The Globe featured the opinions of John Parkins in a squib on Friday:

Here are two words you don’t often see placed next to each other: “corrosive trust.”

That’s a term used by an Alberta professor to describe the clubby atmosphere that tends to emerge when people supposed to represent the public interest are put into a room with industry.

John Parkins of the University of Alberta doesn’t employ the term as a form of flattery. That kind of atmosphere, his research found, is “damaging to democracy” – and that’s an important finding, given that such citizen advisory groups are increasingly being used by industry as sounding boards for public opinion.

But Mr. Parkins found the watchdogs eventually develop a trust in the companies they are supposed to scrutinize, which can mute skepticism. His findings also apply to corporate directors, who are supposed to look after shareholders’ interests.

In other words, it’s another name for regulatory capture.

December 1 is CIBC’s Miracle Day, in which money managers are encouraged to forget all that stupid “best execution” crap and direct their business to a charity case. Anybody doing business with CIBC on December 1 should be subjected to a hostile audit by their clients, but you know something? They won’t be.

Looks like Ireland got its bail-out:

Ireland will receive 67.5 billion euros from the European Union and International Monetary Fund and provide 17.5 billion euros from its own pension reserves, Martti Salmi, a spokesman for the Finnish Finance Ministry, said today after EU finance ministers endorsed the plan in Brussels.

…

The need for a pact is intensifying as Irish banks’ capital dwindles. Allied Irish Banks Plc and Bank of Ireland Plc bonds fell Nov. 26 on concern the government will abandon a pledge to protect senior bondholders and force them to share the bailout costs. Ireland’s Sunday Business Post and the Sunday Tribune newspapers today reported that the ECB vetoed hurting senior bond holders.

The EU Statement reads:

The financial package of the programme will cover financing needs up to 85 billion euros, including 10 billion euros for immediate recapitalisation measures, 25 billion euros on a contingency basis for banking system supports and 50 billion euros covering budget financing needs. Half of the banking support measures (17.5 billion euros) will be financed by an Irish contribution through the Treasury cash buffer and investments of the National Pension Reserve Fund

If I were to make investment decisions on behalf of a client with anything else in mind other than the client’s best interests, I would be in serious trouble. Politicians are not subject to the same rules. However, it tends to emphasize the general principle that sovereign wealth funds (whether they are explicitly named as such, or are pension funds) should be invested outside the home country. That’s where the Caisse’s mandate gets it wrong.

Bank senior debt escaped an immediate write-down:

Irish banks’ senior bonds rose after the nation’s 85 billion-euro ($113 billion) bailout spared holders of the debt from having to share in lenders’ losses.

Bank of Ireland Plc’s 1.47 billion euros of senior floating-rate notes due September 2011 rose 6.9 cents on the euro to 90.25 cents as of 1:10 p.m. in London, an 8 percent increase, according to composite prices compiled by Bloomberg. The securities fell 7 percent on Nov. 26 on concern senior noteholders were being lined up to take some of the burden of the imminent Irish rescue.

EU ministers also took time to grease the skids for sovereign default:

European finance leaders endorsed a Franco-German compromise on post-2013 sovereign bailouts that waters down calls by German Chancellor Angela Merkel for investors to assume losses and share the costs with taxpayers.

The plan asks investors to take writeoffs on a “case-by- case” basis, according to a statement issued today by euro- area finance ministers after a meeting in Brussels to ratify a bailout for Ireland. The proposal is designed to address “collective action clauses” for debt issued after temporary crisis facilities expire in 2013. Such clauses allow bondholders to change terms of their contracts.

…

Merkel said Nov. 18 she was “absolutely convinced” creditors had to share bailout costs.

…

“The proposed clauses for investors are nothing that markets do not know in other currency areas,” said [German government spokesman Steffen] Seibert. “The plan holds no surprises for markets.”

Although the markets may not be surprised, I presume the European banking regulators will be astonished: their stwess tests completely discounted the possibility of sovereign default and looked only at mark-to-market losses in the trading book.

