| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version | |||||||

| Index | Current Yield (at bid) | YTW | Average Trading Value | Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 4.34% | 4.31% | 25,731 | 16.67 | 2 | -0.5379% | 993.1 |

| Fixed-Floater | 4.94% | 4.13% | 267,651 | 14.04 | 6 | -0.0592% | 1,003.4 |

| Floater | 4.60% | -18.01% | 58,912 | 6.44 | 5 | -0.0392% | 1,007.4 |

| Op. Retract | 4.73% | 3.31% | 75,942 | 2.77 | 18 | -0.0043% | 1,000.0 |

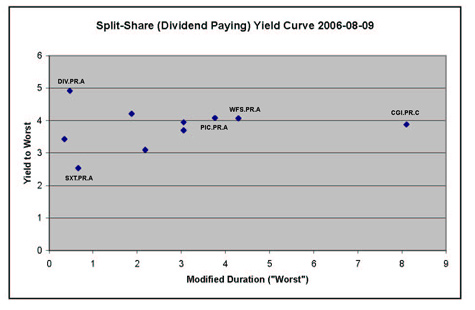

| Split-Share | 5.01% | 3.61% | 56,434 | 2.77 | 10 | 0.0166% | 1,001.9 |

| Interest Bearing | 6.85% | 5.39% | 60,756 | 2.14 | 7 | 0.0090% | 1,010.5 |

| Perpetual-Premium | 5.28% | 4.21% | 170,187 | 3.94 | 42 | 0.1012% | 1,011.5 |

| Perpetual-Discount | 4.72% | 4.75% | 349,324 | 13.79 | 13 | 0.0822% | 1,016.7 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| ACO.PR.A | OpRet | -1.4953% | |

| MFC.PR.C | PerpetualDiscount | +1.0309% | |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| RY.PR.A | PerpetualDiscount | 257,700 | |

| CM.PR.G | PerpetualPremium | 203,000 | |

| HSB.PR.D | PerpetualPremium | 202,600 | |

| PWF.PR.L | PerpetualDiscount | 55,826 | |

| POW.PR.C | PerpetualPremium | 31,090 | |

There were nine other index-included issues with volumes of more than 10,000 shares