There’s an interesting battle shaping up for control of the Republican party:

A battle for control of the Republican Party has erupted as an emboldened Tea Party moved to oust senators who voted to reopen the government while business groups mobilized to defeat allies of the small-government movement.

“We are going to get engaged,” said Scott Reed, senior political strategist for the U.S. Chamber of Commerce. “The need is now more than ever to elect people who understand the free market and not silliness.” The chamber spent $35.7 million on federal elections in 2012, according to the Center for Responsive Politics, a Washington-based group that tracks campaign spending.

I remain a conservative, but I ended my involvement with the Conservative party when it became apparent that it was no longer the party of fiscal restraint and realism, but had morphed into a Junior Republican party.

Brian Milner of the Globe reminds us that, for all the talk of rising interest rates, the economy really needs stimulus rather than restraint:

The latest Canadian inflation figures inspire descriptions like benign, subdued, tepid and tame. Consumer price inflation remained steady in September at an annual rate of 1.1 per cent. The core price index, which excludes more volatile food and energy costs, also didn’t budge from the previous level of 1.3 per cent. With inflation essentially a non-factor, the conventional wisdom is that the Bank of Canada can afford to leave monetary policy untouched.

…

Right now, although prices have been rising slightly in most categories (led by booze and tobacco), the inflation rate sits perilously close to the bottom end of the bank’s target range of 1 to 3 per cent, well below the mid-point of 2 per cent the bank and its counterparts in other developed countries regard as ideal. Now, 1 per cent would be welcomed in deflation-ravaged Japan, which hasn’t posted a level that high since 2008. But it ought to be setting off warning bells here.

Isn’t market timing wonderful?

Hedge-fund manager John Paulson’s PFR Gold Fund fell 16 percent in September after bullion and related stocks declined, according to a report to investors obtained by Bloomberg News.

Last month’s loss brings the 2013 decline in the $350 million fund, which invests in gold stocks and derivatives, to 62 percent, according to the report. Bullion producers fell 9.4 percent and the metal dropped 5 percent in September after a Federal Reserve policy maker said a small reduction in bond purchases may occur in October and the threat of a U.S. attack on Syria eased.Paulson, 57, is known for making $15 billion for his investors in 2007 by betting against subprime mortgages before the housing collapse.

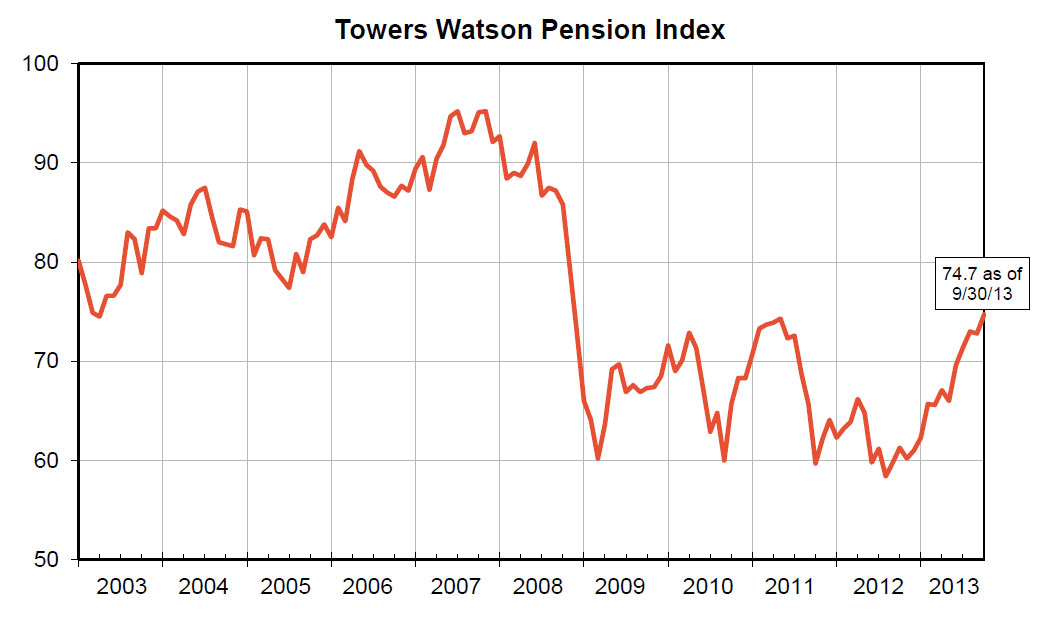

Towers Perrin reports:

A strong equity market drove September financial results. The benchmark asset portfolio earned almost 3% for the month, driving the Towers Watson Pension Index up 2.6% to 74.7. With this increase the index is now up almost 20% for the year.

