Standard & Poor’s has announced:

- •We are revising our outlook on Sun Life Financial to positive, reflecting our belief that the company will maintain AAA capital adequacy post-LICAT rollout, which would lead to an upgrade within the next 24 months.

- •We also expect the company to maintain modestly growing net income over the next two years.

- •At the same time, we affirmed our ‘AA-‘ratings on SLF and its core subsidiaries.

…

“Over the last five years, the company has successfully executed its four-pillar strategy, focusing on its Canadian, Asian, Investment Management and US group benefits businesses.” said S&P Global Ratings credit analyst Peggy Poon. Given the significantly de-risked business risk profile following the successful sale of the U.S. individual annuity business in 2013 and our forecast for Canada’s macroeconomic environment, we believe the company will maintain ‘AAA’ capital adequacy as measured by our model prospectively in addition to modestly growing its net income over the next few years.

Affected issues are SLF.PR.A, SLF.PR.B, SLF.PR.C, SLF.PR.D, SLF.PR.E, SLF.PR.G, SLF.PR.H, SLF.PR.I, SLF.PR.J and SLF.PR.K.

The FixedResets of the company exhibit an Implied Volatility of 18% … which is higher than the high-single-digits I would consider normal for an investment-grade company, but lower than I would expect if the market fully subscribed to my theory that these issues will eventually be subject to a Deemed Retraction.

March 13, 2017

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.5444 % | 2,137.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.5444 % | 3,922.3 |

| Floater | 3.56 % | 3.69 % | 46,591 | 18.11 | 4 | 1.5444 % | 2,260.5 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1567 % | 3,008.2 |

| SplitShare | 4.98 % | 3.75 % | 63,114 | 0.73 | 5 | 0.1567 % | 3,592.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1567 % | 2,803.0 |

| Perpetual-Premium | 5.35 % | 4.59 % | 64,318 | 2.81 | 20 | 0.0098 % | 2,743.8 |

| Perpetual-Discount | 5.15 % | 5.20 % | 96,680 | 15.11 | 18 | 0.1814 % | 2,930.4 |

| FixedReset | 4.40 % | 4.15 % | 229,286 | 6.73 | 98 | 0.4524 % | 2,348.7 |

| Deemed-Retractible | 5.05 % | 0.39 % | 139,870 | 0.20 | 31 | 0.0530 % | 2,855.2 |

| FloatingReset | 2.48 % | 3.24 % | 46,184 | 4.60 | 9 | -0.0053 % | 2,495.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PF.G | FixedReset | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.92 Evaluated at bid price : 23.98 Bid-YTW : 4.29 % |

| SLF.PR.H | FixedReset | 1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.00 Bid-YTW : 6.33 % |

| TD.PF.D | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.74 Evaluated at bid price : 23.63 Bid-YTW : 4.20 % |

| CM.PR.P | FixedReset | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 21.87 Evaluated at bid price : 22.15 Bid-YTW : 4.03 % |

| BAM.PF.B | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 21.42 Evaluated at bid price : 21.75 Bid-YTW : 4.51 % |

| RY.PR.J | FixedReset | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.70 Evaluated at bid price : 23.50 Bid-YTW : 4.17 % |

| MFC.PR.I | FixedReset | 1.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.27 Bid-YTW : 5.24 % |

| MFC.PR.L | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.35 Bid-YTW : 5.94 % |

| BAM.PF.F | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.92 Evaluated at bid price : 23.74 Bid-YTW : 4.35 % |

| MFC.PR.N | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.11 Bid-YTW : 5.51 % |

| MFC.PR.M | FixedReset | 1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.06 Bid-YTW : 5.61 % |

| FTS.PR.G | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 20.83 Evaluated at bid price : 20.83 Bid-YTW : 4.15 % |

| BAM.PF.H | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-31 Maturity Price : 25.00 Evaluated at bid price : 26.75 Bid-YTW : 2.98 % |

| BAM.PF.A | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.78 Evaluated at bid price : 23.19 Bid-YTW : 4.51 % |

| BAM.PF.D | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 23.07 Evaluated at bid price : 23.45 Bid-YTW : 5.22 % |

| BMO.PR.S | FixedReset | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.35 Evaluated at bid price : 22.70 Bid-YTW : 4.02 % |

| CM.PR.O | FixedReset | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.29 Evaluated at bid price : 22.66 Bid-YTW : 4.03 % |

| FTS.PR.M | FixedReset | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.69 Evaluated at bid price : 23.36 Bid-YTW : 4.04 % |

