Goldman may be showing the same cut-throat ruthlessness in its personnel policy as it shows in its customer relations:

Goldman Sachs Group Inc. said the U.S. fraud case against the firm hinges on the actions of the employee it placed on paid leave this week.

Fabrice Tourre, the 31-year-old Goldman Sachs executive director who was accused of misleading investors about a mortgage-linked investment in 2007, will also be de-registered from the Financial Services Authority, a spokeswoman at the firm in London said yesterday.

“It’s all going to be a factual dispute about what he remembers and what the other folks remember on the other side,” Greg Palm, Goldman Sachs’s co-general counsel, said in a call with reporters yesterday, without naming Tourre. “If we had evidence that someone here was trying to mislead someone, that’s not something we’d condone at all and we’d be the first one to take action.”

By characterizing the case as a dispute involving a single employee, Goldman Sachs may be taking its first steps to publically distance itself from Tourre in the case, some lawyers said. That could reduce bad publicity and ultimately make it easier for the company to settle the case.

Very surprising, if true. Regulatory announcements and responses are generally well-orchestrated, with all parties concerned knowing what’s going to happen by the time an issue becomes public; but after two days of honourable conduct by management, it loos like Tourre’s being thrown to the wolves.

There are rumours that Tourre has agreed to testify to a US Senate panel; there is no word on whether anybody from, you know, the Selection Agent will be asked any questions like, f’rinstance: why did you agree to buy this stuff?

In the meantime, Rabobank has sued Merrill regarding similar allegations, which seems to me to be an admission that Rabobank is completely incapable of evaluating a potential investment.

Paulson has addressed investor concerns regarding the issue. In 2007, Paulson wasn’t seen as a member of the Savvy Investor Club (I presume they didn’t have enough employees from the right schools) and the Smart Money was more than happy to bet against them:

Mr. Paulson sent a letter to investors Tuesday night saying that in 2007 his firm wasn’t seen as an experienced mortgage investor, and that “many of the most sophisticated investors in the world” were “more than willing to bet against us.”

…

On the conference call, Mr. Paulson calmly explained the trade with Goldman, which involved a “short” bet on mortgage bonds. He said that the very nature of the transaction required both a “long” and “short” investor, suggesting that investors knew that a bearish investor had bet against the deal.Mr. Paulson suggested to clients that the large investors who purchased the Goldman deal and others relied on rating firms, and didn’t do enough of their homework, investors say.

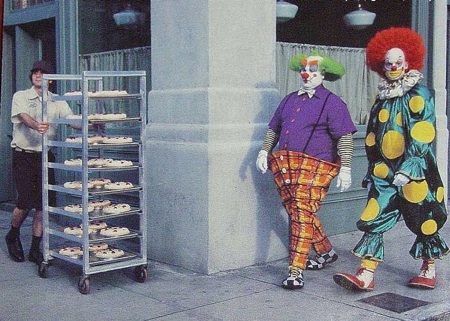

For those of you who don’t understand the whole Goldman / ACA / Paulson / Rabobank / Merrill / regulators / government thing, here’s a helpful graphic illustrating the financial world in mid-2007:

The spread on Greek bonds hit an all-time high:

The yield on the Greek 10-year bond surpassed 8 percent today, the highest in more than a decade and more than twice the comparable German rate. The spread, or difference between the security and bunds, Europe’s benchmark government securities, climbed to an all-time high of 521 basis points.

This is all happening as US debt issuance is cresting:

The U.S. Treasury may sell an unprecedented $128 billion in notes next week as expectations increase that the amount of securities auctioned by the government is peaking with the economy strengthening.

The U.S. will sell $44 billion in two-year notes, $42 billion in five-year securities, $32 billion in debt maturing in seven years and $10 billion in five-year Treasury Inflation Protected Securities, according to the average estimate of nine primary dealers in a Bloomberg News survey. The $118 billion in nominal debt matches a record. The U.S. will announce the amounts tomorrow for the auctions conducted over four days beginning April 26.

Good interview on the Queers Against Israeli Apartheid thing that was mentioned yesterday; at best – at absolute best – this is a cat-fight between competing visions of the Pride Parade, in which city bureaucrats have been stupid enough to become involved. It’s strictly an internal matter for Pride. In fact, the Pride parade ceased to have much to do with Gay Pride years ago – nowadays it’s a celebration of sex, the kinkier the better. Ah, to be twenty again! Not that this little news-stream has much to do with finance, of course, but I reserve the right to go off on tangents occasionally whenever I find something particularly annoying.

