The Federal Reserve Bank of Cleveland has released the February 2010 edition of Economic Trends with articles:

- December Price Statistics

- Financial Markets, Money and Monetary Policy

- What Is the Yield Curve Telling Us?…And Should We Have Listened?

- A Sign of Normalization

- Imports and Economic Growth

- The Employment Situation, January 2010

- Real GDP: Fourth-Quarter 2009 Advance Estimate

- Fourth District Employment Conditions

- Seriously Delinquent Mortgages in the Fourth District

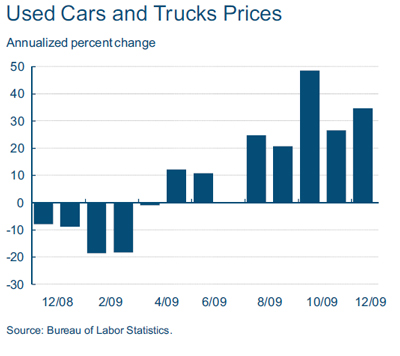

There’s a fascinating note on used car prices:

Roughly half of the overall increase in the core CPI in December was due to a 35 percent increase in used car and truck prices. Th e unusual strength in used car and truck prices over the past five months (up nearly 31 percent) has been somewhat of a mystery. Initially, the story read as if the CARS program negatively impacted used auto supply, driving up auction prices. However, it’s hard to imagine that this is still the case. Perhaps the story now is that there has been some substitution away from new vehicles recently, possibly due to credit constraints, as some used car purchases are cash transactions. Either way, new vehicle prices slipped down 3.1 percent in December.

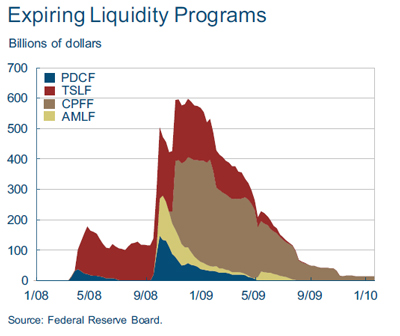

They also discuss the Fed’s gradual easing out of targetted intervention:

Four of the Federal Reserve’s new credit facilities were allowed to expire on February 1. These include the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), the Commercial Paper Funding Facility (CPFF), the Primary Dealer Credit Facility (PDCF), and the Term Securities Lending Facility (TSLF). As financial market functioning improved, private sources of liquidity became sufficient and the demand for credit via the special facilities diminished. It is important to note that credit extended through these facilities required good collateral backing. Moreover, to limit the use of the facilities, the terms of lending were set to be less attractive than private sources. In this sense, the facilities mimicked the features of the Fed’s Discount Window—a facility available to qualified depositories in normal times.

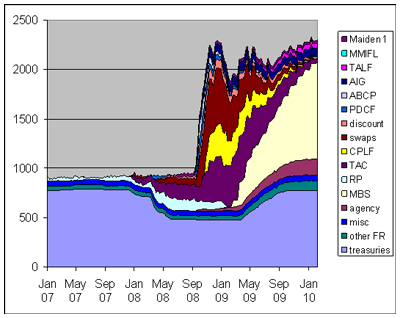

Mind you, the Fed’s balance sheet is still bloated by over a trillion dollars in mortgage paper, so hold off on plans for your end-of-crisis party. Econbrowser‘s James Hamilton provided some perspective in his post Bernanke on the Fed’s balance sheet: