Good times to be in corporate finance:

Canadian companies are borrowing more than ever, breaking records for selling new debt in a push to lock in low interest rates before borrowing costs rise.

Corporations and financial institutions have set a new mark for fixed-income sales this year by issuing more than $100-billion in debt, higher than the full-year record set in 2012.

…

As usual, Canadian banks dominate bond sales this year, raising $47-billion, up 23 per cent from 2012, according to CIBC. However, non-bank borrowers have increased their game, raising an usually large amount of debt, helping to push total issuance to sky-high levels.

ETFs and mutual funds have the great virtue of increasing liquidity for retail investors – I often recommend bond ETFs to clients. But the mismatch between retail liquidity and underlying liquidity is getting worrisome:

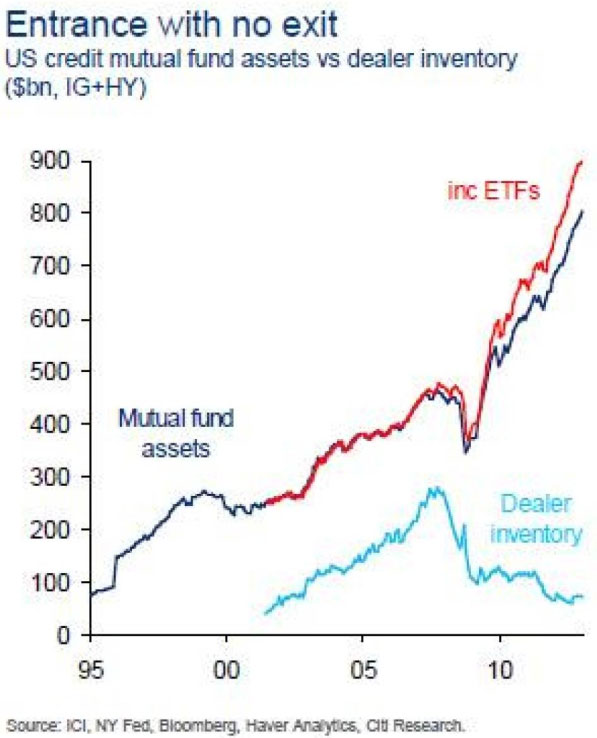

A recent presentation by Citi’s Matt King, includes a chart entitled “Entrance with No Exit” that has been costing me sleep. Mr. King’s chart asserts that if and when a significant percentage of the holders of almost $900-billion (U.S.) invested in U.S. corporate debt mutual funds and ETFs (investment grade plus high yield debt) want to sell, there may not be anyone to bid for them.

In the past, large banks carried enormous portfolios of both investment grade and high yield debt issues and provided liquidity to the market – buying bonds when the market was weak and selling when it was strong.

Since the financial crisis, however, U.S. banks have responded to regulatory pressure over proprietary trading and capital requirements by drastically reducing their holdings – from about $300-billion to less than $100-billion – while mutual fund and ETF fixed income assets have almost doubled from just under $500-billion.

There’s $900-billion in corporate debt funds and ETFs and a tenth of that in the banking system so, there is no way the banks can offset a buyers strike in bond funds if it occurs.

If an apocalypse happens due to this, it will be bargain season for long term investors, but those who need the cash – or even the margin – might find themselves a little embarrassed.

Decreased liquidity in corporate bonds was discussed on November 5, while US regulatory moves to extend their power over asset managers was discussed November 6. Does anybody else see a pattern here? Mark my words, there will be enforced ‘gating’ of mutual fund and ETF redemptions soon (ETF redemptions coming in big blocks from arbitrageurs). All that power has to go somewhere! We will then see ETFs trading at a discount to NAV, and a lot of very unhappy mutual fund fund clients.

So what’s the solution? As far as I can tell, there ain’t one. Companies will have to keep a little extra cash on hand in case the markets decide to shut down for a while; investors will have to keep a little more cash on hand than otherwise for the same reason. Ultimately, the benefits of allowing retail decent access to the corporate bond markets outweighs the harms … but you can bet the regulators won’t see it that way. Nobody must be hurt! If anybody is ever hurt by anything, it’s because of a Wall Street conspiracy!

