Corporations are well placed to weather the next crisis:

Companies from the U.S. to Europe and Asia are selling the fewest bonds since 2004, as rising cash levels allow borrowers to weather a slowing economy.

Debt offerings fell to $1.17 trillion in the first half of the year, 39 percent less than the same period in 2009, according to data compiled by Bloomberg. The decline was led by financial companies, which issued 35 percent less debt.

Issuance is declining as borrowers with 15 percent more cash than a year earlier avoid tapping credit markets amid concern that Europe’s sovereign-debt crisis may slow the global economic recovery. Corporate bonds have returned 4.9 percent in the first half of the year, beating the MSCI World Index of stocks, which is down 8.9 percent, by the most in nine years.

…

Cash at investment-grade companies rose to $668 billion at the end of the first quarter from $580 billion a year earlier, while debt fell 2 percent to $2.3 trillion, JPMorgan Chase & Co. analysts led by Eric Beinstein in New York wrote last week.

In the midst of the sovereign debt crisis, the EU is taking firm action:

Bankers in Europe will not be allowed to take home more than a third of their bonuses in cash from the start of next year under planned new rules, a British lawmaker said Tuesday.

…

Under the negotiated agreement, cash could only constitute 30 percent of a regular bonus and one-fifth a large bonus. A new watchdog for European banks will define what constitutes a large bonus. There will also be an opportunity for a “clawback” of bonuses if deals made to reach profit targets later fell apart.

In addition, banks that have received government bailouts will have to limit bonuses paid to their managers, while directors will not be eligible to receive any bonus unless it is justified to supervisors. Banks must also set limits on bonuses in relation to salaries to avoid any windfall payouts.

What will happen, I think, is that talent will migrate to hedge funds, which will take over a significant part of the market-making function. Maybe this is a good thing. But I doubt that anybody’s thought about it.

Ms Gertrude Tumpel-Gugerell, Member of the Executive Board of the European Central Bank, spoke at the US Financial Services Roundtable, Brussels, 28 June 2010, stringing together non-sequiters to reach a politically desirable conclusion (emphasis added):

The first priority relates to the development of financial infrastructures in those markets where they are not yet sufficiently used or available, notably in OTC derivatives markets. The crisis has shown that markets with adequate infrastructures and hence proper risk management and risk provisions have proven to be more resilient than markets without such infrastructures, such as the OTC derivatives markets. Therefore, expanding the use of central counterparties (CCPs) in these increasingly systemically relevant markets is a key measure to reduce counterparty and operational risk. Another important step is the mandatory reporting of all trades to centralised trade registries, so-called trade repositories, in order to enhance market transparency. In my view, if CCPs and trade repositories for credit default swaps had been available before the Lehman default, Lehman’s CDS exposures could have been managed in a much more transparent and resilient way and could have mitigated the negative chain reaction on CDS markets that followed the demise of Lehman.

CCPs and trade repositories for OTC derivatives are ultimately beneficial for all stakeholders. Still, there are the well-known challenges of effective collective action in the context of the provision of public goods. Hence, private sector efforts alone may not suffice to foster sufficient progress towards the use of CCPs and trade repositories for OTC derivatives. It is therefore important to adopt and implement the regulatory requirements for the mandatory central clearing of all eligible products and the reporting of trades to trade repositories in a timely manner. Given, however, the global nature of OTC derivatives markets, it is clear that such regulatory tools will only be successful if they are applied in a coordinated manner around the globe. I strongly support the recently launched work of the Financial Stability Board to develop common approaches to fostering the central clearing of eligible OTC derivatives as well as to expand the range of potentially clearable products through enhanced standardisation.

Quite frankly, I don’t understand her use of the word “therefore”!

The OSC has published a new edition of Perspectives. Articles feature:

- CSA publishes proposed amendments to mutual fund regulations

- CSA publishes frequently asked questions about order protection and locked and crossed markets

- OSC updates registrant section of its website

There’s some more reaction to mandatory margining proposals, this time from ISDA:

A change in the wording of the financial reform bill now being finalized in the US Congress could cost US companies as much as $1 trillion in capital and liquidity requirements, according to research by the International Swaps and Derivatives Association, Inc. (ISDA). About $400 billion would be needed as collateral that corporations could be required to post with their dealer counterparties to cover the current exposure of their OTC derivatives transactions. ISDA estimates that $370 billion represents the additional credit capacity that companies could need to maintain to cover potential future exposure of those transactions. If markets return to levels prevailing at the end of 2008, additional collateral needs would bring the total to $1 trillion.

