Lowe’s Companies, Inc. and RONA Inc. have announced:

that they have entered into a definitive agreement under which Lowe’s is expected to acquire all of the issued and outstanding common shares of RONA for C$24 per share in cash, and all of the issued and outstanding preferred shares of RONA for C$20 per share in cash. The total transaction value is C$3.2 billion (US$2.3 billion) (the “Transaction”). The offer represents a premium of 104 percent to RONA’s closing common share price on February 2, 2016 and a 38 percent premium to RONA’s 52-week high of C$17.36. Together, Lowe’s Canada and RONA stores will create Canada’s leading home improvement retailer with 2015 pro forma revenues from Canadian operations of approximately C$5.6 billion. Excluding transaction and integration costs, we anticipate the Transaction will be accretive to Lowe’s earnings in the first year following the close of the acquisition.

The Transaction has been unanimously approved by the Boards of Directors of Lowe’s and RONA and is supported by the management teams of both companies. The Transaction is expected to proceed by way of a plan of arrangement by which Lowe’s would acquire all of the outstanding shares of RONA, subject to RONA common shareholder approval and satisfaction of customary conditions, including the receipt of all necessary regulatory approvals. The RONA Board has received an opinion from Scotia Capital Inc. that the consideration to be received by RONA’s common and preferred shareholders pursuant to the Transaction is fair, from a financial point of view.

The RONA Board will recommend that RONA shareholders vote in favor of the plan of arrangement at a special meeting of shareholders expected to be held before the end of the first quarter of 2016. Further information regarding the Transaction will be included in RONA’s information circular to be mailed to RONA shareholders in advance of the special meeting. The arrangement agreement provides that RONA is subject to customary non-solicitation provisions.

$20 is quite the premium over yesterday’s closing quote of 12.41-05!

The consensus is that the deal will succeed – f’rinstance, Frederic Tomesco of Bloomberg:

The fact both boards agreed to the C$3.2 billion ($2.3 billion) offer, along with Lowe’s commitment to preserve head-office jobs and maintain supply agreements, will likely seal the deal. Political conditions in Canada’s second-most populous province also favor the acquisition after helping to scupper a hostile offer in 2012.

Rona’s biggest shareholder, the provincial pension fund manager Caisse de Dépôt et Placement du Québec, said Wednesday it would tender its shares to the offer. Quebec’s new economy minister indicated the government probably wouldn’t stand in the way of a deal.

“If three of the groups that were against Lowe’s last time — the board, the government and the Caisse — are saying it’s a good idea, it would be hard to see it not get the green light,” Karl Moore, a management professor at McGill University’s Desautels Faculty of Management in Montreal, said in a telephone interview. “There’ll be some squawking for sure, but that’s predictable. The opposition has to be against this deal in principle.”

Matthew Townsend and Scott Deveau of Bloomberg point out that the plunging loonie helped a lot:

The Canadian dollar’s loss is Lowe’s gain.

After being rebuffed in its attempt to buy Quebec-based retailer Rona Inc. in 2012, Lowe’s Cos. reached agreement on Wednesday to buy it for C$3.2 billion ($2.3 billion). Two big changes in the past four years made the transaction possible: The Parti Quebecois, which opposed the original deal, is out of power, and the loonie fell to its lowest level against the dollar in more than a decade.

…

Lowe’s withdrew the $1.8 billion unsolicited bid for Rona in 2012 after the board and some Quebec politicians opposed the offer, concerned about a loss of jobs and local control in the French-speaking province. The withdrawal came just 12 days after the separatist Parti Quebecois won elections.Since then, the Liberals have taken power in Quebec, and the loonie has dropped to 72 cents versus the U.S. dollar, compared with parity when Lowe’s pulled its bid, making it cheaper for Lowe’s to offer a richer premium. So while the C$24 a share bid in Canadian dollar terms is about 65 percent higher than the C$14.50 a share bid that was rejected, in U.S. dollar terms the offer is just 16 percent higher.

… and Bloomberg’s Brooke Sutherland suggests it’s all about footprint:

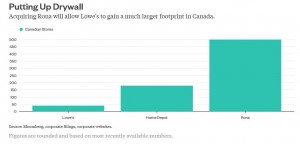

Focusing on Canada may be a distraction, but it’s a distraction that could pay off for Lowe’s. While the home-improvement company has benefited from a rebounding real estate market, the maturing U.S. retail landscape and the rise of online shopping puts a cap on the growth opportunities for big-box vendors. Many are shuttering stores, or at least slowing down expansion.