| MFC.PR.K | FixedReset | 1.27 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.48 Bid-YTW : 5.82 % |

| BMO.PR.W | FixedReset | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 21.93 Evaluated at bid price : 22.20 Bid-YTW : 3.99 % |

| BIP.PR.B | FixedReset | 1.37 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.86 Bid-YTW : 4.45 % |

| BAM.PR.K | Floater | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 12.65 Evaluated at bid price : 12.65 Bid-YTW : 3.73 % |

| PWF.PR.T | FixedReset | 1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.64 Evaluated at bid price : 22.99 Bid-YTW : 4.04 % |

| BMO.PR.T | FixedReset | 1.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.12 Evaluated at bid price : 22.43 Bid-YTW : 3.97 % |

| FTS.PR.H | FixedReset | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 16.25 Evaluated at bid price : 16.25 Bid-YTW : 4.16 % |

| MFC.PR.F | FixedReset | 1.55 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.75 Bid-YTW : 9.06 % |

| RY.PR.M | FixedReset | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.57 Evaluated at bid price : 23.36 Bid-YTW : 4.08 % |

| BAM.PR.X | FixedReset | 1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 16.30 Evaluated at bid price : 16.30 Bid-YTW : 4.73 % |

| FTS.PR.K | FixedReset | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 20.76 Evaluated at bid price : 20.76 Bid-YTW : 4.11 % |

| BAM.PR.C | Floater | 1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 12.69 Evaluated at bid price : 12.69 Bid-YTW : 3.72 % |

| BAM.PR.B | Floater | 2.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 12.77 Evaluated at bid price : 12.77 Bid-YTW : 3.69 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BMO.PR.C | FixedReset | 74,168 | YTW SCENARIO Maturity Type : Call Maturity Date : 2022-05-25 Maturity Price : 25.00 Evaluated at bid price : 25.29 Bid-YTW : 4.28 % |

| HSE.PR.G | FixedReset | 65,726 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 23.09 Evaluated at bid price : 24.35 Bid-YTW : 4.82 % |

| FTS.PR.G | FixedReset | 65,034 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 20.83 Evaluated at bid price : 20.83 Bid-YTW : 4.15 % |

| BAM.PF.D | Perpetual-Discount | 41,700 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 23.07 Evaluated at bid price : 23.45 Bid-YTW : 5.22 % |

| RY.PR.Z | FixedReset | 41,293 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.25 Evaluated at bid price : 22.56 Bid-YTW : 3.93 % |

| BAM.PF.G | FixedReset | 35,721 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-13 Maturity Price : 22.92 Evaluated at bid price : 23.98 Bid-YTW : 4.29 % |

| There were 44 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.P | FixedReset | Quote: 15.80 – 16.15 Spot Rate : 0.3500 Average : 0.2183 YTW SCENARIO |

| FTS.PR.F | Perpetual-Discount | Quote: 23.60 – 23.87 Spot Rate : 0.2700 Average : 0.1851 YTW SCENARIO |

| BMO.PR.B | FixedReset | Quote: 26.06 – 26.24 Spot Rate : 0.1800 Average : 0.1023 YTW SCENARIO |

| MFC.PR.B | Deemed-Retractible | Quote: 23.10 – 23.32 Spot Rate : 0.2200 Average : 0.1424 YTW SCENARIO |

| IAG.PR.A | Deemed-Retractible | Quote: 22.70 – 23.00 Spot Rate : 0.3000 Average : 0.2256 YTW SCENARIO |

| BAM.PR.B | Floater | Quote: 12.77 – 13.00 Spot Rate : 0.2300 Average : 0.1677 YTW SCENARIO |

Toronto Rock Lacrosse Tickets: Update #4

I have no more pairs of Toronto Rock Lacrosse tickets to give away!

The fifth lucky winner, who got the tickets for March 25 against the Vancouver Stealth, was Jeremy Tabarrok.

Giveaways this year were:

| Toronto Rock Lacrosse Ticket Giveaway | |

| Date | Opponent |

The games are a lot of fun. One thing that has impressed me is that these guys’ technical skills are so good they can concentrate on strategy … there are a lot fewer loose balls than I remember from my days of box lacrosse at age 10!

There will be more tickets next year!

