Nortel has announced:

that it, Nortel Networks Limited (“NNL”) and certain of its other Canadian subsidiaries will seek creditor protection under the Companies’ Creditors Arrangement Act (“CCAA”) in Canada. As well, certain of the Company’s U.S. subsidiaries, including Nortel Networks Inc. and Nortel Networks Capital Corporation, have filed voluntary petitions in the United States under Chapter 11 of the U.S. Bankruptcy Code, and certain of the Company’s EMEA** subsidiaries are expected to make consequential filings in Europe.

…

In addition, the Company will request the courts to impose certain restrictions on trading in the Company’s common shares and Nortel Networks Limited’s preferred shares in order to preserve valuable tax assets in the United States. Trading restrictions, if imposed, would apply immediately to investors beneficially owning at least 4.75% of (i) the outstanding common shares of Nortel Networks Corporation or (ii) any series of preferred shares of Nortel Networks Limited. For these purposes, beneficial ownership of stock will be measured in accordance with special U.S. tax rules that, among other things, apply constructive ownership concepts and take into account indirect holdings. There will be no immediate trading restrictions imposed on debt securities of the Company or its affiliates, but the Company by this press release is advising debtholders that the courts may, at the Company’s request, impose certain trading restrictions at a later date.

I confess I am not familiar with the “special U.S. tax rules” that have made trading curbs advisable.

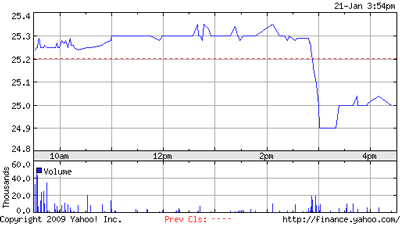

NTL.PR.F & NTL.PR.G were slapped with a default rating by DBRS after suspending dividends in December.

NTL.PR.F & NTL.PR.G are tracked by HIMIPref™ but have been relegated to the “Scraps” index rather than “Ratchet” on credit concerns.

Assiduous Reader medinvic has asked if the preferreds are automatically worthless. Well … not necessarily, but that’s the base case scenario. At this point, I think that the best preferred shareholders can hope for is a Thornberg-style cram-down offer they can’t refuse, as discussed on July 22, 2008.

Update: The Toronto Stock Exchange has announced:

DELISTING REVIEW – Nortel Networks Limited (the “Company”) – TSX is reviewing the Cumulative Redeemable Class A Preferred Shares, Series 5 (Symbol: NTL.PR.F) and the Non-Cumulative Redeemable Class A Preferred Shares, Series 7 (Symbol: NTL.PR.G) of the Company with respect to meeting the requirements for continued listing. The Company is being reviewed on an expedited basis.

Update, 2009-1-16: The TSX has announced:

Further to TSX Bulletin 2009-0057 dated January 14, 2009, TSX’s review of the Cumulative Redeemable Class A Preferred Shares, Series 5 (Symbol: NTL.PR.F) and the Non-Cumulative Redeemable Class A Preferred Shares, Series 7 (Symbol: NTL.PR.G) of the Company with respect to meeting the requirements for continued listing has been stayed pursuant to the Initial Order issued on January 14, 2009 by the Ontario Superior Court of Justice under the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C-36, As Amended.