Lowe’s, for example, had 1,793 U.S. locations as of January 2015 — a gain of about 76 from a year earlier, much of which could be explained by the acquisition of Orchard Supply Hardware. The way to keep growing its store base is to make more acquisitions and push harder into adjacent markets such as Canada, where Home Depot currently has almost five times as many locations as Lowe’s. With Canada’s home improvement industry valued at C$45 billion, Lowe’s can’t really afford to sit on the sidelines.

John Heinzl was kind enough to quote me when discussing the preferred share part of the deal:

Rona Inc.’s battered preferred-share investors may not be getting as fat a premium as common shareholders in the $3.2-billion takeover by Lowe’s Cos. Inc., but they should be thrilled with what they’re being offered, money managers say.

As part of the deal, the U.S. home-improvements chain is offering $20 for each Class A rate-reset preferred share of Quebec-based Rona. The offer, which is based on a fairness opinion from Scotia Capital, represents a 59-per-cent premium to the closing price of Rona’s preferred shares before the deal was announced.

…

Some Rona preferred shareholders said it’s possible Lowe’s might make a higher offer for the preferreds. “Perhaps they could be persuaded to offer more money. Perhaps. I’m not banking on it but not discounting it either,” said Benj Gallander, co-editor of Contra the Heard Investment Letter. “These are early days.”Don’t hold your breath, said preferred-share fund manager James Hymas, president of Hymas Investment Management. Rona’s preferred shareholders don’t have the leverage to squeeze more money out of Lowe’s, he said.

“They can always try, but I don’t know how far they’ll get,” said Mr. Hymas, who does not own Rona’s preferred shares.

…

After all the suffering Rona’s preferred investors have endured, they should be happy that Lowe’s is willing to take them out at $20, Mr. Hymas said.“You don’t want to kill the goose that lays the golden egg,” he said. “They’re not going to sweeten that deal. There is no reason to.”

I base this view on the fact that during the conference call the following statements were made:

what’s important to understand that a positive vote from the pref holders is not a condition precedent to the closing of the transaction.

…

If you don’t have a majority acceptance from the prefs, does RONA continue to report its financial results? … Yes. So the entity would need to continue to report as a public listed entity. Yes.

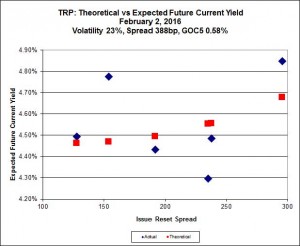

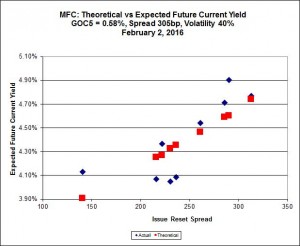

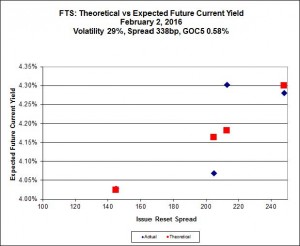

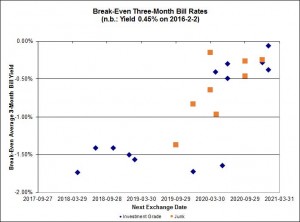

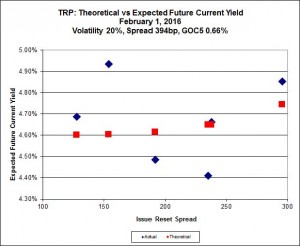

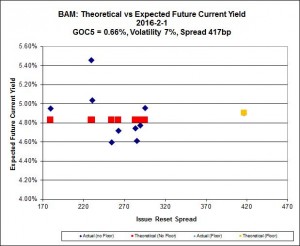

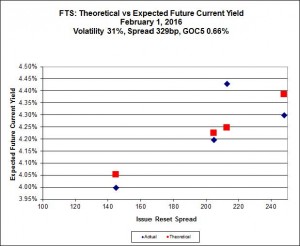

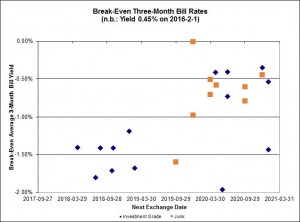

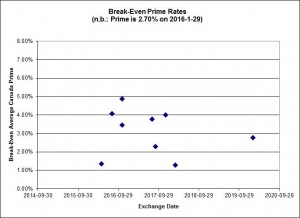

So a negative vote from RONA preferred shareholders will mean just that the shares will continue to be outstanding. Since RON.PR.A is a FixedReset, 5.25%+265, that commenced trading 2011-2-22 after being announced 2011-2-1, it has a relatively low reset. Absurdly low for junk, albeit more reasonable for investment grade. Investment-grade issues with comparable resets are:

- MFC.PR.J, +261, bid at 17.89

- RY.PR.M, +262, bid at 18.45

- TD.PF.D, +279, bid at 19.00

- SLF.PR.I, +273, bid at 17.45

- BAM.PF.B, +263, bid at 16.46

- BMO.PR.Y, +271, bid at 19.35

So it’s a decent premium over fair value even given an upgrade in credit quality. I’ll suggest that Lowe’s takes the view that they’re willing to give that premium to the preferred shareholders if they’re co-operative, or give it to the lawyers, bookkeepers, auditors and accountants if that’s what the preferred shareholders decide they want. Since the takeover deal is not conditional on preferred shareholder approval they’ve got no reason to pay an extortionate premium for the prefs.

