The Financial Crisis Inquiry Commission is forecast to conclude “It’s complicated.”:

The federal commission that investigated the origins of the financial crisis is set to issue three competing conclusions next week.

The Financial Crisis Inquiry Commission’s main report, to be released Jan. 27, is backed only by the panel’s six Democratic appointees. The four Republicans have written two separate dissents, according to a blog post by one of them.

…

The Democrats’ final report cites a broad swath of failures for the crisis, according to three people who have been briefed on the report or have seen parts of it. They blame greedy bankers and mortgage brokers, lax derivatives oversight, bumbling credit-rating firms, predatory lending, a lack of risk management at banks and decades of deregulation, said the people who spoke on condition of anonymity because the report isn’t yet public.

…

Though he didn’t give details, Hennessey said he had signed on to a 27-page dissent along fellow Republicans Bill Thomas, the former California congressman who serves as the panel’s vice chairman, and Douglas Holtz-Eakin.The dissent will “supersede” the preliminary paper that came out last month, Hennessey said on his blog.

…

Wallison’s report will focus mainly on the government’s housing policy as the cause of the crisis, they said. He also takes aim at how the commission was run, putting blame on the management of its Democratic chairman, Phil Angelides, and not the committee staff, the people added. Wallison’s dissent also criticizes the administrations of Presidents Bill Clinton and George W. Bush for their housing policies, the people said.

The FCIC preliminary dissent was discussed on December 16. The whole thing is just a Rorschach test.

Government Motors is planning to double its subsidy sucking capacity:

After exploring its options, the team settled on doubling capacity for the Volt next year, they said. GM is still evaluating the Volt’s technology for other models.

…

GM should be able to sell all of its Volt production as long as the government’s $7,500 tax incentive is in place, Hall said. The incentive expires after GM sells 200,000 of the car.

Which makes an interesting juxtaposition with school funding:

U.S. governors and legislatures facing deficits of more than $140 billion are slashing local school budgets, cuts that may mean jammed classrooms, fewer teachers and libraries without librarians.

The Texas Legislature is considering a 13 percent reduction in education funding and South Dakota Governor Dennis Daugaard recommended taking 10 percent out of per-pupil spending. Cuts proposed in those states, and in Kansas, Washington, Ohio and Iowa, come after New Jersey Governor Chris Christie took $820 million away from schools in his current $29.4 billion budget.

and:

Utah Representative Jason Chaffetz said Republicans have contacted bankruptcy attorneys to discuss ways to change the law to allow states to restructure financial obligations such as debts to retirees. He said it hasn’t been decided whether that would mean allowing states to file for bankruptcy.

Chaffetz said he proposed legislation to oppose federal bailouts of pensions.

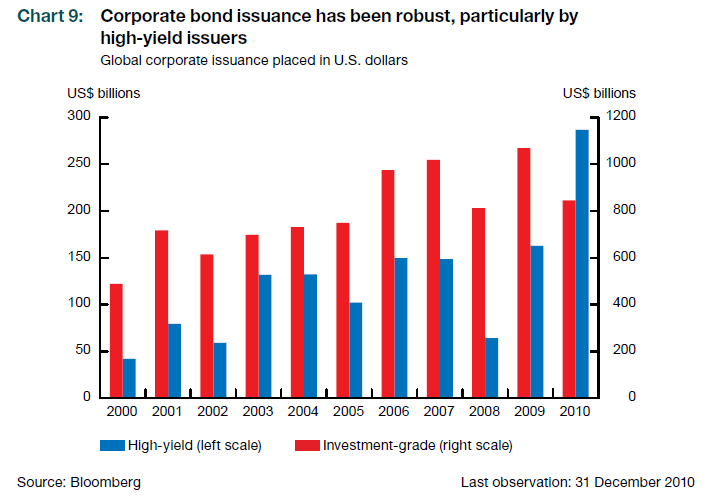

Goldman sold some 30-year paper:

Goldman Sachs Group Inc. sold $2.5 billion of 30-year debt in its first sale of the securities in more than three years, as investors accept the lowest premiums since April for bank bonds with similar credit grades.

