Commerce Split Inc. has announced:

it plans on holding a special meeting of shareholders in December 2009 to vote on a reorganization plan for the Company.

The reorganization proposal will provide both Priority Equity and Class A shareholders with an opportunity to participate in an alternative structure going forward. This proposal is designed to address the impact that the significant decline in price of the Company’s underlying holding of CIBC common stock and the resultant activation of the Priority Equity Protection Plan has had on the ability of the Company to meet some of its original investment objectives.

Many of the characteristics of the proposal will be similar to the previous shareholder proposal that was contained in the December 23, 2008 Management Information Circular. This previous proposal, although not passed, did receive overwhelming support, outside of certain larger shareholders. If this proposal had been implemented at that time, both classes of shareholders would have experienced significant improvement in the value of their investments. As a consequence of the results of this vote and continued interest in seeking a solution that balances the interests of both classes of shareholders, the Company is bringing forward this proposal which will provide shareholders with a choice of remaining in the current Fund with all the existing attributes or the option to transfer into a new Fund that will have a different set of attributes, subject to maintaining an equal number of shares of each Class outstanding in each option.

The Company, subject to all necessary Board and regulatory approvals, expects to send out the full details of this proposal to all shareholders through a Management Information Circular in November, 2009 with a shareholder vote to follow in December, 2009.

The proposal will allow shareholders the option to participate in a new Fund with different attributes. The new Fund would allow the fixed income instruments purchased under the Priority Equity Protection Plan to be liquidated and the proceeds to be re-invested in common shares of CIBC. This would allow the new Fund to begin receiving dividends on a more fully invested position (on up to 100% of Fund assets versus a currently invested position in CIBC common stock of 20%) in CIBC common stock, increase income producing potential under the covered call writing program and increase participation in any capital appreciation of CIBC common stock held. The requirement that an equal number of Priority Equity shareholders and Class A shareholders be outstanding would also be maintained in the New Fund.

Priority Equity shareholders transferring their Priority Equity shares to the new Fund would receive i) one new $5 preferred share to yield 7.5% per annum and ii) one $5 par value equity share that will receive dividends of 7.5% per annum if and when the Company’s net asset value exceeds $12.50.

In addition, each Priority Equity share exchanged would receive i) one half Series I warrant, with one full Series I warrant allowing holders to purchase a full Unit (a Unit consisting of one new preferred share, one new equity share and a Class A share) of the Company at a price of $10 for 1 year and ii) a full Series II warrant to acquire a full Unit of the Company at a price of $12.50 for 2 years. These warrants will effectively provide upside potential on the performance of CIBC shares held in the Fund. The Company believes that the proposed package of securities will provide Priority Equity shareholders with substantial value added compared to their existing investment.

Class A shares will receive dividends when the net asset value reaches $15 per unit in the new Fund with all other attributes to remain the same. The value of the Class A share opportunity in the new Fund is that it will provide more exposure to any increases in CIBC common stock held through the Fund and the Company believes this provides substantial shareholder value relative to Class A shareholders’ existing investment.

Shareholders that do not wish to transfer into the new Fund may maintain their investment in the existing Fund under the existing set of attributes for each class of share.

The Company believes this reorganization plan is in the best interest of all shareholders. The full details of the Plan will be sent to all shareholders in November, 2009.

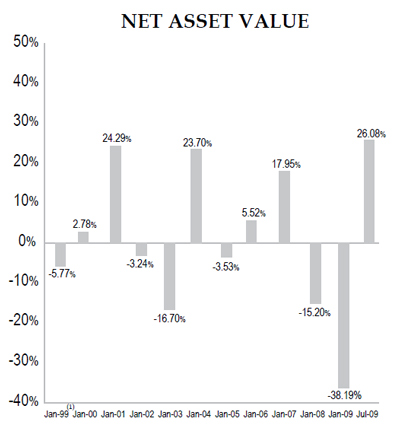

The immediate thing that strikes me about this press release is the plethora of detail relative to the terse release from XMF.PR.A, its sister in misery. This may be related to its September 15 valuation of $9.24 net of accrued preferred share dividends.

XCM closed today at 1.18-1.24, 50×63, while XCM.PR.A closed at 7.75-86, 100×2 … in contrast to XMF.PR.A, the October retraction is in the money (although not clear whether retractors will get the accrued dividend). Of course, the higher NAV has led to a lower committment to the fixed income portfolio: XCM has 21% exposure to CM as of August 31, which makes arbitrage somewhat riskier.

The fascinating part about this reorganization is the optional nature of the proposed conversions. It remains to be seen whether the proposed exchange will be coercive or not … the final proposal may well have unpleasant language about fees and expenses and so on that would, in practical terms, force conversion if the plan is passed.

XCM.PR.A was last mentioned on PrefBlog when management refused to consider winding up the company. XCM.PR.A is not tracked by HIMIPref™.