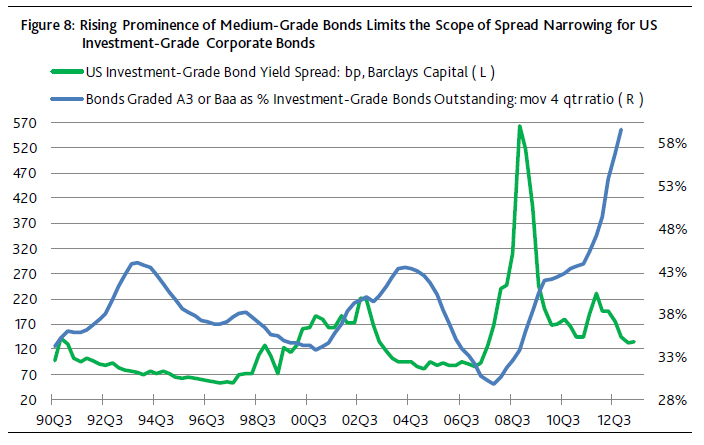

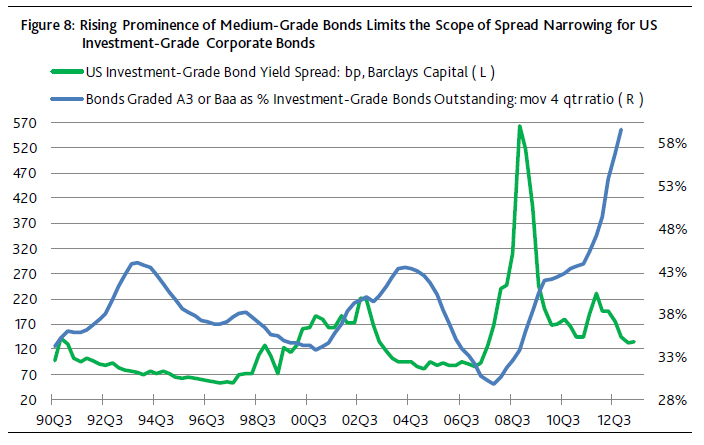

Moody’s points out that the stock of US investment grade corporate bonds is heavily weighted towards lesser credits:

It would be remiss not to add that the risk profile of the US investment-grade corporate bond market also has risen considerably. Given how the share of investment-grade bonds outstanding rated either A3 or Baa has soared from year-end 2007’s 31% to year-end 2012’s record 62%, it’s unlikely that the investment-grade bond yield spread might quickly return to its medians of the two previous recoveries of 103 bp for industrial companies and of 78 bp for financial companies. According to Barclays Capital, these spreads were recently at 135 bp for the industrials and 138 bp for the financials. (Figure 8.)

In conclusion, this very much remains a subpar recovery of above-average risk. What happens to business sales and profits will not only determine the durability of the latest equity rally, it will also have much to say about whether or not Treasury bond yields rise and credit spreads narrow.

Click for Big

Click for BigThe Too-Big-To-Fail Banks, not surprisingly, claim there is no Too-Big-To-Fail subsidy:

Lobby groups for the largest U.S. banks pushed back against claims that they remain too big to fail, rebutting assertions by lawmakers and regulators that they enjoy a “taxpayer subsidy” because of their size.

The Dodd-Frank Act, passed by Congress in response to the 2008 credit crisis, greatly diminished whatever advantage the biggest lenders held over smaller rivals, five industry groups wrote today in a brief on the issue. Senator Elizabeth Warren, a Massachusetts Democrat, used outdated information when she raised the matter at a hearing last month, the groups said.

“There is substantial evidence that the market recognizes the impact Dodd-Frank has had on investor expectations,” the Clearing House, Financial Services Forum, Financial Services Roundtable, Securities Industry and Financial Markets Association and American Bankers Association said in their brief. “Given the sizable costs associated with new regulations, together with the new orderly liquidation framework, any purported TBTF-related funding advantage has clearly been reduced or even eliminated.”

I can’t find the actual brief, even when looking at tweets from the Financial Services Roundtable – the links don’t work. Perhaps they’re waiting for the recipients to publish it before making it public.

Bloomberg published a good article on complexity:

A highly unusual collaboration between economists and scientists offers an important insight for those who want to fix the world’s crisis-prone financial system: There’s no simple way to understand a complex network.

