574 % | 2,517.9 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1574 % | 3,986.3 |

| Floater | 3.01 % | 3.12 % | 65,755 | 19.42 | 4 | -0.1574 % | 2,676.7 |

| OpRet | 4.41 % | -3.39 % | 24,220 | 0.08 | 2 | -0.0196 % | 2,749.9 |

| SplitShare | 4.28 % | 4.08 % | 35,850 | 3.69 | 5 | 0.0713 % | 3,199.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0196 % | 2,514.5 |

| Perpetual-Premium | 5.44 % | -3.29 % | 71,137 | 0.08 | 20 | 0.1610 % | 2,483.7 |

| Perpetual-Discount | 5.16 % | 5.05 % | 109,250 | 15.38 | 15 | 0.6970 % | 2,667.3 |

| FixedReset | 4.23 % | 3.58 % | 245,785 | 8.58 | 77 | 0.3659 % | 2,539.0 |

| Deemed-Retractible | 4.95 % | -0.68 % | 96,125 | 0.11 | 40 | 0.4981 % | 2,629.6 |

| FloatingReset | 2.56 % | 1.92 % | 63,660 | 3.43 | 5 | 0.4177 % | 2,547.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| SLF.PR.G | FixedReset | -2.02 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.36 Bid-YTW : 4.67 % |

| PWF.PR.P | FixedReset | -1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 3.68 % |

| BAM.PR.K | Floater | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 16.66 Evaluated at bid price : 16.66 Bid-YTW : 3.15 % |

| IAG.PR.A | Deemed-Retractible | -1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.71 Bid-YTW : 5.28 % |

| BAM.PR.N | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 21.42 Evaluated at bid price : 21.42 Bid-YTW : 5.58 % |

| ENB.PR.J | FixedReset | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 22.72 Evaluated at bid price : 23.75 Bid-YTW : 4.22 % |

| BAM.PF.F | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 3.95 % |

| GWO.PR.L | Deemed-Retractible | 1.09 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 26.00 Evaluated at bid price : 26.08 Bid-YTW : 1.37 % |

| BAM.PR.X | FixedReset | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 20.83 Evaluated at bid price : 20.83 Bid-YTW : 4.04 % |

| RY.PR.L | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.53 Bid-YTW : 2.80 % |

| ENB.PF.C | FixedReset | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 22.67 Evaluated at bid price : 23.78 Bid-YTW : 4.29 % |

| BAM.PF.B | FixedReset | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 23.32 Evaluated at bid price : 25.30 Bid-YTW : 3.87 % |

| IAG.PR.G | FixedReset | 1.22 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.52 Bid-YTW : 1.79 % |

| MFC.PR.B | Deemed-Retractible | 1.29 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.35 Bid-YTW : 5.02 % |

| GWO.PR.P | Deemed-Retractible | 1.29 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-03-31 Maturity Price : 25.25 Evaluated at bid price : 25.88 Bid-YTW : 4.81 % |

| SLF.PR.A | Deemed-Retractible | 1.44 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.67 Bid-YTW : 4.93 % |

| PWF.PR.R | Perpetual-Premium | 1.44 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-30 Maturity Price : 25.00 Evaluated at bid price : 26.02 Bid-YTW : 4.92 % |

| SLF.PR.D | Deemed-Retractible | 1.64 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.56 Bid-YTW : 5.21 % |

| SLF.PR.E | Deemed-Retractible | 1.68 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.64 Bid-YTW : 5.22 % |

| SLF.PR.C | Deemed-Retractible | 1.72 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.65 Bid-YTW : 5.16 % |

| GWO.PR.G | Deemed-Retractible | 1.72 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-23 Maturity Price : 25.00 Evaluated at bid price : 25.38 Bid-YTW : -13.88 % |

| GWO.PR.R | Deemed-Retractible | 1.85 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.72 Bid-YTW : 4.96 % |

| CU.PR.D | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 24.34 Evaluated at bid price : 24.77 Bid-YTW : 4.97 % |

| CU.PR.E | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 24.33 Evaluated at bid price : 24.76 Bid-YTW : 4.97 % |

| BAM.PR.T | FixedReset | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 23.40 Evaluated at bid price : 24.69 Bid-YTW : 3.74 % |

| TRP.PR.C | FixedReset | 2.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 20.05 Evaluated at bid price : 20.05 Bid-YTW : 3.78 % |

| GWO.PR.I | Deemed-Retractible | 2.06 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.75 Bid-YTW : 5.16 % |

| MFC.PR.F | FixedReset | 2.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.91 Bid-YTW : 4.57 % |

| HSE.PR.A | FixedReset | 2.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 20.41 Evaluated at bid price : 20.41 Bid-YTW : 3.91 % |

| FTS.PR.J | Perpetual-Discount | 2.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 24.32 Evaluated at bid price : 24.74 Bid-YTW : 4.82 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.C | FixedReset | 63,650 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 23.13 Evaluated at bid price : 24.92 Bid-YTW : 3.55 % |

| MFC.PR.A | OpRet | 52,800 | Scotia crossed 50,000 at 25.31. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-06-19 Maturity Price : 25.00 Evaluated at bid price : 25.27 Bid-YTW : 2.01 % |

| CM.PR.E | Perpetual-Premium | 28,773 | Called for Redemption effective 2015-1-31. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-23 Maturity Price : 25.00 Evaluated at bid price : 24.98 Bid-YTW : -0.33 % |

| TRP.PR.A | FixedReset | 27,895 | Resets to 3.266% effective Dec 31. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 20.12 Evaluated at bid price : 20.12 Bid-YTW : 4.11 % |

| IAG.PR.E | Deemed-Retractible | 26,000 | Called for redemption effective 2014-12-31. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-12-31 Maturity Price : 25.75 Evaluated at bid price : 25.99 Bid-YTW : 4.80 % |

| CM.PR.P | FixedReset | 25,588 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-24 Maturity Price : 23.12 Evaluated at bid price : 24.90 Bid-YTW : 3.55 % |

| There were 15 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PF.E | FixedReset | Quote: 25.15 – 26.15 Spot Rate : 1.0000 Average : 0.5936 YTW SCENARIO |

| POW.PR.B | Perpetual-Premium | Quote: 25.02 – 25.39 Spot Rate : 0.3700 Average : 0.2475 YTW SCENARIO |

| HSE.PR.C | FixedReset | Quote: 25.36 – 25.69 Spot Rate : 0.3300 Average : 0.2261 YTW SCENARIO |

| PVS.PR.D | SplitShare | Quote: 24.35 – 24.63 Spot Rate : 0.2800 Average : 0.1848 YTW SCENARIO |

| TRP.PR.A | FixedReset | Quote: 20.12 – 20.48 Spot Rate : 0.3600 Average : 0.2666 YTW SCENARIO |

| POW.PR.A | Perpetual-Premium | Quote: 25.17 – 25.49 Spot Rate : 0.3200 Average : 0.2289 YTW SCENARIO |