Looks like efforts to determine whodunnit have broken down amidst political jockeying:

Democrats and Republicans on the Financial Crisis Inquiry Commission, struggling for months to find consensus behind the scenes, haven’t even been able to agree on whether to include the phrases “Wall Street” and “shadow banking” in the final report. The report is now scheduled to be published in January and is likely to include dissents, FCIC members said yesterday.

The four Republicans on the 10-member panel made their views public in a nine-page document yesterday, saying they place much of the blame for the 2008 crisis on the government and mortgage firms Fannie Mae and Freddie Mac rather than banks.

The dissent itself commences with something sensible:

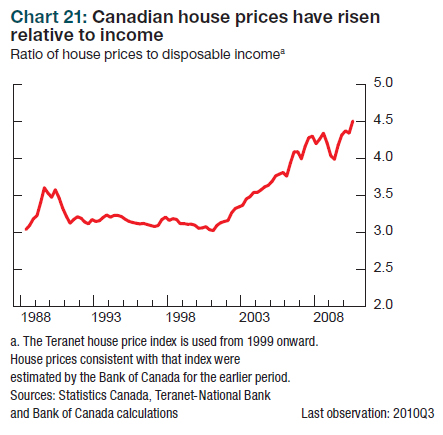

Bubbles happen. In retrospect, they always seem easy to identify, but as they are building, experts debate whether they exist—and, if so, why. The recent housing bubble was no different. Despite national home price appreciation well above the historical trend for almost a decade, and local markets with even more pronounced price swings, most homeowners and mortgage investors believed there were sound fundamentals underpinning their investments.

… and to a large extent blame the elephant:

There were three important ways that the government pushed investors toward investing in mortgage debt. First, the regulatory capital requirements associated with mortgage debt were lower than for other investments. Second, the government encouraged the private market to extend credit to previously underserved borrowers through a combination of legislation, regulation, and moral suasion. Third, and most important, during the bubble’s expansion, the largest investors in the mortgage market, the government-sponsored enterprises (GSEs)—Fannie Mae and Freddie Mac—were instruments of U.S. government housing policy.

All this is true. I’m disappointed to see that there is no criticism of structural problems in the US mortgage market: 30-year terms with the homeowner able to redeem at par at any time; no recourse to the borrower in the event of default; tax-deductibility of mortgage payments.

The Republicans address tranche retention:

Super-senior risk: The safest, “super-senior” tranches of mortgage-backed structured products were less attractive to investors because they did not provide a sufficient spread above other, safer securities, like U.S. Treasuries.

This looks like it’s glossing over some stuff, to put it mildly. Why is a brokerage creating products too expensive to sell? I don’t think we can paint the brokers as victims on this one.

As I have urged before, I believe there should be not one, but two regulatory regimes: one for banks, expected to buy-and-hold and surcharging trading activities; one for brokerages, expected to trade, surcharging aged inventory.

The Boston Fed has released a policy brief by Jihye Jeon, Judit Montoriol-Garriga, Robert K. Triest, and J. Christina Wang titled Evidence of a Credit Crunch? Results from the 2010 Survey of First District Community Banks:

This policy brief summarizes the findings of the Survey of Community Banks conducted by the Federal Reserve Bank of Boston in May 2010. This survey seeks to understand how the supply of, and demand for, bank business loans changed in the period following the financial crisis. The survey design focuses on assessing how much community banks were willing and able to lend to local businesses that used to be customers of large banks but lost access to credit in the aftermath of the financial crisis. The survey responses provide some evidence that lending standards for commercial loans have tightened moderately at community banks since late 2008, with the tightening being more severe for new customers than for those that already had a relationship with the respondent bank. The survey also reveals that expansions of several SBA guarantee programs since the crisis have ameliorated possible credit constraints on small businesses.

BIS has released the BIS Quarterly Review, December 2010 with features:

- The $4 trillion question: what explains FX growth since the 2007 survey?

- Derivatives in emerging markets

- Counterparty risk and contract volumes in the credit default swap market

- A user’s guide to the Triennial Central Bank Survey of foreign exchange

market activity

Additionally, Basel III rules text and results of the quantitative impact study issued by the Basel Committee.

The Basel Committee issued today the Basel III rules text, which presents the details of global regulatory standards on bank capital adequacy and liquidity agreed by the Governors and Heads of Supervision, and endorsed by the G20 Leaders at their November Seoul summit. The Committee also published the results of its comprehensive quantitative impact study (QIS).

…

The rules text presents the details of the Basel III Framework, which covers both microprudential and macroprudential elements. The Framework sets out higher and better-quality capital, better risk coverage, the introduction of a leverage ratio as a backstop to the risk-based requirement, measures to promote the build up of capital that can be drawn down in periods of stress, and the introduction of two global liquidity standards.

…

With respect to the leverage ratio, the Committee will use the transition period to assess whether its proposed design and calibration is appropriate over a full credit cycle and for different types of business models. Based on the results of a parallel run period, any adjustments would be carried out in the first half of 2017 with a view to migrating to a Pillar 1 treatment on 1 January 2018 based on appropriate review and calibration.

As stated in the rules text, the BCBS is finalizing additional entry criteria related to non-viability contingent capital (NVCC) for instruments other than common equity. Once finalized, the additional criteria are to be added to the Basel III rules text. We currently expect this to occur early in 2011.

The Basel III rules affect the eligibility of instruments for inclusion in regulatory capital and provide for a transition and phase-out for instruments that do not meet the Basel III requirements. OSFI intends to adopt the Basel III changes in its domestic capital guidance for deposit-taking institutions (DTIs). As the Basel III rules text currently provides that the cap on non-qualifying capital will be applied to Tier 1 and Tier 2 instruments separately and refers to the total amount of non-qualifying capital, the finalization of rules related to NVCC may affect the operation of the cap on Tier 1 and Tier 2 non-qualifying instruments. Once the Basel III rules text governing NVCC requirements has been finalized by the BCBS, OSFI intends to issue guidance clarifying the phase-out of all non-qualifying instruments by DTIs, including OSFI’s expectations with respect to rights of redemption under regulatory event5 clauses.

