This issue is USD denominated and as such is not included in the HIMIPref™ universe, but I received a query about it anyway, regarding taxes payable on redemption.

The paid-up capital for the shares is USD 25.00 and the redemption price (commencing 2012-2-25) is USD 25.00, so there’s no problem there; but my interlocuter has been advised that “it may be beneficial for [holders] to sell the issue pre redemption as there are some unusual tax implications if held to redemption.”

According to the prospectus:

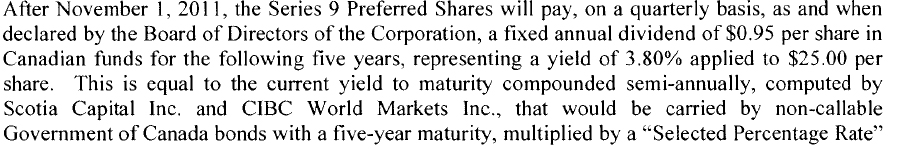

Under the CCRA administrative policy regarding paid-up capital described under ‘‘Foreign Currency Translation Issues’’, changes in the exchange rate of Canadian and U.S. dollars between the date of issuance of the Preferred Shares Series 10 (relevant to the computation of paid up capital) and the date of redemption (relevant to the computation of redemption proceeds) will affect the computation of any such deemed dividend. The difference between the amount paid by the Bank and the amount of the deemed dividend will be treated as proceeds of disposition for the purposes of computing the capital gain or capital loss arising on the disposition of such shares (see ‘‘Disposition’’ above).

and

The CCRA takes the position that notwithstanding that the stated capital, for corporate purposes, of Preferred Shares Series 10 will be maintained in U.S. dollars, the paid-up capital for purposes of the Act of the Preferred Shares Series 10 will be the Canadian dollar equivalent of the consideration for which the Preferred Shares Series 10 are issued, computed at the exchange rate prevailing at the time the Preferred Shares Series 10 are issued.

The “anticipated closing date” of the issue was 2001-12-20 and, according to the Bank of Canada, the noon USD rate was 1.5775 CAD per USD. So the paid-up capital on these shares is roughly CAD 39.44.

I suspect, but I am not sure, that this means that holders who hold until redemption at USD 25.00 (assuming, of course, that such a redemption will in fact occur) will therefore be deemed to have sold their shares at CAD 39.44 – resulting in a huge capital gain for those purchasing their shares when conversion rates were closer to par – and not being able to claim anything for the “negative deemed dividend”.

But: I am not a tax specialist and my suspicions could well be incorrect. I suspect that this will become a rather major issue as the prospective date of redemption approaches and I urge holders to bombard BMO’s Investor Relations Department with questions. I have sent the following query to the Corporate Secretary:

I write to enquire about the tax status of payments should BMO.PR.V be redeemed when the redemption option becomes available to BMO next February.

On a very approximate basis, I compute that the CAD paid-up capital per share on this issue is the USD figure of 25.00 times the conversion rate on issue date (2001-12-20) of 1.5775, or about CAD 39.44.

I further assume for convenience that the USD/CAD conversion rate will be par on the (presumed) date of redemption.

I believe that this implies holders whose shares are redeemed will be deemed for tax purposes to have disposed of their shares at CAD 39.44 (the 2001 issue price using exchange rates at that time) which may result in a very large taxable capital gain for recent purchasers, and that there will be no offsetting deduction for a “negative deemed dividend”.

I request your comment on my conclusion regarding the tax status of holders on possible redemption; I further request that any notice of redemption for this issue that may be prepared in the future contain a section explaining these consequences.

But there is an out, or there should be! “Paid up Capital” is irrelevant to those who sell on the market – in such a case, the capital gain or loss will be simply the usual difference between the CAD equivalent of your purchase price and the CAD equivalent of your sale price; using the conversion factors appropriate for each day.