And yes, the credit quality will almost certainly go up if the deal is approved. DBRS confirmed Lowe’s at A(low):

DBRS Limited (DBRS) has today confirmed the Issuer Rating and Senior Unsecured Debt rating of Lowe’s Companies, Inc. (Lowe’s or the Company) at A (low) as well as its Short-Term Rating at R-1 (low), all with Stable trends. This action follows the Company’s announcement that it has entered into a definitive agreement under which Lowe’s is expected to acquire all issued and outstanding common shares of RONA inc. (RONA) for CAD 24 per share in cash and all issued and outstanding preferred shares of RONA for CAD 20 per share in cash. The total transaction value including the assumption of RONA’s debt is CAD 3.2 billion ($2.3 billion; the Transaction or Acquisition).

…

Despite the risks associated with the effective integration of RONA, DBRS believes that the relatively modest magnitude of the Transaction and the temporary increase in financial leverage keep Lowe’s credit risk profile in a range acceptable for the current rating category. Should Lowe’s be challenged to maintain credit metrics in a range acceptable for the current A (low) rating because of weaker-than-expected consolidated operating performance or more aggressive-than-expected financial management (i.e., slower deleveraging), the current ratings could be pressured.

…. while putting RONA on Review-Positive:

DBRS Limited (DBRS) has today placed the ratings of RONA inc. (RONA or the Company) Under Review with Positive Implications following the Company’s announcement that it has entered into a definitive agreement under which RONA will be acquired by Lowe’s Companies, Inc. (Lowe’s; please see separate DBRS press release) for a total transaction value of $3.2 billion (the Transaction). The total transaction value comprises Lowe’s offer to acquire RONA’s issued and outstanding common shares for $24 per share in cash as well as its issued and outstanding preferred shares for $20 per share, plus RONA’s outstanding debt.

…

Rona’s Under Review – Positive Implications status reflects Lowe’s current ratings (A (low) and R-1 (low) as rated by DBRS), the intention to purchase RONA’s outstanding preferred shares and the assumption of RONA’s outstanding senior unsecured debt. As of September 27, 2015, RONA had approximately $313 million of senior unsecured debt outstanding, consisting of $116 million of senior unsecured debentures and $197 million drawn on its revolving credit facility (maximum limit of $700 million). DBRS notes that the Company’s senior unsecured debentures will mature in October 2016.

S&P has also taken a positive view regarding RONA’s ratings:

- •Home improvement retailers Lowe’s Cos. Inc. and RONA Inc. announced today that they have entered into a definitive agreement under which Lowe’s is expected to acquire RONA for about C$3.2 billion

- •As a result, we are placing our ratings on RONA Inc., including our ‘BB+ long-term corporate credit rating on the company, on CreditWatch with positive implications.

- •We intend to resolve the CreditWatch placement on the acquisition’s closing, which we expect by the third quarter of 2016. At that time, we would likely equalize our long-term corporate credit rating on RONA with that on Lowe’s.

…

The CreditWatch placement follows Lowe’s Cos. Inc.’s and RONA Inc.’s announcement that they have entered into a definitive agreement under which Lowe’s is expected to acquire RONA for about C$3.2 billion. As part of the transaction, we expect Lowe’s to purchase all of the issued and outstanding preferred shares of RONA for C$20 per share in cash and assume its C$116.6 million of unsecured notes that mature in 2016.“The positive CreditWatch placement reflects our view of the potential uplift for RONA creditors from the possible acquisition of the company by the higher-rated Lowe’s,” said Standard & Poor’s credit analyst Alessio Di Francesco.

So, assuming the common shareholders vote in favour of the deal, holders of RON.PR.A will wind up in one of two positions:

- Owning a perfectly normal investment-grade preferred share trading somewhere around $17-$19, or

- Getting $20 cash.

I’d rather take the cash and deploy it into something else! However, a formal recommendation will have to await receipt of the management information circular.

At today’s closing bid of 19.95, RON.PR.A yields 4.22% to perpetuity.

Update, 2016-3-3: RONA has filed the Management Proxy Circular with respect to the two offers.