…

This letter does not apply to regulated life insurance companies or insurance holding companies. While such insurers should be aware of developments related to DTIs on matters where OSFI has traditionally aligned its regulatory requirements (such as eligible capital instruments), OSFI intends to engage in consultation during 2011 before determining which Basel III rule changes will be applied to the life insurance industry and to thereafter issue guidance to insurers to reflect such changes.

The Feds are proposing Pooled Registered Pension Plans, which have been praised by insurance salemen in all walks of life. Blake’s explains:

The main items discussed in the Backgrounder are as follows:

1. Eligible Administrators of the PRPPs will be regulated financial institutions, including trust and insurance companies and other financial institutions with a trust subsidiary.

2. The Administrator will have a fiduciary duty to plan members.3. The PRPPs will have a suitable low-cost default investment option for a broad group, and a manageable number of investment options for members to choose from.

4. Administrators will be required to provide all members with prescribed information on a regular, periodic basis.

5. There will be certain tasks that an employer that offers a PRPP must fulfill.

6. Employers may be permitted to enrol their employees into a PRPP at any stage of their employment and there may be rights of an employee to “opt out” shortly after enrolment.

7. The framework also provides that employers will have the ability to increase the employee’s default contribution rate from time to time, potentially subject to a new “opt out” right.

8. Employer contributions will be locked-in with some jurisdictions permitting what appears to be limited unlocking rights.

9. Jurisdictions will make a determination as to whether to require mandatory employer participation.

10. Employers contributing directly to a PRPP and their employees will be permitted to make contributions under the RPP limits, with the pension adjustment reporting. Self-employed persons and other employees will contribute on the basis of their available RRSP limit.”

The Canadian preferred share market had another poor day on high volume, with PerpetualDiscounts bearing the brunt of the losses. PerpetualDiscounts were down 32bp, while FixedResets lost 4bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0499 % | 2,279.6 |

| FixedFloater | 4.78 % | 3.47 % | 28,230 | 19.06 | 1 | -1.0435 % | 3,520.4 |

| Floater | 2.62 % | 2.40 % | 49,500 | 21.23 | 4 | -0.0499 % | 2,461.4 |

| OpRet | 4.82 % | 3.18 % | 71,299 | 2.39 | 8 | -0.3464 % | 2,378.7 |

| SplitShare | 5.35 % | 1.13 % | 1,073,580 | 0.98 | 4 | 0.1111 % | 2,443.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3464 % | 2,175.1 |

| Perpetual-Premium | 5.74 % | 5.61 % | 154,456 | 6.42 | 27 | -0.1031 % | 1,996.4 |

| Perpetual-Discount | 5.49 % | 5.49 % | 273,631 | 14.62 | 51 | -0.3224 % | 1,986.2 |

| FixedReset | 5.27 % | 3.70 % | 360,286 | 3.10 | 52 | -0.0370 % | 2,244.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ELF.PR.F | Perpetual-Discount | -2.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 21.88 Evaluated at bid price : 22.16 Bid-YTW : 6.08 % |

| BAM.PR.I | OpRet | -1.83 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2011-01-15 Maturity Price : 25.50 Evaluated at bid price : 25.77 Bid-YTW : -9.88 % |

| ELF.PR.G | Perpetual-Discount | -1.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 19.95 Evaluated at bid price : 19.95 Bid-YTW : 6.07 % |

| GWO.PR.G | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 22.81 Evaluated at bid price : 23.04 Bid-YTW : 5.65 % |

| POW.PR.B | Perpetual-Discount | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 23.42 Evaluated at bid price : 23.71 Bid-YTW : 5.73 % |

| RY.PR.B | Perpetual-Discount | -1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 22.20 Evaluated at bid price : 22.34 Bid-YTW : 5.31 % |

| BAM.PR.G | FixedFloater | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 25.00 Evaluated at bid price : 22.76 Bid-YTW : 3.47 % |

| IAG.PR.F | Perpetual-Premium | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 24.54 Evaluated at bid price : 24.76 Bid-YTW : 5.97 % |

| MFC.PR.C | Perpetual-Discount | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 19.64 Evaluated at bid price : 19.64 Bid-YTW : 5.77 % |

| BNA.PR.E | SplitShare | 1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.50 Bid-YTW : 5.22 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.C | FixedReset | 86,855 | RBC crossed 70,000 at 26.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 26.62 Bid-YTW : 3.66 % |

| RY.PR.B | Perpetual-Discount | 46,986 | RBC crosed 25,000 at 22.34. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 22.20 Evaluated at bid price : 22.34 Bid-YTW : 5.31 % |

| MFC.PR.B | Perpetual-Discount | 40,778 | Desardins crossed 30,000 at 20.50. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 20.45 Evaluated at bid price : 20.45 Bid-YTW : 5.72 % |

| SLF.PR.C | Perpetual-Discount | 40,290 | RBC crossed 25,000 at 19.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 5.76 % |

| CM.PR.H | Perpetual-Discount | 31,320 | RBC crossed 25,000 at 22.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 21.75 Evaluated at bid price : 22.04 Bid-YTW : 5.51 % |

| POW.PR.B | Perpetual-Discount | 30,900 | RBC crossed 25,000 at 23.80. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-16 Maturity Price : 23.42 Evaluated at bid price : 23.71 Bid-YTW : 5.73 % |

| There were 51 other index-included issues trading in excess of 10,000 shares. | |||