At any rate, it’s been a fizzle so far:

European governments’ 85 billion- euro ($113 billion) bailout package for Ireland failed to quell the market turmoil menacing the euro as stocks, bonds and the currency declined.

Irish 10-year bonds slid after an early advance, European stocks and the euro declined, and the cost of insuring the debt of Spain and Portugal against default soared to record highs.

Merkel’s big ambition is to ensure that politics trumps markets – a foolish notion. The only sensible thing ever said by any politician about financial markets was by then Prime Minister Chretien when the Canadian bond market was teetering back in 1994. I don’t have the reference, or the exact quote (tell me! Somebody please tell me!) but it was something like: “We’re not doing this [budget cuts] because we want to please the bond markets. We’re doing this so we won’t have to care about the bond markets”.

With respect to the Iberian penninsula:

The cost of insuring against default on Portuguese and Spanish government debt soared to record-high levels as an aid package for Ireland failed to reassure investors the region’s debt crisis will be contained.

Credit-default swaps on Portugal jumped 37 basis points to 539, and contracts on Spain climbed 28.75 to 351.5, according to CMA. The Markit iTraxx SovX Western Europe Index of swaps on 15 governments increased 9 basis points to 197, a record based on closing prices.

European stocks fell, extending losses into a fourth week, and bonds dropped as Ireland’s 85 billion-euro ($113 billion) bailout brought focus on the prospect of more aid to indebted nations. The region’s economy may weaken next year as budget cuts to stem the crisis hurt consumer demand and faltering global expansion curbs exports, the European Commission said.

Nouriel Roubini cheerfully opines:

“There is not enough official money to bail out Spain if trouble occurs.”

The CDS business is changing:

Trading in credit-default swaps, Wall Street’s fastest-growing business before the credit crisis, has tumbled 40 to 60 percent from three years ago as banks prepare for new regulation of derivatives.

…

Barclays Plc analyst Roger Freeman in New York estimates that before and during the credit crisis, Goldman Sachs generated two-thirds of its credit-trading revenue from derivatives. The contracts now likely contribute about a third, with the rest coming from bonds, he said. Michael DuVally, a spokesman at Goldman Sachs in New York, declined to comment.

…

To reduce opacity that Commodity Futures Trading Commission Chairman Gary Gensler says gives banks an information advantage, trades will have to be done on systems that make dealers compete over pricing and may automate some transactions now done by phone. The deals also will be reported publicly.

The changes may drive down pre-tax profit margins for credit swaps to 22 to 23 percent from about 35 percent, said Sanford C. Bernstein & Co. analyst Brad Hintz, ranked by Institutional Investor as the top analyst covering brokerage firms.

…

Goldman Sachs Chief Executive Officer Lloyd Blankfein described such a scenario at a Nov. 16 conference sponsored by Bank of America. After changes in equities markets drove commission rates down and volume up for the bank, the firm invested in new computerized stock-trading platforms and was able to slash half the department’s 5,000 trading jobs, he said.

Regulation of the over-the-counter “derivatives market will drive greater transparency and automation,” Blankfein said at the conference. “While transparency can reduce margins, it also introduces new opportunities in the form of greater client participation and product innovation.”

Good thing? Bad thing? Who knows? Who cares? What’s important is that there are now MORE RULES and therefore no financial crisis will ever happen again.

The BOC has released a working paper by Scott Hendry and Alison Madeley titled Text Mining and the Information Content

of Bank of Canada Communications:

This paper uses Latent Semantic Analysis to extract information from Bank of Canada communication statements and investigates what type of information affects returns and volatility in short-term as well as long-term interest rate markets over the 2002-2008 period. Discussions about geopolitical risk and other external shocks, major domestic shocks (SARS and BSE), the balance of risks to the economic projection, and various forward looking statements are found to significantly affect market returns and volatility, especially for short-term markets. This effect is over and above that from the information contained in any policy interest rate surprise.

