The fund had a disappointing month, dragged down by its holdings in YLO preferreds and the lower-coupon DeemedRetractibles.

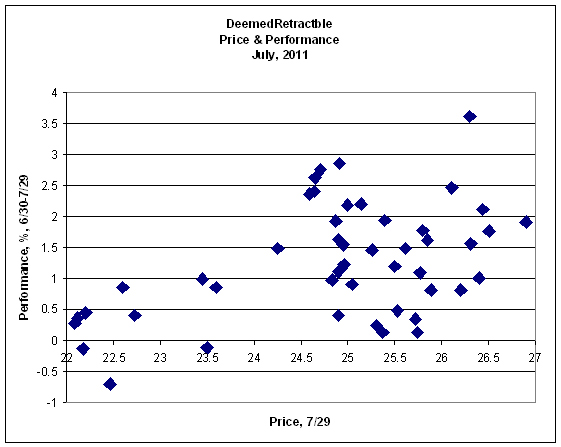

DeemedRetractibles exhibited a very surprising relationship between Price and Performance, as illustrated by:

As for the holdings in YLO preferreds – which were topped up during the month to maintain a weighting of about 3.5% in the face of declining price – what can I say? While I certainly agree that this is not a tip-top credit – which is why I’m limiting exposure to 3.5% – I cannot fathom why the preferreds are trading at only a little over half price – particularly since the sale of Trader Corporation to Apax closed on July 28.

I received an eMail from a client early in the month:

Hi James, TD Newcrest has downgraded this company from hold to reduce in its Morning Action Notes today … It seems to me a good enough reason to not hold their securities in MAPF, even if it is a minor position, with the risk rating raised to high. Why wait for the credit agencies to follow?

Well, in general terms, as I have often stated: Sell Side analysis is a superb source of data, a very good source of ideas and a laughable source of actionable investment advice. It should always be remembered that sell-side analysis does not have performance as its object: the purpose of sell-side analysis is to get you to change your mind about a particular issue so that you’ll trade more.

A couple of analysts did come to Sino’s defence, most notably Dundee’s Richard Kelertas. In a remarkable conference call on Tuesday, he jumped way outside his mandate and accused Mr. Block of committing his own fraud, calling his research “a pile of crap.” If he’s right, he will go down as the hero of the saga. If he’s wrong, he will be remembered like former Nesbitt analyst Egizio Bianchini, who backed Bre-X after the fraud allegations (though it worked out fine for Mr. Bianchini, now vice chair at BMO Capital Markets).

Additionally, I will note:

TD Newcrest analyst Scott Cuthbertson threw in the towel on Yellow Media Inc. (YLO-T2.08-0.08-3.70%), slashing his price target by half to $2 and downgrading it to “sell” after having recommended investors hold it since the beginning of March 2010, when the stock traded around $6.

Generally speaking, I think stocks become more attractive when the price moves down, not less. It is, of course, possible that YLO’s business prospects deteriorated even more rapidly than the share price – but I find that idea a little hard to justify from the financial statements. I couldn’t find any data readily available on Mr. Cuthbertson’s track record – but, as implied above, performance is irrelevant for sell-side analysis.

The reference in the client eMail to the credit rating agencies is also interesting: as I showed in the June edition of PrefLetter, a similarly precipituous decline in the BBD preferreds (back in 2002) lasted for a little over half a year; the actual downgrade marked the end of the panic and the issues recovered in price almost immediately. Presumably, the actual downgrade got more players to look at the issue seriously and decide – ‘hey! This is a not so good credit, but the price indicates imminent bankruptcy and I don’t think the situation is that serious!’