The 6.25 percent notes from the fifth-biggest U.S. bank by assets pay 170 basis points, or 1.7 percentage points, more than similar-maturity Treasuries, according to data compiled by Bloomberg.

The Canadian preferred share market eased off a little on heavy volume, with PerpetualDiscounts down 8bp and FixedResets basically flat.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5011 % | 2,345.7 |

| FixedFloater | 4.79 % | 3.48 % | 27,089 | 19.17 | 1 | -0.4384 % | 3,554.7 |

| Floater | 2.55 % | 2.32 % | 44,079 | 21.47 | 4 | 0.5011 % | 2,532.8 |

| OpRet | 4.81 % | 3.39 % | 65,669 | 2.29 | 8 | -0.1011 % | 2,389.3 |

| SplitShare | 5.30 % | 1.70 % | 465,131 | 0.88 | 4 | 0.0801 % | 2,464.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1011 % | 2,184.7 |

| Perpetual-Premium | 5.64 % | 5.00 % | 138,510 | 5.30 | 20 | -0.0824 % | 2,031.8 |

| Perpetual-Discount | 5.31 % | 5.30 % | 256,691 | 14.96 | 57 | -0.0835 % | 2,081.4 |

| FixedReset | 5.23 % | 3.38 % | 284,976 | 3.04 | 52 | -0.0022 % | 2,273.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| GWO.PR.I | Perpetual-Discount | -1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 21.69 Evaluated at bid price : 22.04 Bid-YTW : 5.13 % |

| GWO.PR.H | Perpetual-Discount | -1.75 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 22.85 Evaluated at bid price : 23.06 Bid-YTW : 5.30 % |

| TRP.PR.B | FixedReset | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 24.92 Evaluated at bid price : 24.97 Bid-YTW : 3.88 % |

| GWO.PR.G | Perpetual-Discount | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 23.43 Evaluated at bid price : 23.71 Bid-YTW : 5.53 % |

| BAM.PR.H | OpRet | -1.02 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2012-03-30 Maturity Price : 25.00 Evaluated at bid price : 25.20 Bid-YTW : 5.37 % |

| IAG.PR.C | FixedReset | 1.12 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 27.19 Bid-YTW : 3.26 % |

| BAM.PR.K | Floater | 1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 18.75 Evaluated at bid price : 18.75 Bid-YTW : 2.81 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TRP.PR.C | FixedReset | 93,594 | Nesbitt crossed 55,000 at 25.60; RBC crossed 17,600 at 25.48. YTW SCENARIO Maturity Type : Call Maturity Date : 2016-02-29 Maturity Price : 25.00 Evaluated at bid price : 25.47 Bid-YTW : 3.97 % |

| RY.PR.F | Perpetual-Discount | 87,356 | Nesbitt crossed blocks of 30,000 and 50,000, both at 23.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 22.82 Evaluated at bid price : 23.00 Bid-YTW : 4.90 % |

| FTS.PR.H | FixedReset | 80,752 | TD crossed 15,000 at 25.75; Nesbitt crossed 50,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.75 Bid-YTW : 3.66 % |

| BMO.PR.P | FixedReset | 78,839 | Nesbitt crossed 60,000 at 27.25. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 27.20 Bid-YTW : 3.34 % |

| TRP.PR.B | FixedReset | 73,454 | National crossed 13,000 at 25.27; RBC crossed 16,600 at 26.07. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-21 Maturity Price : 24.92 Evaluated at bid price : 24.97 Bid-YTW : 3.88 % |

| MFC.PR.A | OpRet | 68,509 | Nesbitt crossed 60,000 at 25.80. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 25.72 Bid-YTW : 3.56 % |

| There were 60 other index-included issues trading in excess of 10,000 shares. | |||