Richard W. Fisher gave a rather provocative speech last week titled The State of the West (With Reference to George Shultz, Eisenhower, Buzz Lightyear, George Strait, the San Francisco Fed and Adam and Eve) :

I’ll just say this: Our Congress—past and present—has behaved disgracefully in discharging its fiscal duty. Its members have not shown themselves to be true born leaders.

…

The jig is up. Our fiscal authorities have mortgaged the material assets of our grandchildren to the nth degree. We are at risk of losing our political heritage of reaching across the aisle to work for the common good. In the minds of many, our government’s fiscal misfeasance threatens the world’s respect for America as the beacon of democracy.Only the Congress of the United States can now save us from fiscal perdition. The Federal Reserve cannot. The Federal Reserve has been carrying the ball for the fiscal authorities by holding down interest rates in an attempt to stoke the recovery while the fiscal authorities wrestle themselves off the mat. But there are limits to what a monetary authority can do. For the central bank also plays a fiduciary role for the American people and, given our franchise as the globe’s premier reserve currency, the world. We dare not become the central bank counterpart to Congress by adopting a Buzz Lightyear approach of “To infinity and beyond!” by endlessly purchasing U.S. Treasuries and agency debt so as to encumber future generations of central bankers with Hobson’s choices when it comes to undoing what seems contemporarily appropriate.

So my only comment today regarding the recent federal elections is this: Pray that the president and the Congress will at last tackle the fiscal imbroglio they and their predecessors created and only they can undo.

This speech has been energetically attacked by Tim Duy, but only on the basis of timing:

What is it about fiscal policy that brings out the crazy? Because it all seems pretty simple. Joe Weisenthal hits the nail on the head:

The U.S. recovery has been remarkable on a comparative basis precisely for one reason: Because despite all of the rhetoric, the U.S. has completely avoided the austerity madness that's gripped much of the world.

Weisenthal points us to Ryan Avent and Josh Lehner, both showing in different ways the better post-recession outcomes experienced by the US compared to other economies. Paul Krugman extends the argument by comparing the divergent path of Eurozone and US unemployment rates. The key difference in policy – the US pursued a more aggressive fiscal policy and didn't pull back too quickly. I don't think you can emphasize this point enough.

Which brings us to the fiscal cliff (or slope, which is more accurate and avoids creating the false impression that all is lost come January 1). The tax increases and spending cuts in place promise to repeat the mistakes of the UK and the Eurozone by pivoting too fast and too hard into the realm of fiscal austerity. A solution to the fiscal cliff means smoothing the path to fiscal consolidation (optimally, with no austerity in the near term, but I don't see that as an outcome).

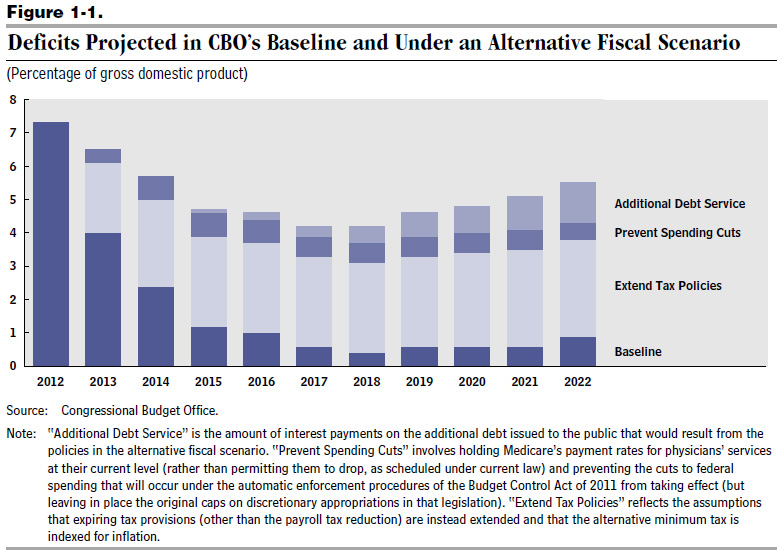

What I want to see from the politicians is sufficient changes to put the US into a structural surplus. Note the word “structural” – it does not mean diving off the fiscal cliff, although according to the Congressional Budget Office, even giving full effect to the fiscal cliff does not lead to a structural surplus; there is a projected deficit every year through 2022, the end of their horizon. Thus, while I would not like to see a sudden dive of the fiscal cliff, I feel that a path must be taken that goes beyond those projected measures (or equivalent) over the medium term.