FTN.PR.A : Annual Report, 2016

Financial 15 Split Inc. has released its Annual Report to November 30, 2016.

| FTN / FTN.PR.A Performance | ||||

| Instrument | One Year |

Three Years |

Five Years |

Ten Years |

| Whole Unit | +16.17% | +13.08% | +17.33% | +3.49% |

| FTN.PR.A | +5.38% | +5.38% | +5.38% | +5.38% |

| FTN | +37.86% | +26.24% | +42.92% | +4.51% |

| S&P/TSX Financial Index | +16.11% | +10.73% | +14.90% | +7.02% |

| S&P 500 Financial Index | +16.49% | +20.17% | +25.71% | +1.27% |

Figures of interest are:

MER: 1.16% of the whole unit value, excluding one time initial offering expenses.

Average Net Assets: We need this to calculate portfolio yield. MER of 1.16% Total Expenses of 3,834,619 implies $331-million net assets. Preferred Share distributions of 9,986,252 @ 0.525 / share implies 19.0-million shares out on average. Average Unit Value (beginning & end of year) = (16.85 + 17.18) / 2 = 17.02. Therefore 19.0-million @ 17.02 = 323-million average net assets. Good agreement between these two methods! Call it 327-million average.

Underlying Portfolio Yield: Dividends received (net of withholding) of 9,514,391 divided by average net assets of 327-million is 2.91%

Income Coverage: Net Investment Income of 5,990,665 divided by Preferred Share Distributions of 9,986,252 is 60%.

BCE.PR.O : Convert or Hold?

It will be recalled that BCE.PR.O will reset to 4.26% effective March 31.

Holders of BCE.PR.O have the option to convert to FloatingResets, which will pay 3-month bills plus 309bp on the par value of $25.00, reset quarterly. The deadline for notifying the company of the intent to convert is 5:00 p.m. (Montréal/Toronto time) on March 16, 2017; but note that this is a company deadline and that brokers will generally set their deadlines a day or two in advance, so there’s not much time to lose if you’re planning to convert! However, if you miss the brokerage deadline they’ll probably do it on a ‘best efforts’ basis if you grovel in a sufficiently entertaining fashion. The ticker for the new FloatingReset, if it is issued, will be BCE.PR.P.

BCE.PR.O came into existence by way of conversion from BAF.PR.C. This was a mandatory exchange following the BCE takeover of Bell Aliant.

BAF.PR.C was a FixedReset, 4.55%+309, that commenced trading 2011-12-7 after being announced 2011-11-21.

The most logical way to analyze the question of whether or not to convert is through the theory of Preferred Pairs, for which a calculator is available. Briefly, a Strong Pair is defined as a pair of securities that can be interconverted in the future (e.g., BCE.PR.O and the FloatingReset BCE.PR.P that will exist if enough holders convert). Since they will be interconvertible on this future date, it may be assumed that they will be priced identically on this date (if they aren’t then holders will simply convert en masse to the higher-priced issue). And since they will be priced identically on a given date in the future, any current difference in price must be offset by expectations of an equal and opposite value of dividends to be received in the interim. And since the dividend rate on one element of the pair is both fixed and known, the implied average rate of the other, floating rate, instrument can be determined. Finally, we say, we may compare these average rates and take a view regarding the actual future course of that rate relative to the implied rate, which will provide us with guidance on which element of the pair is likely to outperform the other until the next interconversion date, at which time the process will be repeated.

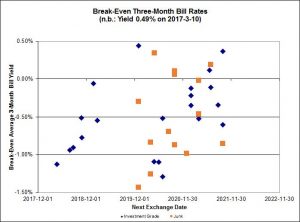

We can show the break-even rates for each FixedReset / FloatingReset Strong Pair graphically by plotting the implied average 3-month bill rate against the next Exchange Date (which is the date to which the average will be calculated).

The market appears to have a distaste at the moment for floating rate product; most of the implied rates until the next interconversion are lower than the current 3-month bill rate and the averages for investment-grade and junk issues are both well below current market rates, at -0.42% and -0.47%, respectively! Whatever might be the result of the next few Bank of Canada overnight rate decisions, I suggest that it is unlikely that the average rate over the next five years will be lower than current – but if you disagree, of course, you may interpret the data any way you like.

Since credit quality of each element of the pair is equal to the other element, it should not make any difference whether the pair examined is investment-grade or junk, although we might expect greater variation of implied rates between junk issues on grounds of lower liquidity, and this is just what we see.