HP, among others, is extending term on its borrowings:

Companies are cutting back on commercial paper, short-term borrowings that typically mature in 270 days or less, with the amount outstanding falling for a fourth straight week to $1.065 trillion in the period ended Nov. 24, Federal Reserve data show. HP’s commercial paper outstanding surged to $5.17 billion on July 31 from $294 million in October 2009, according to a regulatory filing.

HP may issue $650 million of five-year notes that yield 73 basis points more than similar-maturity Treasuries, and $1.35 billion of 10-year bonds that pay a spread of 95 basis points, according to a person familiar with the transaction, who declined to be identified because terms aren’t set. Bank of America Corp., BNP Paribas SA, UBS AG and Wells Fargo & Co. are managing the sale, the person said.

DBRS commented on SEC Rule 17g-5 and its exemption today:

The Amended Rule relates to credit rating agencies (CRAs) that are registered with the SEC as NRSROs and hired by issuers, sponsors or arrangers (collectively, the Arrangers) to assign credit ratings to SF instruments. The Amended Rule prohibits an NRSRO from issuing or maintaining ratings on certain SF instruments unless the following requirements are met:

- Hired NRSROs disclose on a password-protected website to any non-hired NRSRO certain information about the SF instrument(s) they are engaged to rate.

- Arrangers make available on a password-protected website all information they provide a hired NRSRO to any non-hired NRSRO that wishes to access that information.

This is total craziness. They’re recognizing that you need (or would very much appreciate) material non-public information to do a proper credit analysis, but continue to allow selective disclosure to the rating agencies at the expense of actual investors. I’ve urged the repeal of Regulation FD, but the new rules simply entrench it further.

When will the first arrest of a CRA employee for tipping be made? The more people that have access to this information, the more likely it will squirm its way out into the marketplace. Credit analysis is not, perhaps, quite as sexy or immediate as take-over news and earnings projections, but I’m sure a hedge fund or two would greatly appreciate, say, a list of structured finance vehicles with underlying assets having certain characteristics.

We’re doing a fine job in Afghanistan:

When Afghanistan’s vice president visited the United Arab Emirates last year, local authorities working with the Drug Enforcement Administration discovered that he was carrying $52 million in cash. With wry understatement, a cable from the American Embassy in Kabul called the money “a significant amount” that the official, Ahmed Zia Massoud, “was ultimately allowed to keep without revealing the money’s origin or destination.”

This is an important secret, so Clinton’s trying to whip up a Global War on WikiLeaks.

Closer to home, Chief Blair is all upset because the SIU had to investigate police violence through YouTube. I agree, and I’m upset too. Why hasn’t Blair found out who made the arrests and taken statements, maybe held a press conference? Is it because Snitches Get Stitches? Every time something like this happens, I make a mental note. Perhaps someday the police will want something from me that they can’t demand. I’ll review my notes.

