This is an interesting issue, since it is quoted at $26.31-40, a fat premium despite being imminently callable.

Options on this issue are:

Redemption 2006-08-24 2007-08-23 26.000000

Redemption 2007-08-24 2008-08-23 25.750000

Redemption 2008-08-24 2009-08-23 25.500000

Redemption 2009-08-24 2010-08-23 25.250000

Redemption 2010-08-24 2999-12-29 25.000000

And the YTW Analysis is:

Call 2006-09-23 YTM: -5.90 % [Restricted: -0.69 %] (Prob: 31.33 %)

Call 2006-12-09 YTM: 1.55 % [Restricted: 0.51 %] (Prob: 5.01 %)

Call 2007-09-23 YTM: 3.75 % [Restricted: 3.75 %] (Prob: 8.58 %)

Call 2008-09-23 YTM: 4.32 % [Restricted: 4.32 %] (Prob: 4.24 %)

Call 2009-09-23 YTM: 4.54 % [Restricted: 4.54 %] (Prob: 3.16 %)

Call 2010-09-23 YTM: 4.66 % [Restricted: 4.66 %] (Prob: 2.78 %)

Option Certainty 2035-02-14 YTM: 5.75 % [Restricted: 5.75 %] (Prob: 44.90 %)

Not the kind of issue I’d like to own! I can understand why some people might not wish to hit the current bid of $26.31 – they may have high transaction costs through their brokers, while a redemption will be done for free – buy why would anybody put a bid up there? It pays $1.525 annually with 10-million shares outstanding and Royal has done two perpetual issues this year with coupons of $1.1125 (RY.PR.A, 12-million shares) and $1.175 (RY.PR.B, 12-million shares) … so why would Royal keep it outstanding? Even a cost of $0.75 for brokerage commissions on a new issue sold entirely to retail through other dealers AND a $1.00 premium on early redemption is recouped pretty quickly with those kind of numbers.

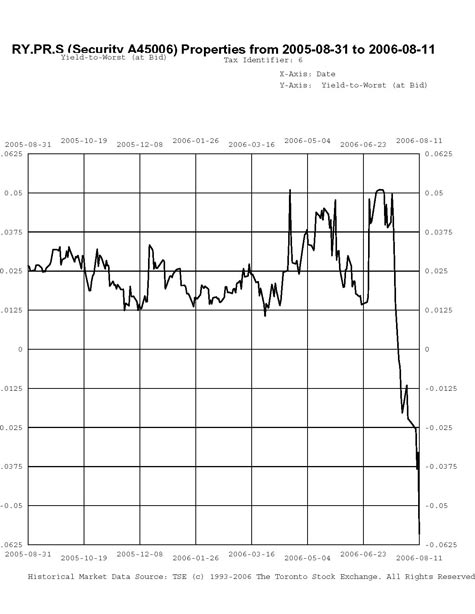

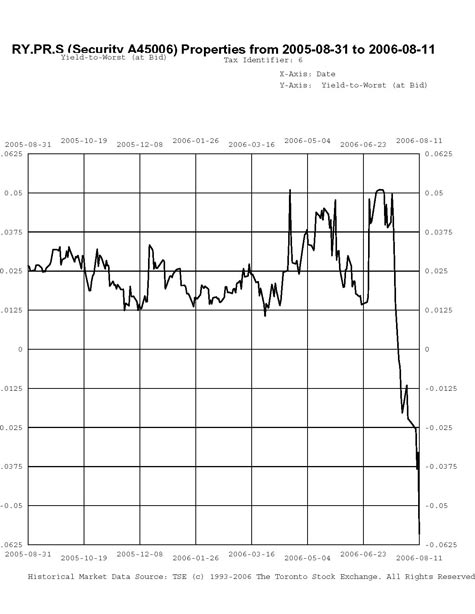

And, as is shown below, it’s been a sell candidate for the past year, with a consistently low YTW (except for few pops in YTW recently, which don’t mean a lot given the short term to presumed maturity):

There may be some who look at the very high calculated probability of this issue being extand for nearly thirty years in the future and take issue with the calculation. That’s entirely understandable. I do too. HIMIPref™ is known to have a certain amount of difficulty in calculating meaningful numbers for issues whose prices are constrained by a relatively near term call. For this reason, the parameters minCostBidPseudoModifiedDurationBuy, minWorstBidPseudoModifiedDurationBuy and minYTWModifiedDurationBuy were developed, which put a lower limit on three of the calculated modified duration measures. These parameters have been optimized to values of 1.02, 2.481 and 0.00, respectively (the most stringent condition is applied).

Due to these minima, RY.PR.S is not even eligible for purchase by HIMIPref™ regardless of valuation.

Another quibble that may be addressed is the question of declining redemption premia. It could be argued that due to the known decrease in redemption price of $0.25 annually for the next four years, it is proper to evaluate the chance of redemption of these shares as if they were paying $1.525 – $0.25 = $1.275 per annum, this being the net effect on Royal Bank’s cash flow of waiting a year. This calculated rate certainly is a lot closer to the coupon of the recent issues than the raw rate!

From an investment perspective it doesn’t make a lot a difference, though. Essentially, you are buying these in the hopes that the four year yield-to-worst of 4.66% will be realized. There is no hope of a capital gain – any decline in interest rates will simply increase the very high probability that the issue will be called. Given the hopelessness of the potential for capital gains with rate decreases, the high level of protection agains rate decreases is almost worthless.

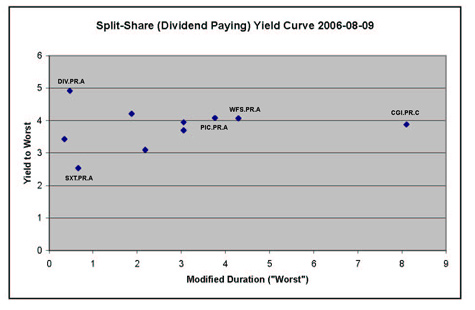

Investors can do better. A look at the chart Premium-Perpetual Yield Curve, 2006-07-28 shows that there are plenty of alternatives.