It’s a Fed-Watching Frenzy!

“The minutes largely reiterated what the chairman said in June,” Ryan Larson, the Chicago-based head of U.S. equity trading at RBC Global Asset Management (U.S.) Inc., said by e-mail. His firm oversees $290 billion. “Tapering, whether it will be this year or next, is inevitable. The market was initially encouraged that the Fed is waiting on additional data, but possibly taken aback by the fact that about half the participants indicated that asset purchases should end later this year.”

Minutes from the central bank’s June 18-19 meeting, released today in Washington, showed that while several members judged that a reduction in asset purchases “would likely soon be warranted,” many officials want to see more signs employment is picking up before they’ll begin slowing the pace of $85 billion in monthly bond purchases.

The Globe was a bit more colourful:

The minutes show there was an intense debate about how to communicate the Fed’s intentions. A minority of policy makers are worried that the Fed’s policies are too aggressive, risking inflation and asset-price bubbles, and should be reversed as soon as possible. And among the supporters of more QE, there was a feeling that the central bank should nonetheless send the message that economic conditions were improving, heralding an eventual end to the bond-buying program.

It was decided that Mr. Bernanke should attempt to lay out a path for QE at the press conference that followed the meeting. That’s when he told reporters that if the economic outlook held, the Fed likely would slow its bond purchases later in 2014 and end the program in the middle of 2015, when the unemployment rate likely will have fallen to about 7 per cent.

Stock markets plunged immediately, as traders the world over largely disregarded Mr. Bernanke’s insistence that the Fed also could boost asset purchases if the economy failed to unfold as expected.

BIS has published a paper titled Analysis of risk-weighted assets for credit risk in the banking book:

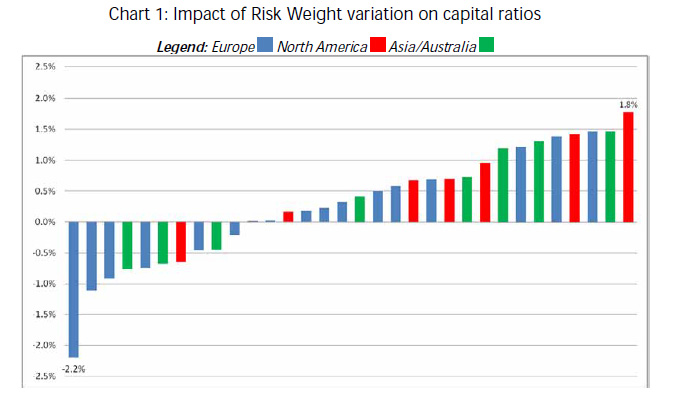

The bottom-up portfolio benchmarking exercise (the hypothetical portfolio exercise, or HPE), under which banks were asked to evaluate the risk of a common set of (largely low-default) wholesale obligors and exposures, revealed notable dispersion in the estimates of PD and LGD assigned to the same exposures. The three wholesale asset classes covered by the HPE analysis (sovereign, bank, and corporate) account on average for about 40% of participating banks’ total credit RWAs. A rough translation of the implied risk weight variations into potential impact on banks’ capital ratios suggests that the impact could be material; at the extremes, capital ratios could vary by as much as 1.5 to 2 percentage points (or 15 to 20% in relative terms) in either direction around the 10% benchmark used for this study. However, most of the banks (22 of the 32 participating banks) lie within one percentage point of that benchmark (see Chart 1 below).

Click for Big

Change from 10% capital ratio if individual bank risk weights from the HPE are adjusted to the median from the sample. Each bar represents one bank. The chart is based on the assumption that variations observed at each bank for the hypothetical portfolios are representative for the entire sovereign, bank, and corporate portfolios of the bank and are adjusted accordingly. No other adjustments are made to RWA or capital.

A reader brings to my attention a debunking of green disinformation:

- The “Gas Town Steam Clock” is not powered by steam

- The iconic wind turbine at Grouse Mountain is an energy sink

- BC Hydro’s emissions reporting is highly misleading

- Vancouver is nowhere as near as green as it likes to thing it is

I left this one out yesterday: DBRS confirmed RY at Pfd-1(low), although its NVCC-compliant RY.PR.W is still under Review-Negative:

RBC’s diversified business model and geographic profile have provided the Bank with consistently strong profitability and return on equity throughout various business and credit cycles. RBC is the largest retail bank in Canada and currently holds first or second-ranking positions in each business it participates in domestically, with an objective to become the leader in every business. The Bank continues to build on its leading market positions within Canada and is expanding its presence globally, particularly in wealth management and capital markets, where the Bank has been increasing its market share among the top global banks.

