Canadian Life Companies Split Corp. has announced:

the completion of the capital reorganization of the Preferred Shares of the Company (the “Reorganization”) that was approved at the special meeting of shareholders held on April 16, 2012, and the related consolidation of Class A Shares (the “Consolidation”).

As a result of the Reorganization, holders of Preferred Shares who did not exercise the 2012 Special Retraction Right, will receive the following securities for each Preferred Share:

1. one 2012 Preferred Share (Symbol: LFE.PR.B),

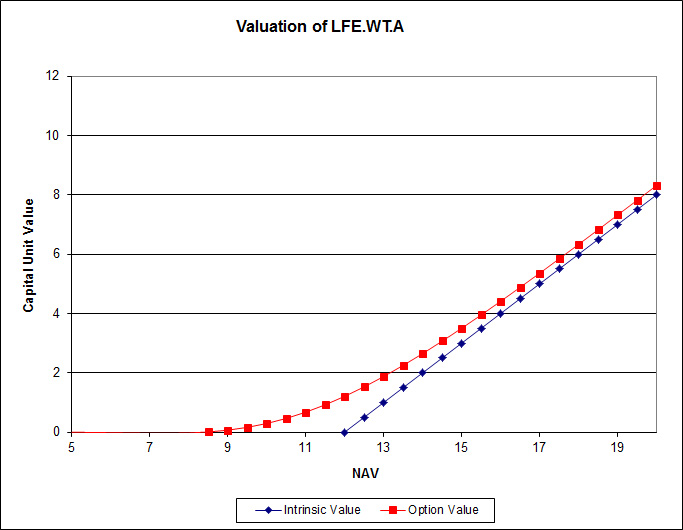

2. one 2013 Warrant (Symbol: LFE.WT.A); and

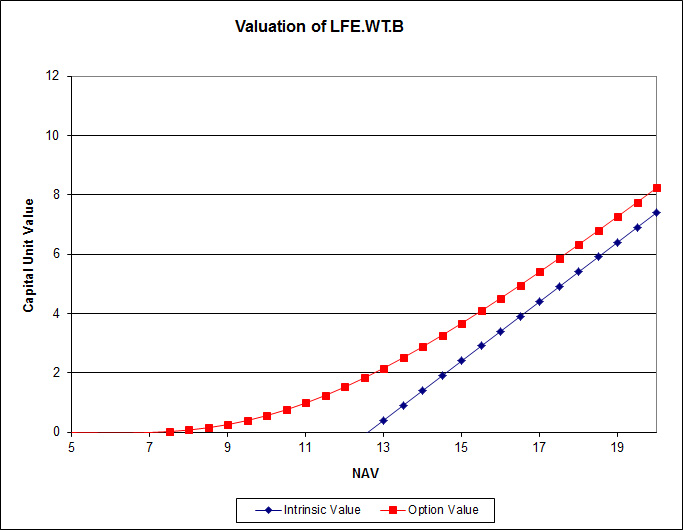

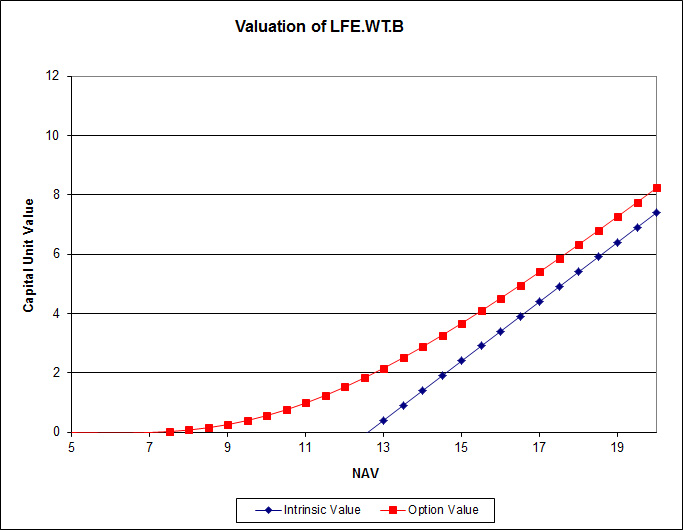

3. one 2014 Warrant (Symbol: LFE.WT.B).

The 2012 Preferred Share, 2013 Warrants and 2014 Warrants will be listed on the TSX and posted for trading at market open on June 25, 2012.

The exercise prices for the 2013 Warrants and the 2014 Warrants are $12.00 and $12.60, respectively. As previously announced, the Consolidation is necessary to maintain an equal number of Class A shares and 2012 Preferred Shares outstanding following the Reorganization. After the Reorganization and the Consolidation, there will be 7,776,613 2012 Preferred Shares and 7,776,613 Class A Shares outstanding with a net asset value per unit of $11.66 as of the opening of business on June 25, 2012.

Additional information regarding the capital reorganization is contained in the Management Information Circular dated March 14, 2012 prepared in respect of the special meeting, available on SEDAR at www.sedar.com or on the Company’s website www.lifesplit.com.

The NAVPU of $11.66 implies a small gain from the estimated pro-forma June 15 valuation of $11.55.

