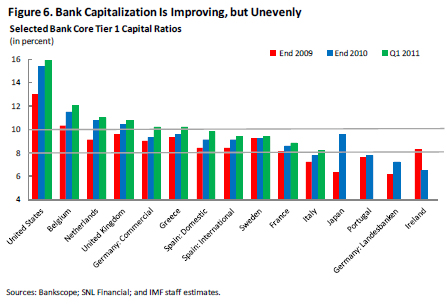

The IMF has released the Global Financial Stability Report for June 2011. To the disappointment of many, it did not include a centrefold, but I found one chart particularly interesting:

Click for Big

Click for BigIreland is going to allow some banks’ senior debt to default:

Irish Finance Minister Michael Noonan said Wednesday he has sought the support of the International Monetary Fund in Washington to bring a radical new plan to the European Union to impose significant losses on senior bond holders in Anglo Irish Bank Corp. and Irish Nationwide Building Society–the country’s two most troubled lenders.

…

Noonan told the IMF that Anglo Irish and Irish Nationwide are not “real” banks because the lenders are in the process of being wound down, and that senior bondholders should have to share in the losses of “speculative” investments with Irish taxpayers.

…

According to Irish central bank figures, at the end of March there were EUR3.15 billion unguaranteed senior bonds outstanding in Anglo Irish and only EUR601 million left in Irish Nationwide.

Analysts say savings from the proposed burden-sharing will therefore go nowhere near offsetting the EUR34.5 billion the Irish authorities have injected into Anglo Irish and Irish Nationwide, the two lenders at the heart of Ireland’s inter-linked banking and sovereign-debt crises. The cost of rescuing all six broken Irish lenders will likely top EUR70 billion when capitalizations are completed this year.

Noonan, appointed finance minister to the new coalition government in March, has in the past said he was prevented by the ECB from pushing burden sharing on senior bond holders in any of the broken Irish banks.

This puts Ireland on a collision course with the ECB:

For Mr. Noonan to get his way, he needs to persuade European Union leaders and the European Central Bank to break the great commandant since the onset of Europe’s debt crisis in 2008: thou shalt not burn senior bond holders in European banks.

The ECB has been particularly trenchant on the point. It told the new Irish government soon after it swept to power in mid-March (Thursday marked the administration’s first one hundred days) not to ever consider under any circumstance forcing losses on senior bond holders for fear of worsening Europe’s debt crisis.

This politicization of the bankruptcy process is going to be very harmful in the end. How? I don’t know how. It might be something subtle, like increasing European bank funding costs by X bp for the next thirty years. Or it could be more exciting. I don’t know. But I do know that 300 years of bankruptcy law exists for a reason and when you throw it out for reasons of temporary expediency, you’re almost certainly going to make matters worse.

Meanwhile:

Moody’s Investors Service Friday said it may cut Italy’s sovereign credit rating from Aa2, citing such challenges as reforming a rigid labour market while also facing the likelihood of rising interest rates.

It looks like the Canadian financial oligopoly may be losing influence! Glass-Lewis prefers the LSE-TMX deal over the boys’ club bid:

Influential shareholder-advisory firm Glass Lewis is advising TMX Group Inc.(X-T43.300.310.72%) shareholders to vote in favour of a plan to combine with London Stock Exchange Group Inc., saying it’s less risky than a competing takeover for TMX put forward by a consortium of Canadian financial institutions calling themselves Maple Group.

…

Glass Lewis’s opinion matters in takeovers because many investment firms rely on the firm’s research to aid in making decisions on shareholder votes. For that reason, the recommendation may sway some votes in LSE’s favour.

It’s a little odd – Glass Lewis is an international firm, lowering the chance that their recommendation is influenced by the Canadian requirement to cooperate with the bank/regulatory complex. On the other hand, they’re owned by Ontario Teachers, which is a member of the club in good standing.

More angst over capital rules:

Bank of America Corp. (BAC) Chief Executive Officer Brian T. Moynihan said excessive capital surcharges on the largest banks could limit lending and discourage investors from funding the industry.

…

The Basel Committee on Banking Supervision is considering a capital surcharge of as much as 3.5 percentage points on the largest banks if they get bigger, according to two people familiar with the talks.

Draft plans circulated before a meeting next week would subject banks to a sliding scale depending on their size and links to other lenders, said the people, who declined to be identified because the proposals aren’t public.

Interesting piece about the Sino-Forest takedown:

Four days after attacking Canada’s largest forestry firm, Carson Block finally faced investors and analysts on a conference call Monday.