If we plug in the current bid price of the BCE.PR.O FixedReset, we may construct the following table showing consistent prices for its soon-to-be-issued FloatingReset counterpart given a variety of Implied Breakeven yields consistent with issues currently trading:

| Estimate of FloatingReset BCE.PR.P (received in exchange for BCE.PR.O) Trading Price In Current Conditions | |||||

| Assumed FloatingReset Price if Implied Bill is equal to |

|||||

| FixedReset | Bid Price | Spread | 0.00% | -0.50% | -1.00% |

| BCE.PR.O | 23.39 | 309bp | 22.19 | 21.67 | 21.16 |

Based on current market conditions, I suggest that the FloatingResets that will result from conversion are likely to be cheap and trading below the price of their FixedReset counterparts. Therefore, I recommend that holders of BCE.PR.O continue to hold the issue and not to convert. I will note that, given the apparent cheapness of the FloatingResets, it may be a good trade to swap the FixedReset for the FloatingReset in the market once both elements of each pair are trading and you can – presumably, according to this analysis – do it with a reasonably good take-out in price, rather than doing it through the company on a 1:1 basis. But that, of course, will depend on the prices at that time and your forecast for the path of policy rates over the next five years. There are no guarantees – my recommendation is based on the assumption that current market conditions with respect to the pairs will continue until the FloatingResets commence trading and that the relative pricing of the two new pairs will reflect these conditions.

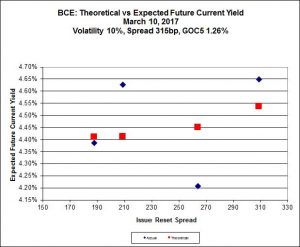

Insofar as the relative valuation of BCE.PR.O is concerned, Implied Volatility analysis indicates it’s a little cheap relative to other BCE issues, but this conclusion may be distorted because BCE.PR.Q is so expensive:

BPO.PR.P : Convert or Hold?

It will be recalled that BPO.PR.P will reset to 4.161% effective April 1.

Holders of BPO.PR.P have the option to convert to FloatingResets, which will pay 3-month bills plus 300bp on the par value of $25.00, reset quarterly. The deadline for notifying the company of the intent to convert is 5:00 p.m. (Toronto time) on March 16, 2017; but note that this is a company deadline and that brokers will generally set their deadlines a day or two in advance, so there’s not much time to lose if you’re planning to convert! However, if you miss the brokerage deadline they’ll probably do it on a ‘best efforts’ basis if you grovel in a sufficiently entertaining fashion. The ticker for the new FloatingReset, if it is issued, will be BPO.PR.Q.

BPO.PR.P is a FixedReset, 5.15%+300, that commenced trading 2010-10-21 after being announced 2010-10-13.

The most logical way to analyze the question of whether or not to convert is through the theory of Preferred Pairs, for which a calculator is available. Briefly, a Strong Pair is defined as a pair of securities that can be interconverted in the future (e.g., BPO.PR.P and the FloatingReset BPO.PR.Q that will exist if enough holders convert). Since they will be interconvertible on this future date, it may be assumed that they will be priced identically on this date (if they aren’t then holders will simply convert en masse to the higher-priced issue). And since they will be priced identically on a given date in the future, any current difference in price must be offset by expectations of an equal and opposite value of dividends to be received in the interim. And since the dividend rate on one element of the pair is both fixed and known, the implied average rate of the other, floating rate, instrument can be determined. Finally, we say, we may compare these average rates and take a view regarding the actual future course of that rate relative to the implied rate, which will provide us with guidance on which element of the pair is likely to outperform the other until the next interconversion date, at which time the process will be repeated.

We can show the break-even rates for each FixedReset / FloatingReset Strong Pair graphically by plotting the implied average 3-month bill rate against the next Exchange Date (which is the date to which the average will be calculated).

The market appears to have a distaste at the moment for floating rate product; most of the implied rates until the next interconversion are lower than the current 3-month bill rate and the averages for investment-grade and junk issues are both well below current market rates, at -0.42% and -0.47%, respectively! Whatever might be the result of the next few Bank of Canada overnight rate decisions, I suggest that it is unlikely that the average rate over the next five years will be lower than current – but if you disagree, of course, you may interpret the data any way you like.

Since credit quality of each element of the pair is equal to the other element, it should not make any difference whether the pair examined is investment-grade or junk, although we might expect greater variation of implied rates between junk issues on grounds of lower liquidity, and this is just what we see.