It was a very rough day for the Canadian preferred share market, with PerpetualDiscounts losing 60bp and FixedResets down 83bp (!) bringing the median weighted average yield on the latter index up to 4.38%, a level not seen since the beginning of July, 2009. Volume was exceptionally high and the Volume Highlights table is split equally between FixedResets and PerpetualDiscounts.

PerpetualDiscounts now yield 6.26%, equivalent to 8.76% interest at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.7% (maybe just a little more?) so the Pre-Tax Interest-Equivalent Spread (also called the Seniority Spread) is now about 305bp, up substantially from the 295bp reported April 14 and pushing the high of 310bp reported April 7.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.61 % | 2.73 % | 53,358 | 20.85 | 1 | -1.3699 % | 2,117.9 |

| FixedFloater | 4.89 % | 2.96 % | 48,529 | 20.44 | 1 | 0.0901 % | 3,271.8 |

| Floater | 1.92 % | 1.67 % | 48,563 | 23.45 | 4 | 0.0832 % | 2,410.6 |

| OpRet | 4.91 % | 3.77 % | 99,709 | 0.51 | 10 | -0.3974 % | 2,298.3 |

| SplitShare | 6.35 % | 2.89 % | 139,884 | 0.08 | 2 | -0.1312 % | 2,148.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3974 % | 2,101.6 |

| Perpetual-Premium | 5.90 % | 4.79 % | 30,752 | 15.82 | 2 | -0.7903 % | 1,828.0 |

| Perpetual-Discount | 6.21 % | 6.26 % | 202,614 | 13.54 | 76 | -0.6027 % | 1,716.6 |

| FixedReset | 5.54 % | 4.38 % | 498,410 | 3.63 | 44 | -0.8348 % | 2,135.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.E | FixedReset | -3.57 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.65 Bid-YTW : 5.13 % |

| IGM.PR.B | Perpetual-Discount | -2.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 23.10 Evaluated at bid price : 23.25 Bid-YTW : 6.38 % |

| IAG.PR.C | FixedReset | -2.05 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.25 Bid-YTW : 4.87 % |

| MFC.PR.B | Perpetual-Discount | -1.99 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.68 Evaluated at bid price : 18.68 Bid-YTW : 6.31 % |

| GWO.PR.H | Perpetual-Discount | -1.97 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 19.41 Evaluated at bid price : 19.41 Bid-YTW : 6.32 % |

| HSB.PR.E | FixedReset | -1.91 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.69 Bid-YTW : 5.02 % |

| SLF.PR.F | FixedReset | -1.83 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.31 Bid-YTW : 4.79 % |

| POW.PR.D | Perpetual-Discount | -1.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 19.66 Evaluated at bid price : 19.66 Bid-YTW : 6.42 % |

| GWO.PR.J | FixedReset | -1.68 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.40 Bid-YTW : 4.49 % |

| CIU.PR.B | FixedReset | -1.61 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-01 Maturity Price : 25.00 Evaluated at bid price : 27.51 Bid-YTW : 4.38 % |

| HSB.PR.C | Perpetual-Discount | -1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 20.20 Evaluated at bid price : 20.20 Bid-YTW : 6.39 % |

| TD.PR.G | FixedReset | -1.55 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 4.57 % |

| RY.PR.B | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 6.03 % |

| RY.PR.T | FixedReset | -1.48 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 4.51 % |

| CM.PR.K | FixedReset | -1.42 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.67 Bid-YTW : 4.66 % |

| BAM.PR.M | Perpetual-Discount | -1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 16.87 Evaluated at bid price : 16.87 Bid-YTW : 7.13 % |

| BAM.PR.E | Ratchet | -1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 22.64 Evaluated at bid price : 21.60 Bid-YTW : 2.73 % |

| BAM.PR.N | Perpetual-Discount | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 16.85 Evaluated at bid price : 16.85 Bid-YTW : 7.14 % |

| TD.PR.K | FixedReset | -1.33 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.75 Bid-YTW : 4.46 % |

