Turnover picked up in September to 23%

Trades were, as ever, triggered by a desire to exploit transient mispricing in the preferred share market (which may be thought of as “selling liquidity”), rather than any particular view being taken on market direction, sectoral performance or credit anticipation.

| MAPF Sectoral Analysis 2010-9-30 | |||

| HIMI Indices Sector | Weighting | YTW | ModDur |

| Ratchet | 0% | N/A | N/A |

| FixFloat | 0% | N/A | N/A |

| Floater | 0% | N/A | N/A |

| OpRet | 0% | N/A | N/A |

| SplitShare | 0.6% (0) | 6.48% | 6.75 |

| Interest Rearing | 0% | N/A | N/A |

| PerpetualPremium | 5.4% (+5.4) | 5.88% | 13.99 |

| PerpetualDiscount | 79.8% (-6.9) | 5.65% | 14.45 |

| Fixed-Reset | 8.2% (-0.7) | 3.55% | 3.37 |

| Scraps (FixedReset) | 4.0% (0) | 6.72% | 12.78 |

| Cash | 2.0% (+2.2) | 0.00% | 0.00 |

| Total | 100% | 5.43% | 13.11 |

| Totals and changes will not add precisely due to rounding. Bracketted figures represent change from August month-end. Cash is included in totals with duration and yield both equal to zero. | |||

The “total” reflects the un-leveraged total portfolio (i.e., cash is included in the portfolio calculations and is deemed to have a duration and yield of 0.00.). MAPF will often have relatively large cash balances, both credit and debit, to facilitate trading. Figures presented in the table have been rounded to the indicated precision.

September marked a distinct change in the market: with the increasing price and implied volatility of PerpetualDiscount preferred shares (see MAPF Performance: August 2010) the fund not only took a position in PerpetualPremium Preferred Shares, but also increased its holdings of PerpetualDiscounts priced in the 24.00-25.00 range.

Following last month’s performance report, analysis of the data using the Straight Perpetual Implied Volatility Calculator produces the following table:

| Fits to Implied Volatility | ||||||

| Issuer | 2010-09-30 | 2010-08-31 | 2010-07-30 | |||

| Yield | Volatility | Yield | Volatility | Yield | Volatility | |

| PWF | 5.35% | 14% | 5.85% | 9% | 5.89% | 9% |

| CM | 5.10% | 16% | 5.46% | 11% | 5.77% | 0.01% |

| GWO | 5.50% | 12% | 5.77% | 10% | 5.82% | 10% |

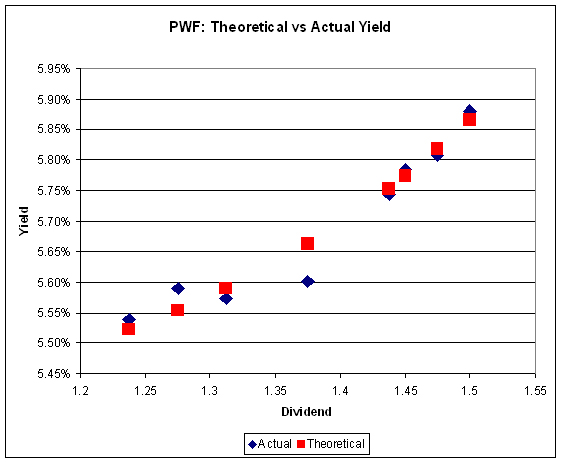

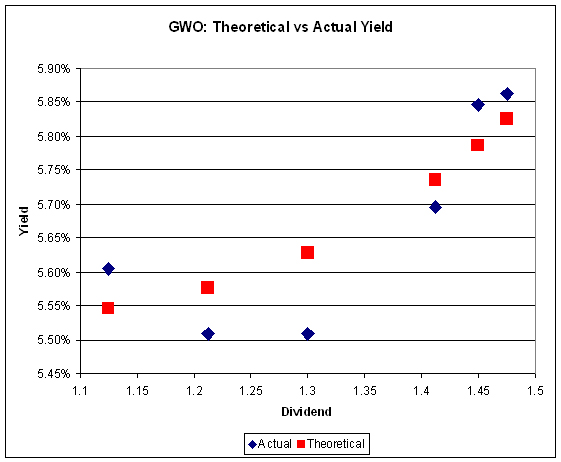

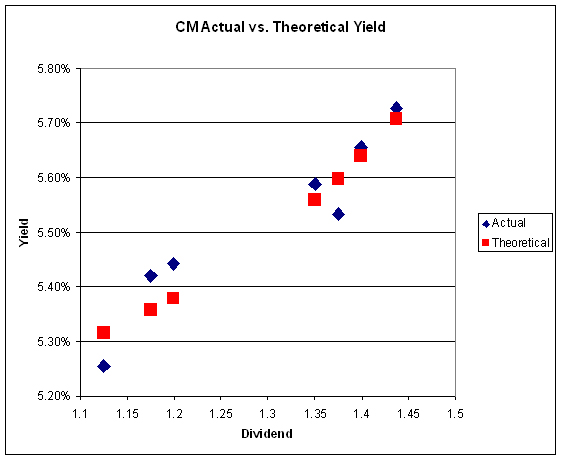

Graphs from the Straight Perpetual Volatility Calculator for September 30 are:

