Assiduous Readers will remember that I was quoted in a recent article by John Heinzl expressing a strong opinion on the Capital Units issues by SplitShare corporations:

For those reasons, Mr. Hymas says the capital shares are only appropriate for “suckers.”

This statement has attracted a certain amount of commentary and I have received some material criticizing my views. All further quotes in this post have been taken, in order, from an eMailed commentary – it has been interspersed with my commentary, but is quoted verbatim and in its entirety.

Response to “Ups and Downs of Doing The Splits” – John Heinzl, Globe and Mail, March 2, 2011

I have had a lot of involvement in split shares over the last two years, and I have to differ markedly from the assessment of Mr. Hymas, who prefers the preferreds to the capital units. I believe the exact opposite to be the case.

The split-share preferreds have limited upside, yet unlimited downside. They are essentially equity investments with a ‘preferred share’ wrapper. Most have downside protection to some degree, but rest assured, they can fall pretty well as much as the equity market can.

Asymmetry of returns is a feature of all fixed income, not simply SplitShare preferreds. Naturally, they can default, and one must take account of the chance of default: but firstly most will have Asset Coverage of at least 2:1 at issue time – meaning that the underlying portfolio can drop by half before the preferred shareholders take any loss at all – and secondly the Capital Unitholders will be wiped out before the preferred shareholders lose a penny.

No, there are no guarantees – there never are. But the preferreds have at issue time a significant amount of first-loss protection provided by the Capital Units.

The capital units are a whole other story. In my view they offer the BEST deal out there.

Imagine if you had a $100,000 portfolio of Canadian equities. You are totally exposed to the performance of the underlying assets, so a market fall of 50% takes an equivalent bite out of your assets. Now suppose instead you invest in a capital share with the following characteristics: leverage factor is 3.75 times. Discount to NAV is 20%. Maturity is 3 years. (These numbers are most assuredly achievable).

These numbers can be illustrated by the following:

Preferred Par Value: $10.00

Whole Unit NAV: $13.64

Price of Capital Units: $2.91

However, the capital units are issued at a premium to NAV (since they absorb all the issue expenses) of 5-10%. Thus, by choosing this example, you are to a degree saying that the Capital Units are only worth buying once they have lost about 25% of their value relative to NAV and have lost most of their NAV as well. I claim that this shows that the guys who paid full price for them are suckers.

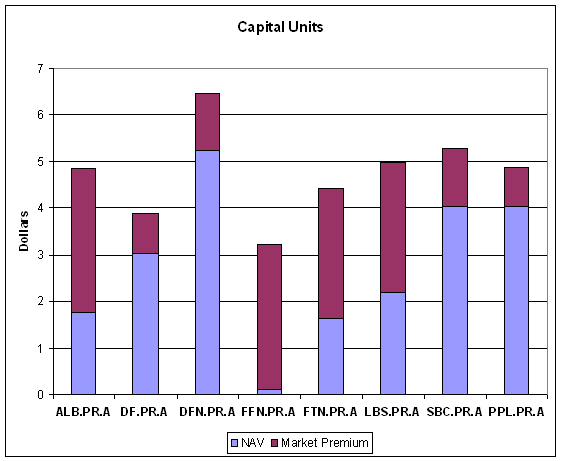

While discounts of market price to intrinsic value are not unknown, they are by no means automatic. I gave a seminar on SplitShares in March, 2009 – the very height of the crisis! – and used the following chart to illustrate the fact that, even (or particularly!) when distressed, these things will generally trade at a premium to intrinsic value:

The seminar was videotaped and is available for viewing (and downloading in Apple QuickTime format for personal use) for a small fee.

You could invest $26,667 in the capital units, and put the remainder in cash or investment grade bonds yielding , say, 3.5%. By doing so you get the same upside as the underlying assets.

Actually, it will be a bit better, because at maturity the discount will be made up, so you get an extra kicker of 6% per year. But in the event of a 50% fall in the market, although you would probably lose all of the value of the capital units, your cash would remain at $73,333, plus interest. You have dramatically outperformed on the downside, losing about 27% vs. 50%.

Yes, certainly, but you are not looking at the situation at issue time. You are looking for a distressed situation, in which somebody (the sucker) has already taken an enormous loss, not just on the NAV but also on the market price relative to NAV. Your illustration relies on the same presumption as the attractiveness of the preferred shares: the willingness of the sucker to take the first loss.