It was a mixed day for the Canadian preferred share market, with PerpetualPremiums up 12bp, FixedResets gaining 5bp and DeemedRetractibles off 1bp. Volatility continued to be low. FixedResets dominated a day of relatively low volume, perhaps influenced by a move towards the new FixedReset ETF, ZPR, which now claims to have $5.2-million under management and traded slightly under 40,000 shares today (at about $15 each, or a total of $0.6-million).

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1867 % | 2,462.1 |

| FixedFloater | 4.20 % | 3.54 % | 28,397 | 18.21 | 1 | -0.3965 % | 3,829.6 |

| Floater | 2.81 % | 3.02 % | 55,764 | 19.63 | 4 | -0.1867 % | 2,658.5 |

| OpRet | 4.60 % | 0.13 % | 36,268 | 0.59 | 4 | 0.0570 % | 2,595.3 |

| SplitShare | 5.43 % | 4.75 % | 61,490 | 4.46 | 3 | 0.0396 % | 2,864.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0570 % | 2,373.2 |

| Perpetual-Premium | 5.25 % | 2.66 % | 72,007 | 0.87 | 30 | 0.1235 % | 2,319.6 |

| Perpetual-Discount | 4.83 % | 4.88 % | 98,028 | 15.63 | 3 | 0.2312 % | 2,631.7 |

| FixedReset | 4.98 % | 2.99 % | 200,308 | 4.19 | 75 | 0.0458 % | 2,452.3 |

| Deemed-Retractible | 4.90 % | 2.58 % | 124,076 | 0.74 | 46 | -0.0084 % | 2,405.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.D | Deemed-Retractible | -1.19 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-12-31 Maturity Price : 25.50 Evaluated at bid price : 25.80 Bid-YTW : 0.59 % |

| ELF.PR.H | Perpetual-Premium | 1.09 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-17 Maturity Price : 25.00 Evaluated at bid price : 25.89 Bid-YTW : 5.09 % |

| GWO.PR.N | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.43 Bid-YTW : 3.33 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.P | FixedReset | 348,735 | RBC crossed 218,700 at 25.10; Nesbitt crossed 100,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.09 Bid-YTW : 3.42 % |

| GWO.PR.N | FixedReset | 127,325 | TD crossed 122,500 at 24.35. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.43 Bid-YTW : 3.33 % |

| BNS.PR.R | FixedReset | 118,200 | RBC crossed blocks of 86,700 and 30,000, both at 25.25. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.23 Bid-YTW : 3.35 % |

| TRP.PR.A | FixedReset | 106,602 | Nesbitt crossed 96,800 at 25.60. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-11-23 Maturity Price : 23.78 Evaluated at bid price : 25.68 Bid-YTW : 3.14 % |

| BMO.PR.M | FixedReset | 92,537 | Desjardins crossed 11,000 at 24.97; Scotia crossed 28,700 at the same price. Desjardins bought 10,000 from TD at 24.95. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.94 Bid-YTW : 3.13 % |

| GWO.PR.J | FixedReset | 73,676 | TD crossed 55,700 at 26.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-12-31 Maturity Price : 25.00 Evaluated at bid price : 26.25 Bid-YTW : 2.21 % |

| There were 23 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BNA.PR.E | SplitShare | Quote: 25.10 – 25.50 Spot Rate : 0.4000 Average : 0.2636 YTW SCENARIO |

| PWF.PR.R | Perpetual-Premium | Quote: 27.10 – 27.44 Spot Rate : 0.3400 Average : 0.2091 YTW SCENARIO |

| MFC.PR.B | Deemed-Retractible | Quote: 24.31 – 24.56 Spot Rate : 0.2500 Average : 0.1647 YTW SCENARIO |

| TCA.PR.Y | Perpetual-Premium | Quote: 52.01 – 52.50 Spot Rate : 0.4900 Average : 0.4055 YTW SCENARIO |

| RY.PR.I | FixedReset | Quote: 25.27 – 25.49 Spot Rate : 0.2200 Average : 0.1357 YTW SCENARIO |

| MFC.PR.C | Deemed-Retractible | Quote: 24.00 – 24.24 Spot Rate : 0.2400 Average : 0.1750 YTW SCENARIO |