So anyway, I’m sticking to my guns. Whatever the merits (or faults) of YLO common as an investment, I can’t for the life of me figure out why the preferreds are trading so low – and until I can figure that out, I’m going to assume that this is simply another episode of mass hysteria, brought about by retail’s tendency to see all things in a binary light: there’s either no problems at all, or bankruptcy is imminent, with nothing in between. This is just another case of the relatively random fluctuations in market price brought about by supply and demand imbalances that are the fund’s bread and butter, writ large. I will also note that eMails such as the one I received are how the retail perspective transmits to institutional portfolios: I can assure you that in this kind of situation, with dramatic market movements and heavy media coverage, a lot of Portfolio Managers sell (sometimes against their better judgement, if they have any) simply so they won’t have to explain their holdings to their clients. The business is, in general, not about performance; it’s about story telling.

In the meantime, however, the fund’s holdings of YLO preferreds cost about 0.62% in return for the month.

The fund’s Net Asset Value per Unit as of the close July 29 was $11.0683.

| Returns to July 29, 2011 | |||

| Period | MAPF | Index | CPD according to Claymore |

| One Month | -0.46% | +0.87% | +0.74% |

| Three Months | +2.70% | +2.69% | +2.05% |

| One Year | +15.79% | +13.10% | +9.56% |

| Two Years (annualized) | +15.62% | +11.48% | N/A |

| Three Years (annualized) | +27.92% | +9.79% | +7.29% |

| Four Years (annualized) | +18.09% | +5.17% | |

| Five Years (annualized) | +15.47% | +4.25% | |

| Six Years (annualized) | +13.58% | +4.06% | |

| Seven Years (annualized) | +12.67% | +4.20% | |

| Eight Years (annualized) | +13.47% | +4.43% | |

| Nine Years (annualized) | +13.46% | +4.63% | |

| Ten Years (annualized) | +13.24% | +4.57% | |

| The Index is the BMO-CM “50” | |||

| MAPF returns assume reinvestment of distributions, and are shown after expenses but before fees. | |||

| CPD Returns are for the NAV and are after all fees and expenses. | |||

| * CPD does not directly report its two-year returns. | |||

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +0.75%, +2.24% and +10.45%, respectively, according to Morningstar after all fees & expenses. Three year performance is +8.00%. | |||

| Figures for Jov Leon Frazer Preferred Equity Fund Class I Units (which are after all fees and expenses) for 1-, 3- and 12-months are +0.13%, +0.80% and +6.69% respectively, according to Morningstar | |||

| Figures for Manulife Preferred Income Fund (formerly AIC Preferred Income Fund) (which are after all fees and expenses) for 1-, 3- and 12-months are +0.68%, +2.40% & +7.39%, respectively | |||

| Figures for Horizons AlphaPro Preferred Share ETF are not yet available (inception date 2010-11-23) | |||

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page. The fund is available either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited.

Sometimes everything works … sometimes the trading works, but sectoral shifts overwhelm the increment … sometimes nothing works. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’. There were a lot of strongly motivated market participants during the Panic of 2007, generating a lot of noise! Unfortunately, the conditions of the Panic may never be repeated in my lifetime … but the fund will simply attempt to make trades when swaps seem profitable, without worrying about the level of monthly turnover.

There’s plenty of room for new money left in the fund. I have shown in recent issues of PrefLetter that market pricing for FixedResets is demonstrably stupid and I have lots of confidence – backed up by my bond portfolio management experience in the markets for Canadas and Treasuries, and equity trading on the NYSE & TSX – that there is enough demand for liquidity in any market to make the effort of providing it worthwhile (although the definition of “worthwhile” in terms of basis points of outperformance changes considerably from market to market!) I will continue to exert utmost efforts to outperform but it should be borne in mind that there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit | ||||||