Not all split share capital units are attractive: some trade at premiums, and offer little leverage. Remember, these things are effectively long-dated options or warrants, although – even better – they can receive dividends. Any option or warrant calculator will tell you that if the capital units are priced correctly they should trade at a premium, not a discount, especially when leverage increases.

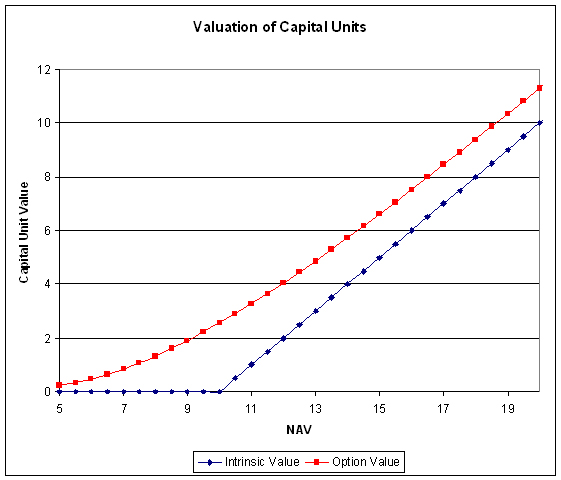

I discussed the valuation of Capital Units as options in my Seminar on SplitShares and provided the following charts. The first shows the theoretical value – given reasonable assumptions regarding volatility – of the capital units as the Whole Unit NAV changes. I will also note that this computation of theoretical value ignores all of the cash effects in the portfolio – dividends in, dividends out, fees and expenses out and portfolio changes to offset these effects – that will, in general, reduce the attractiveness of the Capital Units.

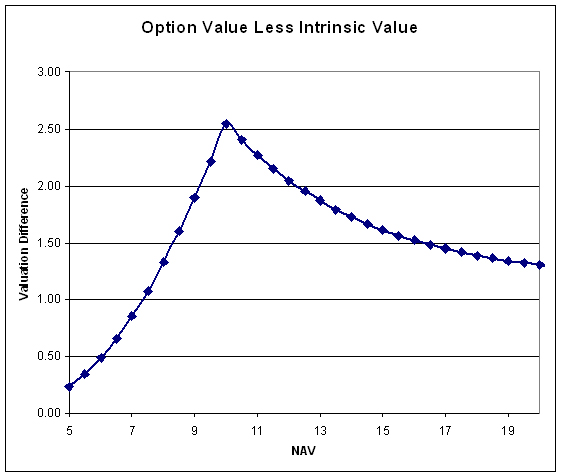

The second shows the premium of expected market price over intrinsic value as the NAV changes:

Instead, over the last few years I have seen cases where capital units offered leverage of up to 20 times, and yet still traded at a discount to NAV. That remarkable set of circumstances enabled investors to replace all-equity portfolios with a capital shares and cash combination portfolio which limited their equity exposure, and hence risk, to a fraction of what would otherwise be the case. Yet without losing any upside.

The remarkable paradox about capital units is that the higher the leverage, and hence the risk, in these things, the more one can reduce portfolio risk.

Scott Swallow, Financial Advisor

Manulife Securities Incorporated

Scott, I suggest that the critical element of your argument is the phrase “remarkable set of circumstances” and that, in the absence of such remarkable circumstances, our views are probably not very different.

Perhaps, as printed, my “sucker” epithet was too general – I certainly did not mean to suggest that all capital units were always bad all the time at all prices. If somebody offers to sell me capital units with an intrinsic value of $10 for a penny each, I’ll back up the truck! As I like to say, at the right price, even a bag of shit can be attractive: I buy fifteen of them every spring for my garden! So, perhaps I can be faulted for not qualifying my statement enough – but the reporter and I were talking about the issuance of these securities and he only had 1,000 words or so to work with – a full investigation of Split Shares takes considerably more space than that.

But your argument, as stated earlier, rests on the assumption that somebody else has taken a double loss – first on NAV, then on market price relative to NAV. I claim, that given the risk-reward profile of capital units at issue time in general, the IPO buyers (and most of those in the secondary market) are suckers.

[…] can find his detailed analysis here. Previous Post […]

[…] There’s more discussion of this nuance (for free, you cheap bastards) in the post Split Share Capital Unit Debate. But – and it’s a big but, as the Bishop said to the Actress – there will be a […]