Trading was heavy in November as a disorderly decline in a confused market brought many opportunities to the Fund, although there was a decline from October’s extraordinary level of activity.

Trades were, as ever, triggered by a desire to exploit transient mispricing in the preferred share market (which may the thought of as “selling liquidity”), rather than any particular view being taken on market direction, sectoral performance or credit anticipation.

| MAPF Sectoral Analysis 2008-11-28 | |||

| HIMI Indices Sector | Weighting | YTW | ModDur |

| Ratchet | 0% | N/A | N/A |

| FixFloat | 0% | N/A | N/A |

| Floater | 0% | N/A | N/A |

| OpRet | 0% | N/A | N/A |

| SplitShare | 33.4% (+12.3) | 16.57% | 4.24 |

| Interest Rearing | 0% | N/A | N/A |

| PerpetualPremium | 0.0% (0) | N/A | N/A |

| PerpetualDiscount | 66.5% (-8.4) | 8.22% | 11.15 |

| Scraps | 0% | N/A | N/A |

| Cash | +0.1% (-3.8) | 0.00% | 0.00 |

| Total | 100% | 11.00% | 8.83 |

| Totals and changes will not add precisely due to rounding. Bracketted figures represent change from October month-end. Cash is included in totals with duration and yield both equal to zero. | |||

The “total” reflects the un-leveraged total portfolio (i.e., cash is included in the portfolio calculations and is deemed to have a duration and yield of 0.00.). MAPF will often have relatively large cash balances, both credit and debit, to facilitate trading. Figures presented in the table have been rounded to the indicated precision.

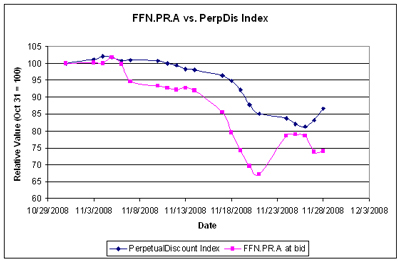

The proportion of SplitShares held increased as the fund took a position in FFN.PR.A on November 19, following a preciptuous price decline.

FFN.PR.A was one of November’s worst performers:

Asset coverage of 1.4+:1 as of November 14 according to the company. Now with a pre-tax bid-YTW of 17.40% based on a bid of 5.63 and a hardMaturity 2014-12-1 at 10.00. XFN may be used as a proxy (albeit not a terribly good one) for the holdings and is down 7.2% since Nov. 14, so estimate the month-end asset coverage as $13.00. Given that the ask price of the FFN capital units was 4.10 at month-end, this implies a retraction price of $8.43 … although retractions are tricky with this issue in this environment because the company requires ten notice days prior to the month-end retraction valuation date. Still, it’s tempting!

Although the asset coverage of the preferred share’s obligations is only about 1.3:1, the coverage of the capital invested is over 2:1. Additionally, the estimated retraction – as of November 28 – is very attractive, providing a large, immediate profit. The fly in the ointment regarding retraction is the lengthy notice period – ten days – required prior to the retraction date; this problem is exacerbated by all the holidays in December. The fund may elect to retract its holding of FFN.PR.A, but a decision will not be made until the last minute!

Sadly, this has been an unprofitable trade to date, but the enormous yield, good asset coverage (relative to invested capital) and favourable retraction possibility means my only regret is missing the bottom by a few days!

Credit distribution is:

| MAPF Credit Analysis 2008-11-28 | |

| DBRS Rating | Weighting |

| Pfd-1 | 56.7% (-18.5) |

| Pfd-1(low) | 10.5% (+10.2) |

| Pfd-2(high) | 0% (0) |

| Pfd-2 | 0.4% (0) |

| Pfd-2(low) | 32.3% (+12.2) |

| Cash | 0.1% (-3.8) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from October month-end. | |

The fund does not set any targets for overall credit quality; trades are executed one by one. Variances in overall credit will be constant as opportunistic trades are executed. The overall credit quality of the portfolio is now roughly equal to the credit quality of CPD at August month-end. The fund has a position in FBS.PR.B, currently under review-negative by DBRS and the position in FFN.PR.A is vulnerable, but is should be noted that while the asset coverage relative to obligations is under pressure, the asset coverage relative to invested capital remains comfortable.

| MAPF Split Share Positions (Major) Asset coverage |

|||||

| Ticker | NAVPU 11/28 (Estimate) |

Preferred Obligation |

Asset Coverage (Obligation) |

MAPF Book Price |

Asset Coverage (Invested Capital) |

| FBS.PR.B | $12.09 | $10.00 | 1.2+:1 | $7.02 | 1.7+:1 |

| FFN.PR.A | $13.05 | $10.00 | 1.3+:1 | $6.43 | 2.0+:1 |

| BNA.PR.C | $45.82 | $25.00 | 1.8+:1 | $17.25 | 2.7-:1 |

| FBS.PR.B NAVPU $11.28 11/27, XFN has increased 7.2% in interim | |||||

| FFN.PR.A NAVPU $14.06 11/14, XFN has declined 7.2% in interim | |||||

| BNA.PR.C, approximately 2.4 shares of BAM.A per unit; BAM.A closed at 19.09 11/28 | |||||

Liquidity Distribution is:

| MAPF Liquidity Analysis 2008-11-28 | |

| Average Daily Trading | Weighting |

| <$50,000 | 11.1% (+9.5) |

| $50,000 – $100,000 | 33.2% (+4.7) |

| $100,000 – $200,000 | 1.0% (-29.4) |

| $200,000 – $300,000 | 21.3% (+2.8) |

| >$300,000 | 33.2% (+15.2) |

| Cash | 0.1% 3.9% (-3.8) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from October month-end. | |

MAPF is, of course, Malachite Aggressive Preferred Fund, a “unit trust” managed by Hymas Investment Management Inc. Further information and links to performance, audited financials and subscription information are available the fund’s web page. A “unit trust” is like a regular mutual fund, but is sold by offering memorandum rather than prospectus. This is cheaper, but means subscription is restricted to “accredited investors” (as defined by the Ontario Securities Commission) and those who subscribe for $150,000+. Fund past performances are not a guarantee of future performance. You can lose money investing in MAPF or any other fund.

A similar portfolio composition analysis has been performed on The Claymore Preferred Share ETF (symbol CPD) as of August 29. When comparing CPD and MAPF:

- MAPF credit quality is similar

- MAPF liquidity is somewhat higher

- MAPF Yield is higher

- But … MAPF is more exposed to PerpetualDiscounts and SplitShares

- MAPF is less exposed to Fixed-Resets and Operating Retractibles