It is very clear that Implied Volatility has increased dramatically over the past two months – so dramatically, in fact, that the percentage of the portfolio comprised of PerpetualDiscounts priced between 24.00 and 25.00 has increased to 6.2% in September, from 4.9% in August and 0% in July; this is in addition to the more dramatic inclusion of PerpetualPremiums in the portfolio.

The yield pick-up for holding high-coupon Straights is such that the fund is starting to toy with the idea of selling the more deeply discounted PerpetualDiscounts to buy the higher priced ones; only nibbles as yet, but it has been a long, long time since the fund has “sold volatility”.

Credit distribution is:

| MAPF Credit Analysis 2010-9-30 | |

| DBRS Rating | Weighting |

| Pfd-1 | 0 (0) |

| Pfd-1(low) | 59.2% (-2.8) |

| Pfd-2(high) | 22.2% (+2.8) |

| Pfd-2 | 0 (0) |

| Pfd-2(low) | 12.6% (-2.2) |

| Pfd-3(high) | 4.0% (0) |

| Cash | 2.0% (+2.2) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from August month-end. | |

Liquidity Distribution is:

| MAPF Liquidity Analysis 2010-9-30 | |

| Average Daily Trading | Weighting |

| <$50,000 | 0.0% (0) |

| $50,000 – $100,000 | 9.0% (-2.9) |

| $100,000 – $200,000 | 20.2% (-5.3) |

| $200,000 – $300,000 | 23.6% (-7.5) |

| >$300,000 | 45.1% (+13.4) |

| Cash | 2.0% (+2.2) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from August month-end. | |

MAPF is, of course, Malachite Aggressive Preferred Fund, a “unit trust” managed by Hymas Investment Management Inc. Further information and links to performance, audited financials and subscription information are available the fund’s web page. The fund may be purchased either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited. A “unit trust” is like a regular mutual fund, but is sold by offering memorandum rather than prospectus. This is cheaper, but means subscription is restricted to “accredited investors” (as defined by the Ontario Securities Commission) and those who subscribe for $150,000+. Fund past performances are not a guarantee of future performance. You can lose money investing in MAPF or any other fund.

A similar portfolio composition analysis has been performed on the Claymore Preferred Share ETF (symbol CPD) as of August 31, 2010, and published in the September, 2010, PrefLetter. When comparing CPD and MAPF:

- MAPF credit quality is better

- MAPF liquidity is a higher

- MAPF Yield is higher

- Weightings in

- MAPF is much more exposed to PerpetualDiscounts

- MAPF is much less exposed to Operating Retractibles

- MAPF is now about equally exposed to SplitShares

- MAPF is less exposed to FixFloat / Floater / Ratchet

- MAPF weighting in FixedResets is much lower

I find your analysis of the pref market most interesting and clearly the performance of your fund in September was outstanding. I wonder if you would explain why you think that prefs in the $24.00 to $25.00 range are desirable. Is it because they are more volatile and offer you greater trading possibilities…and if so why? Earlier you have indicated that the outperformance of your fund was in part due to being overweight deeply discounted issues.

I have been selling prefs that reach par in order to buy just those deeply discounted issues… particularly banks…but then I am a buy and hold…at least for a while…investor. Am I off base doing this?

It’s all a matter of degree.

There should – in a rational market – be increased yield for near-par prefs to compensate for their option value (or their negative convexity, whichever way you want to express it).

How much increased yield? 1bp is too little. 1000bp is too much. All that I’m saying is that – for a few issues, not for each one – the yield pick-up has, at certain times, been sufficiently high to justify a trade into them out of more deeply discounted issues. The fund is still over-weighted in the deep-discounts, just not as overweighted as it has been.

I wouldn’t say you’re off base by swapping in the other direction. Much will depend on your goals for the portfolio. It’s a question of how much you are willing to pay (in yield given up) for the benefit of owning shares with less chance of being called – and for an active trader, that’s just one of many considerations.