If we plug in the current bid price of the BPO.PR.P FixedReset, we may construct the following table showing consistent prices for its soon-to-be-issued FloatingReset counterpart given a variety of Implied Breakeven yields consistent with issues currently trading:

| Estimate of FloatingReset BPO.PR.Q (received in exchange for BPO.PR.P) Trading Price In Current Conditions | |||||

| Assumed FloatingReset Price if Implied Bill is equal to |

|||||

| FixedReset | Bid Price | Spread | 0.00% | -0.50% | -1.00% |

| BPO.PR.P | 20.32 | 300bp | 19.15 | 18.65 | 18.15 |

Based on current market conditions, I suggest that the FloatingResets that will result from conversion are likely to be cheap and trading below the price of their FixedReset counterparts. Therefore, I recommend that holders of BPO.PR.P continue to hold the issue and not to convert. I will note that, given the apparent cheapness of the FloatingResets, it may be a good trade to swap the FixedReset for the FloatingReset in the market once both elements of each pair are trading and you can – presumably, according to this analysis – do it with a reasonably good take-out in price, rather than doing it through the company on a 1:1 basis. But that, of course, will depend on the prices at that time and your forecast for the path of policy rates over the next five years. There are no guarantees – my recommendation is based on the assumption that current market conditions with respect to the pairs will continue until the FloatingResets commence trading and that the relative pricing of the two new pairs will reflect these conditions.

Insofar as the relative valuation of BPO.PR.P is concerned, Implied Volatility analysis indicates it’s reasonably priced relative to other BPO issues:

FFH.PR.K : Convert or Hold?

It will be recalled that FFH.PR.K will reset to 4.671% effective April 1.

Holders of FFH.PR.K have the option to convert to FloatingResets, which will pay 3-month bills plus 351bp on the par value of $25.00, reset quarterly. The deadline for notifying the company of the intent to convert is 5:00pm (Toronto time) on March 16, 2017; but note that this is a company deadline and that brokers will generally set their deadlines a day or two in advance, so there’s not much time to lose if you’re planning to convert! However, if you miss the brokerage deadline they’ll probably do it on a ‘best efforts’ basis if you grovel in a sufficiently entertaining fashion. The ticker for the new FloatingReset, if it is issued, will be FFH.PR.L.

FFH.PR.K is a FixedReset, 5.00%+351, that commenced trading 2012-3-21 after being announced 2012-3-12.

The most logical way to analyze the question of whether or not to convert is through the theory of Preferred Pairs, for which a calculator is available. Briefly, a Strong Pair is defined as a pair of securities that can be interconverted in the future (e.g., FFH.PR.K and the FloatingReset FFH.PR.L that will exist if enough holders convert). Since they will be interconvertible on this future date, it may be assumed that they will be priced identically on this date (if they aren’t then holders will simply convert en masse to the higher-priced issue). And since they will be priced identically on a given date in the future, any current difference in price must be offset by expectations of an equal and opposite value of dividends to be received in the interim. And since the dividend rate on one element of the pair is both fixed and known, the implied average rate of the other, floating rate, instrument can be determined. Finally, we say, we may compare these average rates and take a view regarding the actual future course of that rate relative to the implied rate, which will provide us with guidance on which element of the pair is likely to outperform the other until the next interconversion date, at which time the process will be repeated.

We can show the break-even rates for each FixedReset / FloatingReset Strong Pair graphically by plotting the implied average 3-month bill rate against the next Exchange Date (which is the date to which the average will be calculated).

The market appears to have a distaste at the moment for floating rate product; most of the implied rates until the next interconversion are lower than the current 3-month bill rate and the averages for investment-grade and junk issues are both well below current market rates, at -0.42% and -0.47%, respectively! Whatever might be the result of the next few Bank of Canada overnight rate decisions, I suggest that it is unlikely that the average rate over the next five years will be lower than current – but if you disagree, of course, you may interpret the data any way you like.

Since credit quality of each element of the pair is equal to the other element, it should not make any difference whether the pair examined is investment-grade or junk, although we might expect greater variation of implied rates between junk issues on grounds of lower liquidity, and this is just what we see.

If we plug in the current bid price of the FFH.PR.K FixedReset, we may construct the following table showing consistent prices for its soon-to-be-issued FloatingReset counterpart given a variety of Implied Breakeven yields consistent with issues currently trading:

| Estimate of FloatingReset FFH.PR.L (received in exchange for FFH.PR.K) Trading Price In Current Conditions | |||||

| Assumed FloatingReset Price if Implied Bill is equal to |

|||||

| FixedReset | Bid Price | Spread | 0.00% | -0.50% | -1.00% |

| FFH.PR.K | 22.69 | 351bp | 21.52 | 21.02 | 20.52 |

Based on current market conditions, I suggest that the FloatingResets that will result from conversion are likely to be cheap and trading below the price of their FixedReset counterparts. Therefore, I recommend that holders of FFH.PR.K continue to hold the issue and not to convert. I will note that, given the apparent cheapness of the FloatingResets, it may be a good trade to swap the FixedReset for the FloatingReset in the market once both elements of each pair are trading and you can – presumably, according to this analysis – do it with a reasonably good take-out in price, rather than doing it through the company on a 1:1 basis. But that, of course, will depend on the prices at that time and your forecast for the path of policy rates over the next five years. There are no guarantees – my recommendation is based on the assumption that current market conditions with respect to the pairs will continue until the FloatingResets commence trading and that the relative pricing of the two new pairs will reflect these conditions.

