Lord Adair Turner, of Turner Report fame, has some things to say about bank regulation:

“If we were philosopher kings designing a banking system entirely anew for a greenfield economy, should we have set still higher capital ratios than in the Basel III regime? Yes I believe we should,” the Financial Services Authority’s Adair Turner told bankers at the Mansion House dinner in London’s financial district. “But starting from where we actually are, the Basel III reforms will significantly improve the resilience of our banking systems.”

…

Turner said inadequate regulation was more to blame for the near collapse of the banking system than excessive leverage and bonuses.

…

“We do need appropriate regulation of bonuses to reduce incentives for excessive risk taking,” Turner said. “We also need to move beyond the demonization of overpaid traders and their unnecessary CDO-squareds.”

The CBOE is attempting to resurrect Credit Default Options:

CBOE Holdings Inc. is seeking to resurrect credit-default options, or contracts that pay off when companies fail to repay their debt, as regulators try to shift some trading of over-the-counter derivatives onto exchanges.

The owner of the largest U.S. options exchange first created the derivatives in 2007. Trading volume amounted to 56 contracts in 2007 and 2008, and none changed hands last year, CBOE said. To generate interest, the settlement price for contracts would be less than the $100,000 value on the original options, according to a proposal filed with the U.S. Securities and Exchange Commission.

CBOE is trying to win business from the $29.6 trillion credit-default swap market, where contracts are traded over the counter. Among changes mandated by the Dodd-Frank Act, signed into law in July, are requirements that standardized interest- rate, credit-default and other swaps be processed by clearinghouses and traded on exchanges or similar systems.

We don’t have to worry about another bank crisis, because the Basel Committee did a great job! We know that, because they say so themselves:

The new rules are “extremely demanding” and “radically transform the regulatory capital framework,” Nout Wellink, chairman of the Basel Committee on Banking Supervision and president of the Bank of the Netherlands, said at a meeting in Singapore of officials who regulate the financial industry.

“If, prior to the crisis, banks had the levels of capital we are asking for, we likely would not have experienced such a deep crisis,” Mr. Wellink said, according to the text of his speech.

I continue to believe that the problem is not so much with capital, the numerator of the Pillar 1 ratios, but with the denominator – mainly risk-weighted assets. But those fixes would be harder to explain politically.

Daniel K Tarullo, Member of the Board of Governors of the Federal Reserve System, gave a speech at the Brookings Panel on Economic Activity, Washington DC, 17 September 2010. In contrast to my complaint about the Bail Outs and Financial Fragility paper, he draws a clear distinction between “illiquid” and “insolvent”:

But when the value of whole classes of the underlying collateral was drawn into serious question, initially by the collapse of the subprime housing market, participants’ lack of information about the collateral they held led to a shattering of confidence in all the collateral.

In the absence of the regulation and government backstop that have applied to the traditional banking system since the Depression, a run on assets in the entire repo market ensued. The resulting forced sale of assets into an illiquid market turned many illiquid institutions into insolvent ones. The fallout has been such that, to this day, the amount of repo funding available for non-agency, mortgage-backed securities, commercial mortgage-backed securities, high-yield corporate bonds, and other instruments backed by assets with any degree of risk remains substantially below its pre-Lehman levels.

He’s concerned about the potential for crowding out of the banks:

Where competition from unregulated entities is permitted, explicitly or de facto, capital and other requirements imposed on regulated firms may shrink margins enough to make them unattractive to investors. The result, as we have seen in the past, will be some combination of regulatory arbitrage, assumption of higher risk in permitted activities, and exit from the industry. Each of these outcomes at least potentially undermines the original motivation for the regulation.

Government apologist and sycophant Mark Carney gave a variation of the standard precious handwringing speech about productivity last March:

There are two imperatives–one domestic, one international–to secure strong, sustainable, and balanced economic growth for Canada. Both recall Aesop’s fable of the ant and the grasshopper, the moral of which can be best summed up as “idleness brings want.” In short, in a wicked world, Canada needs productive virtue.

I filled in yet another government form today – which took time away from programming – and found out that the super-cool fillable form was encrypted: which meant I could not save the completed version electronically or print it to a PDF. Instead I have to print it onto paper, fax it to the recipient, fax it to myself and (since I try to be productive and receive my faxes electronically) save the fax, then dispose of the idiotic and unnecessary paper.

Do you want to know the first step to productivity, Mr. Carney? How about morons on the government payroll thinking about what they’re doing?

The Globe’s in a tizzy about the potential cost of dementia care, but I don’t know what they’re worried about. Here’s the plan:

- Hire the cheapest caregivers (nurses, health aides) you possibly can

- Then cut their pay even more (make sure they’re all part-timers!)

- Give them more beds to look after than even the most competent practitioner could handle

- Keep the patients drugged up so they’re less work (make sure the doctor knows which side his bread’s buttered on!)

- Have a huge number of extremely detailed rules about patient care, endorsed by big-name practitioners

- Talk about the rules incessantly.

- Ensure all employees sign a statement that they have read, understood and will comply with all rules.

- Ignore the rules (ridiculous even to try, given patient load, staff and facilities)

- Every now and then, hang some poor sucker of a nurse who gave standard treatment to the wrong person. Wring your hands. Talk about the rules

I’m not saying it’s a good plan, but we all know that that’s what will happen eventually so why not start getting used to it now?