This month’s issue of the research journal Nature Physics features a handful of papers in which physicists, other natural scientists and leading experts in economics and finance — including prominent banking regulators and Nobel Prize-winning economist Joseph Stiglitz — put their minds together to figure out finance. What the scientists bring to the table is experience in studying networks, bewildering tangles of interlinked and interdependent things such as an ecological food web or the Internet.

…

Fifty years ago, ecologists interested in the stability of food webs at first mistakenly concluded that more complexity — more species and a greater density of links among them — would tend to make an ecosystem more stable. This turned out to be wrong. Later work by noted ecologist Robert May demonstrated that while healthy ecological networks are rich and diverse, too much complexity tends to make them unstable and prone to collapse. Loosely speaking, networks with too much complexity can go wrong in too many ways.

One of the papers referenced was by Caccioli, Marsili and Vivo, titled Eroding market stability by proliferation of �financial instruments:

We contrast Arbitrage Pricing Theory (APT), the theoretical basis for the development of �financial instruments, with a dynamical picture of an interacting market, in a simple setting. The proliferation of �financial instruments apparently provides more means for risk diversification, making the market more e�fficient and complete. In the simple market of interacting traders discussed here, the proliferation of �financial instruments erodes systemic stability and it drives the market to a critical state characterized by large susceptibility, strong fluctuations and enhanced correlations among risks. This suggests that the hypothesis of APT may not be compatible with a stable market dynamics. In this perspective, market stability acquires the properties of a common good, which suggests that appropriate measures should be introduced in derivative markets, to preserve stability.

This basic thesis has been known for some time. One of the reasons the US long bond futures contract was designed the way it was – with Cheapest To Deliver options for the seller, as well as a certain amount of leeway in delivery times – was to make it more complex. More complexity makes it harder to analyze, which encourages liquidity since there will be a range of views regarding the fair price of the instrument given the same data from the physical market.

In practice, markets are never perfectly liquid. The very fact that information can be aggregated into prices, requires that prices respond to trading (see e.g. [6] for evidence on FX markets or [5] for equity markets). In other words, it is because markets are illiquid that they can aggregate information into prices. Liquidity indeed is a matter of time scale and volume size [4, 5]. This calls for a view of �financial markets as interacting systems. In this view, trading strategies can affect the market in important ways. Both theoretical models and empirical research, show that trading activity implied by derivatives affects the underlying market in non-trivial ways [10].

…

The aim of this paper is to contrast, within a simple framework, the picture of APT with a dynamical picture of a market as an interacting system. We show that while the introduction of derivatives makes the market more e�fficient, competition between �financial institutions naturally drives the market to a critical state characterized by a sharp singularity. Close to the singularity the market exhibits the three properties alluded to above: 1) a strong susceptibility to small perturbations and 2) strong fluctuations in the underlying stock market. Furthermore 3) while correlations across different derivatives is largely negligible in normal times, correlations in the derivative market are strongly enhanced in stress times, when the market is close to the critical state. In brief, this suggests that the hypothesis of APT may not be compatible with the requirement of a stable market.

…

But it is precisely because these models are simple that one is able to point out why theoretical concepts such as effi�cient or complete markets and competitive equilibria have non-trivial implications. The reason being that these conditions hold only in special points of the phase diagram where singularity occurs (phase transitions). It is precisely when markets approach these ideal conditions that instabilities and strong

fluctuations appear [13, 14]. Loosely speaking, this arises from the fact that the market equilibrium becomes degenerate along some directions in the phase space. In a complete, arbitrage-free market, the introduction of a derivative contract creates a symmetry, as it introduces perfectly equivalent ways of realizing the same payoffs. Fluctuations along the direction of phase space identified by symmetries can grow unbounded. Loosely speaking, the �financial industry is a factory of symmetries, which is why the proliferation of �financial instruments can cause strong fluctuations and instabilities. In this respect, the study of competitive equilibria alone can be misleading. What is mostly important is their stability with respect to adaptive behavior of agents and the dynamical fluctuations they support and generate.

…

It has been recently suggested that market stability appears to have the properties of a public good [22]. A public good is a good i) whose consumption by one individual does not reduce its availability for consumption by others (non-rivalry) and ii) such that no one can be e�ectively excluded from using the good (non-excludability). At the level of the present stylized description, the expansion in the repertoire of traded assets introduces an externality which drives the market to unstable states. This suggests that systemic instability may be prevented by the introduction of a tax on derivative markets, such as that advocated long ago for foreign exchange markets by Tobin [23], or by the introduction of “trading permits”, similar to those adopted to limit Carbon emissions [25]. The stabilizing effect of a Tobin tax has already been shown within a model of a dynamic market which is mathematically equivalent to the one presented here [24].