Insofar as the relative valuation of FFH.PR.K is concerned, Implied Volatility analysis indicates it’s reasonably priced relative to other FFH issues, although FFH.PR.C seems so expensive it may be distorting the results:

BAM.PR.T : Convert or Hold?

It will be recalled that BAM.PR.T will reset to 3.471% effective April 1.

Holders of BAM.PR.T have the option to convert to FloatingResets, which will pay 3-month bills plus 231bp on the par value of $25.00, reset quarterly. The deadline for notifying the company of the intent to convert is 5:00 p.m. (Toronto time) on March 16, 2017; but note that this is a company deadline and that brokers will generally set their deadlines a day or two in advance, so there’s not much time to lose if you’re planning to convert! However, if you miss the brokerage deadline they’ll probably do it on a ‘best efforts’ basis if you grovel in a sufficiently entertaining fashion. The ticker for the new FloatingReset, if it is issued, will be BAM.PR.W

BAM.PR.T is a FixedReset, 4.50%+231, that commenced trading 2010-10-29 after being announced 2010-10-21.

The most logical way to analyze the question of whether or not to convert is through the theory of Preferred Pairs, for which a calculator is available. Briefly, a Strong Pair is defined as a pair of securities that can be interconverted in the future (e.g., BAM.PR.T and the FloatingReset BAM.PR.W that will exist if enough holders convert). Since they will be interconvertible on this future date, it may be assumed that they will be priced identically on this date (if they aren’t then holders will simply convert en masse to the higher-priced issue). And since they will be priced identically on a given date in the future, any current difference in price must be offset by expectations of an equal and opposite value of dividends to be received in the interim. And since the dividend rate on one element of the pair is both fixed and known, the implied average rate of the other, floating rate, instrument can be determined. Finally, we say, we may compare these average rates and take a view regarding the actual future course of that rate relative to the implied rate, which will provide us with guidance on which element of the pair is likely to outperform the other until the next interconversion date, at which time the process will be repeated.

We can show the break-even rates for each FixedReset / FloatingReset Strong Pair graphically by plotting the implied average 3-month bill rate against the next Exchange Date (which is the date to which the average will be calculated).

The market appears to have a distaste at the moment for floating rate product; most of the implied rates until the next interconversion are lower than the current 3-month bill rate and the averages for investment-grade and junk issues are both well below current market rates, at -0.42% and -0.47%, respectively! Whatever might be the result of the next few Bank of Canada overnight rate decisions, I suggest that it is unlikely that the average rate over the next five years will be lower than current – but if you disagree, of course, you may interpret the data any way you like.

Since credit quality of each element of the pair is equal to the other element, it should not make any difference whether the pair examined is investment-grade or junk, although we might expect greater variation of implied rates between junk issues on grounds of lower liquidity, and this is just what we see.

If we plug in the current bid price of the BAM.PR.T FixedReset, we may construct the following table showing consistent prices for its soon-to-be-issued FloatingReset counterpart given a variety of Implied Breakeven yields consistent with issues currently trading:

| Estimate of FloatingReset BAM.PR.W (received in exchange for BAM.PR.T) Trading Price In Current Conditions | |||||

| Assumed FloatingReset Price if Implied Bill is equal to |

|||||

| FixedReset | Bid Price | Spread | 0.00% | -0.50% | -1.00% |

| BAM.PR.T | 19.00 | 231bp | 17.81 | 17.29 | 16.78 |

Based on current market conditions, I suggest that the FloatingResets that will result from conversion are likely to be cheap and trading below the price of their FixedReset counterparts. Therefore, I recommend that holders of BAM.PR.T continue to hold the issue and not to convert. I will note that, given the apparent cheapness of the FloatingResets, it may be a good trade to swap the FixedReset for the FloatingReset in the market once both elements of each pair are trading and you can – presumably, according to this analysis – do it with a reasonably good take-out in price, rather than doing it through the company on a 1:1 basis. But that, of course, will depend on the prices at that time and your forecast for the path of policy rates over the next five years. There are no guarantees – my recommendation is based on the assumption that current market conditions with respect to the pairs will continue until the FloatingResets commence trading and that the relative pricing of the two new pairs will reflect these conditions.