| Month | NAVPU | Portfolio Average YTW |

Leverage Divisor |

Securities Average YTW |

Capital Gains Multiplier |

Sustainable Income per current Unit |

| June, 2007 | 9.3114 | 5.16% | 1.03 | 5.01% | 1.2857 | 0.3628 |

| September | 9.1489 | 5.35% | 0.98 | 5.46% | 1.2857 | 0.3885 |

| December, 2007 | 9.0070 | 5.53% | 0.942 | 5.87% | 1.2857 | 0.4112 |

| March, 2008 | 8.8512 | 6.17% | 1.047 | 5.89% | 1.2857 | 0.4672 |

| June | 8.3419 | 6.034% | 0.952 | 6.338% | 1.2857 | $0.4112 |

| September | 8.1886 | 7.108% | 0.969 | 7.335% | 1.2857 | $0.4672 |

| December, 2008 | 8.0464 | 9.24% | 1.008 | 9.166% | 1.2857 | $0.5737 |

| March 2009 | $8.8317 | 8.60% | 0.995 | 8.802% | 1.2857 | $0.6046 |

| June | 10.9846 | 7.05% | 0.999 | 7.057% | 1.2857 | $0.6029 |

| September | 12.3462 | 6.03% | 0.998 | 6.042% | 1.2857 | $0.5802 |

| December 2009 | 10.5662 | 5.74% | 0.981 | 5.851% | 1.0819 | $0.5714 |

| March 2010 | 10.2497 | 6.03% | 0.992 | 6.079% | 1.0819 | $0.5759 |

| June | 10.5770 | 5.96% | 0.996 | 5.984% | 1.0819 | $0.5850 |

| September | 11.3901 | 5.43% | 0.980 | 5.540% | 1.0819 | $0.5832 |

| December 2010 | 10.7659 | 5.37% | 0.993 | 5.408% | 1.0000 | $0.5822 |

| March, 2011 | 11.0560 | 6.00% | 0.994 | 5.964% | 1.0000 | $0.6594 |

| June | 11.1194 | 5.87% | 1.018 | 5.976% | 1.0000 | $0.6645 |

| July, 2011 | 11.0683 | 6.14% | 0.995 | 6.109% | 1.0000 | $0.6762 |

| NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains. Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00% The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99 Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings. The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested. Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

||||||

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company (definition refined in May). These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31, in addition to the call schedule explicitly defined. See OSFI Does Not Grandfather Extant Tier 1 Capital, CM.PR.D, CM.PR.E, CM.PR.G: Seeking NVCC Status and the January, February, March and June, 2011, editions of PrefLetter for the rationale behind this analysis. | ||||||

Significant positions were held in DeemedRetractible and FixedReset issues on June 30; all of the former and most of the latter currently have their yields calculated with the presumption that they will be called by the issuers at par prior to 2022-1-31. This presents another complication in the calculation of sustainable yield. The fund also holds a position in a SplitShare (BNA.PR.C) and an OperatingRetractible Scrap (YLO.PR.B) which also have their yields calculated with the expectation of a maturity.

However, if the entire portfolio except for the PerpetualDiscounts were to be sold and reinvested in these issues, the yield of the portfolio would be the 5.67% shown in the MAPF Portfolio Composition: July 2011 analysis (which is greater than the 5.44% index yield on July 29). Given such reinvestment, the sustainable yield would be $11.0683 * 0.0567 = $0.6276, a decrease from the $11.1194 * 0.0565 = $0.6282, reported in June.

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.

With regard to the YLO Preferreds:

James, my understanding, assuming a worst case scenario, is that the

bondholders are first in line, the preferred holders are next, and then the dregs are the common holders. It seems the biggest issue with the talking heads is the yield on the common and the expectation for a reduction (we know the market is always right). I assume that the company would look at the bond interest and preferred dividends and ensure that those two items are not compromised, while the common div is ‘expected’ to decline anyway.

Your understanding of the worst case scenario is correct, although you might want to refine it by putting the bank creditors at the very top of the list – their loans will be secured and have conditions attached (one such condition is rumoured to be a restriction on dividend payments if the credit rating falls below investment grade).

And yes, the talking heads focus almost exclusively on the common. Tim Kiladze has an apocalyptic piece in the Globe today, cherry-picking from the DBRS June comment among other things.