The campaign to ensure that retail’s choice of investment be restricted (or, at least, attract a blizzard of paper) has gained some ground, with American brokerages restricting sales:

Morgan Stanley and Wells Fargo & Co. are reviewing whether to continue sales of leveraged and inverse exchange-traded funds as regulators caution that the securities might not be suitable for individual investors.

…

UBS AG’s brokerage unit in New York, St. Louis-based Edward Jones and Ameriprise Financial Inc. of Minneapolis have halted sales of leveraged ETFs.

…

David Weiskopf, a Schwab spokesman, said the San Francisco- based company’s representatives don’t recommend leveraged ETFs.

…

Individual investors at Bank of America Corp. have been permitted to buy leveraged and inverse ETFs from its brokerage unit since 2006 only when they specifically request them, said Selena Morris, a spokeswoman for the Charlotte, North Carolina- based company.

Felix Salmon writes a review of High Frequency Trading that I found rather shallow; but some people like it. However, it looks like Flash orders will be prohibited:

NYSE Euronext, the world’s largest owner of stock exchanges, told the SEC in May that flash orders result in most investors getting worse prices. The practice is used by some high-frequency traders, who stream hundreds of bids and offers a minute and help pair off investor orders.

Analysts including Raymond James Financial Inc.’s Patrick O’Shaughnessy said earlier this week that regulators’ response to flash orders might result in restrictions on computer-driven trading, which could hurt profit for exchanges.

John Nester, a spokesman for the SEC, didn’t immediately return a telephone call seeking comment.

Bats CEO Joe Ratterman said today in an e-mail to clients that the Kansas City, Missouri-based exchange would support an industrywide ban on flash orders. Nasdaq CEO Robert Greifeld told Schumer July 28 that Nasdaq would also support a prohibition, according to a statement issued by the New York senator’s office.

Both introduced the systems over the past three months to compete against Direct Edge, which has gained market share through its three-year-old Enhanced Liquidity Provider program.

“If regulators get rid of it, or do anything to significantly circumscribe the program, it will hurt Direct Edge and help Nasdaq and NYSE,” Justin Schack, vice president of market structure analysis at New York-based Rosenblatt Securities Inc., said in an interview. “It takes away a big competitive weapon that Direct Edge used to gain market share.”

Schumer’s statement:

U.S. Senator Charles E. Schumer (D-NY) announced Tuesday that the head of the NASDAQ stock exchange supports his call to ban the practice of so-called “flash trading” that gives advance knowledge of stock orders to certain traders. Schumer said he was assured by Robert Greifeld, the CEO of NASDAQ, that the exchange, which has long prided itself on bringing transparency to public markets, began reluctantly offering the practice only after competing marketplaces did so.

I profoundly doubt whether anybody knows one way or the other whether pricing and liquidity are positively or negatively affected by Flash Orders; I don’t even know whether it would be possible to generalize about such a thing. But hell, facts don’t matter, right?

But it should be obvious that this is all about money anyway – who cares about trivialities like market efficiency?:

Both introduced the systems over the past three months to compete against Direct Edge, the trading platform that has gained market share through its three-year-old Enhanced Liquidity Provider program. Direct Edge, which is not regulated by the SEC, more than doubled its market share since November to 11.9 percent of the total volume traded in the U.S. in June by using revenue from its ELP program to cut other costs.

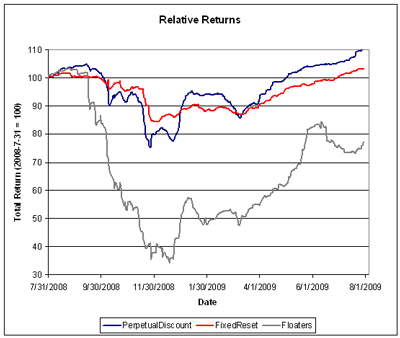

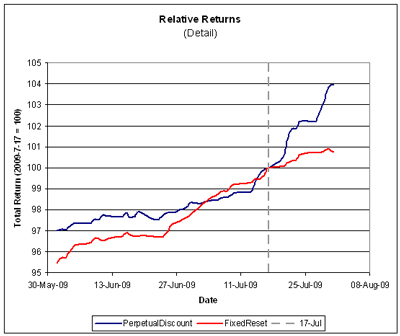

Preferred shares had another very good day, with PerpetualDiscounts rocketting up 72bp, with FixedResets putting in a decent performance of +10bp. Volume continued to be high (a nice day for RBC), with FixedResets again locked out of the volume highlights table … is the bloom off the rose?

It will be most fascinating to see what happens once we hit September and new issue season. I’m really not sure if issuers will be able to get anywhere near market rates for FixedResets … a rate of, say 4.25%+150 might find takers to be less enthusiastic than normal. On the other hand, recent market improvements suggest that they should be able to issue straight perpetuals at around 6%. Even paying 5%+225 would be a good improvement on that, but that would indicate a huge concession to market … we shall see!