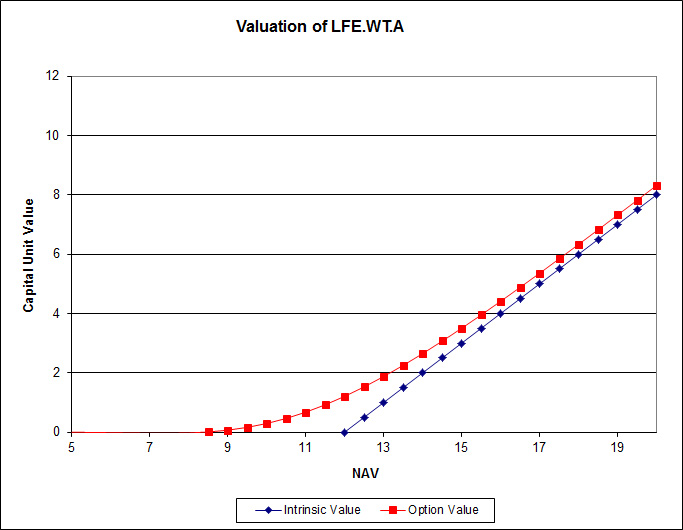

As discussed in the post LFE.PR.A Unveils Reorg Proposal, the “2013 Warrants” (LFE.WT.A), may be exercised at any time until 2013-6-3 and the “2014 Warrants” (LFE.WT.B) at any time until 2014-6-2. Note that these are the deadlines as far as the company is concerned; your custodial broker will probably have a deadline a day or two in advance of this. Your broker should be able to tell you its deadline a few weeks in advance of the company deadline.

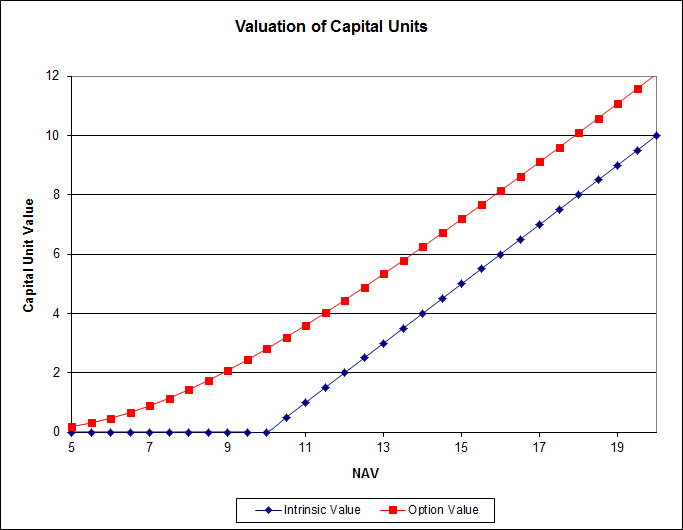

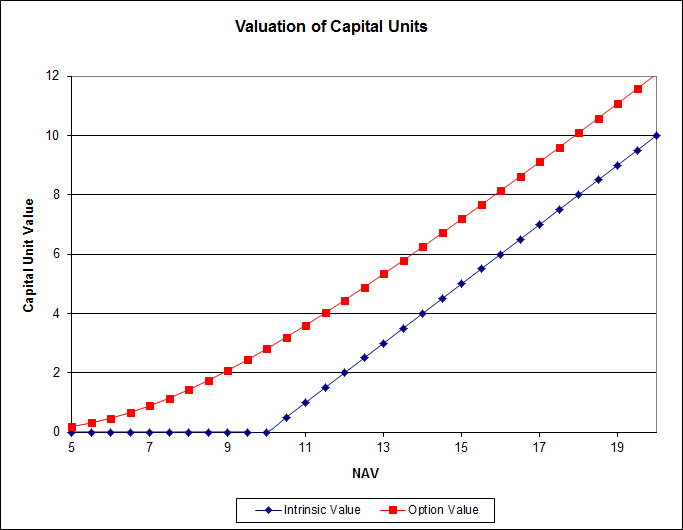

The termination date for the company is 2018-12-1. Let’s take a shot at valuing the components!

The tricksy thing about valuing the options is that there is a very significant cash drag on the portfolio, since the dividend yield on the underlying portfolio is about 4.5% (of the whole unit value) while the preferred shares are getting a distribution of 6.25% (of their 10% par value) and the MER is about 1.00% (of the whole unit value, after the fee reduction that is part of the reorganization).

This means that at a NAVPU of 12.00, the portfolio has cash outflows of 0.625 (preferred shares) + 0.12 (1% of NAV) = $0.745, or about 6.21% of the NAV, with inflows of 0.045 * 12 = $0.54, for a net outflow of $0.205, or about 1.71% p.a. This is deducted from the Risk-Free Rate to get the Net Risk Free Rate to be used in Black-Scholes.

For Annual Volatility of the underlying portfolio, let’s use 30%

This gives rise to the following calculation when the NAVPU is $12:

LFE Components Valuation

at NAVPU = $12.00 |

| Ticker |

LFE |

LFE.WT.A |

LFE.WT.B |

| Time |

6.5 |

1.0 |

2.0 |

| Sigma |

30% |

30% |

30% |

| Gross Risk-Free |

2% |

2% |

2% |

| Net Risk-Free |

0.29% |

0.29% |

0.29% |

| Calculated Values |

| d1 |

0.6456 |

0.7675 |

0.6556 |

| d2 |

-0.1193 |

0.4675 |

0.2314 |

| N(d1) |

0.7407 |

0.7786 |

0.7440 |

| N(d2) |

0.4525 |

0.6799 |

0.5915 |

| Option Value |

4.45 |

1.21 |

1.52 |

The calculation for the capital units, LFE, is dubious. In the first place, I’m not convinced Implied Volatilities for such relatively long periods are realistic; in the second place, the value will be highly path-dependent, as the end-value may be affected by dilution due to exercise of the warrants. [see note] Still, the results for the two warrants look relatively reasonable – although the quotes near the close on the day of issue are much, much, lower, this is on zero volume.

Click for big

Click for big

Click for big

Click for big

Update – Note: And in the third place, Sequence of Returns risk means that the cash drag is more harmful than is modelled by the Black-Scholes Risk-Free Rate Adjustment.