That will be a nice little profit centre for the banks – setting up credit lines dedicated to collateralization! Now, is this a good thing, or a bad thing? Nobody knows. It hasn’t been discussed.

Naturally, some companies will be affected more than others:

Berkshire [Hathaway Inc.] owns derivatives with a notional value of about $62 billion and has “negligible” collateral requirements, Barclays analyst Jay Gelb said today in a report. [Warren] Buffett’s firm, based in Omaha, Nebraska, may need to post $6 billion to $8 billion in collateral under rules being debated by the U.S. Congress, he said.

The SEC has announced new rules to discourage political corruption in the investment advisory business. Sadly, there are no rules disallowing the hiring of former SEC employees.

CM has issued CHF 500-million in 5-year covered bonds at 1.75%. Bonds OnLine is reporting 5-year Swiss governments at a rather alarming -0.26% (that’s right, negative twenty-six beeps); the only data I can find for 5-years on the Swiss National Bank site is dated May 31. DBRS rates them AAA:

The ratings are based on several factors. First, the Covered Bonds are senior unsecured direct obligations of CIBC, which is the fifth largest bank in Canada and rated AA and R-1 (high) with a Stable trend by DBRS. Second, in addition to a general recourse to CIBC’s assets, the Covered Bonds are supported by a diversified collateral pool of first-lien prime residential mortgages insured by Canada Mortgage and Housing Corporation (CMHC) (the Cover Pool). CMHC is an agent of Her Majesty in right of Canada and is rated AAA by DBRS.

MFC.PR.B traded 5,792 shares on the TSX today in a range of 19.63-80 and closed at 19.01-66, 10×12. The last trade was at 3:58pm, 300 shares at 19.66. I can only suppose the market maker decided to get an early start on his weekend.

Much the same thing happened with GWO.PR.J: traded 3,400 shares in a range of 26.62-85 before closing at 25.92-62, 20×7.

BAM.PR.G traded 145 shares, all at 21.40, and closed at 20.91-40, 15×10. I can only imagine that the market maker was overwhelmed by the volume.

These are particularly annoying incidents, because it’s not just month-end, it’s quarter-end.

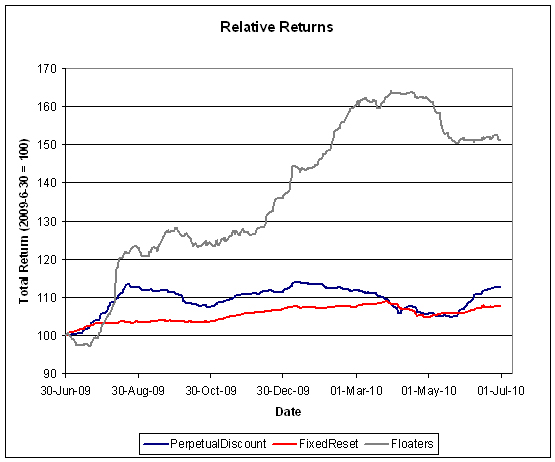

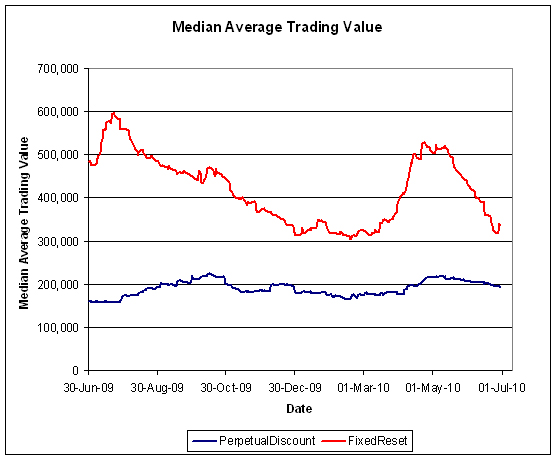

PerpetualDiscounts squeaked out a win today, gaining 4bp, while FixedResets gained 7bp on light volume and, as we have seen, a surprising and probably spurious amount of volatility.