It was a day of small gains for the Canadian preferred share market, with PerpetualDiscounts winning 10bp, FixedResets gaining 5bp and DeemedRetractibles up 7bp. Surprisingly, the Performance Highlights table is relatively lengthy. FloatingResets traded up a storm today on big blocks through Nesbitt, with an assist from Scotia, although there is no way of telling whether or not they were ‘real’ crosses or internal crosses; volume was above average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2622 % | 2,522.0 |

| FixedFloater | 4.16 % | 3.44 % | 30,800 | 18.47 | 1 | -0.7391 % | 4,033.7 |

| Floater | 2.94 % | 2.97 % | 59,658 | 19.78 | 3 | 0.2622 % | 2,723.0 |

| OpRet | 4.61 % | 1.19 % | 67,910 | 0.37 | 3 | 0.1868 % | 2,660.4 |

| SplitShare | 4.74 % | 5.13 % | 65,290 | 3.92 | 6 | 0.0807 % | 2,961.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1868 % | 2,432.7 |

| Perpetual-Premium | 5.57 % | 3.88 % | 124,296 | 0.09 | 11 | 0.1290 % | 2,309.0 |

| Perpetual-Discount | 5.57 % | 5.55 % | 176,877 | 14.51 | 27 | 0.1010 % | 2,364.9 |

| FixedReset | 4.96 % | 3.33 % | 231,281 | 3.31 | 82 | 0.0504 % | 2,485.5 |

| Deemed-Retractible | 5.07 % | 4.02 % | 189,766 | 1.47 | 42 | 0.0677 % | 2,413.9 |

| FloatingReset | 2.61 % | 2.38 % | 305,823 | 4.49 | 5 | 0.0952 % | 2,458.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CIU.PR.A | Perpetual-Discount | -2.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-11-13 Maturity Price : 21.20 Evaluated at bid price : 21.20 Bid-YTW : 5.44 % |

| BAM.PR.X | FixedReset | -1.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-11-13 Maturity Price : 21.79 Evaluated at bid price : 22.12 Bid-YTW : 4.36 % |

| CU.PR.C | FixedReset | -1.34 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-01 Maturity Price : 25.00 Evaluated at bid price : 25.71 Bid-YTW : 3.11 % |

| FTS.PR.G | FixedReset | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-11-13 Maturity Price : 22.77 Evaluated at bid price : 23.96 Bid-YTW : 4.04 % |

| FTS.PR.F | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-11-13 Maturity Price : 22.96 Evaluated at bid price : 23.25 Bid-YTW : 5.27 % |

| IAG.PR.A | Deemed-Retractible | 1.62 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.56 Bid-YTW : 5.90 % |

| MFC.PR.C | Deemed-Retractible | 1.78 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.69 Bid-YTW : 6.28 % |

| TRP.PR.B | FixedReset | 1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-11-13 Maturity Price : 20.81 Evaluated at bid price : 20.81 Bid-YTW : 3.88 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.Z | FloatingReset | 256,885 | Nesbitt crossed 200,000 at 25.00; Scotia crossed 50,000 at 25.03. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.03 Bid-YTW : 2.52 % |

| BMO.PR.R | FloatingReset | 251,600 | Nesbitt crossed 200,000 at 25.03; Scotia crossed 50,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-08-25 Maturity Price : 25.00 Evaluated at bid price : 25.04 Bid-YTW : 2.38 % |

| TD.PR.T | FloatingReset | 208,816 | Nesbitt crossed 200,000 at 25.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-07-31 Maturity Price : 25.00 Evaluated at bid price : 25.16 Bid-YTW : 2.26 % |

| BNS.PR.B | FloatingReset | 207,987 | Nesbitt crossed 200,000 at 25.02. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.03 Bid-YTW : 2.54 % |

| BNS.PR.Z | FixedReset | 115,587 | Nesbitt crossed 100,000 at 23.70. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.66 Bid-YTW : 4.15 % |

| TRP.PR.C | FixedReset | 44,454 | Desjardins crossed 30,000 at 22.80. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-11-13 Maturity Price : 22.37 Evaluated at bid price : 22.74 Bid-YTW : 3.83 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| CU.PR.E | Perpetual-Discount | Quote: 23.37 – 23.82 Spot Rate : 0.4500 Average : 0.3462 YTW SCENARIO |

| BAM.PF.D | Perpetual-Discount | Quote: 19.69 – 19.96 Spot Rate : 0.2700 Average : 0.1909 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 23.30 – 23.49 Spot Rate : 0.1900 Average : 0.1302 YTW SCENARIO |

| CU.PR.C | FixedReset | Quote: 25.71 – 25.94 Spot Rate : 0.2300 Average : 0.1704 YTW SCENARIO |

| MFC.PR.I | FixedReset | Quote: 26.07 – 26.28 Spot Rate : 0.2100 Average : 0.1516 YTW SCENARIO |

| BNA.PR.C | SplitShare | Quote: 24.26 – 24.43 Spot Rate : 0.1700 Average : 0.1177 YTW SCENARIO |