| RY.PR.W | Perpetual-Discount | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 20.14 Evaluated at bid price : 20.14 Bid-YTW : 6.09 % |

| RY.PR.P | FixedReset | -1.30 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.59 Bid-YTW : 4.38 % |

| GWO.PR.L | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 22.50 Evaluated at bid price : 22.61 Bid-YTW : 6.32 % |

| TD.PR.I | FixedReset | -1.25 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.76 Bid-YTW : 4.45 % |

| RY.PR.R | FixedReset | -1.22 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.70 Bid-YTW : 4.28 % |

| CM.PR.I | Perpetual-Discount | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.87 Evaluated at bid price : 18.87 Bid-YTW : 6.26 % |

| NA.PR.M | Perpetual-Premium | -1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 23.86 Evaluated at bid price : 24.06 Bid-YTW : 6.24 % |

| POW.PR.C | Perpetual-Discount | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 22.51 Evaluated at bid price : 22.79 Bid-YTW : 6.41 % |

| PWF.PR.K | Perpetual-Discount | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 19.49 Evaluated at bid price : 19.49 Bid-YTW : 6.39 % |

| BNS.PR.K | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 19.77 Evaluated at bid price : 19.77 Bid-YTW : 6.11 % |

| PWF.PR.M | FixedReset | -1.12 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 26.40 Bid-YTW : 4.39 % |

| TD.PR.E | FixedReset | -1.11 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.71 Bid-YTW : 4.46 % |

| IAG.PR.E | Perpetual-Discount | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 24.34 Evaluated at bid price : 24.55 Bid-YTW : 6.17 % |

| TD.PR.Q | Perpetual-Discount | -1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 22.94 Evaluated at bid price : 23.10 Bid-YTW : 6.09 % |

| RY.PR.A | Perpetual-Discount | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.60 Evaluated at bid price : 18.60 Bid-YTW : 5.99 % |

| MFC.PR.C | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.01 Evaluated at bid price : 18.01 Bid-YTW : 6.34 % |

| CM.PR.J | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.12 Evaluated at bid price : 18.12 Bid-YTW : 6.25 % |

| POW.PR.A | Perpetual-Discount | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 21.76 Evaluated at bid price : 22.01 Bid-YTW : 6.41 % |

| TRP.PR.A | FixedReset | -1.02 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.14 Bid-YTW : 4.56 % |

| BAM.PR.J | OpRet | -1.02 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : 5.29 % |

| IAG.PR.A | Perpetual-Discount | 1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.55 Evaluated at bid price : 18.55 Bid-YTW : 6.27 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| NA.PR.N | FixedReset | 83,710 | Desjardins crossed 75,000 at 26.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-14 Maturity Price : 25.00 Evaluated at bid price : 26.10 Bid-YTW : 3.86 % |

| BNS.PR.L | Perpetual-Discount | 72,395 | National crossed blocks of 15,000 and 10,000, both at 18.80. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.71 Evaluated at bid price : 18.71 Bid-YTW : 6.05 % |

| BMO.PR.P | FixedReset | 70,335 | National crossed 24,900 at 26.21. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 4.56 % |

| CM.PR.J | Perpetual-Discount | 59,426 | Nesbitt crossed 40,000 at 18.12. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 18.12 Evaluated at bid price : 18.12 Bid-YTW : 6.25 % |

| PWF.PR.O | Perpetual-Discount | 57,445 | TD crossed 43,900 at 22.80. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-21 Maturity Price : 22.58 Evaluated at bid price : 22.70 Bid-YTW : 6.42 % |

| TRP.PR.A | FixedReset | 39,897 | Nesbitt bought 10,000 from RBC at 25.07. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.14 Bid-YTW : 4.56 % |

| There were 75 other index-included issues trading in excess of 10,000 shares. | |||

[…] interest-equivalent spread is now about 320bp, a significant widening from the 305bp reported April 22, above the recent high of +310bp reported April 7 and a big move wider than the +285bp reported on […]

[…] It was another zippetty-doo-dah day in the Canadian preferred share market, with PerpetualDiscounts rocketting up another 57bp, while FixedResets were up 5bp. The gain brings the PerpetualDiscount total return index to its highest level since April 20 and the yields (basically the price index) to their lowest level April 21. […]