PerpetualDiscounts now yield 5.97%, equivalent to 8.36% interest at the standard conversion factor of 1.4x. Long corporates now yield an astonishing (to me) 5.45%, so the pre-tax interest-equivalent spread (also called the Seniority Spread) now stands at about 290bp, the same level reported on June 23, but a narrowing of 25bp from the 315bp spread reported on May 31.

And that’s a wrap for June, 2010!

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.81 % |

2.92 % |

27,881 |

20.35 |

1 |

0.0000 % |

2,048.0 |

| FixedFloater |

5.20 % |

3.37 % |

21,210 |

19.70 |

1 |

-2.2897 % |

3,077.5 |

| Floater |

2.42 % |

2.85 % |

76,191 |

20.08 |

3 |

-0.2578 % |

2,239.0 |

| OpRet |

4.87 % |

3.57 % |

82,897 |

0.89 |

11 |

-0.0423 % |

2,335.9 |

| SplitShare |

6.37 % |

6.35 % |

91,524 |

3.47 |

2 |

-0.0439 % |

2,178.7 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.0423 % |

2,136.0 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0431 % |

1,916.3 |

| Perpetual-Discount |

5.94 % |

5.97 % |

192,482 |

13.90 |

77 |

0.0431 % |

1,814.0 |

| FixedReset |

5.37 % |

3.90 % |

335,785 |

3.46 |

47 |

0.0686 % |

2,189.3 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| MFC.PR.B |

Perpetual-Discount |

-2.96 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 19.01

Evaluated at bid price : 19.01

Bid-YTW : 6.17 % |

| GWO.PR.J |

FixedReset |

-2.63 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.92

Bid-YTW : 4.90 % |

| BAM.PR.G |

FixedFloater |

-2.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 25.00

Evaluated at bid price : 20.91

Bid-YTW : 3.37 % |

| BAM.PR.B |

Floater |

-1.80 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 15.30

Evaluated at bid price : 15.30

Bid-YTW : 2.85 % |

| PWF.PR.F |

Perpetual-Discount |

-1.27 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 21.50

Evaluated at bid price : 21.77

Bid-YTW : 6.13 % |

| TD.PR.N |

OpRet |

-1.26 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.77

Bid-YTW : 3.92 % |

| BAM.PR.K |

Floater |

-1.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 15.26

Evaluated at bid price : 15.26

Bid-YTW : 2.86 % |

| TD.PR.G |

FixedReset |

1.13 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 27.75

Bid-YTW : 3.56 % |

| BAM.PR.H |

OpRet |

1.21 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-07-30

Maturity Price : 25.50

Evaluated at bid price : 25.92

Bid-YTW : -13.77 % |

| TRI.PR.B |

Floater |

1.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 23.32

Evaluated at bid price : 23.60

Bid-YTW : 1.82 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| TRP.PR.C |

FixedReset |

376,889 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 23.10

Evaluated at bid price : 24.93

Bid-YTW : 4.03 % |

| PWF.PR.P |

FixedReset |

159,850 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 23.16

Evaluated at bid price : 25.11

Bid-YTW : 4.04 % |

| PWF.PR.J |

OpRet |

121,223 |

Called for redemption.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2011-05-30

Maturity Price : 25.25

Evaluated at bid price : 25.71

Bid-YTW : 3.51 % |

| PWF.PR.I |

Perpetual-Discount |

82,900 |

RBC crossed blocks of 10,000 and 57,300, both at 24.90.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 24.42

Evaluated at bid price : 24.80

Bid-YTW : 6.15 % |

| TRP.PR.B |

FixedReset |

78,929 |

Nesbitt crossed 50,000 at 24.56.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 24.55

Evaluated at bid price : 24.60

Bid-YTW : 3.90 % |

| BNS.PR.M |

Perpetual-Discount |

27,091 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-06-30

Maturity Price : 19.80

Evaluated at bid price : 19.80

Bid-YTW : 5.79 % |

| There were 22 other index-included issues trading in excess of 10,000 shares. |