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.7004 % |

1,205.4 |

| FixedFloater |

7.13 % |

5.32 % |

38,119 |

16.88 |

1 |

1.6667 % |

2,153.6 |

| Floater |

3.16 % |

3.75 % |

73,226 |

17.94 |

3 |

0.7004 % |

1,505.9 |

| OpRet |

4.91 % |

-3.63 % |

141,138 |

0.10 |

15 |

0.2972 % |

2,249.1 |

| SplitShare |

5.87 % |

6.65 % |

98,747 |

4.13 |

3 |

0.2752 % |

1,974.5 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2972 % |

2,056.6 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.7277 % |

1,846.6 |

| Perpetual-Discount |

6.01 % |

6.06 % |

162,458 |

13.82 |

71 |

0.7277 % |

1,700.7 |

| FixedReset |

5.50 % |

4.08 % |

558,129 |

4.16 |

40 |

0.0952 % |

2,097.2 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| SLF.PR.B |

Perpetual-Discount |

1.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 19.36

Evaluated at bid price : 19.36

Bid-YTW : 6.28 % |

| BAM.PR.M |

Perpetual-Discount |

1.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 16.35

Evaluated at bid price : 16.35

Bid-YTW : 7.38 % |

| GWO.PR.X |

OpRet |

1.06 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2009-10-30

Maturity Price : 26.00

Evaluated at bid price : 26.74

Bid-YTW : -5.06 % |

| TD.PR.R |

Perpetual-Discount |

1.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 24.05

Evaluated at bid price : 24.25

Bid-YTW : 5.80 % |

| TD.PR.S |

FixedReset |

1.17 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-08-30

Maturity Price : 25.00

Evaluated at bid price : 25.90

Bid-YTW : 4.01 % |

| CM.PR.D |

Perpetual-Discount |

1.18 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 23.70

Evaluated at bid price : 24.00

Bid-YTW : 6.02 % |

| CM.PR.P |

Perpetual-Discount |

1.19 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 22.35

Evaluated at bid price : 22.91

Bid-YTW : 6.01 % |

| W.PR.J |

Perpetual-Discount |

1.21 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 22.31

Evaluated at bid price : 22.58

Bid-YTW : 6.25 % |

| CM.PR.J |

Perpetual-Discount |

1.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 18.88

Evaluated at bid price : 18.88

Bid-YTW : 6.00 % |

| MFC.PR.C |

Perpetual-Discount |

1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 18.81

Evaluated at bid price : 18.81

Bid-YTW : 6.07 % |

| PWF.PR.F |

Perpetual-Discount |

1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 21.26

Evaluated at bid price : 21.26

Bid-YTW : 6.22 % |

| IAG.PR.C |

FixedReset |

1.25 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 27.45

Bid-YTW : 3.96 % |

| HSB.PR.D |

Perpetual-Discount |

1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 20.30

Evaluated at bid price : 20.30

Bid-YTW : 6.24 % |

| SLF.PR.A |

Perpetual-Discount |

1.43 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 19.21

Evaluated at bid price : 19.21

Bid-YTW : 6.27 % |

| BAM.PR.J |

OpRet |

1.43 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2018-03-30

Maturity Price : 25.00

Evaluated at bid price : 23.41

Bid-YTW : 6.48 % |

| CM.PR.H |

Perpetual-Discount |

1.48 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 19.94

Evaluated at bid price : 19.94

Bid-YTW : 6.06 % |

| CIU.PR.A |

Perpetual-Discount |

1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 20.36

Evaluated at bid price : 20.36

Bid-YTW : 5.75 % |

| GWO.PR.G |

Perpetual-Discount |

1.61 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 21.50

Evaluated at bid price : 21.50

Bid-YTW : 6.13 % |

| BAM.PR.G |

FixedFloater |

1.67 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 25.00

Evaluated at bid price : 15.25

Bid-YTW : 5.32 % |

| CM.PR.I |

Perpetual-Discount |

1.71 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 19.62

Evaluated at bid price : 19.62

Bid-YTW : 6.03 % |

| PWF.PR.K |

Perpetual-Discount |

1.89 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 20.48

Evaluated at bid price : 20.48

Bid-YTW : 6.09 % |

| GWO.PR.I |

Perpetual-Discount |

1.92 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 18.56

Evaluated at bid price : 18.56

Bid-YTW : 6.14 % |

| BAM.PR.B |

Floater |

1.93 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 10.56

Evaluated at bid price : 10.56

Bid-YTW : 3.76 % |

| POW.PR.B |

Perpetual-Discount |

2.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 21.70

Evaluated at bid price : 21.70

Bid-YTW : 6.23 % |

| POW.PR.A |

Perpetual-Discount |

2.32 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 22.27

Evaluated at bid price : 22.54

Bid-YTW : 6.26 % |

| W.PR.H |

Perpetual-Discount |

3.28 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 21.76

Evaluated at bid price : 22.06

Bid-YTW : 6.28 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| CM.PR.H |

Perpetual-Discount |

144,352 |

RBC crossed two blocks of 30,000 each at 19.97. Nesbitt bought blocks of 12,500 and 10,000 from anonymous at 20.00.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 19.94

Evaluated at bid price : 19.94

Bid-YTW : 6.06 % |

| POW.PR.C |

Perpetual-Discount |

103,691 |

RBC crossed 67,700 at 23.00.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 22.69

Evaluated at bid price : 22.93

Bid-YTW : 6.38 % |

| SLF.PR.A |

Perpetual-Discount |

74,461 |

Desjardins bought 25,000 from Nesbitt at 19.15. RBC crossed 25,000 at 19.16.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 19.21

Evaluated at bid price : 19.21

Bid-YTW : 6.27 % |

| BNS.PR.N |

Perpetual-Discount |

61,990 |

Nesbitt crossed 20,700 at 22.35.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 22.25

Evaluated at bid price : 22.36

Bid-YTW : 5.91 % |

| BAM.PR.B |

Floater |

61,400 |

RBC crossed 35,000 at 10.55.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 10.56

Evaluated at bid price : 10.56

Bid-YTW : 3.76 % |

| BMO.PR.L |

Perpetual-Discount |

58,260 |

RBC crossed 30,000 at 25.00.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-07-30

Maturity Price : 24.79

Evaluated at bid price : 25.01

Bid-YTW : 5.90 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. |