It was a slightly positive day for the Canadian preferred share market, with PerpetualDiscounts gaining 6bp, FixedResets up 7bp and DeemedRetractibles flat. The Performance Highlights Table is surprisingly lengthy considering the modest overall changes and is dominated by winners. Volume was above average; block trading data is not available.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5804 % | 2,454.7 |

| FixedFloater | 4.29 % | 3.56 % | 27,926 | 18.30 | 1 | 0.2715 % | 3,915.4 |

| Floater | 2.75 % | 3.00 % | 63,507 | 19.73 | 5 | 0.5804 % | 2,650.4 |

| OpRet | 4.62 % | 2.33 % | 65,123 | 0.44 | 3 | 0.0642 % | 2,643.2 |

| SplitShare | 4.77 % | 5.25 % | 63,297 | 3.98 | 6 | -0.0718 % | 2,942.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0642 % | 2,417.0 |

| Perpetual-Premium | 5.82 % | 4.96 % | 108,543 | 0.08 | 7 | -0.0797 % | 2,283.3 |

| Perpetual-Discount | 5.55 % | 5.59 % | 166,612 | 14.37 | 30 | 0.0623 % | 2,345.3 |

| FixedReset | 4.97 % | 3.70 % | 232,582 | 3.57 | 85 | 0.0695 % | 2,442.2 |

| Deemed-Retractible | 5.14 % | 4.44 % | 188,641 | 6.84 | 43 | 0.0000 % | 2,379.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ENB.PR.P | FixedReset | -1.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 22.33 Evaluated at bid price : 23.12 Bid-YTW : 4.61 % |

| CIU.PR.C | FixedReset | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 19.10 Evaluated at bid price : 19.10 Bid-YTW : 4.37 % |

| ENB.PR.Y | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 22.27 Evaluated at bid price : 23.05 Bid-YTW : 4.52 % |

| BAM.PR.C | Floater | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 17.55 Evaluated at bid price : 17.55 Bid-YTW : 3.01 % |

| ENB.PR.N | FixedReset | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 22.92 Evaluated at bid price : 24.35 Bid-YTW : 4.45 % |

| BMO.PR.Q | FixedReset | 1.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.58 Bid-YTW : 3.67 % |

| BAM.PR.M | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 19.95 Evaluated at bid price : 19.95 Bid-YTW : 6.02 % |

| BAM.PF.C | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 19.92 Evaluated at bid price : 19.92 Bid-YTW : 6.16 % |

| BNS.PR.Y | FixedReset | 1.46 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.69 Bid-YTW : 3.79 % |

| TRP.PR.C | FixedReset | 1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-21 Maturity Price : 22.09 Evaluated at bid price : 22.36 Bid-YTW : 3.91 % |

| IFC.PR.A | FixedReset | 1.62 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.49 Bid-YTW : 4.12 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CIU.PR.B | FixedReset | 169,394 |

YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-01 Maturity Price : 25.00 Evaluated at bid price : 25.71 Bid-YTW : 3.56 % |

| TD.PR.S | FixedReset | 157,774 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.52 Bid-YTW : 3.67 % |

| BMO.PR.M | FixedReset | 69,493 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.62 Bid-YTW : 3.74 % |

| BNS.PR.P | FixedReset | 64,837 | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-04-25 Maturity Price : 25.00 Evaluated at bid price : 24.64 Bid-YTW : 3.69 % |

| CU.PR.C | FixedReset | 46,756 | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-01 Maturity Price : 25.00 Evaluated at bid price : 25.32 Bid-YTW : 3.80 % |

| BMO.PR.R | FixedReset | 33,910 | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-08-25 Maturity Price : 25.00 Evaluated at bid price : 25.11 Bid-YTW : 2.49 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| TRI.PR.B | Floater | Quote: 19.80 – 20.23 Spot Rate : 0.4300 Average : 0.3135 YTW SCENARIO |

| TD.PR.R | Deemed-Retractible | Quote: 26.06 – 26.33 Spot Rate : 0.2700 Average : 0.1539 YTW SCENARIO |

| IAG.PR.G | FixedReset | Quote: 25.55 – 25.90 Spot Rate : 0.3500 Average : 0.2363 YTW SCENARIO |

| MFC.PR.K | FixedReset | Quote: 23.45 – 23.90 Spot Rate : 0.4500 Average : 0.3517 YTW SCENARIO |

| CU.PR.F | Perpetual-Discount | Quote: 21.26 – 21.59 Spot Rate : 0.3300 Average : 0.2363 YTW SCENARIO |

| ENB.PR.F | FixedReset | Quote: 23.37 – 23.70 Spot Rate : 0.3300 Average : 0.2374 YTW SCENARIO |