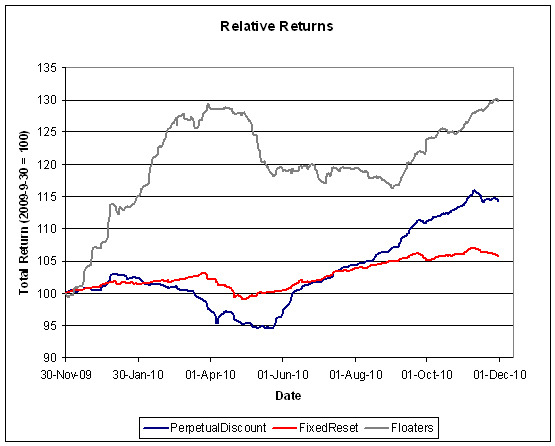

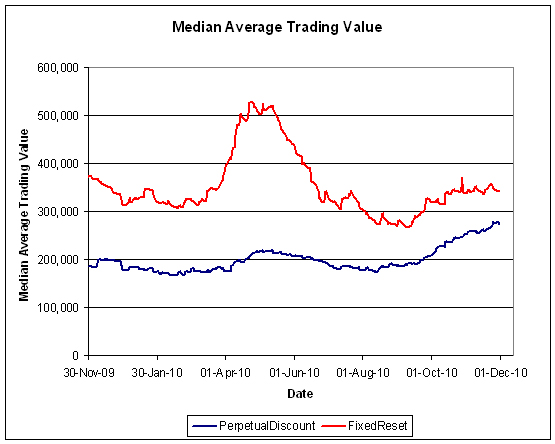

It was a down day on fair volume for the Canadian preferred share market; FixedResets were particularly soft. PerpetualDiscounts were down 8bp and FixedResets lost 17bp, taking the median weighted average yield on the latter index up to 3.27%.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0750 % |

2,268.4 |

| FixedFloater |

4.81 % |

3.46 % |

27,086 |

19.14 |

1 |

-0.4405 % |

3,495.6 |

| Floater |

2.62 % |

2.35 % |

51,470 |

21.37 |

4 |

0.0750 % |

2,449.2 |

| OpRet |

4.75 % |

3.11 % |

61,284 |

2.40 |

8 |

0.0238 % |

2,396.2 |

| SplitShare |

5.44 % |

0.32 % |

118,986 |

1.03 |

3 |

-0.3120 % |

2,472.7 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0238 % |

2,191.1 |

| Perpetual-Premium |

5.67 % |

5.32 % |

157,722 |

5.40 |

24 |

0.0394 % |

2,013.9 |

| Perpetual-Discount |

5.35 % |

5.37 % |

276,608 |

14.87 |

53 |

-0.0808 % |

2,043.7 |

| FixedReset |

5.22 % |

3.27 % |

342,008 |

3.15 |

51 |

-0.1702 % |

2,273.2 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BNS.PR.Y |

FixedReset |

-1.98 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-29

Maturity Price : 24.75

Evaluated at bid price : 24.80

Bid-YTW : 3.46 % |

| TRP.PR.A |

FixedReset |

-1.14 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.95

Bid-YTW : 3.50 % |

| BMO.PR.M |

FixedReset |

-1.09 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-09-24

Maturity Price : 25.00

Evaluated at bid price : 26.36

Bid-YTW : 2.93 % |

| BNS.PR.M |

Perpetual-Discount |

-1.00 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-29

Maturity Price : 22.52

Evaluated at bid price : 22.67

Bid-YTW : 5.01 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.N |

Perpetual-Discount |

126,180 |

TD crossed 100,000 at 24.85 and bought 16,100 from Nesbitt at the same price.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-29

Maturity Price : 24.55

Evaluated at bid price : 24.78

Bid-YTW : 5.35 % |

| TRP.PR.A |

FixedReset |

99,096 |

RBC crossed two blocks of 25,000 each and one of 30,000, all at 26.15.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2015-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.95

Bid-YTW : 3.50 % |

| TD.PR.O |

Perpetual-Discount |

72,479 |

Desjardins crossed 30,000 at 24.23.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-29

Maturity Price : 23.95

Evaluated at bid price : 24.21

Bid-YTW : 5.05 % |

| BNS.PR.P |

FixedReset |

67,182 |

RBC crossed 25,000 at 26.28; Nesbitt crossed 25,000 at the same price.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 25.00

Evaluated at bid price : 26.15

Bid-YTW : 3.20 % |

| GWO.PR.N |

FixedReset |

43,525 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-11-29

Maturity Price : 24.55

Evaluated at bid price : 24.60

Bid-YTW : 3.68 % |

| TDS.PR.C |

SplitShare |

37,985 |

Recent new issue.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2011-12-15

Maturity Price : 10.00

Evaluated at bid price : 10.44

Bid-YTW : 0.32 % |

| There were 40 other index-included issues trading in excess of 10,000 shares. |