One caller, who sounded very upset, asked an obvious question: In preparing his infamous report on Sino-Forest Corp., how much time did he spend speaking with the company?

Mr. Block wasn’t rattled. He calmly stated that he spoke with Sino’s investor relations executive for a maximum of two and a half hours, and that she seemed knowledgeable on the company.

If the line had been open to all callers, the gasp would have been audible as everyone absorbed the same information: This guy wiped out more than $3-billion of shareholder value from a company he spoke to for only a couple of hours.

Shocking. He actually went out and did field research instead of copying down what the company’s IR staff told him! Such things should not be allowed! The story is highly deficient in at least one respect:

According to experts, investors trusted Mr. Block for two reasons: Sino-Forest’s history of poor transparency that lent credibility to his claims, and the fact that whistle blowers are so often right in these situations. From Enron to Bernie Madoff (famously cited in the first line of Mr. Block’s report), the lone wolf in the wilderness is often correct.

It looks like the writer belongs to the Sell Side School of Analysis – but some people have been digging:

Muddy Waters Research, a firm specializing in finding Chinese companies it believes are frauds, shorts the firms’ shares and publicizes the charges on its website.

So far it has made money on its first five bets.

…

Muddy Waters’ track record is based on a Reuters analysis of the published research that is available on the firm’s website. It is not clear whether Muddy Waters or its director of research Carson Block have made other research calls or taken other positions.

…

Of the five companies Muddy Waters is known to have advised investors to sell, with all asserting some level of accounting irregularities, two have been delisted from the Nasdaq and one has not traded since April.

Of the two that continue to trade, neither has come anywhere close to approaching the levels they changed hands at before the reports.

I suggest that another reason some investors are considering the Muddy Waters analysis credible is because of his track record (which may be selective; but five take-downs is a pretty good career). But I’m not an expert.

Whether the Sino-Forest call is correct or not is something on which I have zero expertise (and, frankly, not really a lot of interest). But Mr. Block said it best:

Mr. Block, for his part, has no trouble explaining potential cracks in the financial system. He describes the capital markets as a “hot potato” where the various groups (auditors, bankers, lawyers, etc.) pass the blame to each other when the system suddenly fails. “The gatekeepers whom investors think are providing protection against fraudulent listings don’t function as they should,” he says.

Rob Carrick has a good article on fee-based accounts:

Investors are going to have to become familiar with fee-based accounts because they’re gradually taking over in the advice business. The analysis firm Investor Economics reports that the share of fee-based assets had grown to 48 per cent in the full-service brokerage business as of March 31 from 36 per cent five years ago.

I think fee-based accounts are a great thing, provided:

- The account manager is a fiduciary

- The account manager handles only fee based accounts and doesn’t get a dime from anybody for transactions

- The track record is published

- The advisor’s company accepts only fee-based accounts

Union Gas issued 30-year notes at 4.88%.

It was a yellow-letter day for some investors!

| YLO Issues, 2011-6-17 |

| Ticker |

Quote

6/16 |

Quote

6/17 |

Bid YTW

6/17 |

YTW

Scenario

6/17 |

Performance

6/17

(bid/bid) |

| YLO.PR.A |

23.10-15 |

23.46-59 |

8.53% |

Soft Maturity

2012-12-30 |

+1.56% |

| YLO.PR.B |

15.51-68 |

15.70-75 |

14.50% |

Soft Maturity

2017-06-29 |

+1.22% |

| YLO.PR.C |

13.36-45 |

14.80-90 |

10.96% |

Limit Maturity |

+10.78% |

| YLO.PR.D |

13.61-65 |

15.01-26 |

11.04% |

Limit Maturity |

+10.29% |

There’s a lot of weeping and wailing about the Vancouver riot, with questions being asked about what went wrong. I’ll answer them – society has gone wrong. We impose so ridiculous constraints on public conduct nowadays – right, Anthony Weiner? – that occasionally things blow up. A kid who has gotten into trouble at school – fairly serious trouble – for throwing a snowball at a wall (as has one kid I know) is going to long for a day of no rules. It’s exactly the same process that makes the Internet such a troll zone.

