As Assiduous Readers will know, I advocate that contingent capital be issued by banks with the conversion trigger being the decline of the common stock below a certain price; should conversion be triggered, the conversion into equity of the preferreds / Innovative Tier 1 Capital / Sub Debt should be at that same price.

The Conversion/Trigger price should be set at issue-time of the instrument and, I suggest, be one-half the issue-time price of the common in the case of Tier 1 Capital, with a factor of one-quarter applied for Tier 2 capital. Note that in such a case, Tier 2 capital will not be “gone concern” capital; it will be available to meet losses on a going-concern basis, but the small probability of the issuer’s common losing three-quarters of its value should make it easier, and cheaper, to sell.

Anyway, one nuance to this idea is that the conversion feature will be supportive of the preferreds price in times of stress, since the preferred will convert at face value into current market price of common.

In other words, say the price of both common and preferred has nearly, but not quite, halved, but the situation appears to be stabilizing. In such an event, some investors will buy the preferreds in the hope that conversion will be triggered since they will be paid full face value for the preferred in market value of the common. Therefore, the preferreds will be bid up – at least to some extent – in times of stress.

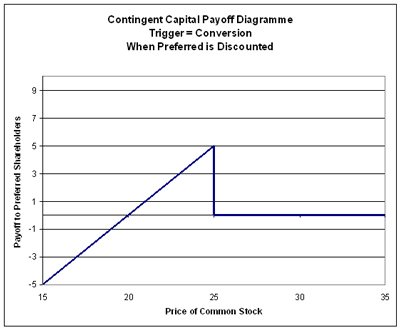

Let us say that issues exist such that the conversion/trigger price is $25, but the price of the preferreds has declined such that the effective conversion price is $20. The payoff diagram in terms of the common stock price then looks like this:

This diagram assumes that the conversion/strike price is $25, and that the preferreds are trading for 80% of face value.

Thus, an investor contemplating the purchase of the preferreds at 80% of face value will make $5 per share if the common dips just below the trigger price and stays there; he will only realize a loss if the price of the common goes below 80% of the conversion price. This is in addition to any calculations he might make as to the intrinsic value of the preferred if it doesn’t convert, of course.

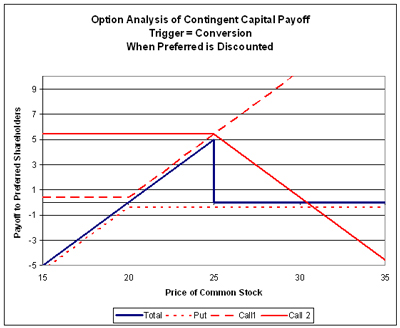

This payoff diagram can be analyzed into component options:

In this diagram, I have offset the payoff diagrams for the options slightly in order that they be more readily distinguished.

It may be seen that the payoff structure can be replicated with three options:

- Long Call, strike $20

- Short Put, strike $20

- Short Call, strike $25

What’s the point? Well, there isn’t one, really. But I wanted to point out the supportive effect of the conversion feature on the preferreds – even in times of stress! – and show how the payoffs could be replicated or hedged in such a case. Doubtless, more mulling over this dissection will lead to more conclusions being drawn about the relative behaviour of preferred and common prices in such a scenario of extreme stress.

I am wondering if contingent capital like you describe is not similar to Split Share Preferreds in some important respects.

Take BNA.PR.B/C/D for example. These are issued by BAM Split and BAM Split owns shares of BAM which are divided between the capital units and the pref shares. Feb 28 NAV is not posted yet, but Jan 31 NAV was 77.87 and BAM.A was $21.55, corresponding to 3.61 BAM.A per BNA unit.

Once BAM.A shares fall more than 68%, then BNA prefs have a NAV of <$25 and would be similar to common shares short a call (limited upside). In a way, providing dividend coverage is about 1.00, the prefs are effectively converted into common for as long as the common shares stay at 32% or less of the Jan 31 price.

Of course, as we saw last year, if BAM recovers, the prefs go back to being prefs again, so this is not exactly comparable to contingent capital, but has some similarities.

What can we learn from this analogy? The prefs go down, but not as much as the common. There was no particular accelerated selling pressure on the common as NAV approached par. And, the credit rating agencies are happy to rate split share prefs — often with investment grades at the beginning (though not when NAV approaches par).

In comparison with other split shares where NAV/Pref Par is 1.5 or greater (your recommendation for contingent capital calls for 2.0), you should expect an investment grade credit rating in favorable circumstances. Moody’s is saying that uncertain conversion conditions mean ratings are likely to be non-investment grade, but your proposal might be more attractive to issuers and investors.

The only drawback is my complaint that split share pref credit ratings are subject to 20-50X more frequent ratings downgrades than corresponding operating pref credit ratings — I think the raters don’t capture the full risk of a split share pref: it is considerably more likely to default than the operating prefs of the underlying company in a weak market where the common shares decline but business is OK. You have argued that split share recovery given default is better, so maybe the ratings are justified. If so, the same features apply to your notion of contingent capital.

I hope you are able to share your version of contingent capital with the rating agencies to help broaden the publicity for an interesting and useful idea.

btw, the analogy of long call at $20, short put at $20 and short call at $25 (which has to include a bond at $20 paying Pref Div Yield – Common Yield) is equivalent to long common short the $25 call +/- dividends — a covered write the same as a Split Share pref with unit NAV approaching par.

I am wondering if contingent capital like you describe is not similar to Split Share Preferreds in some important respects.

I think you’re quite right – and the contingent capital I describe is actually superior to a split share because once conversion is triggered, the holders have full exposure to the common with unlimited upside, as opposed to the short call you highlight for the split shares.

btw, the analogy of long call at $20, short put at $20 and short call at $25 (which has to include a bond at $20 paying Pref Div Yield – Common Yield) is equivalent to long common short the $25 call +/- dividends — a covered write the same as a Split Share pref with unit NAV approaching par.

Certainly, but my post was an effort to show how the payoff structure of the contingent capital could be replicated or hedged with options prior to conversion … say, when the common reaches $30 and preferred shareholders start getting a little nervous.

My next step – with no clear schedule! – is to quantify the value of this option package as the price of the common and preferred changes.

[…] should, either. The potential for value transfer has been discussed on PrefBlog, in the post Payoff Structure of Contingent Capital with Trigger = Conversion. The only way to prevent this is to ensure that there is no value transfer at conversion. This […]