Two of the eight new BMO ETFs are of interest:

BMO Long Federal Bond Index ETF (ZFL)

BMO Real Return Bond Index ETF (ZRR)

These have management fees of 20bp and 25bp respectively.

Interesting mea culpa from Scottwood Capital, indicating that yes, there are some investors who believe that a short term credit line will solve structural deficit problems:

As the situation in Greece continued to deteriorate and spread in May, we were indeed watching closely for how that could affect our market and Scottwood’s positions. However, when the EU and IMF announced their $1Trillion rescue package, we believed that that would eliminate many of the – real and perceived – potential macro risks that had been hanging over what had been up to that time extremely healthy and vibrant US credit markets. Our belief was based on the fact that, as opposed to 2008, the Euro governments now had the entire US playbook to show exactly what programs worked (and how, and why) and what did not (and how, and why).

Scottwood does not publish performance figures.

The SEC is holding a public meeting on Market Structure:

The Commission already has proposed rules that would:

- Establish a consolidated audit trail system to help regulators keep pace with new technology and trading patterns in the markets.

- Generally require that information about an investor’s interest in buying or selling a stock be made available to the public, instead of just to a select group operating with a dark pool.

- Effectively prohibit broker-dealers from providing their customers with unfiltered access to exchanges and alternative trading systems and ensure that broker-dealers implement appropriate risk controls.

- Create a large trader reporting system to enhance the Commission’s ability to identify large market participants, collect information on their trades, and analyze their trading activity.

As an old bond buy, I am flabbergasted by point 2. That information is GOLD. I suspect that implentation of point 2 will reduce liquidity, since participants will be less willing to make such indications if it’s going to be broadcast. What’s next? Making it illegal for brokers to work a block trade?

Point 3 also has interesting implications. It would be nice to see Exchange membership opened up to large funds and chip away at the brokerage oligopoly. Unfiltered access was discussed on January 19; to it’s credit, the SEC addressed such a possibility in its request for comments:

The Commission seeks comment on any other potential costs to brokers or dealers that may result from the proposed rule. While the Commission does not anticipate that there would be significant adverse consequences to a broker or dealer’s business, activities, or financial condition as a result of the proposed rule, it seeks commenters’ views regarding the possibility of any such impact. For instance, would the proposed rule impact a broker or dealer’s ability to attract or retain its market access customers? Could a broker or dealer lose order flow, because its customer might seek other arrangements in order to access the securities markets, such as becoming a member of a particular exchange or becoming a broker or dealer? The Commission requests for commenters to quantify those costs, where possible.

I saw what I’m reasonably sure was an Eight-Spotted Forester Moth in my garden today. Apparently my neighbor’s Virginia Creeper is a larval host, which is the first use I’ve ever heard of for the disgusting stuff.

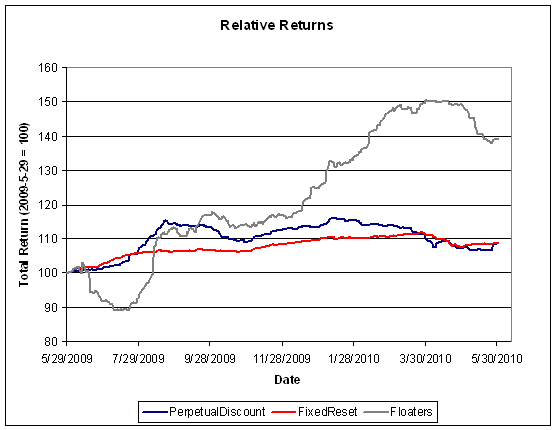

It was another zippetty-doo-dah day in the Canadian preferred share market, with PerpetualDiscounts rocketting up another 57bp, while FixedResets were up 5bp. The gain brings the PerpetualDiscount total return index to its highest level since April 20 and the yields (basically the price index) to their lowest level April 21.

PerpetualDiscounts have returned -0.35% from April 20 and +1.23% month-to-date. Figures for FixedResets are -0.02% and +1.25%, respectively. Three consecutive nice days don’t make a rally – but it’s a lot better than the steady drip-drip-drip of price declines in the sector we’ve been seing all year!

GWO PerpetualDiscounts did especially well on the day, occupying the best five places on the performance table. This was their first day of trading ex-dividend. See comments.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.67 % |

2.74 % |

45,542 |

20.70 |

1 |

0.0000 % |

2,077.9 |

| FixedFloater |

5.23 % |

3.29 % |

32,231 |

19.96 |

1 |

0.2892 % |

3,062.8 |

| Floater |

2.16 % |

2.50 % |

98,882 |

21.01 |

3 |

0.4413 % |

2,246.2 |

| OpRet |

4.90 % |

4.03 % |

95,660 |

0.98 |

11 |

0.0355 % |

2,302.7 |

| SplitShare |

6.43 % |

2.31 % |

112,413 |

0.08 |

2 |

0.2444 % |

2,157.2 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0355 % |

2,105.6 |

| Perpetual-Premium |

5.55 % |

4.80 % |

22,424 |

15.74 |

1 |

0.0000 % |

1,817.0 |

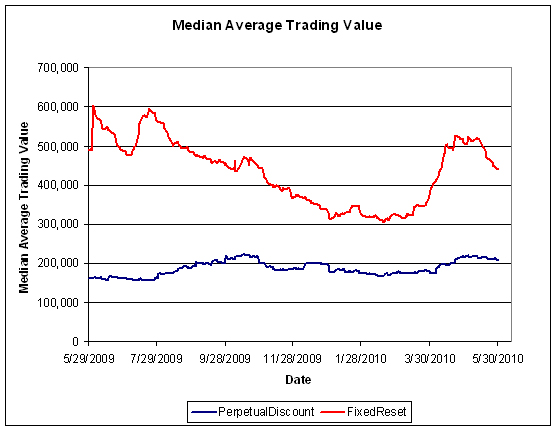

| Perpetual-Discount |

6.22 % |

6.28 % |

211,533 |

13.54 |

77 |

0.5713 % |

1,721.0 |

| FixedReset |

5.48 % |

4.25 % |

445,232 |

3.65 |

45 |

0.0527 % |

2,152.6 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| RY.PR.W |

Perpetual-Discount |

-1.10 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 20.70

Evaluated at bid price : 20.70

Bid-YTW : 5.97 % |

| POW.PR.B |

Perpetual-Discount |

1.01 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 21.01

Evaluated at bid price : 21.01

Bid-YTW : 6.47 % |

| TRI.PR.B |

Floater |

1.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 22.71

Evaluated at bid price : 23.00

Bid-YTW : 1.69 % |

| POW.PR.A |

Perpetual-Discount |

1.14 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 21.86

Evaluated at bid price : 22.10

Bid-YTW : 6.43 % |

| PWF.PR.F |

Perpetual-Discount |

1.18 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 20.60

Evaluated at bid price : 20.60

Bid-YTW : 6.46 % |

| GWO.PR.J |

FixedReset |

1.21 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 26.70

Bid-YTW : 3.87 % |

| POW.PR.C |

Perpetual-Discount |

1.32 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 22.73

Evaluated at bid price : 23.00

Bid-YTW : 6.40 % |

| ELF.PR.F |

Perpetual-Discount |

1.33 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 19.00

Evaluated at bid price : 19.00

Bid-YTW : 7.10 % |

| POW.PR.D |

Perpetual-Discount |

1.54 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 19.75

Evaluated at bid price : 19.75

Bid-YTW : 6.44 % |

| CM.PR.G |

Perpetual-Discount |

1.63 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 21.54

Evaluated at bid price : 21.80

Bid-YTW : 6.26 % |

| HSB.PR.D |

Perpetual-Discount |

1.74 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 19.86

Evaluated at bid price : 19.86

Bid-YTW : 6.42 % |

| GWO.PR.G |

Perpetual-Discount |

1.96 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 20.74

Evaluated at bid price : 20.74

Bid-YTW : 6.27 % |

| GWO.PR.F |

Perpetual-Discount |

2.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 23.15

Evaluated at bid price : 23.44

Bid-YTW : 6.28 % |

| GWO.PR.L |

Perpetual-Discount |

2.12 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 22.36

Evaluated at bid price : 22.47

Bid-YTW : 6.29 % |

| GWO.PR.H |

Perpetual-Discount |

2.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 19.46

Evaluated at bid price : 19.46

Bid-YTW : 6.24 % |

| GWO.PR.I |

Perpetual-Discount |

2.42 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 17.95

Evaluated at bid price : 17.95

Bid-YTW : 6.27 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| RY.PR.A |

Perpetual-Discount |

74,199 |

Nesbitt crossed 50,000 at 18.76.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 18.77

Evaluated at bid price : 18.77

Bid-YTW : 5.97 % |

| TD.PR.O |

Perpetual-Discount |

51,091 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 20.30

Evaluated at bid price : 20.30

Bid-YTW : 6.05 % |

| BMO.PR.J |

Perpetual-Discount |

40,130 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-05-28

Maturity Price : 18.82

Evaluated at bid price : 18.82

Bid-YTW : 6.03 % |

| NA.PR.P |

FixedReset |

35,130 |

RBC crossed 25,000 at 27.14.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-17

Maturity Price : 25.00

Evaluated at bid price : 27.05

Bid-YTW : 4.36 % |

| BNS.PR.X |

FixedReset |

34,880 |

TD crossed 25,000 at 27.10.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-25

Maturity Price : 25.00

Evaluated at bid price : 27.08

Bid-YTW : 4.17 % |

| CIU.PR.B |

FixedReset |

33,300 |

RBC crossed 12,100 at 27.35. TD crossed 20,000 at 27.49.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-01

Maturity Price : 25.00

Evaluated at bid price : 27.31

Bid-YTW : 4.26 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. |

Update, 2010-5-31: Revised figures for PerpetualDiscounts and FixedResets after correction of erroneous dividends (see comments):

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Perpetual-Discount |

6.22 % |

6.28 % |

211,533 |

13.47 |

77 |

0.4693 % |

1,719.3 |

| FixedReset |

5.48 % |

4.25 % |

445,232 |

3.65 |

45 |

0.0211 % |

2,151.9 |