It was a poor day on the Canadian preferred share market, with PerpetualDiscounts down 15bp, FixedResets losing 13bp and DeemedRetractibles off 1bp. Volume was good.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1516 % |

2,468.1 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1516 % |

3,712.0 |

| Floater |

2.45 % |

2.22 % |

39,732 |

21.75 |

4 |

-0.1516 % |

2,664.9 |

| OpRet |

4.88 % |

2.88 % |

67,102 |

0.92 |

9 |

0.1119 % |

2,431.9 |

| SplitShare |

5.25 % |

-0.07 % |

62,040 |

0.49 |

6 |

0.0444 % |

2,497.4 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.1119 % |

2,223.7 |

| Perpetual-Premium |

5.66 % |

5.12 % |

144,213 |

1.38 |

12 |

0.0674 % |

2,075.1 |

| Perpetual-Discount |

5.47 % |

5.60 % |

119,218 |

14.40 |

18 |

-0.1544 % |

2,174.3 |

| FixedReset |

5.16 % |

3.31 % |

198,584 |

2.84 |

57 |

-0.1325 % |

2,308.3 |

| Deemed-Retractible |

5.08 % |

4.89 % |

297,058 |

8.17 |

47 |

-0.0120 % |

2,151.6 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| GWO.PR.J |

FixedReset |

-5.78 % |

Meaningless. The issue traded 132,519 shares in a range of 26.81-00 before “lasting” at 25.12-27.00. Remember that given the shoddy data dissemination of the TMX, “lasting” is not necessarily the same as “closing” … but I haven’t checked, since “Trades & Quotes” isn’t updated ’till midnight.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.12

Bid-YTW : 5.39 % |

| MFC.PR.C |

Deemed-Retractible |

-1.08 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 22.04

Bid-YTW : 6.06 % |

| IAG.PR.E |

Deemed-Retractible |

1.01 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2019-01-30

Maturity Price : 25.00

Evaluated at bid price : 26.01

Bid-YTW : 5.35 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| GWO.PR.J |

FixedReset |

132,519 |

Nesbitt crossed blocks of 30,000 and 100,000, both at 26.94.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.12

Bid-YTW : 5.39 % |

| BNS.PR.P |

FixedReset |

104,360 |

Nesbitt crossed 90,000 at 26.15.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 25.00

Evaluated at bid price : 26.14

Bid-YTW : 2.84 % |

| RY.PR.T |

FixedReset |

84,569 |

RBC crossed three blocks of 25,000 each, all at 27.45.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-09-23

Maturity Price : 25.00

Evaluated at bid price : 27.30

Bid-YTW : 3.40 % |

| RY.PR.C |

Deemed-Retractible |

77,590 |

Nesbitt crossed 30,000 at 24.42. RBC crossed blocks of 13,300 and 25,000, both at 24.50.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.44

Bid-YTW : 4.94 % |

| TRP.PR.B |

FixedReset |

66,360 |

National crossed blcoks of 20,000 and 35,000, both at 25.20.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-06-17

Maturity Price : 25.11

Evaluated at bid price : 25.16

Bid-YTW : 3.51 % |

| BNS.PR.Y |

FixedReset |

63,158 |

National crossed 45,000 at 25.45.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.41

Bid-YTW : 3.29 % |

| There were 37 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| GWO.PR.J |

FixedReset |

Quote: 25.12 – 27.00

Spot Rate : 1.8800

Average : 1.1461

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.12

Bid-YTW : 5.39 % |

| POW.PR.A |

Perpetual-Discount |

Quote: 24.80 – 25.10

Spot Rate : 0.3000

Average : 0.1890

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-06-17

Maturity Price : 24.55

Evaluated at bid price : 24.80

Bid-YTW : 5.74 % |

| ALB.PR.B |

SplitShare |

Quote: 22.30 – 22.69

Spot Rate : 0.3900

Average : 0.2852

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-03-29

Maturity Price : 21.80

Evaluated at bid price : 22.30

Bid-YTW : 1.54 % |

| BAM.PR.O |

OpRet |

Quote: 25.91 – 26.33

Spot Rate : 0.4200

Average : 0.3165

YTW SCENARIO

Maturity Type : Option Certainty

Maturity Date : 2013-06-30

Maturity Price : 25.00

Evaluated at bid price : 25.91

Bid-YTW : 3.07 % |

| CM.PR.I |

Deemed-Retractible |

Quote: 25.01 – 25.20

Spot Rate : 0.1900

Average : 0.1131

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.01

Bid-YTW : 4.80 % |

| GWO.PR.M |

Deemed-Retractible |

Quote: 25.32 – 25.55

Spot Rate : 0.2300

Average : 0.1589

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2019-04-30

Maturity Price : 25.00

Evaluated at bid price : 25.32

Bid-YTW : 5.61 % |