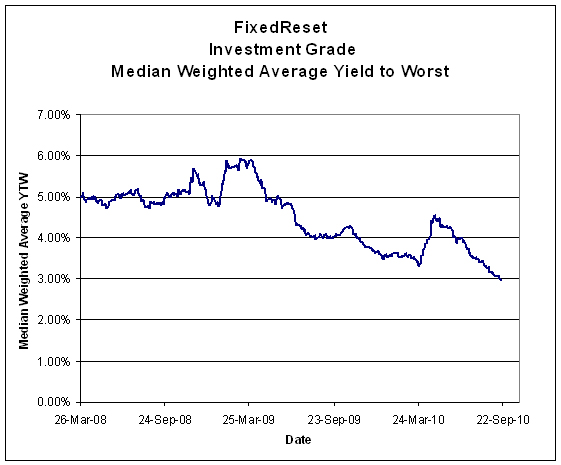

How ’bout that Canadian preferred share market, eh? It continues to move from strength to strength, with PerpetualDiscounts gaining 21bp today while FixedResets managed to eke out a 1bp win. Volume was very heavy. Nesbitt wrote some very nice tickets today, but that’s not necessarily the same thing as making good money. It depends on what kind of crosses they were.

PerpetualDiscounts now yield 5.54%, equivalent to 7.76% interest at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.3% so the pre-tax interest-equivalent spread (also called the Seniority Spread) now stands at about 245bp, a continued tightening from the 255bp reported September 15

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0182 % |

2,120.5 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0182 % |

3,212.2 |

| Floater |

2.87 % |

3.32 % |

80,056 |

18.95 |

3 |

0.0182 % |

2,289.5 |

| OpRet |

4.85 % |

-0.21 % |

80,063 |

0.19 |

9 |

0.0256 % |

2,386.0 |

| SplitShare |

5.93 % |

-27.57 % |

62,852 |

0.09 |

2 |

-0.9927 % |

2,372.4 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0256 % |

2,181.8 |

| Perpetual-Premium |

5.66 % |

5.05 % |

144,221 |

5.34 |

14 |

0.0946 % |

1,998.9 |

| Perpetual-Discount |

5.49 % |

5.54 % |

200,622 |

14.52 |

63 |

0.2111 % |

1,983.6 |

| FixedReset |

5.21 % |

2.95 % |

300,698 |

3.29 |

47 |

0.0116 % |

2,280.7 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BNA.PR.C |

SplitShare |

-1.83 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2019-01-10

Maturity Price : 25.00

Evaluated at bid price : 22.00

Bid-YTW : 6.29 % |

| MFC.PR.C |

Perpetual-Discount |

-1.22 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 19.50

Evaluated at bid price : 19.50

Bid-YTW : 5.81 % |

| BMO.PR.J |

Perpetual-Discount |

-1.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 22.06

Evaluated at bid price : 22.18

Bid-YTW : 5.12 % |

| NA.PR.K |

Perpetual-Premium |

-1.00 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-10-22

Maturity Price : 25.50

Evaluated at bid price : 25.71

Bid-YTW : 2.97 % |

| BMO.PR.L |

Perpetual-Premium |

1.00 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2017-06-24

Maturity Price : 25.00

Evaluated at bid price : 26.23

Bid-YTW : 5.05 % |

| CM.PR.J |

Perpetual-Discount |

1.02 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 21.50

Evaluated at bid price : 21.84

Bid-YTW : 5.21 % |

| CM.PR.D |

Perpetual-Premium |

1.18 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-10-22

Maturity Price : 25.50

Evaluated at bid price : 25.80

Bid-YTW : 1.26 % |

| ELF.PR.G |

Perpetual-Discount |

1.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 20.55

Evaluated at bid price : 20.55

Bid-YTW : 5.90 % |

| POW.PR.D |

Perpetual-Discount |

1.36 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 22.80

Evaluated at bid price : 23.00

Bid-YTW : 5.44 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.N |

Perpetual-Discount |

506,720 |

Nesbitt crossed blocks of 241,200 and 250,000, both at 24.65.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 24.39

Evaluated at bid price : 24.62

Bid-YTW : 5.41 % |

| BNS.PR.P |

FixedReset |

337,570 |

Nesbitt crossed 321,400 at 26.75.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 25.00

Evaluated at bid price : 26.71

Bid-YTW : 2.57 % |

| TRP.PR.C |

FixedReset |

156,190 |

Scotia crossed 29,300 at 26.30; then crossed blocks of 54,500 shares, 20,000 shares, 26,000 shares and 14,400 shares, all at 26.20.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 23.48

Evaluated at bid price : 26.20

Bid-YTW : 3.54 % |

| CM.PR.I |

Perpetual-Discount |

145,645 |

Nesbitt crossed 25,000 at 22.53 and 100,000 at 22.50.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 22.30

Evaluated at bid price : 22.44

Bid-YTW : 5.31 % |

| BNS.PR.R |

FixedReset |

126,350 |

Nesbitt crossed blocks of 15,000 and 99,900, both at 26.95.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-02-25

Maturity Price : 25.00

Evaluated at bid price : 26.82

Bid-YTW : 2.93 % |

| BAM.PR.K |

Floater |

109,550 |

Nesbitt crossed 100,000 at 15.80.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 15.77

Evaluated at bid price : 15.77

Bid-YTW : 3.32 % |

| BAM.PR.B |

Floater |

104,475 |

Desjardins crossed 100,100 at 15.80.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-22

Maturity Price : 15.80

Evaluated at bid price : 15.80

Bid-YTW : 3.32 % |

| There were 64 other index-included issues trading in excess of 10,000 shares. |