Despite strong performance in recent years, continued long-term domestic growth within Canada is expected to be a challenge given the Bank’s significant market share positions, the mature Canadian banking industry and the competitive landscape. Domestically, RBC and its large competitors have little room to grow beyond market growth rates, which have been strong in recent years. Additionally, foreign banks that previously exited the domestic market during the crisis have re-emerged as competitors.

DBRS does not expect potential house price depreciation in Canada to result in material losses from the Bank’s real estate secured lending portfolio, notwithstanding the high indebtedness of the average Canadian consumer and significant increases in housing prices in certain sectors of the Canadian real estate market.

The rating on the Non-Cumulative First Preferred Shares, Series W remains Under Review with Negative Implications. DBRS hopes to resolve this rating in the near future after the publication of the results from DBRS’s recent Request for Comments on Rating Subordinated, Hybrids and Preferred Bank Capital Securities

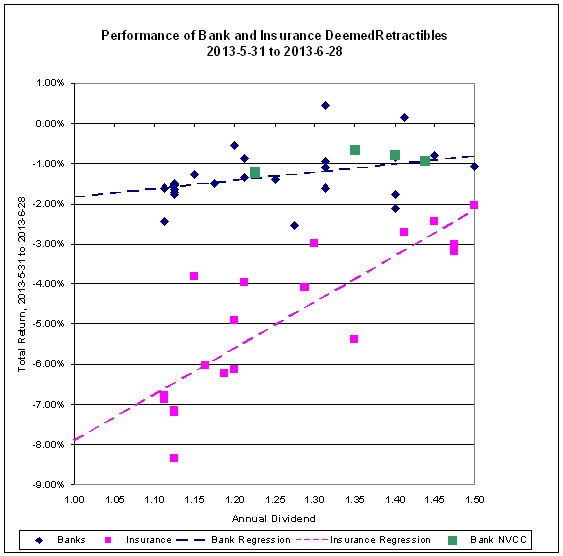

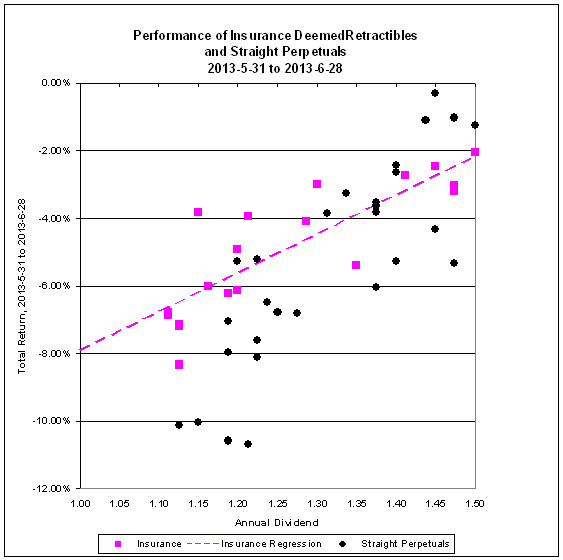

It was another day of retreat for the Canadian preferred share market, with PerpetualDiscounts losing 24bp, FixedResets off 8bp and DeemedRetractibles down 13bp. The Performance Highlights table was at average length – it hasn’t been average for a while!

PerpetualDiscounts now yield 5.41%, equivalent to 7.03% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.65%, so the pre-tax interest-equivalent spread (in this context, the Seniority Spread) is now about 240bp, unchanged from the figure reported July 3.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.5062 % | 2,561.9 |

| FixedFloater | 4.23 % | 3.57 % | 41,662 | 18.12 | 1 | -0.1779 % | 3,880.9 |

| Floater | 2.74 % | 2.94 % | 84,173 | 19.90 | 4 | -0.5062 % | 2,766.2 |

| OpRet | 4.81 % | 2.08 % | 77,228 | 0.71 | 4 | 0.0097 % | 2,616.2 |

| SplitShare | 4.67 % | 4.28 % | 70,619 | 3.95 | 6 | -0.1368 % | 2,969.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0097 % | 2,392.2 |

| Perpetual-Premium | 5.63 % | 4.60 % | 102,398 | 0.79 | 12 | -0.0928 % | 2,277.7 |