…

The proliferation of �financial instruments makes the market look more and more similar to an ideal arbitrage-free, efficient and complete market. But this occurs at the expense of market stability. This is reminiscent of the instability discussed long ago by Sir Robert May [20] which develops in ecosystems upon increasing bio-diversity13. For ecologies this result is only apparently paradoxical. Indeed the species which populate an ecosystem can hardly be thought of as being drawn at random, but are rather subject to natural selection. Indeed, on evolutionary time scales stability can be reconciled with bio-diversity, as shown e.g. in Ref. [21]. The diversity in the ecosystem of �financial instruments has, by contrast, been increasing at a rate much faster than that at which selective forces likely operate.

While I suspect that a Tobin Tax might indeed work, it’s rather a blunt instrument. Far better to allow selective forces to operate, by allowing bankruptcies and firing incompetents. But nobody ever lost his job in the financial industry for incompetence.

Closer to home, Moody’s is taking care to be cautious:

A severe economic shock, such as the kind that hit Japan in the early 1990s and California and Nevada in 2006, could knock Canadian housing prices down by 44%, according to a formula devised by Moody’s Investors Service to rate securities linked to mortgages.

Such a decline would be driven primarily by the phenomenal upswing in Canadian home prices over the past decade, Moody’s said.

While house prices in Spain could plummet by a more severe 52%, Canada joins Spain, as well as the United Kingdom and Australia, in the ratings agency’s assessment of countries where growth in housing prices over the past 10 years has driven their values away from sustainable market fundamentals and into “overheated” territory.

… but TD emphasizes the central distribution of probabilities:

Canada’s real estate bonanza of the past decade has come to end and the long-term trend as one of the most profitable places to invest is also not encouraging, a new research paper from the TD Bank argues.

The “special report” from one of Canada’s largest banks makes the case that gains in housing prices have been exceptionally strong over the last 10 years, even when accounting for a sharp drop during the 2008-09 recession. But now is the time for a bit of a payback.

The report does not predict a collapse in house prices as some analysts have suggested. In fact, it sees prices rebounding after a few years of a correction to as high as eight per cent.

However, the longer term trend is for home price gains to average about two per cent over the next 10 years — flat once inflation is taken into account, says TD chief economist Craig Alexander.

…

The problem with the housing collapse scenario, says Alexander, is that typically a sharp correction needs a trigger in terms of a steep increase in interest rates or unemployment, both of which appear unlikely at this point.

…

Somewhat surprisingly, the report predicts Vancouver and Toronto, along with Victoria, Edmonton and Calgary will continue to outpace the national average in terms of home prices over the next 10 years.

Vancouver and Toronto are regarded as cities with the most inflated prices — despite recent corrections — but TD argues that the two cities will realize the biggest influx of immigrants, so demand will remain higher. The Alberta cities will do well because of both population growth and higher than average income growth.

Alexander says the two biggest factors in trend home prices are population growth and housing formation, which both favour Toronto and Vancouver.

CU Inc., proud issuer of CIU.PR.A, CIU.PR.B and CIU.PR.C was confirmed at Pfd-2(high) by DBRS:

DBRS has today confirmed the Issuer Rating, Commercial Paper, Unsecured Debentures & Medium-Term Notes and Cumulative Preferred Shares of CU Inc. (CUI or the Company) at A (high), R-1 (low), A (high) and Pfd-2 (high), respectively, all with Stable trends. The rating confirmations are based on CUI’s low business risk, which stems from the regulated nature of its operations supported by a reasonable regulatory environment; strong portfolio of diversified regulated businesses; and solid financial profile.

The Company’s business risk profile is viewed as strong as all of its earnings are generated from regulated electricity and gas businesses, which operate under a relatively stable, albeit evolving, regulatory framework.

…

CUI is the highest rated publically owned utility and continues to grow through its investments in low risk assets. The Company has a conservative strategy of funding a significant portion of its capex with internally generated cash flows, conservative dividend payouts and equity injections from its parent (Canadian Utilities Limited; rated “A”). CUI has a proven track record of funding equity in a timely manner to remain in line with its regulatory capital structure. DBRS expects the parent to continue to provide support to CUI, if needed.