Insofar as the relative valuation of BAM.PR.T is concerned, Implied Volatility analysis indicates it’s quite cheap relative to other BAM issues:

March 10, 2017

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3237 % | 2,105.1 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3237 % | 3,862.7 |

| Floater | 3.59 % | 3.80 % | 47,007 | 17.77 | 4 | 0.3237 % | 2,226.1 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0313 % | 3,003.5 |

| SplitShare | 4.98 % | 3.82 % | 64,088 | 0.74 | 5 | -0.0313 % | 3,586.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0313 % | 2,798.6 |

| Perpetual-Premium | 5.35 % | 4.61 % | 65,302 | 2.82 | 20 | 0.0978 % | 2,743.5 |

| Perpetual-Discount | 5.15 % | 5.21 % | 97,692 | 15.06 | 18 | 0.1245 % | 2,925.0 |

| FixedReset | 4.41 % | 4.17 % | 229,614 | 6.71 | 98 | 0.6490 % | 2,338.1 |

| Deemed-Retractible | 5.05 % | 0.68 % | 139,580 | 0.21 | 31 | -0.0885 % | 2,853.7 |

| FloatingReset | 2.48 % | 3.20 % | 46,867 | 4.61 | 9 | 0.3082 % | 2,495.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BIP.PR.B | FixedReset | -1.16 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.51 Bid-YTW : 4.84 % |

| MFC.PR.K | FixedReset | 1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.21 Bid-YTW : 6.00 % |

| CM.PR.Q | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.75 Evaluated at bid price : 23.64 Bid-YTW : 4.19 % |

| TRP.PR.F | FloatingReset | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 18.69 Evaluated at bid price : 18.69 Bid-YTW : 3.21 % |

| RY.PR.H | FixedReset | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.08 Evaluated at bid price : 22.37 Bid-YTW : 4.00 % |

| MFC.PR.L | FixedReset | 1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.11 Bid-YTW : 6.10 % |

| CU.PR.C | FixedReset | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 21.62 Evaluated at bid price : 21.99 Bid-YTW : 4.17 % |

| BAM.PF.F | FixedReset | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.92 Evaluated at bid price : 23.75 Bid-YTW : 4.42 % |

| MFC.PR.H | FixedReset | 1.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.23 Bid-YTW : 4.89 % |

| BMO.PR.T | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 21.66 Evaluated at bid price : 22.10 Bid-YTW : 4.02 % |

| BNS.PR.Z | FixedReset | 1.18 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.28 Bid-YTW : 4.75 % |

| SLF.PR.I | FixedReset | 1.18 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.10 Bid-YTW : 5.04 % |

| TRP.PR.G | FixedReset | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.74 Evaluated at bid price : 23.70 Bid-YTW : 4.33 % |

| HSE.PR.C | FixedReset | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.61 Evaluated at bid price : 23.25 Bid-YTW : 4.71 % |

| GWO.PR.N | FixedReset | 1.24 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.50 Bid-YTW : 9.24 % |

| TD.PF.C | FixedReset | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 21.95 Evaluated at bid price : 22.25 Bid-YTW : 4.01 % |

| PWF.PR.P | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 15.73 Evaluated at bid price : 15.73 Bid-YTW : 4.43 % |

| BAM.PR.Z | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.13 Evaluated at bid price : 22.80 Bid-YTW : 4.71 % |

| SLF.PR.G | FixedReset | 1.32 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.93 Bid-YTW : 8.10 % |

| NA.PR.S | FixedReset | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.50 Evaluated at bid price : 22.79 Bid-YTW : 4.09 % |

| IFC.PR.A | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.66 Bid-YTW : 6.81 % |

| BMO.PR.Q | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.82 Bid-YTW : 4.84 % |

| NA.PR.W | FixedReset | 1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 21.85 Evaluated at bid price : 22.12 Bid-YTW : 4.06 % |

| TRP.PR.C | FixedReset | 1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 16.31 Evaluated at bid price : 16.31 Bid-YTW : 4.18 % |

| IAG.PR.G | FixedReset | 1.57 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.35 Bid-YTW : 5.14 % |

| FTS.PR.M | FixedReset | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.52 Evaluated at bid price : 23.08 Bid-YTW : 4.10 % |