| Perpetual-Discount | 5.39 % | 5.41 % | 142,637 | 14.77 | 26 | -0.2398 % | 2,389.0 |

| FixedReset | 4.96 % | 3.50 % | 237,865 | 3.38 | 83 | -0.0814 % | 2,481.2 |

| Deemed-Retractible | 5.06 % | 4.53 % | 178,192 | 7.03 | 43 | -0.1258 % | 2,385.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| FTS.PR.F | Perpetual-Discount | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 23.05 Evaluated at bid price : 23.46 Bid-YTW : 5.27 % |

| ELF.PR.H | Perpetual-Premium | -1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 24.05 Evaluated at bid price : 24.44 Bid-YTW : 5.64 % |

| BAM.PR.B | Floater | -1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 17.94 Evaluated at bid price : 17.94 Bid-YTW : 2.94 % |

| SLF.PR.G | FixedReset | -1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.46 Bid-YTW : 3.70 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

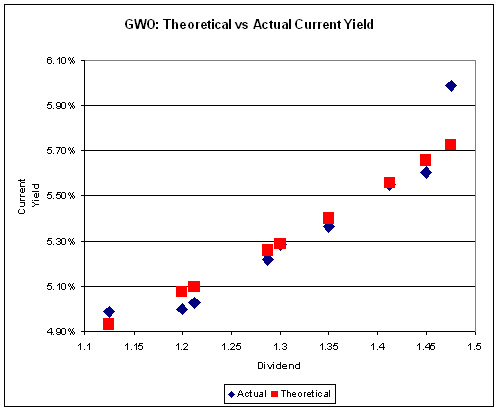

| GWO.PR.H | Deemed-Retractible | 305,615 | TD crossed blocks of 250,000 and 48,600, both at 23.80. Nice tickets! YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.72 Bid-YTW : 5.50 % |

| BNS.PR.Q | FixedReset | 160,395 | RBC crossed blocks of 50,000 and 100,000, both at 25.00. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.95 Bid-YTW : 3.58 % |

| BAM.PR.N | Perpetual-Discount | 143,422 | Desjardins crossed blocks of 50,000 and 83,300, both at 21.30. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 21.24 Evaluated at bid price : 21.24 Bid-YTW : 5.64 % |

| RY.PR.X | FixedReset | 139,715 | RBC crossed 40,000 and 59,600, both at 26.23. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 26.24 Bid-YTW : 2.49 % |

| TD.PR.S | FixedReset | 137,785 | Reset rate announced. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.76 Bid-YTW : 3.59 % |

| ENB.PR.F | FixedReset | 56,221 | National crossed 24,700 at 24.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 23.12 Evaluated at bid price : 24.86 Bid-YTW : 4.21 % |

| There were 64 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| GWO.PR.F | Deemed-Retractible | Quote: 25.30 – 25.59 Spot Rate : 0.2900 Average : 0.1902 YTW SCENARIO |

| TCA.PR.X | Perpetual-Discount | Quote: 49.70 – 50.00 Spot Rate : 0.3000 Average : 0.2132 YTW SCENARIO |

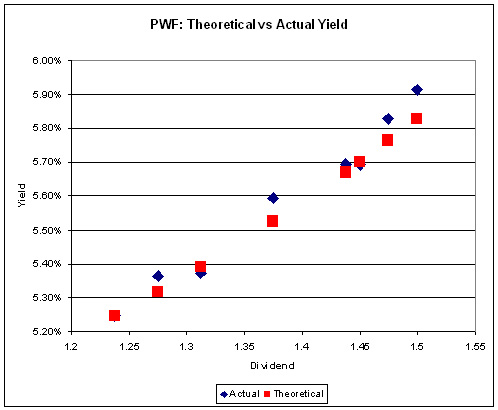

| PWF.PR.O | Perpetual-Premium | Quote: 25.45 – 25.78 Spot Rate : 0.3300 Average : 0.2453 YTW SCENARIO |

| BNA.PR.E | SplitShare | Quote: 25.70 – 26.00 Spot Rate : 0.3000 Average : 0.2182 YTW SCENARIO |

| SLF.PR.A | Deemed-Retractible | Quote: 23.13 – 23.39 Spot Rate : 0.2600 Average : 0.1798 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 24.16 – 24.55 Spot Rate : 0.3900 Average : 0.3101 YTW SCENARIO |