It was a mixed day for the Canadian preferred share market, with PerpetualPremiums off 4bp, FixedResets up 10bp and DeemedRetractibles down 8bp. Volatility was below average. Volume was average.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.6267 % |

2,609.5 |

| FixedFloater |

4.08 % |

3.42 % |

28,945 |

18.45 |

1 |

0.4310 % |

3,988.8 |

| Floater |

2.55 % |

2.86 % |

90,891 |

20.01 |

5 |

-0.6267 % |

2,817.6 |

| OpRet |

4.79 % |

2.52 % |

49,779 |

0.30 |

5 |

0.2165 % |

2,600.9 |

| SplitShare |

4.29 % |

4.51 % |

117,336 |

4.23 |

4 |

0.1540 % |

2,935.1 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2165 % |

2,378.3 |

| Perpetual-Premium |

5.21 % |

1.58 % |

90,152 |

0.14 |

31 |

-0.0431 % |

2,355.7 |

| Perpetual-Discount |

4.82 % |

4.86 % |

139,343 |

15.63 |

4 |

0.0202 % |

2,658.1 |

| FixedReset |

4.89 % |

2.61 % |

290,650 |

3.33 |

80 |

0.0980 % |

2,510.9 |

| Deemed-Retractible |

4.87 % |

3.37 % |

139,025 |

0.55 |

44 |

-0.0810 % |

2,444.8 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| PWF.PR.A |

Floater |

-1.51 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-11

Maturity Price : 23.25

Evaluated at bid price : 23.55

Bid-YTW : 2.21 % |

| TRI.PR.B |

Floater |

-1.15 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-11

Maturity Price : 23.86

Evaluated at bid price : 24.11

Bid-YTW : 2.17 % |

| FTS.PR.J |

Perpetual-Premium |

-1.12 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2021-12-01

Maturity Price : 25.00

Evaluated at bid price : 25.70

Bid-YTW : 4.40 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| TRP.PR.D |

FixedReset |

232,131 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-11

Maturity Price : 23.25

Evaluated at bid price : 25.46

Bid-YTW : 3.58 % |

| BNS.PR.Y |

FixedReset |

94,712 |

RBC crossed blocks of 33,800 and 50,000, both at 24.80.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.88

Bid-YTW : 2.84 % |

| BMO.PR.O |

FixedReset |

63,757 |

RBC crossed 37,400 at 26.40.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-25

Maturity Price : 25.00

Evaluated at bid price : 26.40

Bid-YTW : 2.00 % |

| TD.PR.Q |

Deemed-Retractible |

55,060 |

TD crossed 50,000 at 26.68.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-04-10

Maturity Price : 26.00

Evaluated at bid price : 26.53

Bid-YTW : -12.05 % |

| TD.PR.C |

FixedReset |

41,054 |

Desjardins crossed 10,000 at 25.92 and 24,800 at 26.05.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.87

Bid-YTW : 2.33 % |

| PWF.PR.S |

Perpetual-Discount |

30,706 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-11

Maturity Price : 24.59

Evaluated at bid price : 24.98

Bid-YTW : 4.82 % |

| There were 33 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| PWF.PR.A |

Floater |

Quote: 23.55 – 24.50

Spot Rate : 0.9500

Average : 0.6620

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-11

Maturity Price : 23.25

Evaluated at bid price : 23.55

Bid-YTW : 2.21 % |

| HSB.PR.D |

Deemed-Retractible |

Quote: 25.76 – 26.38

Spot Rate : 0.6200

Average : 0.4608

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-12-31

Maturity Price : 25.25

Evaluated at bid price : 25.76

Bid-YTW : 3.61 % |

| GWO.PR.H |

Deemed-Retractible |

Quote: 25.34 – 25.66

Spot Rate : 0.3200

Average : 0.2218

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-09-30

Maturity Price : 25.25

Evaluated at bid price : 25.34

Bid-YTW : 3.67 % |

| TD.PR.I |

FixedReset |

Quote: 26.62 – 26.85

Spot Rate : 0.2300

Average : 0.1496

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-31

Maturity Price : 25.00

Evaluated at bid price : 26.62

Bid-YTW : 2.02 % |

| TRI.PR.B |

Floater |

Quote: 24.11 – 24.40

Spot Rate : 0.2900

Average : 0.2129

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-03-11

Maturity Price : 23.86

Evaluated at bid price : 24.11

Bid-YTW : 2.17 % |

| W.PR.J |

Perpetual-Premium |

Quote: 25.43 – 25.76

Spot Rate : 0.3300

Average : 0.2530

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-04-10

Maturity Price : 25.00

Evaluated at bid price : 25.43

Bid-YTW : -4.94 % |