| PWF.PR.T | FixedReset | 1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.34 Evaluated at bid price : 22.66 Bid-YTW : 4.10 % |

| FTS.PR.K | FixedReset | 2.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 20.40 Evaluated at bid price : 20.40 Bid-YTW : 4.18 % |

| TRP.PR.B | FixedReset | 2.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 14.99 Evaluated at bid price : 14.99 Bid-YTW : 4.15 % |

| FTS.PR.G | FixedReset | 2.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 20.59 Evaluated at bid price : 20.59 Bid-YTW : 4.20 % |

| TRP.PR.A | FixedReset | 3.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 19.26 Evaluated at bid price : 19.26 Bid-YTW : 4.16 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BMO.PR.C | FixedReset | 512,464 | YTW SCENARIO Maturity Type : Call Maturity Date : 2022-05-25 Maturity Price : 25.00 Evaluated at bid price : 25.31 Bid-YTW : 4.25 % |

| GWO.PR.H | Deemed-Retractible | 82,942 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.45 Bid-YTW : 5.83 % |

| TD.PF.E | FixedReset | 77,058 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.96 Evaluated at bid price : 24.15 Bid-YTW : 4.16 % |

| RY.PR.G | Deemed-Retractible | 70,800 | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-04-09 Maturity Price : 25.00 Evaluated at bid price : 25.16 Bid-YTW : -1.19 % |

| BAM.PR.T | FixedReset | 62,467 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 19.00 Evaluated at bid price : 19.00 Bid-YTW : 4.80 % |

| TD.PF.D | FixedReset | 58,416 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-03-10 Maturity Price : 22.62 Evaluated at bid price : 23.39 Bid-YTW : 4.24 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BIP.PR.B | FixedReset | Quote: 25.51 – 25.86 Spot Rate : 0.3500 Average : 0.2216 YTW SCENARIO |

| VNR.PR.A | FixedReset | Quote: 21.24 – 21.70 Spot Rate : 0.4600 Average : 0.3408 YTW SCENARIO |

| IFC.PR.C | FixedReset | Quote: 22.20 – 22.59 Spot Rate : 0.3900 Average : 0.2744 YTW SCENARIO |

| BMO.PR.S | FixedReset | Quote: 22.43 – 22.69 Spot Rate : 0.2600 Average : 0.1774 YTW SCENARIO |

| RY.PR.M | FixedReset | Quote: 23.00 – 23.19 Spot Rate : 0.1900 Average : 0.1189 YTW SCENARIO |

| SLF.PR.B | Deemed-Retractible | Quote: 23.75 – 23.99 Spot Rate : 0.2400 Average : 0.1727 YTW SCENARIO |

MFC.PR.H: No Conversion to FloatingReset

Manulife Financial Corporation has announced:

that after having taken into account all election notices received by the March 6, 2017 deadline for conversion of its currently outstanding 10,000,000 Non-cumulative Rate Reset Class 1 Shares Series 7 (the “Series 7 Preferred Shares”) (TSX: MFC.PR.H) into Non-cumulative Floating Rate Class 1 Shares Series 8 of Manulife (the “Series 8 Preferred Shares”), the holders of Series 7 Preferred Shares are not entitled to convert their Series 7 Preferred Shares into Series 8 Preferred Shares. There were 464,172 Series 7 Preferred Shares elected for conversion, which is less than the minimum one million shares required to give effect to conversions into Series 8 Preferred Shares.

As announced by Manulife on February 21, 2017, after March 19, 2017, holders of Series 7 Preferred Shares will be entitled to receive fixed rate non-cumulative preferential cash dividends on a quarterly basis, as and when declared by the Board of Directors of Manulife and subject to the provisions of the Insurance Companies Act (Canada). The dividend rate for the five-year period commencing on March 20, 2017, and ending on March 19, 2022, will be 4.31200% per annum or $0.269500 per share per quarter, being equal to the sum of the five-year Government of Canada bond yield as at February 21, 2017, plus 3.13%, as determined in accordance with the terms of the Series 7 Preferred Shares.

Subject to certain conditions described in the prospectus supplement dated February 14, 2012 relating to the issuance of the Series 7 Preferred Shares, Manulife may redeem the Series 7 Preferred Shares, in whole or in part, on March 19, 2022 and on March 19 every five years thereafter.

So MFC.PR.H is now a FixedReset, 4.312%+313, that commenced trading 2012-2-22 after being announced 2012-2-14.

Assiduous Readers will remember that I recommended against conversion following the announcement of the new rate and the notice of extension.